Overview

This article delves into the significance of Blackstone's Assets Under Management (AUM) and its implications for real estate investors. With Blackstone's AUM surpassing $1 trillion, it is crucial to understand how this substantial capital positions the firm to engage in large-scale projects. Such endeavors not only drive demand but also influence property valuations. However, this scenario presents challenges for smaller investors, as increased competition can complicate their investment strategies. Ultimately, grasping the dynamics of Blackstone's AUM is essential for investors aiming to navigate the complexities of the real estate market.

Introduction

In the dynamic realm of investment management, few firms command the respect and attention that Blackstone does. With assets under management (AUM) exceeding $1 trillion, Blackstone has firmly established itself as the world’s largest alternative asset manager and a formidable player in the real estate sector. This remarkable growth not only underscores the firm’s strategic acumen but also highlights its ability to attract substantial capital and demonstrate operational excellence.

As Blackstone continues to broaden its influence, grasping the implications of its AUM becomes essential for investors navigating the market's complexities. By leveraging technological advancements and capitalizing on emerging opportunities, the insights surrounding Blackstone's investment strategies offer a valuable roadmap for those aiming to make informed decisions in an increasingly competitive landscape.

What is AUM and Why It Matters for Blackstone?

Assets Under Management (AUM) signifies the total market value of assets that a financial firm supervises on behalf of its clients. For the firm, AUM acts as a crucial measure, indicating its size and impact within the financial landscape. As of early 2025, the firm has surpassed $1 trillion in Blackstone AUM, solidifying its position as the world's largest alternative asset manager.

This substantial figure not only emphasizes the firm's capability to attract significant capital but also highlights its operational effectiveness and the trust it has gained from investors. In addition to this impressive total, Blackstone AUM includes $260 billion from the private wealth channel, providing access to private markets and institutional-quality opportunities through partnerships with financial advisors. The significance of AUM goes beyond mere figures; it plays a crucial role in shaping financial strategies and opportunities. For property investors, comprehending AUM is crucial, as it directly affects a firm's ability to utilize resources and investigate new market opportunities.

AUM affects the availability of resources for acquisitions, development projects, and other funding initiatives, making it a key factor for those aiming to navigate the complexities of the property sector. In 2025, the firm's AUM is particularly significant given its strategic focus on property-related ventures, which represent a substantial portion of its overall portfolio. This focus on property not only boosts the firm's market presence but also offers investors access to institutional-quality opportunities. As the firm continues to broaden its reach—evidenced by its recent agreement to acquire AirTrunk for over A$24 billion—its AUM will likely grow, further solidifying its influence in the property market.

Management has indicated a strong focus on leveraging technological advancements, particularly artificial intelligence (AI) and digital infrastructure, to drive investment decisions and enhance efficiency. For property investors, the implications of AUM are significant. A higher AUM can lead to increased bargaining power in negotiations, better access to exclusive deals, and enhanced credibility in the eyes of potential partners and clients.

Consequently, tracking Blackstone AUM and its strategic actions within the property sector is crucial for investors seeking to make knowledgeable choices in 2025. Additionally, the information offered by resources such as the Zero Flux newsletter, which compiles vital market trends and insights, can be extremely beneficial for investors. By concentrating on data integrity and obtaining information from trustworthy sources, Zero Flux illustrates the significance of reliable information in making informed financial choices.

This data-driven approach is essential for navigating the complexities of the real estate market, further emphasizing the significance of AUM in shaping financial strategies.

Blackstone's Record AUM: A Snapshot of Recent Growth

In the fourth quarter of 2024, the firm achieved a significant milestone, reporting that Blackstone AUM reached an impressive $1.13 trillion, reflecting an 8.5% rise compared to the previous year. This remarkable growth can be attributed to a combination of robust fundraising initiatives and strategic investments across diverse sectors. A standout achievement for the firm was its ability to attract $171 billion in inflows throughout the year, showcasing its strong appeal to both institutional and individual investors alike.

Additionally, the firm declared a quarterly dividend of $1.44 per common share, contributing to a total annual dividend of $3.95 per share, further illustrating its financial strength. This record Blackstone AUM not only reinforces the firm's dominance in the asset management sector but also strategically positions it for future opportunities, allowing it to leverage its extensive resources and expertise in navigating the evolving market landscape. As the globe’s biggest alternative asset manager, the firm oversees $260 billion in AUM, known as Blackstone AUM, from the private wealth channel, unlocking access to private markets and institutional-grade opportunities through collaborations with financial advisors.

Zero Flux, with its dedication to quality content, plays an essential role in offering insights into firms like Blackstone, assisting investors in staying updated about important changes in the property sector.

Blackstone's Investment Strategy: Focus on Real Estate

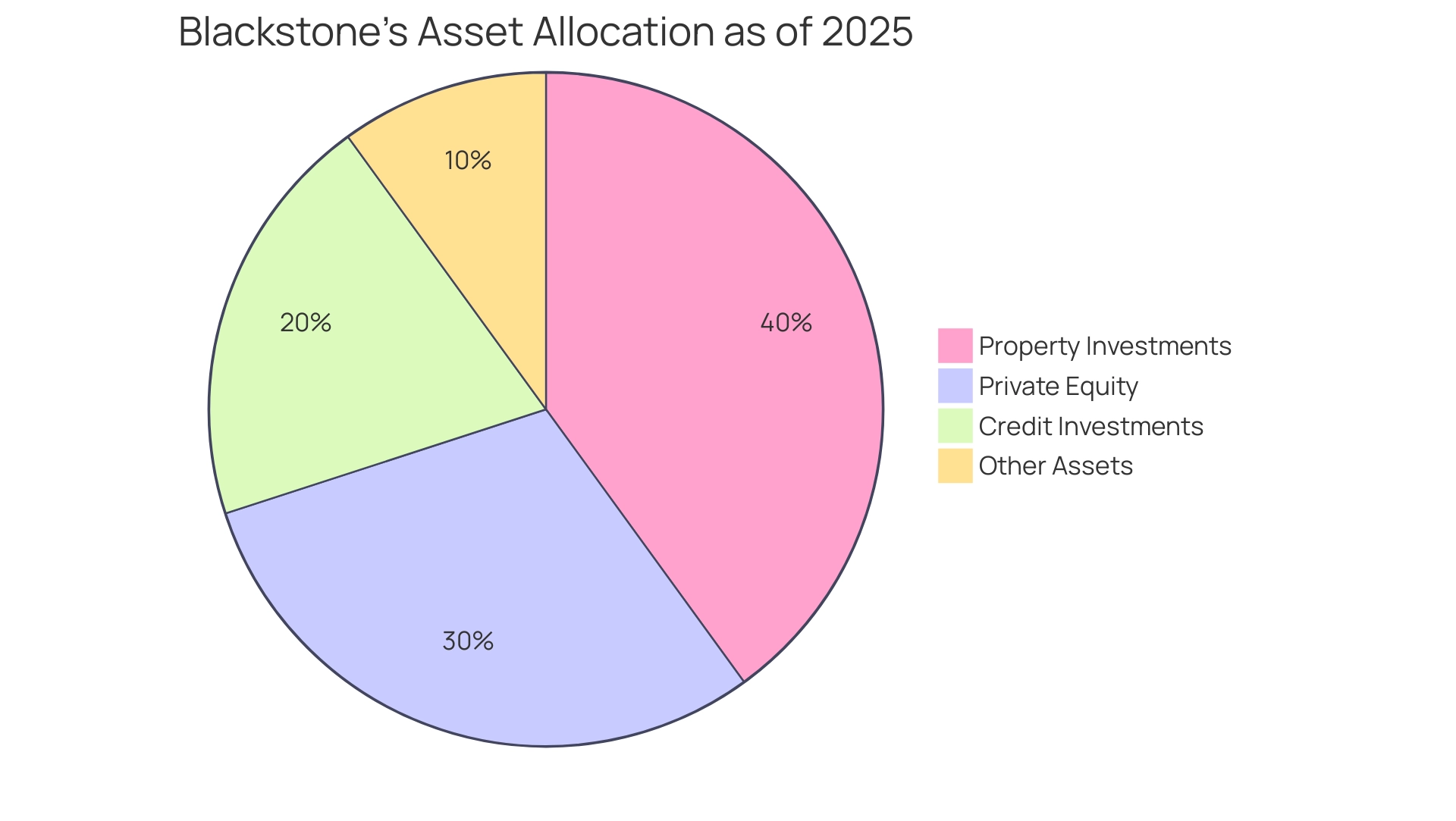

The firm's approach to funding emphasizes property, a significant component of its overall Blackstone AUM. As of 2025, property investments account for approximately 40% of the firm's assets under management, underscoring its commitment to this sector. In 2024, the investment firm allocated over $25 billion to property acquisitions, reflecting a positive outlook on market conditions and the potential for consistent returns.

Strategically, the firm has been acquiring properties across various sectors, including residential, commercial, and industrial real estate. This diversification not only mitigates risk but also positions the firm to capitalize on emerging market trends. For instance, as of February 28, 2025, the Real Estate Income Trust (BREIT) reported an impressive 94% occupancy rate, supported by a leverage ratio of 49% and approximately 90% fixed-rate financing. Such metrics highlight the effectiveness of the firm's operational strategies in maintaining asset performance.

Expert analysts note that the firm’s bold commitment to real estate reflects a broader market trend, where institutional investors increasingly seek stable income-generating assets. Leveraging its extensive market knowledge and operational expertise, the firm identifies high-potential opportunities that significantly enhance the growth of its Blackstone AUM. As stated by Morningstar, Inc., "To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research."

Case studies of the firm’s large-scale ventures reveal a pattern of strategic acquisitions that bolster its portfolio's resilience. For example, the firm's focus on stabilized income-generating commercial properties primarily in the U.S. has proven beneficial, despite the inherent risks associated with such investments, including limited liquidity and reliance on external financing. The case study titled "BREIT Investment Risks" emphasizes these risks, cautioning investors about potential illiquidity and the subjective nature of property valuations.

Investors are advised to carefully consider these factors when evaluating the company's property strategies, as understanding the associated risks is crucial for informed decision-making in the current economic landscape. Additionally, the firm's strategy includes scaling existing platforms and exploring large, unexploited markets such as asset-based finance and private credit, further demonstrating its proactive approach in the real estate sector.

Navigating the Competitive Landscape: Blackstone vs. Other Asset Managers

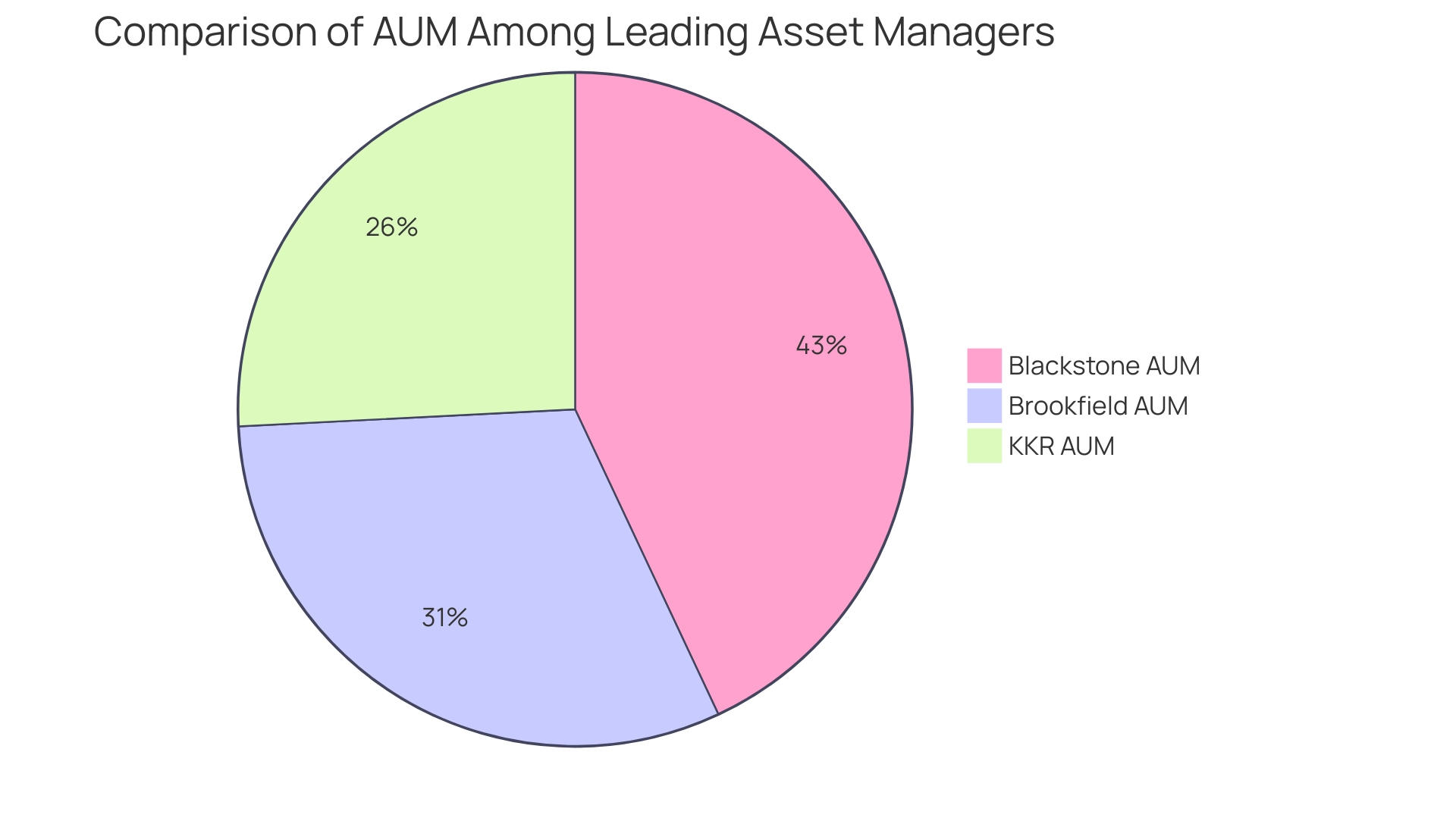

In the competitive asset management environment, the firm distinguishes itself not only through its impressive Blackstone AUM but also through its strategic funding approach. As of early 2025, the firm boasts a Blackstone AUM exceeding $1 trillion, solidifying its position as a leader in the industry. This substantial capital allows the firm to leverage economies of scale, enhancing its ability to attract high-quality investment opportunities, particularly in alternative investments and real estate.

While firms like Brookfield Asset Management and KKR also manage significant assets—Brookfield, for instance, oversees approximately $725 billion—the company's unique focus on alternative investments provides it with a competitive edge. This focus enables the firm to navigate market fluctuations effectively and maintain investor confidence, which is essential for driving future growth. Notably, Brookfield anticipates its asset management division to expand its fee-bearing capital to $1 trillion within the next five years, reflecting the competitive dynamics in the Blackstone AUM sector.

The competitive landscape of asset management in 2025 reveals that the firm's strategic positioning is complemented by its ability to leverage a diverse portfolio and a robust network of institutional investors. This network not only enhances its operational capabilities but also strengthens its position as a reliable authority in the property sector. As the market evolves, the firm's dedication to innovation and strategic investment will likely keep it distinguished from its rivals, including Brookfield and KKR, ensuring its leadership in the asset management field.

Moreover, as property investors evaluate their choices, recognizing the cost-effectiveness of investment strategies is essential. The average expense ratio for passive funds stands at 0.06%, while active management averages 0.68%. This context is crucial for investors aiming to maximize their returns.

Zero Flux, with over 30,000 subscribers, positions itself as a leading authority in property information dissemination, providing valuable insights that assist investors in navigating these complexities.

Implications of Blackstone's AUM Growth for Real Estate Investors

The growth of the firm's assets under management (AUM), particularly Blackstone's AUM, carries profound implications for real estate investors. As the leading alternative asset manager, Blackstone's strategies significantly influence market dynamics and property valuations. This scenario presents a dual-edged sword for investors.

On one hand, Blackstone's substantial capital enables participation in large-scale projects, which can drive demand and subsequently elevate prices in specific markets. For instance, the firm's focus on sectors aligned with demographic shifts positions it to capitalize on emerging opportunities, particularly in areas experiencing substantial growth.

Moreover, the company's stock has increased by 3.19%, reflecting investor confidence in its strategies and potential for future growth. Ken Caplan remarked, "This growth has helped establish what we believe is a generational opportunity in data centers," emphasizing the strategic focus that could benefit investors.

Conversely, the heightened competition introduced by Blackstone's aggressive investment approach may compress profit margins for smaller investors. As the firm scales its existing platforms and explores untapped markets, such as asset-based finance and private credit, the competitive landscape becomes increasingly challenging. This dynamic necessitates that property investors remain vigilant and adaptable, as the market adjusts to the realities of higher interest rates and evolving economic conditions.

Additionally, with around $1.6 trillion in property debt maturities expected in the upcoming years, there presents a major chance for refinancing and recapitalization. The case study titled "Challenges and Opportunities in Real Estate Debt" illustrates this point, as investors focusing on sectors supported by demographic trends are likely to navigate these complexities more effectively. Furthermore, the potential for deregulation and tax cuts to stimulate economic growth could further impact property values and transaction volumes.

Understanding Blackstone's strategies and market positioning is crucial for real estate investors aiming to thrive in this intricate environment, particularly as the implications of Blackstone AUM continue to unfold throughout 2025.

Conclusion

Blackstone's remarkable growth in assets under management (AUM) not only underscores its dominance in the alternative asset management landscape but also highlights its strategic focus on real estate investments. With AUM exceeding $1 trillion as of early 2025, Blackstone has positioned itself as a formidable player, leveraging substantial capital to capitalize on emerging market opportunities. This growth is driven by robust fundraising initiatives, strategic acquisitions, and a commitment to innovation, particularly in utilizing technology to refine investment strategies.

The implications of Blackstone's AUM growth are significant for real estate investors. The firm's substantial capital enables it to engage in large-scale investments, influencing market dynamics and property valuations. While this can create lucrative opportunities, it also introduces increased competition, potentially compressing profit margins for smaller investors. Therefore, understanding Blackstone's investment strategies and market positioning is essential for navigating the complexities of the real estate sector in 2025.

As Blackstone continues to expand its influence and explore untapped markets, its strategic movements will remain pivotal for investors seeking to make informed decisions. The insights derived from monitoring Blackstone's AUM and investment approach provide a valuable roadmap for understanding the evolving landscape of real estate investments. This emphasizes the necessity for vigilance and adaptability in an increasingly competitive market.