Overview

The article "Mastering Commercial Real Estate Investing: A Step-by-Step Guide" provides a comprehensive overview of the essential concepts, strategies, and considerations necessary for successful investment in commercial real estate (CRE). It introduces critical terms such as net operating income (NOI) and cap rates, while also discussing:

- Effective investment strategies

- Financing options

- Property evaluation criteria

- Risk management

- Property management techniques

These elements are crucial for making informed decisions in the evolving CRE landscape, empowering readers to navigate their investment journeys with confidence.

Introduction

In the dynamic realm of commercial real estate investing, grasping the nuances of this sector is crucial for achieving success. Unlike residential real estate, which primarily focuses on housing, commercial real estate encompasses a diverse array of property types, including:

- Office buildings

- Retail spaces

- Industrial facilities

As investors navigate this intricate landscape, understanding key concepts such as:

- Net operating income

- Cap rates

- Cash flow

becomes essential. With the market continually evolving—from suburban office trends to the emergence of sustainable developments—staying informed is paramount. This article explores the foundational elements of commercial real estate investing, providing insights on:

- Defining investment goals

- Examining property types

- Implementing effective management strategies

to seize emerging opportunities in 2025 and beyond.

Understanding the Basics of Commercial Real Estate Investing

Commercial real estate investing involves the acquisition, ownership, management, and sale of assets designated for business use. This sector is markedly distinct from residential real estate, which predominantly focuses on housing. CRE encompasses a diverse range of property types, including office buildings, retail spaces, industrial facilities, and multifamily housing units.

To effectively navigate this complex landscape, it is crucial to understand several key terms:

- Net Operating Income (NOI): This figure represents the income generated from an asset after deducting all operating expenses. Grasping NOI is essential, as it acts as a primary indicator of an asset's profitability and operational efficiency.

- Cap Rate: Short for capitalization rate, this metric is vital for assessing potential returns on investment. It is calculated by dividing the NOI by the asset's purchase price. A lower cap rate typically indicates a higher asset value and lower risk, whereas a higher cap rate may suggest greater risk with the potential for higher returns.

- Cash Flow: This term refers to the net amount of cash being transferred into and out of an asset. Positive cash flow is fundamental for sustaining the financial health of an asset, ensuring that the property generates sufficient revenue to cover costs and deliver returns to stakeholders.

Familiarity with these terms lays a strong foundation for your financial journey in business properties. As we approach 2025, understanding the nuances of net operating income becomes particularly vital, given the evolving market dynamics. Recent trends indicate that certain suburban office markets are experiencing cap rate flatness or even declines, as noted by Victor Calanog, Global Head of Research and Strategy at Manulife Investment Management.

This underscores the necessity for investors to remain vigilant regarding market changes. Moreover, effective funding strategies for business properties often involve public-private partnerships. Such collaborations can streamline development processes and enhance the availability of affordable housing, highlighting the importance of regulatory support within the sector.

With over 30,000 subscribers, Zero Flux emphasizes the significance of quality content in enhancing subscriber engagement and trust, positioning itself as an indispensable resource for those navigating the intricacies of business property investing.

Defining Your Investment Goals and Strategies

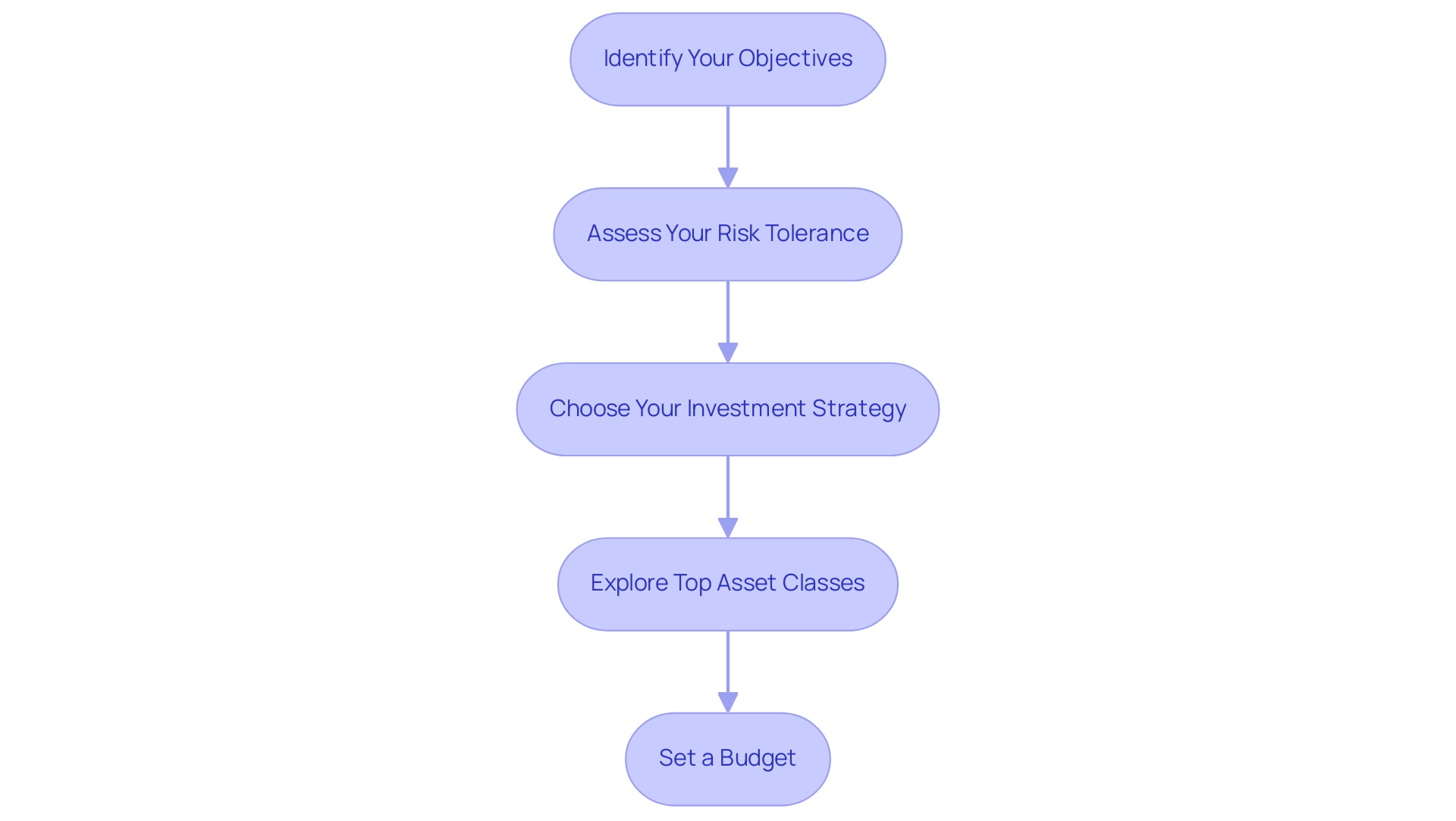

Before embarking on your journey into commercial real estate investing, it is essential to clearly define your financial objectives. This foundational step will guide your decisions and strategies. Here are key steps to consider:

-

Identify Your Objectives: Determine whether your focus is on long-term appreciation, immediate cash flow, or a blend of both. Understanding your primary objective will shape your funding approach.

-

Assess Your Risk Tolerance: Evaluate how much risk you are comfortable taking. This evaluation is crucial, as it will greatly affect your investment decisions and the kinds of assets you contemplate. Recent insights indicate that 88% of commercial real estate investing professionals plan to leverage digital technologies to enhance performance, reflecting a proactive approach to managing risk and optimizing returns. Notably, only 16% of respondents are doing so for compliance alone, highlighting the importance of strategic risk management.

-

Choose Your Investment Strategy: Familiarize yourself with common strategies, such as:

- Buy and Hold: This strategy involves purchasing properties to rent out, generating steady income over time.

- Flipping: This entails buying properties, renovating them, and selling for a profit, capitalizing on market demand.

- Value-Add: Investing in properties that require improvements can significantly increase their value, offering substantial returns.

-

Explore Top Asset Classes: Consider focusing on high-potential asset classes such as industrial and manufacturing, multifamily, and hotel and lodging properties. These sectors have shown resilience and growth potential in the current market.

-

Set a Budget: Establish how much capital you can allocate to your assets, including potential financing options. A well-defined budget will help you navigate the market effectively and avoid overextending your resources.

By meticulously defining your goals and strategies, you position yourself to make informed decisions that align with your financial aspirations. Successful investors in commercial real estate often refer to case studies that highlight the importance of goal-setting in achieving desired outcomes. For example, historical data indicates that business property portfolio optimization can produce average returns of 9.57% each year, underscoring the potential benefits of strategic planning. As you enhance your financial objectives for 2025, keep in mind that a clear vision and a well-organized strategy are crucial for navigating the complexities of commercial real estate investing. Additionally, Zero Flux's commitment to data integrity and factual reporting can serve as a valuable resource in making informed financial decisions.

Exploring Different Types of Commercial Real Estate Investments

Commercial real estate encompasses a diverse array of asset types, each presenting distinct characteristics and financial opportunities:

- Office Buildings: Generally leased to businesses, office buildings can yield steady income streams. However, they are vulnerable to economic shifts, which may affect occupancy rates and rental income.

- Retail Spaces: This category ranges from shopping centers to standalone stores. Effective resource allocation in retail assets necessitates a deep understanding of consumer behavior and prevailing market trends. Notably, retail spaces currently exhibit the lowest vacancy rate at 4.1%, while traditional malls confront challenges with an 8.6% vacancy rate.

- Industrial Assets: Comprising warehouses and manufacturing facilities, industrial investments are increasingly appealing due to the rise in e-commerce and logistics demands. This sector is poised for growth as businesses adapt to changing consumer behaviors.

- Multifamily Housing: Apartment complexes typically ensure consistent cash flow and tend to be less volatile than other business sectors. This stability renders them a preferred choice for investors seeking reliable returns.

- Mixed-Use Developments: These properties blend residential, retail, and other spaces, providing diversified income streams. Nevertheless, investing in commercial real estate may necessitate more complex management due to its multifaceted nature. Understanding the unique risks and rewards associated with this investment type is essential for making informed decisions. As the property market landscape evolves, emerging sectors such as data centers and life sciences are gaining traction, reflecting a shift towards sustainability and technological integration. For instance, green-certified structures now constitute 22% of new business developments, indicating a growing emphasis on environmentally responsible investments.

Moreover, according to Deloitte’s 2025 market outlook survey, nearly half of respondents expect funding to become more expensive, noting that securing financing will be more challenging for the remainder of 2023 and into 2024. Investors must remain vigilant regarding current trends and market dynamics in commercial real estate to seize opportunities across various sectors.

Navigating Financing Options for Your Investments

Securing funding is an essential step in business property investing, especially in the evolving landscape of 2025. Consider these common financing options:

- Traditional Bank Loans: These loans are often preferred due to their lower interest rates, which can be particularly beneficial in a market where economic resilience is expected to improve with lower rates. This context renders traditional bank loans attractive for well-prepared investors, as they typically require strong credit scores and comprehensive documentation.

- SBA Loans: The Small Business Administration provides loans specifically designed for acquiring business real estate. These loans often feature favorable conditions, particularly for small enterprises, making them a compelling choice for those aiming to enter the business property market. In 2025, SBA loans are anticipated to remain a vital financing avenue, with statistics indicating their growing popularity among investors. They generally offer the best rates, further enhancing their appeal.

- Private Lenders: For those in need of swift financing, private lenders can provide more flexible terms, albeit often at higher interest rates. This option can be advantageous for investors looking to seize immediate opportunities without the prolonged approval processes associated with traditional banks.

- Real Estate Investment Trusts (REITs): Investing in REITs allows individuals to gain exposure to business investments without the necessity of directly acquiring assets. This method offers a way to diversify assets and access the business market with reduced capital requirements.

- Crowdfunding Platforms: These platforms enable numerous investors to pool their resources for specific assets, democratizing access to business real estate opportunities. This strategy allows investors to participate in larger deals with diminished individual capital commitments.

When evaluating each financing alternative, consider critical factors such as interest rates, repayment terms, and how each aligns with your overall financial strategy. Moreover, with a potential risk for 2025 regarding business properties being the significantly increased operating expenses—primarily due to property insurance—understanding these financing options will be crucial for making informed financial choices. Additionally, the ongoing interest and involvement of entities like Freddie Mac and Fannie Mae in multifamily lending could significantly influence investment decisions in the market.

As the real estate landscape continues to evolve, securing reliable financing options becomes increasingly vital, particularly in light of the reported rise in payment fraud attempts, which underscores the necessity for vigilance in financial dealings.

Evaluating Properties: Key Considerations for Investors

Assessing a commercial asset requires a meticulous approach, focusing on several essential considerations:

- Location: The significance of location cannot be overstated. A real estate's accessibility, visibility, and proximity to essential amenities play a crucial role in determining its rental income potential and overall value. In 2025, statistics indicate that properties situated in prime locations command higher rental rates, making them more attractive to investors.

- Market Trends: Understanding local market conditions is vital. This includes analyzing supply and demand dynamics, current rental rates, and broader economic indicators. Recent reports highlight that commercial real estate investing is influenced by shifting market trends, with vacancy rates and absorption rates varying significantly across different sectors. For instance, the case study titled 'Commercial Real Estate Market Insights' details how these trends can affect financial choices. Staying informed about trends in commercial real estate investing can provide a competitive edge.

- Physical Condition: A thorough inspection of the premises is essential to identify any necessary repairs or renovations. Properties requiring significant maintenance can detract from your investment returns. Significantly, a survey by the Commercial Real Estate Women Network discovered that 76% of participants indicated their organizations have policies supporting mental health and well-being, highlighting the importance of proactive management. Case studies have shown that timely renovations can enhance value and attract quality tenants.

- Financial Performance: Reviewing the asset's financial statements is critical. This includes examining current leases, operating expenses, and historical income data. A comprehensive financial analysis helps investors assess the asset's profitability and long-term viability.

- Zoning Regulations: Compliance with local zoning laws is non-negotiable. Comprehending these regulations guarantees that the property can be utilized or developed in line with your financial strategy. Failure to comply can result in expensive setbacks and legal issues.

By carefully assessing these elements, investors can make knowledgeable choices in commercial real estate investing that correspond with their funding goals, ultimately improving their success in the property market. As Deloitte Global emphasizes, adapting to changing business expectations is crucial for success in this evolving landscape.

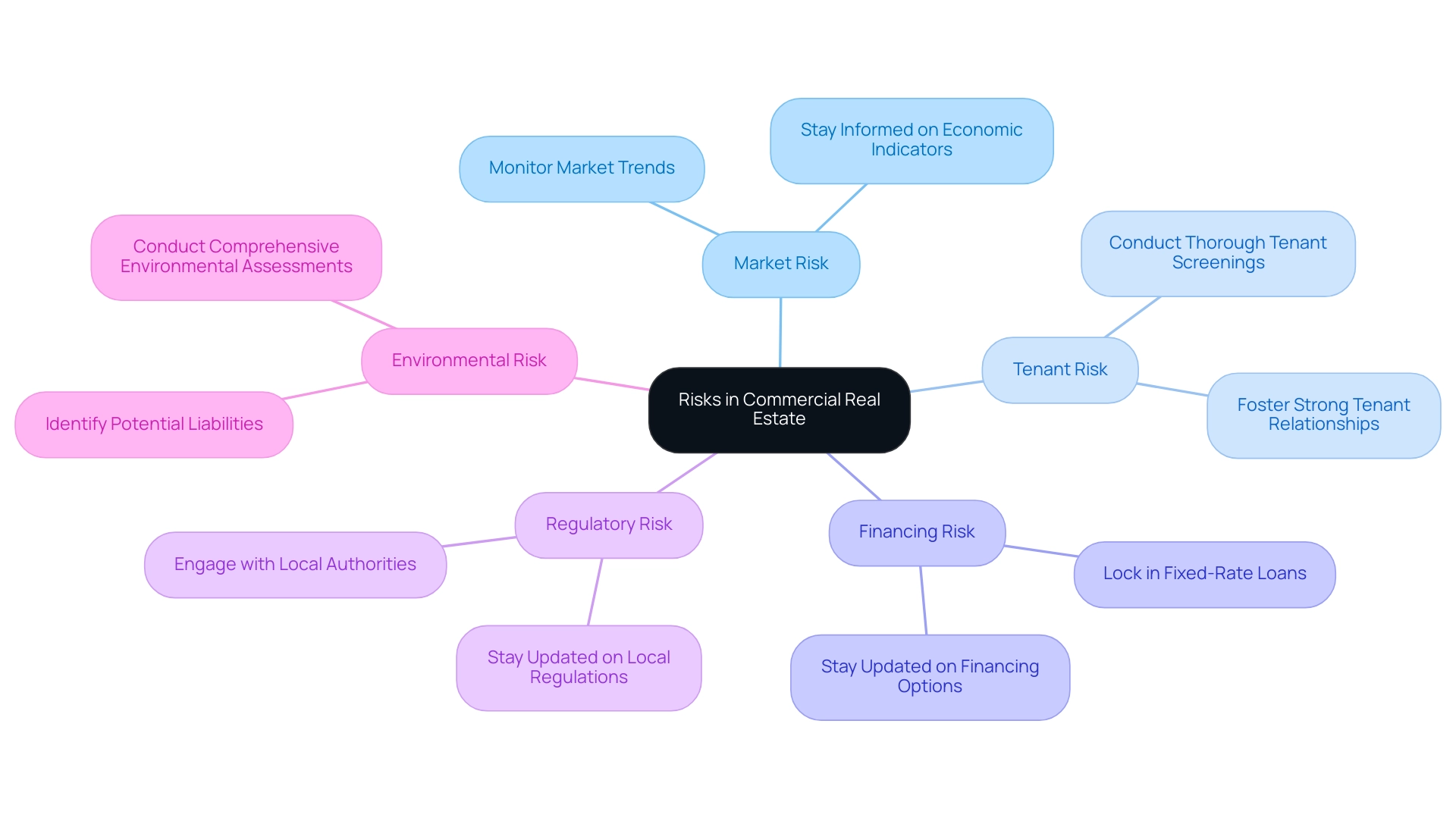

Identifying and Managing Risks in Commercial Real Estate

Navigating a landscape filled with inherent risks is essential when investing in commercial real estate. Understanding these risks and implementing effective strategies is crucial for safeguarding your investments. Below are key risks along with corresponding strategies to manage them:

- Market Risk: Fluctuations in market conditions can significantly affect asset values and rental income. To mitigate this risk, staying informed about market trends and economic indicators is essential. For instance, as of early 2025, the San Francisco multifamily market is witnessing a notable decrease in vacancy rates, indicating strong demand for rental units. Victor Calanog, Global Head of Research and Strategy at Manulife Investment Management, notes that "good retail in prime locations is likely to do well, despite continued growth of the e-commerce segment." Monitoring such trends empowers investors to make informed decisions.

- Tenant Risk: The financial stability of tenants directly influences cash flow. Conducting thorough tenant screenings is vital to ensure that tenants can meet their financial obligations. Additionally, fostering strong relationships with tenants can minimize vacancies and enhance retention rates. Statistics indicate that a stable tenant base is crucial for maintaining consistent cash flow, especially in fluctuating markets. Research shows that buildings with financially stable tenants experience up to 30% less turnover, significantly impacting overall cash flow.

- Financing Risk: Interest rates can be unpredictable, affecting your financing costs. To manage this risk, consider locking in fixed-rate loans, which provide stability in your financial planning. As technological advancements, such as data analytics and artificial intelligence, reshape the commercial real estate sector, staying abreast of financing options can offer a competitive edge. These technologies are anticipated to enhance asset management and improve decision-making processes.

- Regulatory Risk: Changes in zoning laws or regulations can significantly impact property use and value. Staying updated on local regulations and engaging with local authorities is essential to anticipate potential changes. Proactive engagement enables investors to navigate regulatory landscapes more effectively.

- Environmental Risk: Properties may face environmental issues that could lead to costly remediation efforts. Conducting comprehensive environmental assessments before purchasing is crucial to identify potential liabilities. This proactive approach not only safeguards your investment but also aligns with the increasing focus on sustainability in property.

By proactively identifying and managing these risks, investors can enhance their chances of success in commercial real estate investing. The next generation of property talent is expected to leverage artificial intelligence to transform traditional practices, further aiding in risk management and decision-making processes.

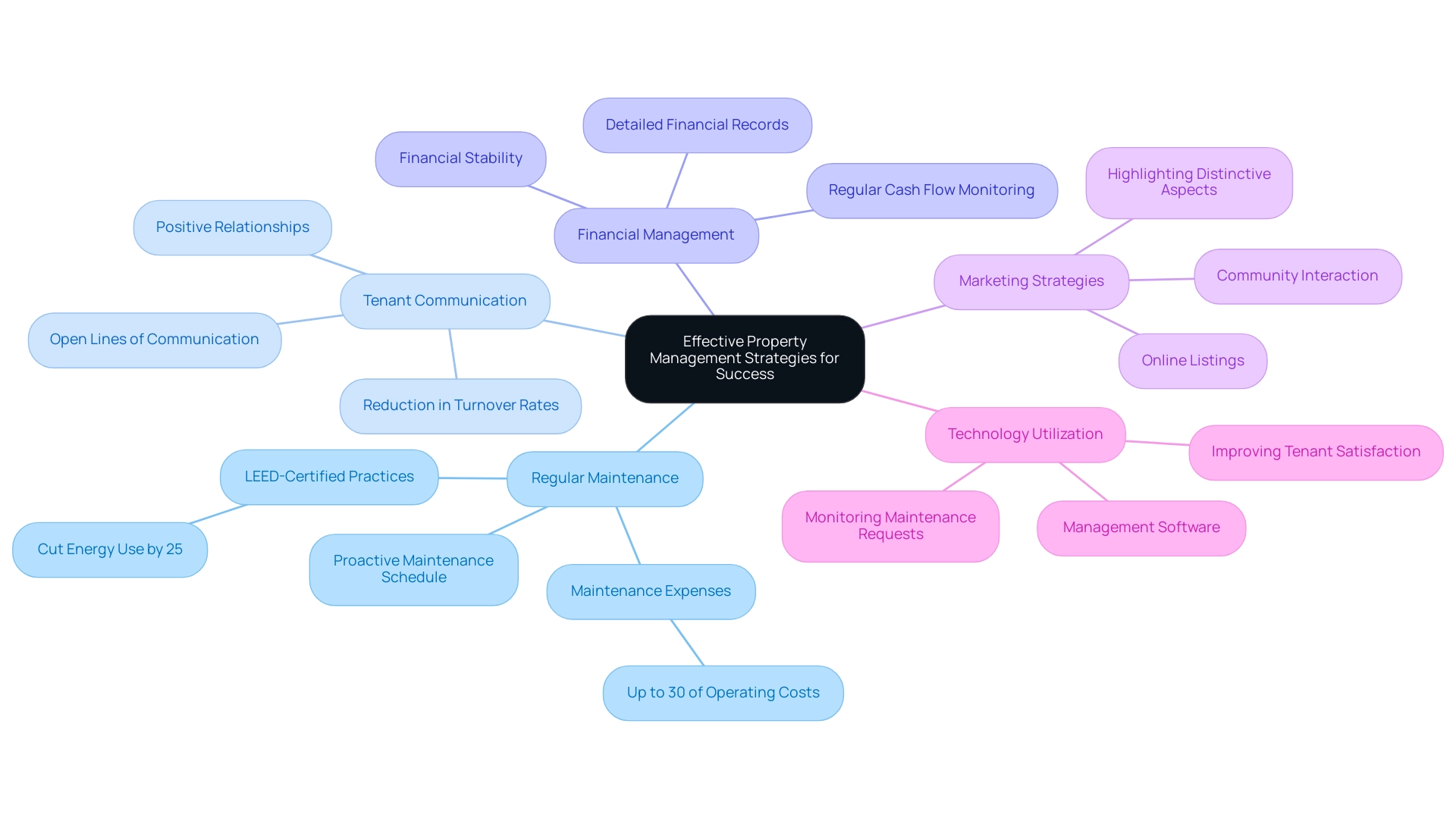

Effective Property Management Strategies for Success

Effective management of assets is essential for maximizing returns on your investments in commercial real estate. Consider the following effective strategies:

- Regular Maintenance: Establish a proactive maintenance schedule to identify and resolve issues before they escalate. This approach not only ensures tenant satisfaction but also extends the lifespan of your asset. In 2025, the focus on routine upkeep is underscored by the fact that maintenance expenses for business establishments can represent up to 30% of total operating costs. Moreover, utilizing LEED-certified practices can cut energy use by around 25%, further enhancing maintenance efficiency and reducing costs.

- Tenant Communication: Cultivating open lines of communication with tenants is vital. Addressing concerns promptly fosters positive relationships and enhances tenant retention. Successful case studies demonstrate that assets with strong tenant communication strategies see a significant reduction in turnover rates, which can be costly for landlords. As highlighted by Kathy Feucht, Global Real Estate leader, "This year’s commercial real estate outlook aims to help leaders turn the corner on the recent challenging years to better position their organizations for the road ahead," emphasizing the need for effective management strategies.

- Financial Management: Maintaining detailed financial records is imperative. Regularly monitoring cash flow and preparing for potential expenses ensures financial stability. A well-managed asset can yield returns that exceed market averages, particularly when financial oversight is prioritized.

- Marketing Strategies: Implement effective marketing strategies to attract and retain tenants. This involves using online listings, interacting with the community, and highlighting the distinctive aspects of your assets. In a competitive market, assets that are promoted effectively can attain higher occupancy rates and rental prices.

- Technology Utilization: Utilize management software to streamline operations. These tools can assist in monitoring maintenance requests, managing tenant communications, and offering insights into asset performance. The integration of technology not only enhances efficiency but also improves tenant satisfaction by ensuring timely responses to their needs.

By implementing these strategies, you can significantly improve the performance of your commercial assets through real estate investing and achieve your financial objectives. The San Francisco multifamily market, for example, is currently experiencing the lowest vacancy rates since 2019, signaling a strengthening demand for well-managed rental units. This trend underscores the importance of effective property management in creating favorable investment environments, particularly as the industry focuses on upskilling and reskilling initiatives to attract and retain talent in property management.

Conclusion

Understanding the complexities of commercial real estate investing is essential for any investor aiming to thrive in this dynamic market. Key concepts such as net operating income, cap rates, and cash flow serve as the foundation for making informed decisions. By clearly defining investment goals and strategies, investors can navigate the diverse property types—from office buildings to multifamily units—while aligning their approaches with current market trends.

Moreover, securing proper financing and evaluating properties thoroughly are critical steps in this journey. Investors must consider various financing options, including:

- Traditional loans

- SBA loans

- Crowdfunding platforms

to find the best fit for their needs. Additionally, understanding market conditions, tenant stability, and regulatory requirements will enhance decision-making processes and risk management strategies.

Ultimately, effective property management plays a pivotal role in maximizing returns. By implementing proactive maintenance, fostering tenant relationships, and leveraging technology, investors can create environments that not only attract and retain tenants but also improve the overall performance of their investments.

As the commercial real estate landscape continues to evolve, staying informed and adaptable will be key to seizing emerging opportunities in 2025 and beyond. By embracing these principles and strategies, investors can position themselves for success in a sector that presents both challenges and significant rewards.