Overview

This article provides a comprehensive overview of various investment strategies in real estate, including:

- Direct ownership

- REITs

- Real estate crowdfunding

- Flipping properties

- Rental units

- Commercial real estate

Each strategy comes with its own set of distinct advantages and disadvantages. Investors are encouraged to align their chosen approach with their financial goals and risk tolerance, as the suitability of each method can vary significantly among conservative, aggressive, new, experienced, and passive investors.

Introduction

In the dynamic realm of real estate investment, a myriad of strategies beckons investors, each offering varying degrees of risk and reward. From the hands-on approach of direct property ownership to the innovative landscape of real estate crowdfunding, every method presents its own unique advantages and challenges. As market conditions evolve, understanding these diverse investment avenues is crucial for individuals aiming to build wealth and secure their financial futures.

This article delves into the primary methods of real estate investment, providing insights into their suitability for different investor profiles while highlighting the potential benefits and pitfalls that accompany each strategy. Whether you are a conservative investor seeking stability or an aggressive player aiming for high returns, the right investment choice can pave the way for success in this ever-changing market.

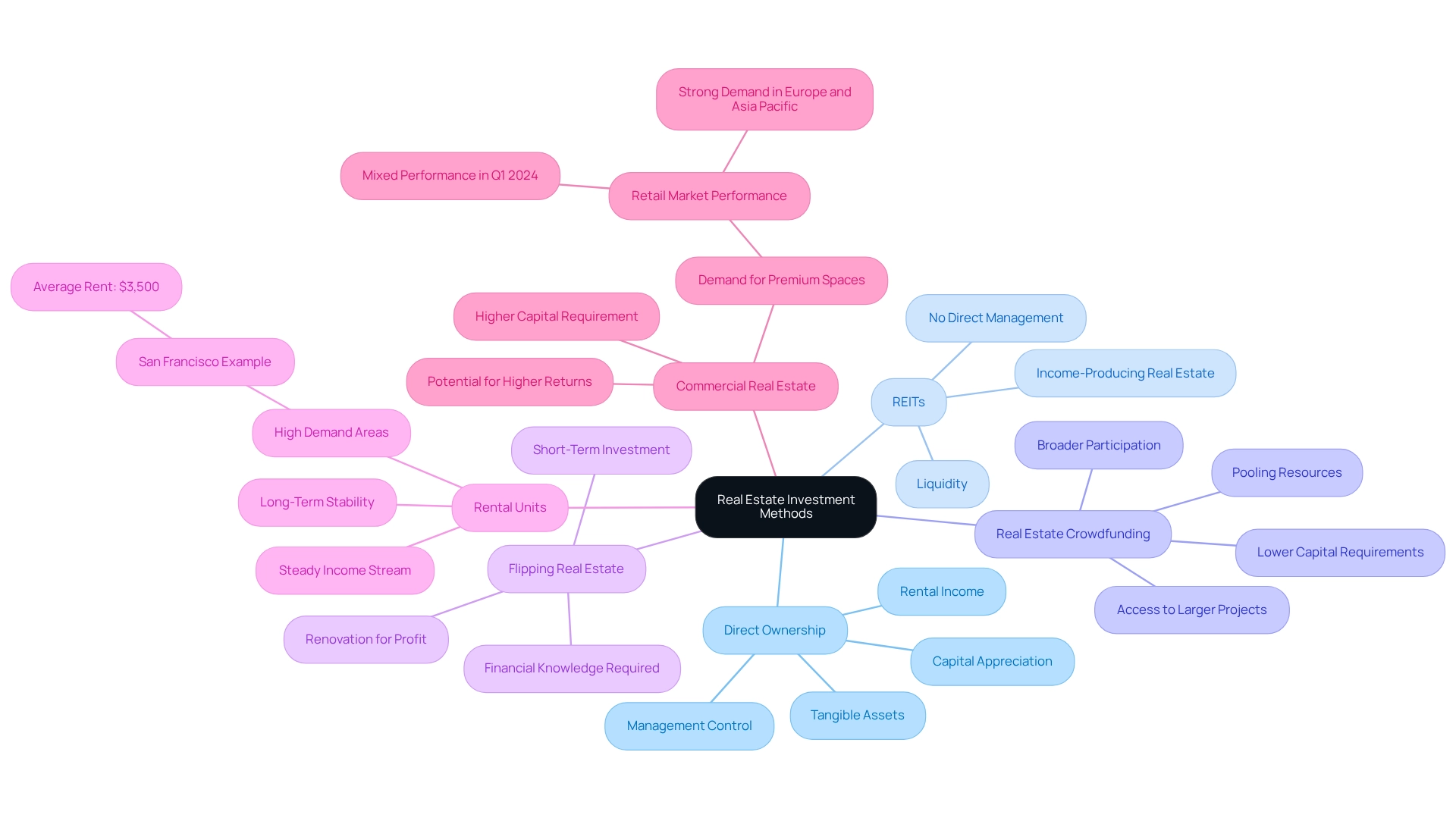

Overview of Real Estate Investment Methods

Real estate investment includes different ways to invest in real estate, with several primary methods, each offering unique characteristics and appeal, such as direct ownership, which entails acquiring tangible assets like residential houses or commercial structures to generate rental income or benefit from capital appreciation. Investors can directly influence property management and value. Recent signs of recovery, including heightened buyer interest, suggest that this method may become more appealing as conditions improve.

- Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-producing real estate. By acquiring shares in REITs, individuals can access real estate markets without the duties of direct ownership, making it a more liquid option.

- Real Estate Crowdfunding: This innovative approach allows multiple investors to pool their resources to fund real estate projects, often facilitated through online platforms. Crowdfunding opens up access to real estate opportunities, allowing involvement in larger projects with reduced individual capital demands. The shift to crowdfunding represents a profound change in the investment environment, allowing broader public participation.

- Flipping Real Estate: Investors acquire real estate, renovate it, and sell it for a profit, usually within a brief period. This strategy can produce substantial returns but necessitates financial knowledge and renovation expertise to reduce risks.

- Rental Units: Acquiring assets to lease to tenants generates a steady stream of income. This approach can offer long-term financial stability, particularly in environments with increasing rental demand. For instance, San Francisco retains its title as the most expensive city for renters globally, with average rent for a one-bedroom apartment around $3,500 monthly, highlighting the potential profitability of rental investments.

- Commercial Real Estate: Investing in office buildings, retail spaces, or industrial properties often requires larger capital but can yield higher returns. The commercial sector is currently experiencing shifts, with demand for premium spaces remaining strong despite challenges in other areas. A recent case analysis showed that although the retail sector experienced varied performance, the need for premium central locations stayed strong in Europe and Asia Pacific, which reflects different ways to invest in real estate. For instance, while direct ownership offers control, it also involves significant management responsibilities. Conversely, REITs and crowdfunding provide liquidity and lower entry costs but may lack the same level of control. Investors should thoughtfully evaluate their financial objectives and risk tolerance when choosing a strategy, particularly in view of current trends suggesting a gradual recovery and heightened buyer interest. As indicated by Realtor, with the possibility of reduced mortgage rates and gradual market stabilization, there could be enhancements in affordability and appeal for investors. Furthermore, Sharad Mehta emphasizes that 43% of homebuyers are Millennials, despite affordability issues, suggesting a demographic change that could impact future financial strategies.

Advantages of Each Investment Method

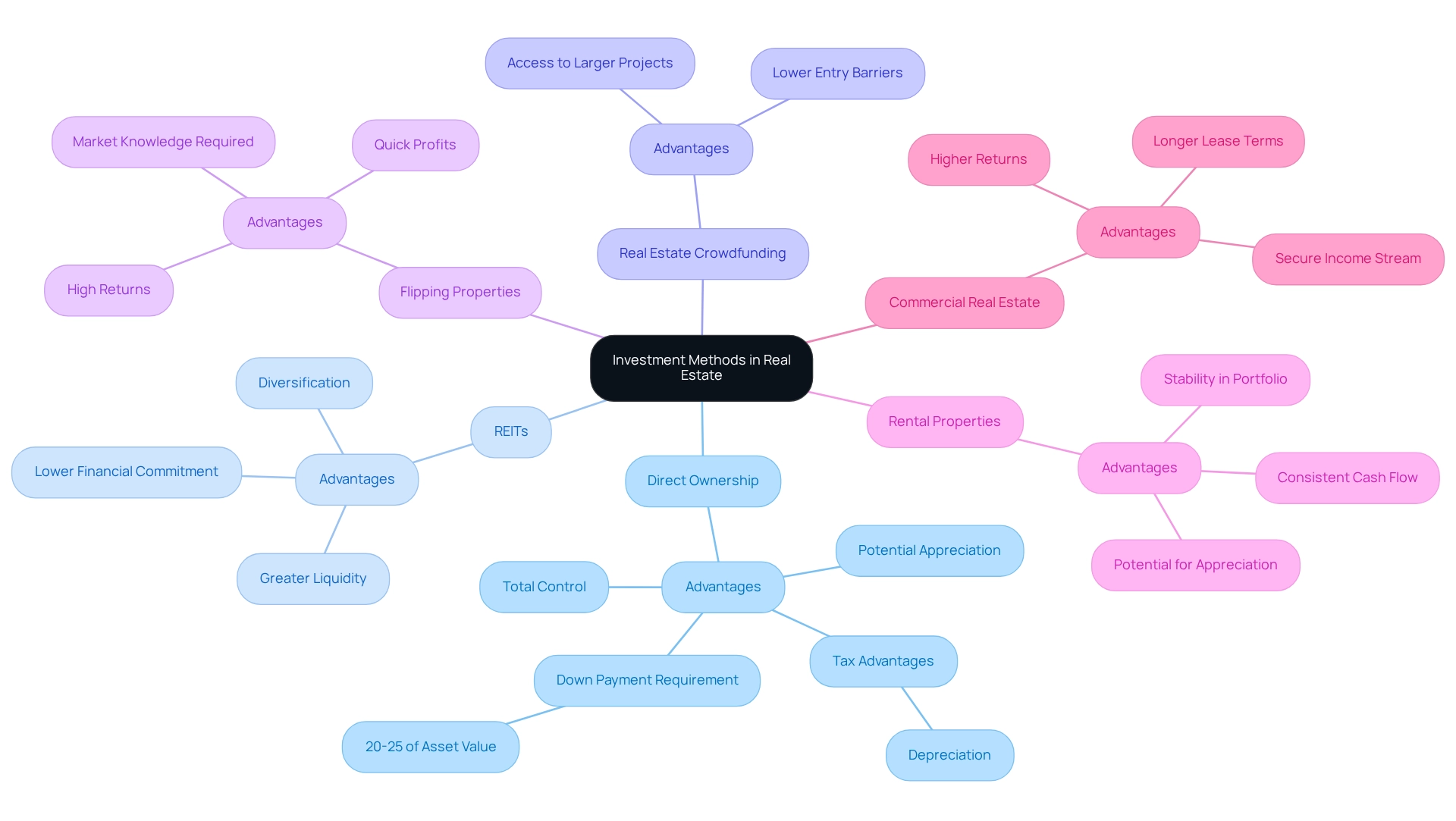

Each of the different ways to invest in real estate presents unique advantages that cater to different investor needs.

-

Direct Ownership: This method provides investors total control over their assets, enabling potential considerable appreciation and tax advantages, including depreciation. However, it usually necessitates a down payment of 20-25% of the asset's value, which can be a hurdle for some. Statistic: Direct ownership of real estate typically requires a down payment of 20-25% of the asset's value.

-

REITs (Real Estate Investment Trusts): REITs offer greater liquidity, allowing individuals to purchase and trade shares like stocks. This approach provides diversification among different properties without requiring substantial financial commitments, making it an appealing choice for those desiring flexibility.

-

Real Estate Crowdfunding: This method lowers the entry barrier for investors, allowing participation in larger projects with smaller amounts of capital. It democratizes access to real estate opportunities, appealing to a broader audience.

-

Flipping Properties: Investors can achieve high returns in a short timeframe if executed correctly. This strategy is particularly appealing to those looking for quick profits, though it requires market knowledge and timing.

-

Rental Properties: This asset generates consistent cash flow and has the potential for appreciation over time, providing both immediate income and long-term growth. It is a favored strategy for those seeking stability in their asset portfolio.

-

Commercial Real Estate: Often characterized by longer lease terms, commercial properties can offer stability and potentially higher returns compared to residential investments. This method is suitable for individuals seeking a more secure income stream.

These advantages highlight the different ways to invest in real estate, allowing individuals to align their strategies with their financial objectives and risk appetite. As Mike Tolj, a specialist in representing business owners and landlords, states, "Let’s collaborate to create a tailored approach that aligns with your goals and maximizes your potential returns."

Furthermore, a case study named 'Choosing Between REITs and Direct Real Estate Ownership' highlights the distinct benefits and challenges of both approaches, proposing that a blend of both strategies could be advantageous. It is essential for stakeholders to inform themselves and create a clear financial strategy, as direct real estate participation can be beneficial for those prepared to exert the effort.

Disadvantages of Each Investment Method

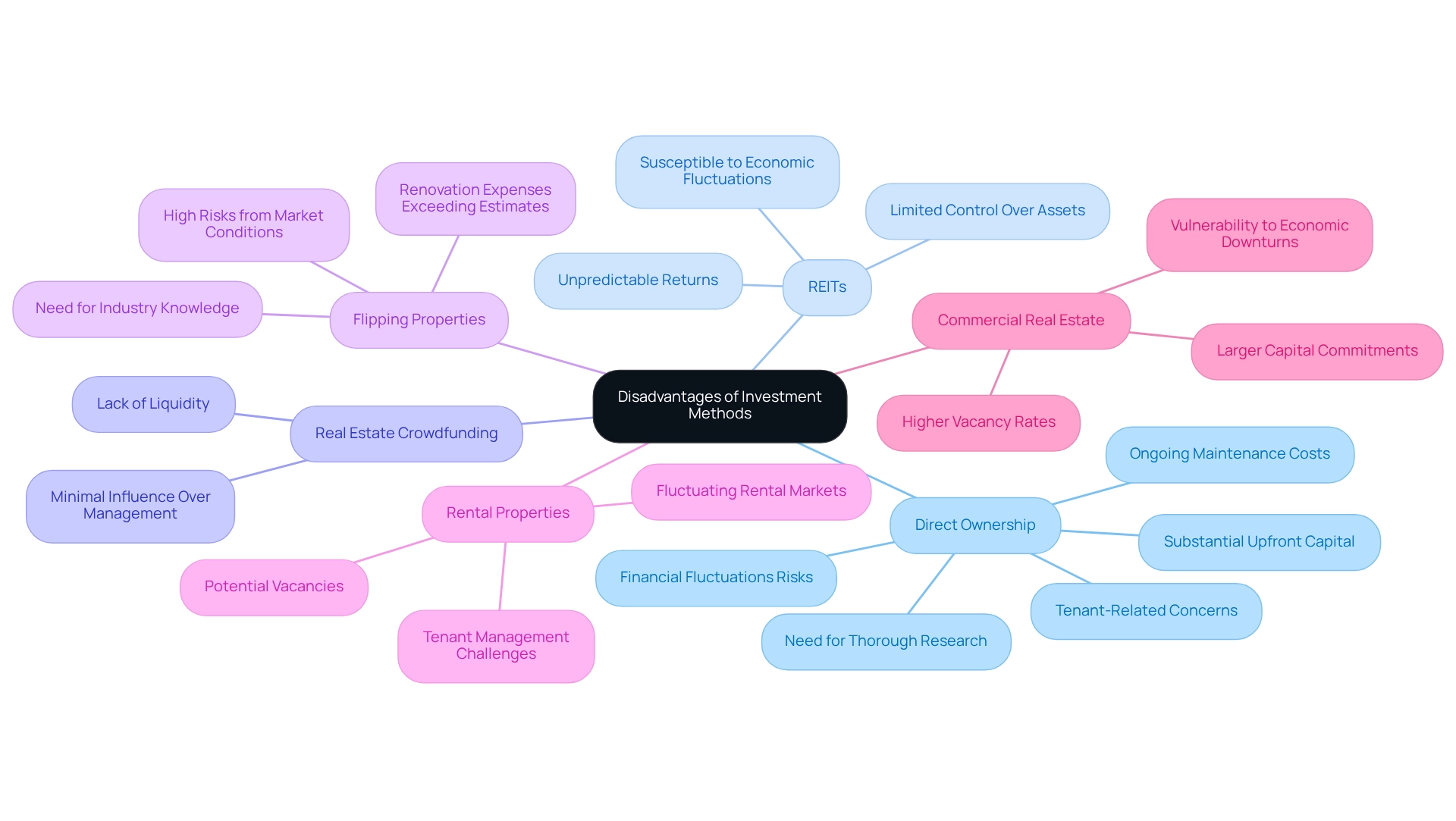

While each investment method offers unique advantages, they also present significant disadvantages that investors must consider:

-

Direct Ownership: This approach demands substantial upfront capital and ongoing maintenance costs. Investors encounter risks from financial fluctuations and tenant-related concerns, which can affect profitability. Conducting thorough research and setting clear investment goals can significantly improve an investor's chances of success in this area, as highlighted in the case study titled "Factors to Consider Before Investing in Direct Real Estate Ownership."

-

REITs: While they provide a pathway to invest in real estate without direct ownership, REITs are susceptible to economic fluctuations. Investors often have limited control over the underlying assets, leading to unpredictable returns. As Daniela Ryabov notes, "Investing in real estate is a popular strategy for building wealth and generating income," which emphasizes different ways to invest in real estate and the potential benefits despite inherent risks.

-

Real Estate Crowdfunding: This method can lack liquidity, as funds may be locked in for extended periods. Investors typically have minimal influence over project management, which can directly affect outcomes.

-

Flipping Properties: This strategy carries high risks, particularly if market conditions deteriorate or renovation expenses exceed initial estimates. Success demands comprehensive industry knowledge and precise timing.

-

Rental Properties: Managing tenants can be challenging, with potential vacancies and fluctuating rental markets impacting cash flow. While owning rental properties allows for passive income generation through rent, these factors necessitate careful management and strategic planning.

-

Commercial Real Estate: Typically requiring larger capital commitments, this sector is more vulnerable to economic downturns, which can lead to higher vacancy rates and diminished revenue.

Acknowledging these drawbacks is essential for stakeholders seeking to reduce risks and develop effective financial strategies. Furthermore, seeking guidance from platforms that provide financial education and highlight different ways to invest in real estate, along with community connection, can be beneficial in navigating these complexities.

Suitability for Different Investor Profiles

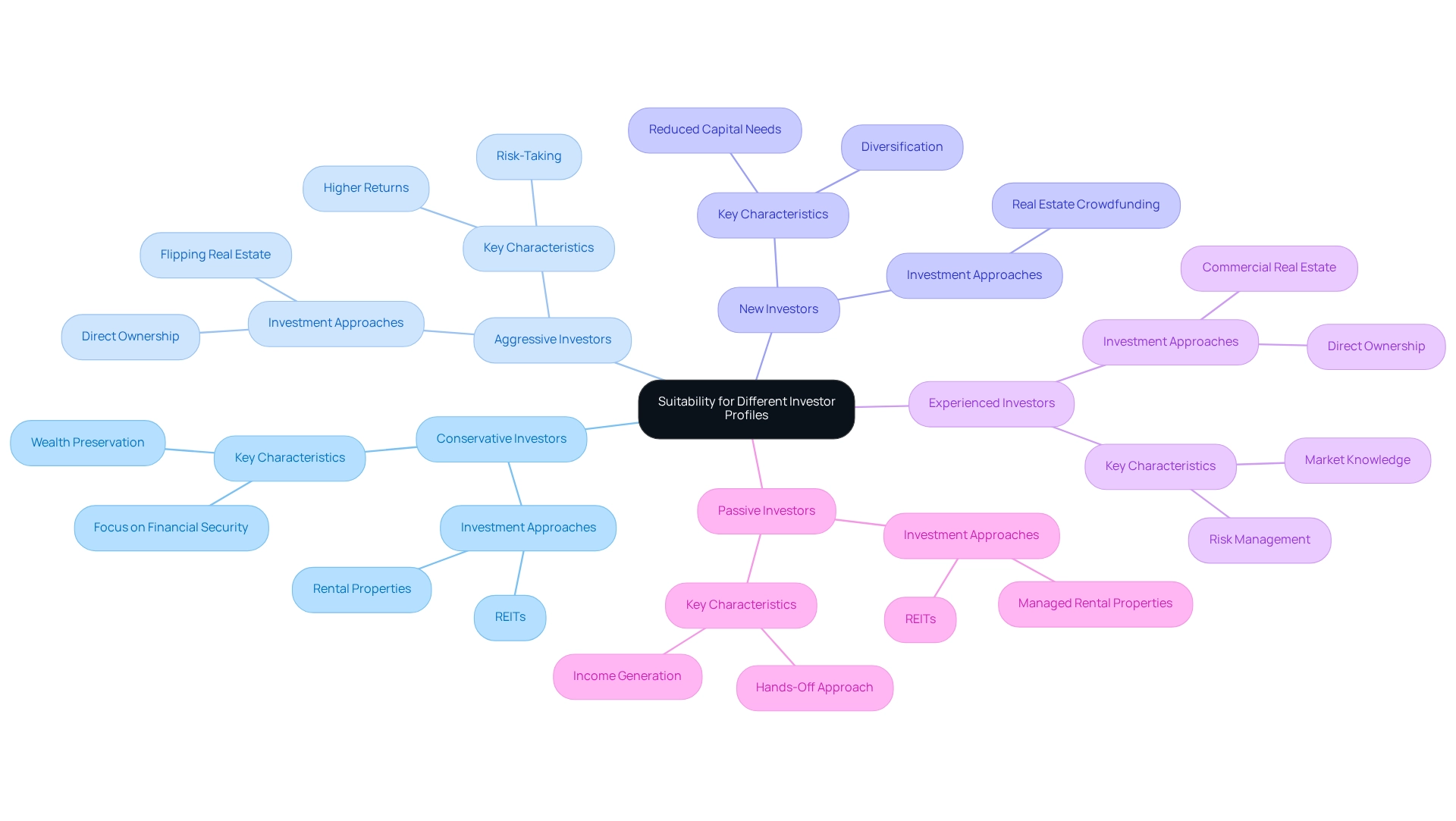

Various types of capital providers may find certain real estate investment approaches more appropriate than others:

-

Conservative Investors: Typically favor Real Estate Investment Trusts (REITs) or rental properties, which offer the potential for steady income with lower risk compared to direct ownership. This method aligns with their emphasis on wealth preservation, as showcased in case studies that stress the cautious behavior of conservative individuals who prioritize financial security over aggressive wealth creation. Moreover, with San Francisco retaining its title as the most expensive city for renters globally, conservative investors may discover lucrative opportunities in high-demand rental markets.

-

Aggressive Investors: Frequently lean towards flipping real estate or direct ownership, aiming for higher returns despite the inherent risks. In 2025, aggressive strategies may involve focusing on assets in rapidly appreciating areas, where the average duration on the listing has reduced to 27 days, indicating a dynamic environment ripe for investment. Successful case studies of assertive individuals illustrate how tactical property choice and timing within the economy can result in significant gains.

-

New Investors: Can gain advantages from real estate crowdfunding, which enables reduced capital needs and diversification without extensive industry knowledge. This approach offers an easy access point into real estate, allowing new participants to engage in the field while minimizing risk exposure.

-

Experienced Investors: Frequently engage in commercial real estate or direct ownership, leveraging their knowledge to manage risks and maximize returns. Their understanding of industry trends and asset selection becomes essential as a new real estate cycle commences, empowering them to capitalize on emerging opportunities. Recognizing that market and asset selection will be crucial in this new cycle can assist seasoned individuals in refining their strategies.

-

Passive Investors: May opt for REITs or rental properties managed by property management companies, minimizing their involvement while still generating income. This strategy is ideal for those who prefer a hands-off approach, enabling them to benefit from different ways to invest in real estate without the demands of active management. By aligning investment methods with individual profiles, investors can navigate the complexities of different ways to invest in real estate more efficiently, selecting strategies that resonate with their financial objectives and risk appetite. Incorporating current statistics on investor preferences in 2025 can further elucidate how these profiles align with market trends.

Conclusion

Understanding the diverse methods of real estate investment is essential for navigating the complexities of the market. Each approach—whether direct ownership, REITs, crowdfunding, flipping properties, rental investments, or commercial real estate—offers distinct advantages and challenges tailored to different investor profiles. For instance, conservative investors may find security in REITs and rental properties, while aggressive investors might pursue the high-stakes potential of flipping or direct ownership.

However, these methods are not without their drawbacks. The substantial capital requirements and ongoing responsibilities of direct ownership, the market volatility associated with REITs, and the risks inherent in flipping properties all underscore the need for careful consideration. Investors must weigh these factors against their financial goals and risk tolerance to make informed decisions.

Ultimately, the key to successful real estate investing lies in aligning the chosen strategy with individual circumstances and market conditions. As the landscape continues to evolve, staying educated and adaptable will be crucial for investors aiming to build wealth and secure their financial futures in this dynamic arena. With the right approach, real estate investment can serve as a powerful vehicle for achieving long-term financial success.