Overview

Commercial real estate investing for beginners requires a solid grasp of property types, financial strategies, and market dynamics. It is crucial to adopt a structured approach to identify and acquire lucrative investment opportunities. This article delineates essential steps, including:

- Defining investment goals

- Conducting thorough research

- Securing financing

- Building a professional network

Collectively, these strategies empower newcomers to adeptly navigate the complexities of the commercial real estate market. By understanding these foundational elements, aspiring investors can position themselves for success in a competitive landscape.

Introduction

Navigating the world of commercial real estate investing can indeed be a daunting endeavor for beginners, particularly due to the complexities involved in understanding market dynamics and financial strategies. This guide presents a structured approach to assist aspiring investors in grasping the essential steps necessary to embark on this lucrative journey, from defining investment goals to conducting thorough due diligence.

However, considering the commercial property market is currently facing significant challenges—such as declining asset values and increased competition—how can new investors effectively position themselves for success amidst these uncertainties?

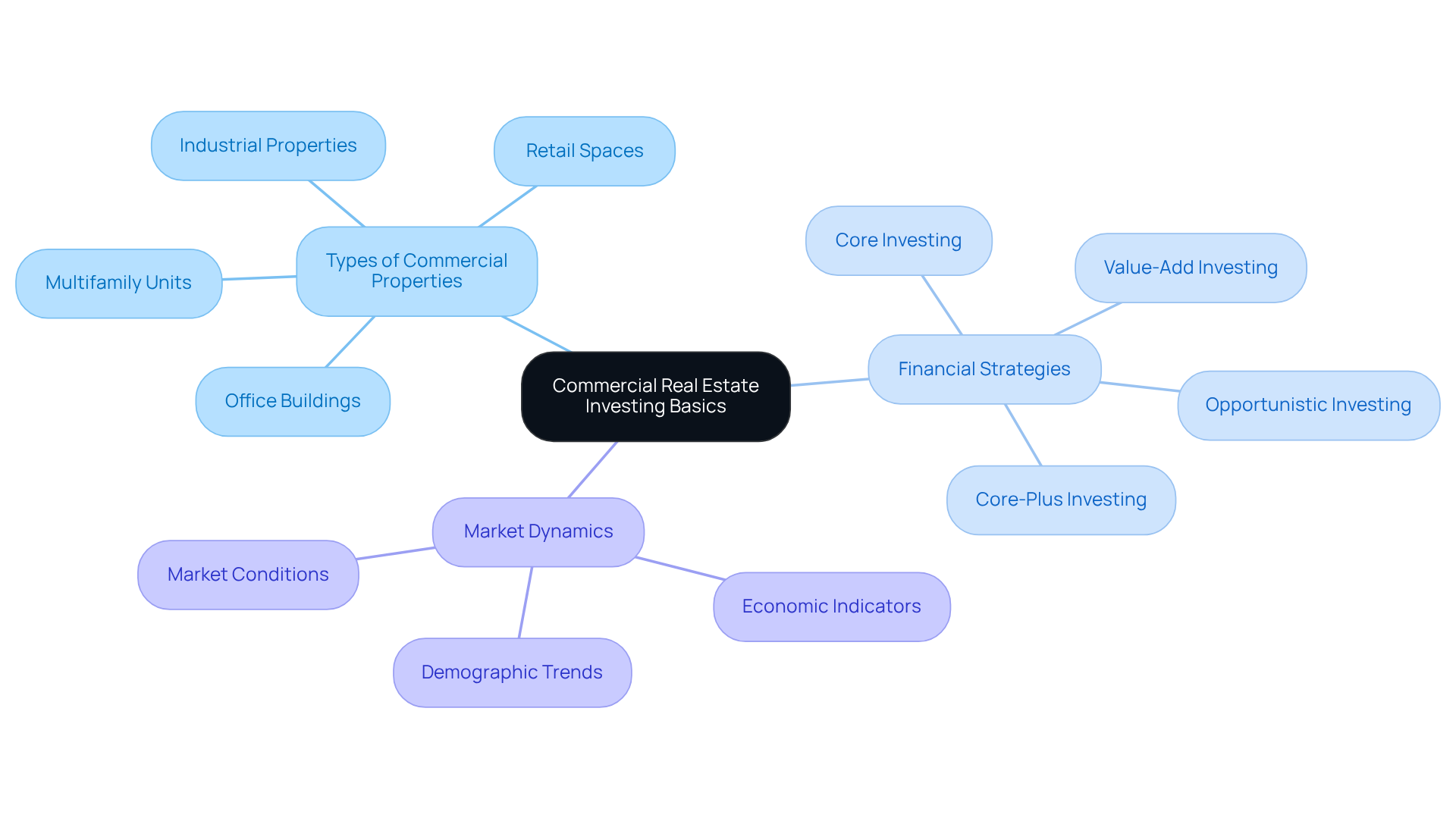

Understand the Basics of Commercial Real Estate Investing

Commercial real estate (CRE) encompasses premises specifically utilized for business purposes, including office buildings, retail spaces, and industrial warehouses. In contrast to residential real estate, which primarily serves as living quarters, CRE is strategically intended to generate income through leasing or selling. Understanding the following key concepts is essential:

- Types of Commercial Properties: It is crucial to familiarize yourself with the various types of CRE, such as office buildings, retail spaces, industrial properties, and multifamily units. Each type presents unique opportunities and challenges.

- Financial Strategies: Explore diverse financial strategies, including core, core-plus, value-add, and opportunistic investing. These strategies cater to different risk tolerances and return expectations, enabling you to align your investments with your financial goals.

- Market Dynamics: Grasp how market conditions, economic indicators, and demographic trends significantly influence property values and investment opportunities. Staying informed about these factors is vital for making sound investment decisions.

By mastering these fundamental concepts, you will be well-equipped to navigate the complexities of commercial real estate investing for beginners and enhance your investment strategies.

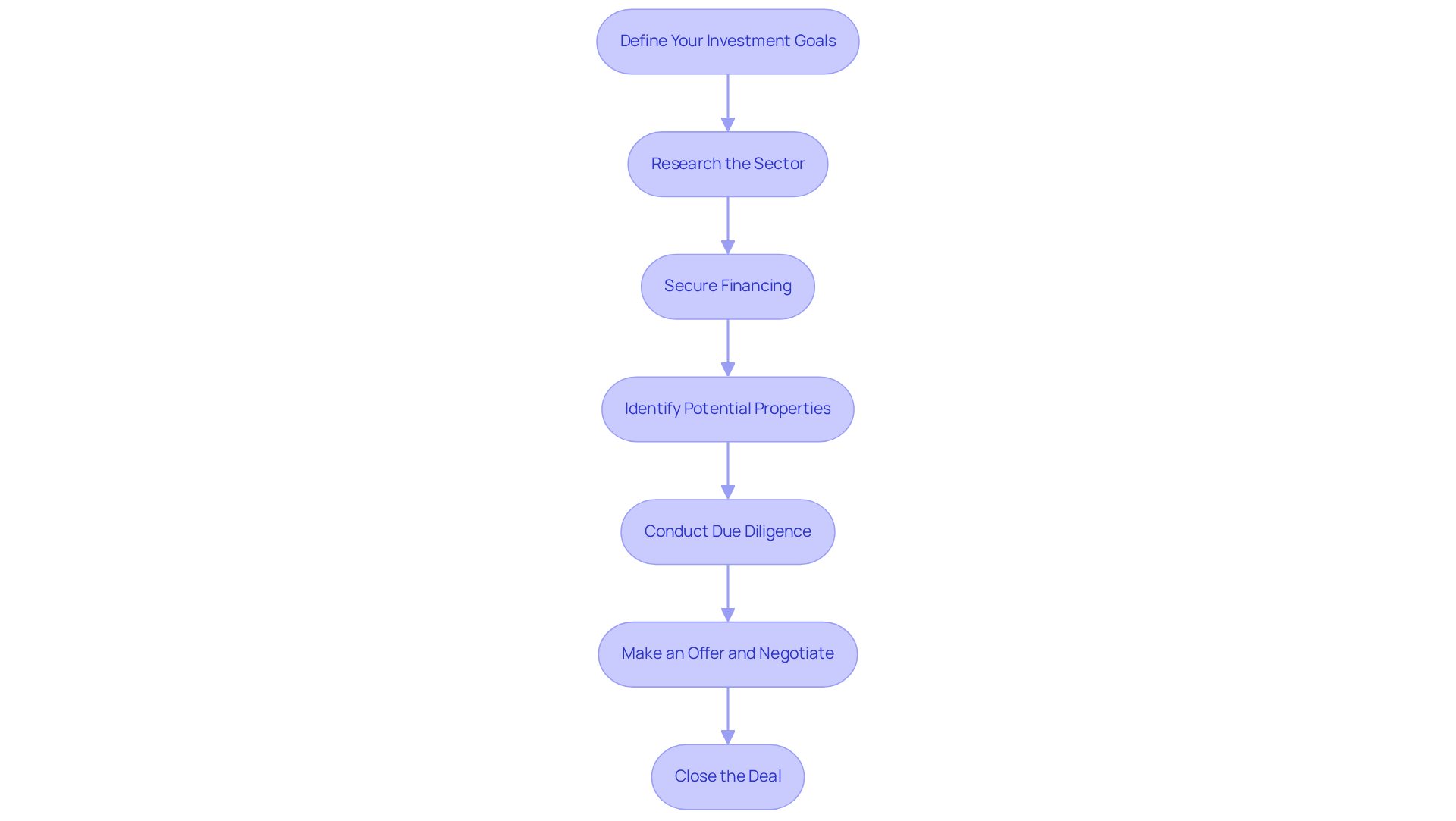

Follow a Step-by-Step Process to Begin Investing

To embark on your journey into commercial real estate investing, adhere to these essential steps:

-

Define Your Investment Goals: Clearly outline your objectives, whether they focus on generating cash flow, achieving property appreciation, or a blend of both. Setting specific, measurable goals will guide your investment strategy.

-

Research the Sector: Conduct comprehensive analysis by examining local conditions, including supply and demand dynamics, prevailing rental rates, and economic indicators that influence property values. Comprehending these elements is vital, as commercial property sectors can differ greatly by area. Significantly, the commercial property market is presently encountering difficulties, with asset values declining by 20% over the past two years and a 47% reduction in global commercial property dollar volume in 2023.

-

Secure Financing: Investigate various financing avenues, such as traditional mortgages, private lenders, or partnerships. The appropriate financing approach can boost your purchasing capability and align with your financial objectives. According to Nolo, average returns for commercial properties vary from 6% to 12% each year, making it crucial to select a financing choice that aligns with your anticipated returns.

-

Identify Potential Properties: Utilize online platforms, engage with real estate agents, and leverage your network to discover commercial properties that align with your financial goals. The current market conditions indicate a competitive landscape, making it essential to act swiftly when opportunities arise.

-

Conduct Due Diligence: Perform meticulous inspections and financial evaluations to gauge the property's condition, potential returns, and associated risks. This step is vital, as thorough due diligence can prevent costly mistakes and ensure informed decision-making. Case studies have demonstrated that investors who perform thorough due diligence are better equipped to avoid pitfalls and enhance their financial potential.

-

Make an Offer and Negotiate: Upon identifying a suitable property, submit a well-considered offer and engage in negotiations with the seller. Effective negotiation can significantly influence the profitability of your financial assets.

-

Close the Deal: Collaborate with legal and financial professionals to finalize the transaction, ensuring all necessary documentation is accurate and complete. This step strengthens your commitment and prepares the groundwork for future success.

By methodically adhering to these steps, you can confidently tackle your first commercial property venture, positioning yourself for long-term success in this dynamic field.

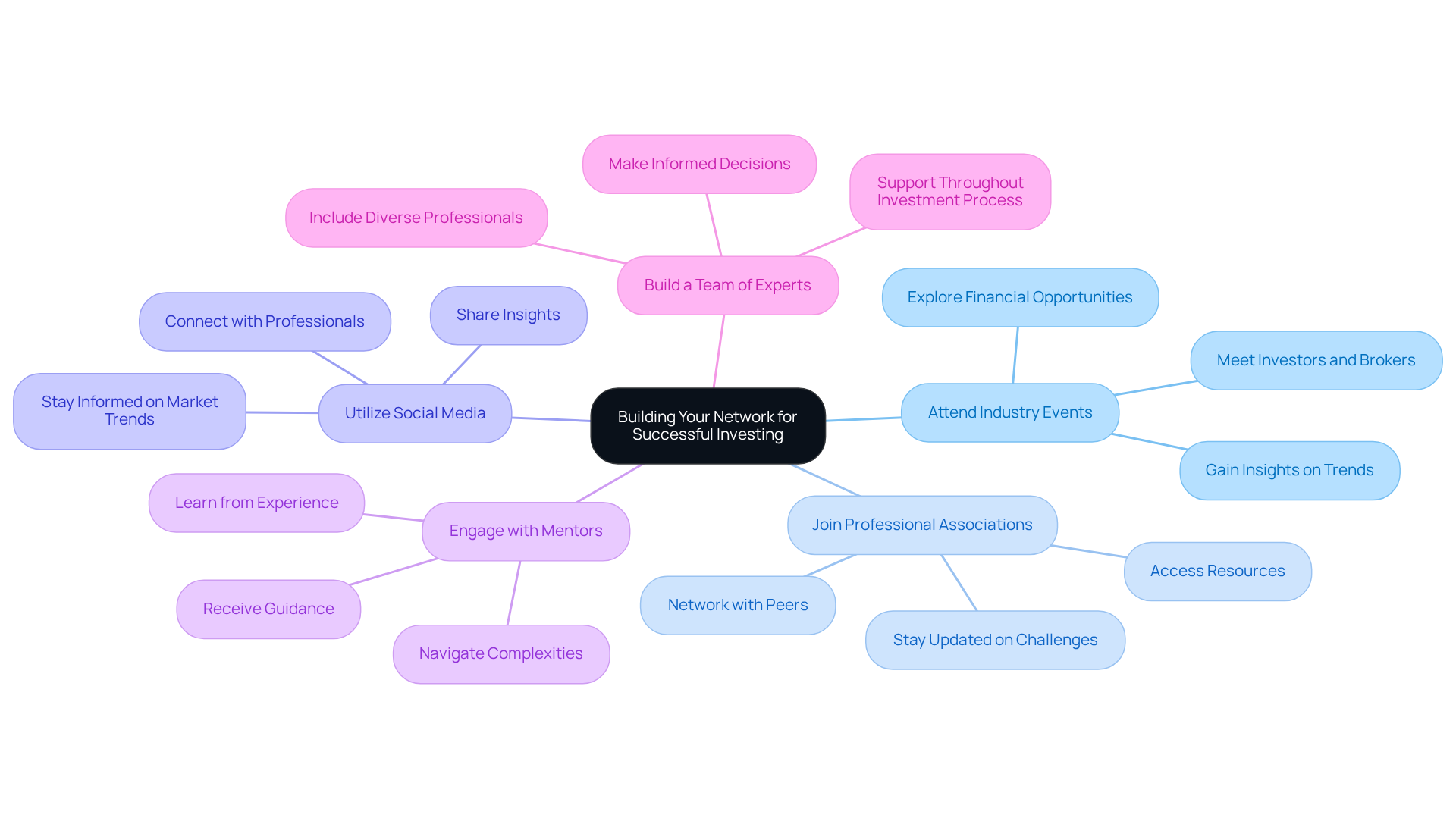

Build Your Network and Resources for Successful Investing

To build a robust network and resources for commercial real estate investing, consider the following strategies:

- Attend Industry Events: Participate in real estate conferences, seminars, and networking events to meet other investors, brokers, and industry professionals. Engaging in these meetings is essential, particularly in an industry valued at $1.2 trillion as of 2022, where relationships can lead to significant financial opportunities.

- Join Professional Associations: Become a member of organizations such as the National Association of Realtors (NAR) or local property investment groups to access invaluable resources and networking opportunities. These associations provide insights into industry trends and challenges, especially as the commercial property sector faced a reduction in size by 6% in the last year.

- Utilize Social Media: Leverage platforms like LinkedIn to connect with industry professionals, share insights, and stay updated on market trends. As Lewis Howes emphasizes, effective networking requires hard work and persistence, making social media an indispensable tool for maintaining connections.

- Engage with Mentors: Seek out seasoned investors who can offer guidance, share their insights, and assist you in navigating the complexities of commercial property. Mentorship can be invaluable, particularly during challenging times, as illustrated in the case study on "Networking in Times of Adversity."

- Build a Team of Experts: Assemble a team that includes property agents, attorneys, accountants, and property managers who can support you throughout the investment process. This diverse group can provide essential assistance, ensuring you make informed decisions in a changing environment.

By actively networking and cultivating relationships, you will enhance your knowledge and increase your chances of success in commercial real estate investing. Additionally, subscribing to resources like Zero Flux can keep you informed about the latest market insights and trends, further supporting your investment journey.

Conclusion

Embarking on a journey into commercial real estate investing is both exhilarating and challenging. By grasping foundational concepts, adhering to a structured approach, and cultivating a robust network, beginners can set themselves up for success in this profitable sector. The core of commercial real estate investing revolves around generating income and capital appreciation through strategic property management and thorough market analysis.

This article delineates essential steps, such as:

- Defining investment goals

- Researching the market

- Securing financing

- Identifying potential properties

- Conducting due diligence

- Negotiating offers

- Closing deals

Each of these steps is vital for navigating the intricate landscape of commercial properties. Moreover, the significance of networking and leveraging resources cannot be overstated; building relationships within the industry can unlock valuable opportunities and insights.

Ultimately, the realm of commercial real estate investing presents substantial potential for those willing to dedicate time and effort to learning and connecting with others. By implementing the strategies discussed, aspiring investors can deepen their understanding, make informed decisions, and embark on a successful investment journey. The future of commercial real estate beckons those prepared to take the first step—seize the opportunity and begin constructing a prosperous investment portfolio today.