Overview

Proven strategies for success in commercial real estate investment in 2025 focus on resilient asset classes, particularly industrial and multifamily properties. By leveraging technology and data analytics, investors can enhance their decision-making processes. Additionally, maintaining adaptability through continuous learning and strategic networking is essential in this dynamic market.

Understanding market trends is crucial, especially with the stabilization of interest rates and the growing emphasis on sustainability. Thorough property analysis and due diligence are imperative to navigate the evolving investment landscape effectively. These insights not only highlight the importance of informed decision-making but also underscore the need for proactive engagement in the real estate sector.

Investors must remain vigilant and responsive to these trends, ensuring they are well-equipped to capitalize on opportunities that arise. By integrating these strategies into their investment approaches, they can position themselves for success in the competitive realm of commercial real estate.

Introduction

The commercial real estate (CRE) landscape is poised for a transformative shift as it adapts to the post-pandemic world of 2025. With a growing emphasis on industrial and multifamily properties, investors are navigating a tightening market characterized by evolving tenant preferences and strategic office leasing. Key economic indicators suggest a resurgence in investment activity, fueled by optimism in domestic assets and potential regulatory changes.

As firms increasingly leverage data-driven insights and innovative technologies, the importance of:

- Strategic planning

- Thorough property analysis

- Robust networking

becomes paramount. Understanding these dynamics is essential for investors looking to capitalize on the opportunities that lie ahead in the dynamic world of commercial real estate.

Understanding the Current Landscape of Commercial Real Estate Investment

The commercial real estate investment market in 2025 is undergoing a significant transformation, characterized by a blend of recovery and adaptation to the new post-pandemic landscape. Investors are increasingly drawn to industrial and multifamily properties, which have demonstrated resilience amid economic fluctuations. This shift is underscored by the national availability rate for retail construction, which has dipped below 5%, indicating a tightening market and heightened demand for these asset classes.

As companies navigate the complexities of a hybrid work environment, the office sector is also stabilizing. Many organizations are reevaluating their spatial needs, resulting in a more strategic approach to office leasing and funding. This evolving demand highlights the importance of understanding tenant preferences, which are shifting towards flexible and amenity-rich spaces.

Key indicators of economic recovery are influencing financial decisions, with executives expressing optimism about future mergers and acquisitions, particularly in domestic assets. A recent survey indicates a potential resurgence in funding activity, especially in sectors like industrial and digital economy properties, as firms seek to enhance their operational capabilities. Richard Barkham, Global Chief Economist & Global Head of Research, noted, "We look forward to helping our clients identify opportunities and navigate change to meet and exceed their goals in 2025."

Moreover, regulatory changes are poised to impact property values and the viability of commercial real estate investment. It is essential for stakeholders to stay informed about legislative developments that could affect their commercial real estate investment portfolios. By closely monitoring these dynamics, participants can position themselves strategically in the market for commercial real estate investment, leveraging insights from data-driven resources like Zero Flux. The newsletter's dedication to quality content not only boosts subscriber engagement but also establishes it as a leading authority in property information, assisting stakeholders in navigating the complexities of the CRE landscape effectively.

Key Market Trends and Economic Indicators to Watch in 2025

In 2025, the landscape of commercial real estate investment is being shaped by several pivotal trends. A significant factor is the anticipated stabilization of interest rates, which is expected to foster a more predictable borrowing environment for investors. This stabilization is crucial, as it facilitates improved financial planning and strategies for commercial real estate investment, particularly in a market where listed Real Estate Investment Trusts (REITs) have outperformed private properties by over 52 percentage points in the past eight quarters.

As Jason A. Yablon observes, "Active managers of listed property funds have historically outperformed passive." This trend can be attributed to the inefficiencies, diversity, and complexity of listed real estate markets.

Sustainability is another critical trend, with an increasing number of individuals prioritizing properties that comply with green building standards. This shift not only reflects a commitment to environmental responsibility but also aligns with consumer preferences, as tenants increasingly seek sustainable living and working spaces. For those in the market, this trend indicates that properties with sustainable features may command higher rents and lower vacancy rates, presenting more attractive opportunities for commercial real estate investment.

The emphasis on sustainability is further reinforced by economic indicators, such as GDP growth and employment rates, which are anticipated to influence the demand for eco-friendly properties.

Demographic shifts, including urbanization and the rise of remote work, are also reshaping the demand for various property types. As more individuals embrace flexible work arrangements, the necessity for traditional office spaces may diminish, while demand for mixed-use developments and residential properties in urban centers could surge. Investors should remain vigilant in monitoring these demographic trends, as they can significantly impact property values and returns in commercial real estate investment.

Furthermore, Deloitte's recent survey suggests a positive outlook for commercial real estate investment in the property sector over the next 12 to 18 months, indicating that stakeholders can expect a more favorable investment environment. The appeal for property organizations to transition to skills-based frameworks, focusing on project execution and problem-solving, further underscores the industry's shift toward agility and responsiveness to market demands. This evolution is essential for bridging the skills gap and enhancing operational efficiency, allowing firms to adapt more effectively to changing market conditions.

In summary, understanding these essential market trends—interest rate stabilization, sustainability, demographic shifts, and economic indicators—will be vital for individuals navigating the commercial property landscape in 2025.

Exploring Different Types of Commercial Real Estate Investments

Commercial real estate encompasses a diverse array of asset types, including office buildings, retail spaces, industrial properties, and multifamily housing. Each category presents unique opportunities and risks that investors must navigate. For instance, industrial properties have shown remarkable resilience, largely driven by the surge in e-commerce, which has transformed demand dynamics.

Conversely, retail spaces are undergoing significant transformations to align with experiential shopping trends, reflecting evolving consumer preferences. Investors should meticulously evaluate their risk tolerance and financial goals when selecting property types. Grasping the nuances of each sector—such as lease structures, tenant profiles, and market demand—can greatly enhance decision-making and investment performance. Notably, statistics indicate that 88% of property professionals plan to leverage digital technologies to boost performance within the next 12 to 18 months, underscoring the necessity of adapting to shifting business expectations.

Moreover, insights from industry leaders emphasize the importance of attracting the next generation of talent to foster innovation in commercial property. As we approach 2025, the landscape is set for a revival, with positive sentiment suggesting potential increases in revenue growth and transaction activity across various sectors. This environment presents both opportunities and risks, particularly when comparing industrial properties to retail spaces.

Investors must remain vigilant and informed to seize emerging trends and adeptly navigate the complexities of the market. Case studies illustrate the success of various financial strategies within the realm of commercial real estate investment. For example, a recent analysis of industrial property assets revealed that those who swiftly adapted to e-commerce demands achieved substantial returns, reinforcing the significance of agility in asset management approaches. Additionally, Zero Flux's commitment to data integrity and sourcing information from credible outlets has enhanced subscriber engagement, highlighting the value of reliable information in making informed investment decisions.

As Tony Dong noted, "Roth IRAs are a great place for funds that have low tax efficiency," a relevant consideration for individuals seeking to optimize their strategies. As the commercial real estate investment sector continues to evolve, staying informed about the latest trends and expert insights will be crucial for investors aiming for success in 2025.

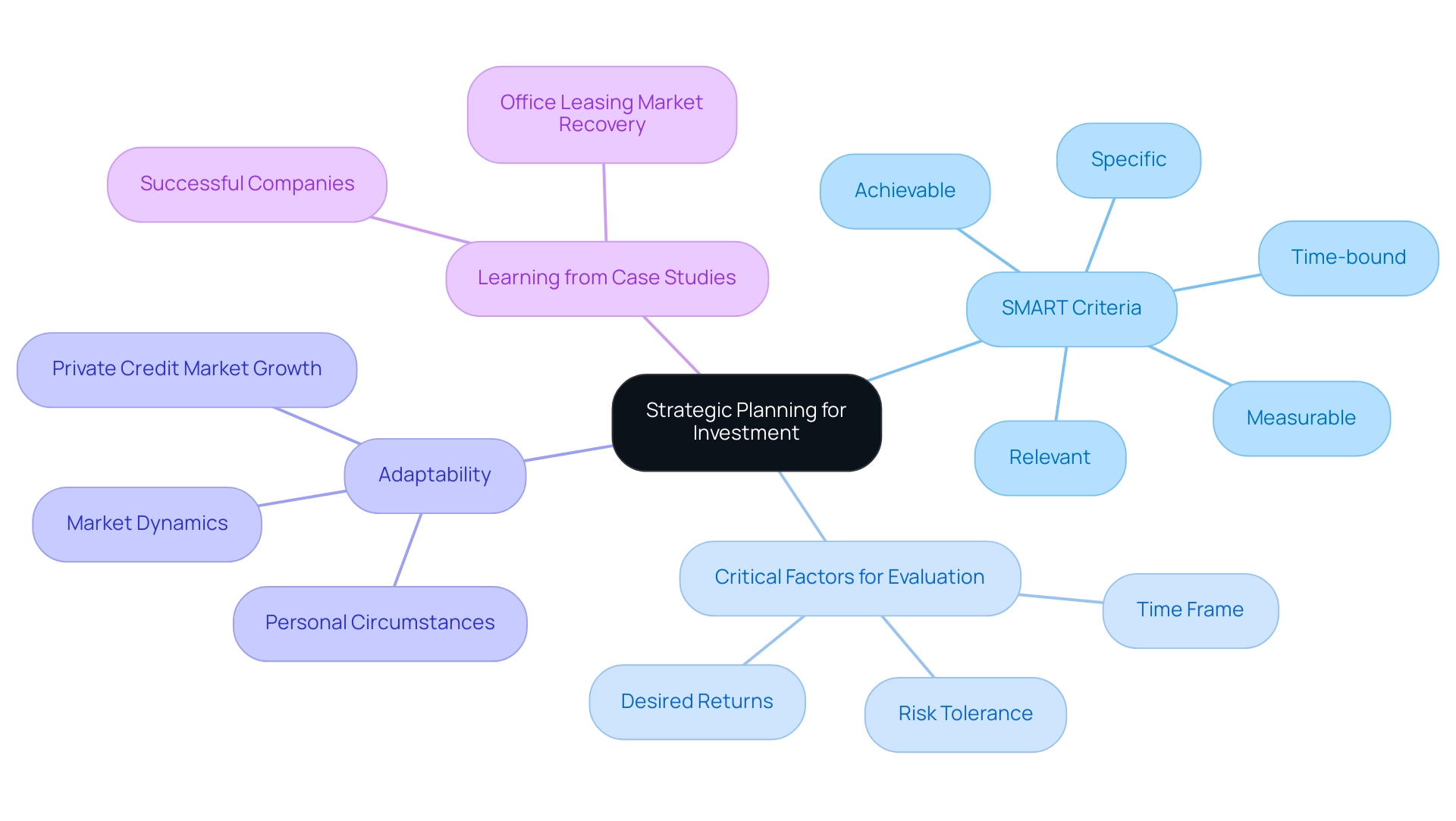

Strategic Planning: Setting Goals for Your Investment Journey

Successful strategic planning in commercial real estate investment ventures hinges on the establishment of clear, measurable objectives. Investors must evaluate critical factors such as desired returns, time frame, and risk tolerance to forge a robust framework for their strategies. By implementing the SMART criteria—Specific, Measurable, Achievable, Relevant, and Time-bound—investors can significantly enhance the clarity and effectiveness of these goals.

As we look toward 2025, the commercial real estate landscape is set to evolve, making it imperative for stakeholders to regularly review and adjust their objectives in response to shifting market conditions and personal circumstances. This proactive approach not only ensures alignment with evolving market dynamics but also fosters resilience in investment strategies.

For instance, the recent growth in the private credit market exemplifies a shift in financing preferences. Many asset managers are raising substantial funds to explore private credit options amid challenges in traditional lending. This trend underscores the necessity for individuals to remain adaptable and informed. Positive feedback from the Zero Flux community, which values data-driven insights, further emphasizes this point. Zero Flux compiles 5-12 handpicked real estate insights daily, reinforcing its role as a vital resource for investors navigating these changes.

Moreover, successful goal setting for financial endeavors often involves learning from case studies. Companies that have adeptly maneuvered through market intricacies demonstrate the significance of establishing SMART objectives, which have resulted in quantifiable success in their financial outcomes. As Stuart M. Saft, Partner at Holland & Knight LLP, noted, "One of the most significant trends of 2024 was the regeneration and recovery of the office leasing market."

By concentrating on strategic planning and leveraging expert viewpoints, investors can position themselves for success in the dynamic landscape of commercial real estate investment in 2025.

Securing Financing: Strategies for Successful Investment Funding

Securing funding for commercial real estate investment demands a multifaceted approach, integrating traditional bank loans, private equity, and innovative crowdfunding platforms. Investors must meticulously evaluate their financial health alongside specific project needs to pinpoint the most suitable funding sources. Establishing robust connections with lenders and acquiring a comprehensive understanding of their lending standards can significantly streamline the funding process.

In 2025, the landscape of commercial property financing is evolving, marked by a pronounced shift towards alternative approaches. Options such as seller financing and strategic partnerships are gaining momentum, offering participants enhanced flexibility and access to capital. For instance, successful crowdfunding initiatives have emerged as viable funding channels, allowing backers to pool resources and share risks, thereby democratizing access to commercial property opportunities.

Moreover, the impact of interest rates on financing strategies is critical and cannot be overlooked. As interest rates fluctuate, they directly affect borrowing costs and investment viability. Recent insights from Deloitte’s 2025 commercial property outlook survey reveal that 69% of executives from major commercial property firms foresee easier access to financing, indicating a positive outlook for stakeholders navigating this dynamic market.

Additionally, the integration of technology, particularly artificial intelligence and data analytics, is poised to revolutionize property management and enhance tenant experiences. These advancements are expected to simplify transactions and shape the future of commercial properties, making technology adoption indispensable for stakeholders. This technological shift underscores the importance of adapting financing strategies to align with emerging trends and market demands.

As the commercial real estate investment sector continues to evolve, staying informed about financing alternatives and market conditions will be crucial for those aiming to capitalize on opportunities and effectively mitigate risks. Furthermore, understanding regional preferences—such as the focus on industrial and manufacturing properties in Asia Pacific and multifamily properties in North America—will provide a broader context for financial decisions. Lastly, with 76% of respondents from the Commercial Real Estate Women Network indicating that their organizations have policies supporting mental health and well-being, investors should also consider the implications of workplace environments in their funding strategies.

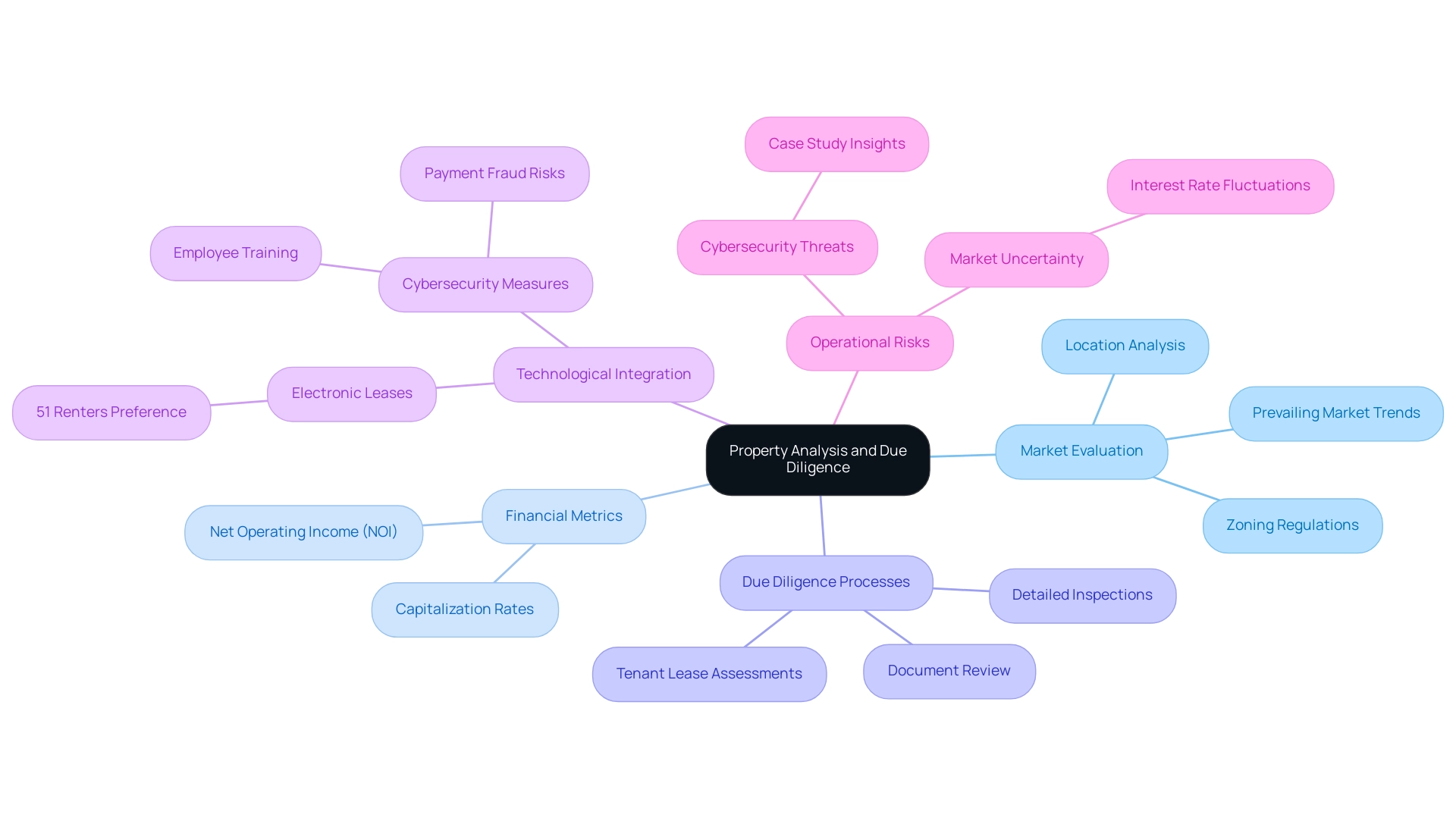

Conducting Thorough Property Analysis and Due Diligence

Conducting a thorough property analysis is crucial for successful commercial real estate ventures. This process involves evaluating multiple factors, including location, prevailing market trends, and the financial performance of the property. Investors should engage in a comprehensive due diligence process, which entails reviewing property documents, conducting detailed inspections, and assessing tenant leases to ensure all aspects are considered.

Utilizing key financial metrics such as Net Operating Income (NOI) and capitalization rates is essential for gauging a property's profitability. Understanding how these metrics relate to market conditions can significantly influence financial choices. In 2025, it is especially crucial for stakeholders to remain aware of local market dynamics and zoning regulations, as these factors can significantly influence property value and financial feasibility.

Statistics indicate that 51% of renters prefer to sign their leases electronically, highlighting a shift towards digital processes that can streamline property management and enhance tenant satisfaction. This trend underscores the necessity for investors to adapt to evolving market preferences and integrate technology into their management strategies.

Moreover, the importance of due diligence cannot be overstated; it serves as a safeguard against potential risks and enhances the likelihood of successful investments. A recent case study on cybersecurity threats in commercial properties revealed that many organizations encountered payment fraud, prompting a call for improved cybersecurity measures and employee training. This demonstrates the necessity for stakeholders to not only concentrate on financial metrics but also to take into account the wider operational risks linked to property management.

As Anthony A. Luna notes, "Discover how Coastline Equity is leveraging AI tools to make residential leasing even stronger and more effective," emphasizing the importance of innovation in adapting to market changes.

In summary, a thorough due diligence process, along with efficient property analysis methods, is essential for navigating the complexities of commercial property acquisition in 2025. By prioritizing these practices, investors can make informed decisions that lead to sustainable success.

Leveraging Technology and Data Analytics for Investment Success

In 2025, technology is set to transform the landscape of commercial real estate investment funding. Investors are increasingly leveraging data analytics to gain insights into market trends, assess property performance, and uncover lucrative investment opportunities. Advanced tools, such as predictive analytics and AI-driven platforms, empower individuals to make informed, data-driven decisions that enhance their competitive edge.

Notably, Zero Flux boasts over 30,000 subscribers, underscoring the growing demand for data-driven insights in the property sector.

The integration of property management software further streamlines operations, enhancing efficiency and fostering improved tenant relations. By automating routine tasks and providing real-time data, these technologies enable individuals to focus on strategic growth and responsiveness to market dynamics. AI applications, including automated property valuation and virtual assistants, are becoming essential tools in this evolving landscape.

Moreover, the adoption of virtual and augmented reality (VR/AR) technologies is revolutionizing client engagement. The case study titled "Enhancing Client Experience with VR/AR" exemplifies how these immersive tools facilitate enhanced property navigation and provide potential buyers with real-time information, attracting a broader audience, including those from distant locations. Consequently, effective property marketing and client interaction increasingly rely on these innovative technologies.

The influence of technology on commercial real estate investment is further highlighted by the growing necessity for upskilling within the workforce. As the skills gap widens, stakeholders must prioritize training initiatives to ensure their teams are equipped to leverage these advancements effectively. Deloitte notes that "even though the business case for sustainability strategies is gaining ground, there remains a balancing act as firms try to evaluate short-term financial returns and long-term benefits."

This proactive approach not only addresses immediate operational needs but also positions firms for long-term success in a rapidly evolving market.

In conclusion, adopting technology and data analysis is not merely a choice but an essential requirement for individuals aiming to succeed in commercial real estate investment within the sector in 2025. By harnessing these tools, they can navigate complexities, capitalize on emerging trends, and ultimately drive sustainable growth.

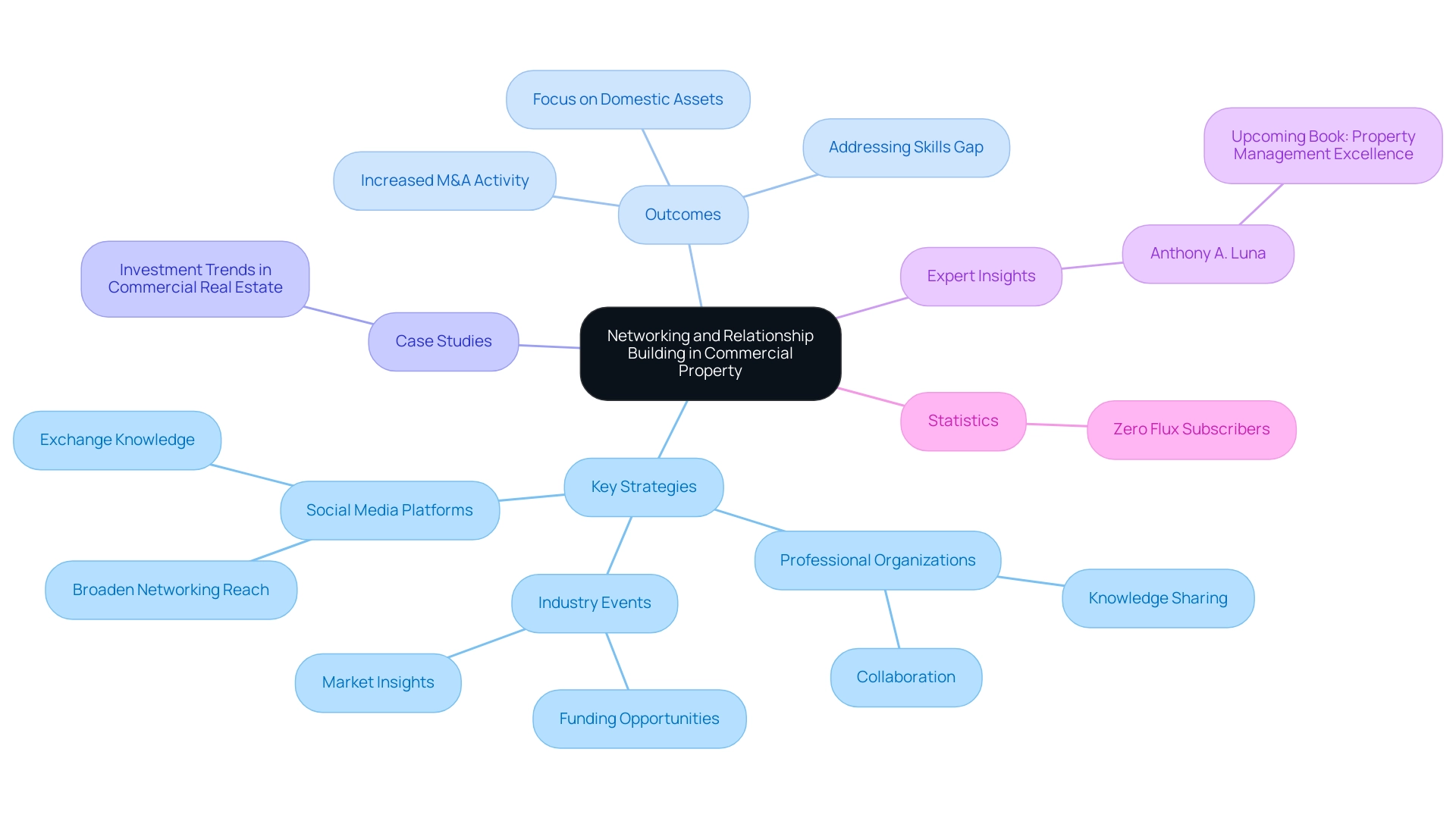

Networking and Relationship Building: Keys to Unlocking Opportunities

Networking in commercial property serves as a vital catalyst for unlocking funding opportunities. Actively engaging in industry events, joining professional organizations, and connecting with peers are essential strategies for cultivating meaningful relationships. Establishing connections with brokers, lenders, and other stakeholders not only paves the way for unique deals but also provides crucial insights into evolving market trends.

Recent patterns reveal a resurgence of optimism among participants, particularly in sectors like industrial and digital economy properties, following a downturn in global property funding. This shift highlights the significance of networking, as industry leaders increasingly focus on domestic assets and are open to mergers and acquisitions to leverage current market demands. A recent case study illustrates that individuals are eager to amplify their involvement in these sectors, reflecting a positive outlook for the future.

Furthermore, harnessing social media platforms and online forums can significantly broaden one's networking reach, enabling individuals to connect with a wider audience and exchange knowledge. A robust network not only enhances commercial real estate investment prospects but also fosters collaboration and knowledge sharing within the sector, which is crucial for navigating the complexities of commercial property.

As the commercial property landscape evolves, the importance of relationship development cannot be overstated. Experts assert that effective networking strategies are essential for attracting and retaining talent, especially given the widening skills gap within the industry. Leaders are prioritizing accelerated upskilling and reskilling initiatives to address this gap, rendering networking even more critical.

By prioritizing relationship development, investors can strategically position themselves in a competitive market, ensuring they remain informed and ready for emerging opportunities. Zero Flux, for instance, has garnered over 30,000 subscribers, underscoring its role as a dependable source of insights in the property market. Anthony A. Luna, a contributing author for Forbes, emphasizes that effective networking is pivotal for success in this dynamic landscape, as he prepares to publish his book on property management excellence in April 2025.

Continuous Learning: Adapting to Evolving Market Conditions

In the ever-evolving landscape of commercial real estate investment, the significance of ongoing education cannot be overstated. Investors must remain vigilant, staying informed about market trends, regulatory shifts, and technological innovations that shape the industry. Engaging in professional development through targeted courses, workshops, and industry conferences not only broadens knowledge but also sharpens essential skills.

For example, the adoption of AI in commercial real estate is gaining momentum, with 76% of industry professionals either researching or piloting AI solutions, particularly in accounting and financial planning. This statistic underscores the necessity of remaining informed about technological advancements that can enhance operational efficiency.

Furthermore, a substantial 70% of respondents in North America anticipate undertaking deep energy retrofits within the next 12 to 18 months, indicating a growing trend towards sustainability that stakeholders must consider. Following reputable industry publications and thought leaders provides invaluable insights into emerging trends. Notably, funding opportunities in the industrial sector are increasingly concentrated on last-mile facilities, automation, and sustainable construction practices, reflecting a shift towards more innovative and environmentally conscious strategies.

Fostering a culture of continuous learning empowers individuals to remain agile and responsive to changing market conditions. Success stories abound, such as Coastline Equity's utilization of AI tools to streamline residential leasing processes, illustrating how embracing new technologies can lead to more effective operations. As Tim Coy, Research Manager at Deloitte’s Center for Financial Services, aptly states, "Staying informed about market trends is crucial for making strategic financial choices."

By prioritizing ongoing education and professional development, investors can significantly enhance their strategies for commercial real estate investment, positioning themselves for success in 2025 and beyond.

Conclusion

The commercial real estate landscape is experiencing a pivotal transformation as it adapts to the evolving demands of the post-pandemic era. Investors are increasingly gravitating toward industrial and multifamily properties, which have demonstrated resilience and promise in a tightening market. Understanding the implications of shifting tenant preferences and the importance of strategic office leasing is vital for navigating this landscape effectively.

Key market trends, such as the stabilization of interest rates, a focus on sustainability, and demographic shifts, are shaping investment strategies. These factors not only influence property values but also present unique opportunities for those willing to adapt. Investors must engage in thorough property analysis and due diligence, leveraging data-driven insights and technology to enhance decision-making and operational efficiency.

Moreover, networking and relationship building remain essential components of successful investment strategies. Establishing connections within the industry can unlock exclusive opportunities and provide valuable insights into market dynamics. Continuous learning and professional development are crucial for staying ahead in this rapidly changing environment, ensuring that investors are equipped to embrace new technologies and innovative practices.

In summary, the commercial real estate sector in 2025 is characterized by both challenges and opportunities. By prioritizing strategic planning, robust analysis, and proactive networking, investors can position themselves for success in this dynamic market. Adapting to these changes and leveraging the right resources will be key to thriving in the evolving world of commercial real estate.