Overview

This article delves into the construction of passive income in real estate through a variety of strategies, including:

- Rental properties

- REITs

- Crowdfunding

These methods empower investors to generate income with minimal effort. It outlines the numerous benefits of passive income, such as:

- Financial freedom

- Wealth accumulation

While offering a comprehensive step-by-step guide for investors. This guide aids in navigating the complexities of the real estate market effectively, ensuring that readers can make informed investment decisions.

Introduction

In the realm of investment, the allure of passive income through real estate presents a compelling opportunity for financial growth and stability. This approach empowers investors to earn money with minimal ongoing effort, leveraging diverse sources such as:

- Rental properties

- Real Estate Investment Trusts (REITs)

- Crowdfunding platforms

As the landscape of real estate investing evolves, grasping the intricacies of passive income strategies becomes essential for those aiming to establish a sustainable income stream. With a significant portion of investors recognizing the benefits of this strategy, there has never been a more opportune moment to explore the potential of real estate as a pathway to financial independence and wealth accumulation.

Understanding Passive Income in Real Estate

Earnings from real estate passive income involve profits generated from rental units or financial contributions without necessitating active oversight. This revenue stream encompasses various sources, including rental payments, dividends from Real Estate Investment Trusts (REITs), and profits from property crowdfunding. Understanding this concept is crucial for investors aiming to establish a sustainable income source that demands minimal ongoing effort.

- Definition: Passive income is defined as money earned with little to no effort on the part of the investor, facilitating financial growth without constant oversight.

- Sources: Common sources of passive income in real estate include:

- Rental Properties: Owning residential or commercial properties that generate consistent rental income.

- REITs: Investing in publicly traded companies that own, operate, or finance income-producing real estate, providing dividends to shareholders.

- Real Estate Crowdfunding: Participating in collective investment platforms that pool funds to invest in real estate projects, offering returns based on the project's performance.

- Importance: Passive income enables investors to earn money while pursuing other interests or investments, creating a diversified income portfolio.

Recent trends indicate that a significant percentage of investors are generating passive income from real estate. In 2025, it is projected that around 70% of property investors will be utilizing strategies for real estate passive income, reflecting an increasing awareness of the advantages of this method. For instance, the Melbourne real estate market exemplifies this trend, characterized by steady population growth, strong employment opportunities, and an average rental yield of 4.9%, alongside a vacancy rate of just 3.5%. This combination positions Melbourne as a desirable choice for passive revenue generation.

Moreover, expert opinions underscore the significance of real estate passive income for achieving long-term financial stability. As Chris Heller, Chief Real Estate Officer at OJO Labs, observes, comprehending strategies for real estate passive income is crucial for investors to navigate the intricacies of the market efficiently. This understanding is further supported by Zero Flux's commitment to quality content, which enhances subscriber engagement and establishes it as a reliable authority in property insights.

With the typical 30-year mortgage rate expected to drop to approximately 6.7% by year-end, the conditions for investing in properties that produce real estate passive income are becoming increasingly favorable.

In summary, real estate passive income not only offers financial gains with minimal effort but also allows investors to concentrate on other activities, making it an essential component of a balanced investment approach.

Exploring Passive Income Strategies in Real Estate

Generating passive income through real estate can be effectively achieved through various strategies that promise substantial returns:

- Rental Properties: Acquiring residential or commercial properties for rental purposes can yield a consistent income stream. Key factors to consider include the property's location, effective property management, and careful tenant selection. In 2025, the average return on capital (ROI) for rental properties is expected to be approximately 10%, with many investors reporting returns that significantly surpass conventional financial options.

- Real Estate Investment Trusts (REITs): Investing in REITs allows individuals to purchase shares in companies that own and manage real estate portfolios. This investment vehicle provides dividends without the complexities of direct property management. As of 2025, the average ROI for REITs is projected to be around 8%, making them an attractive option for generating real estate passive income.

- Crowdfunding Platforms: Real estate crowdfunding offers a unique opportunity for investors to pool their resources to finance real estate projects. This method generally necessitates lower capital outlays and enables diversification among different properties, thereby mitigating risk. Success stories from crowdfunding platforms highlight how investors have funded innovative projects, leading to substantial returns.

- Turnkey Properties: These completely refurbished properties are prepared for immediate leasing, enabling investors to begin generating revenue right away. This strategy is particularly appealing for those who prefer a hands-off approach, as it eliminates the need for renovation and tenant placement.

- Short-Term Rentals: Utilizing platforms like Airbnb, property owners can rent out their spaces for short durations, often achieving higher returns compared to traditional long-term rentals. The demand for short-term rentals continues to grow, especially in markets like Atlanta, GA, where affordability and ongoing infrastructure projects enhance investment potential.

As the rental property market evolves, landlords must navigate a complex landscape shaped by local regulations and tenant protections. For instance, 17% of landlords report compliance with these regulations as a significant challenge, as noted by Saad Dar. However, adapting to these changes—such as incorporating energy-efficient features and smart home technology—can position landlords for success in an increasingly competitive market.

The case study titled "Future of Rental Property Management" illustrates that landlords who adapt to changing renter preferences, such as prioritizing flexibility and digital connectivity, are likely to thrive. Additionally, the median home price in Phoenix is currently $420K, reflecting the current market conditions. By utilizing these strategies, investors can successfully create a sustainable real estate passive income stream through property.

Benefits of Earning Passive Income Through Real Estate

Investing in real estate for passive income offers a multitude of advantages that can significantly bolster financial stability and growth:

- Financial Freedom: The passive income generated from real estate can either supplement or replace traditional income sources, paving the way to financial security and independence. In 2025, statistics indicate that a substantial number of property investors are leveraging real estate passive income to achieve their financial goals, underscoring its significance in wealth management.

- Wealth Building: Real property is well-known for its long-term appreciation potential. As property values increase over time, investors can amass substantial wealth, making it a strategic choice for those aiming to enhance their financial portfolios. Long-term growth potential is essential for realizing real estate passive income, aligning portfolios with properties poised for future appreciation.

- Tax Advantages: Holdings in real property provide considerable tax benefits, including depreciation and mortgage interest deductions. These advantages can significantly amplify overall returns, making property an attractive choice for savvy investors.

- Diversification: Incorporating property into an investment portfolio can mitigate risk by broadening revenue streams and asset categories. This diversification is crucial in today's volatile market, enabling investors to stabilize their revenue through real estate passive income.

- Inflation Hedge: Real estate often acts as a reliable hedge against inflation. As inflation rises, rental earnings and property values typically increase, allowing real estate passive income to help investors preserve their purchasing power over time.

A case study highlighting demographic shifts reveals that Millennials and Gen Z are transforming rental markets by prioritizing affordability, urban amenities, and technology-enabled homes. Investors who align their portfolios with these preferences can secure a consistent and growing tenant base, further enhancing their potential for real estate passive income. As noted by HLC Equity, "Whether you’re assessing property investment strategies or pursuing long-term portfolio growth, we’re here to assist you at every stage of the process."

With over 30,000 subscribers, Zero Flux provides insights that reflect current trends and demands in the property market, reinforcing the importance of these strategies.

In summary, the advantages of real estate passive income through property are numerous, making it an enticing approach for individuals seeking financial independence and long-term wealth growth.

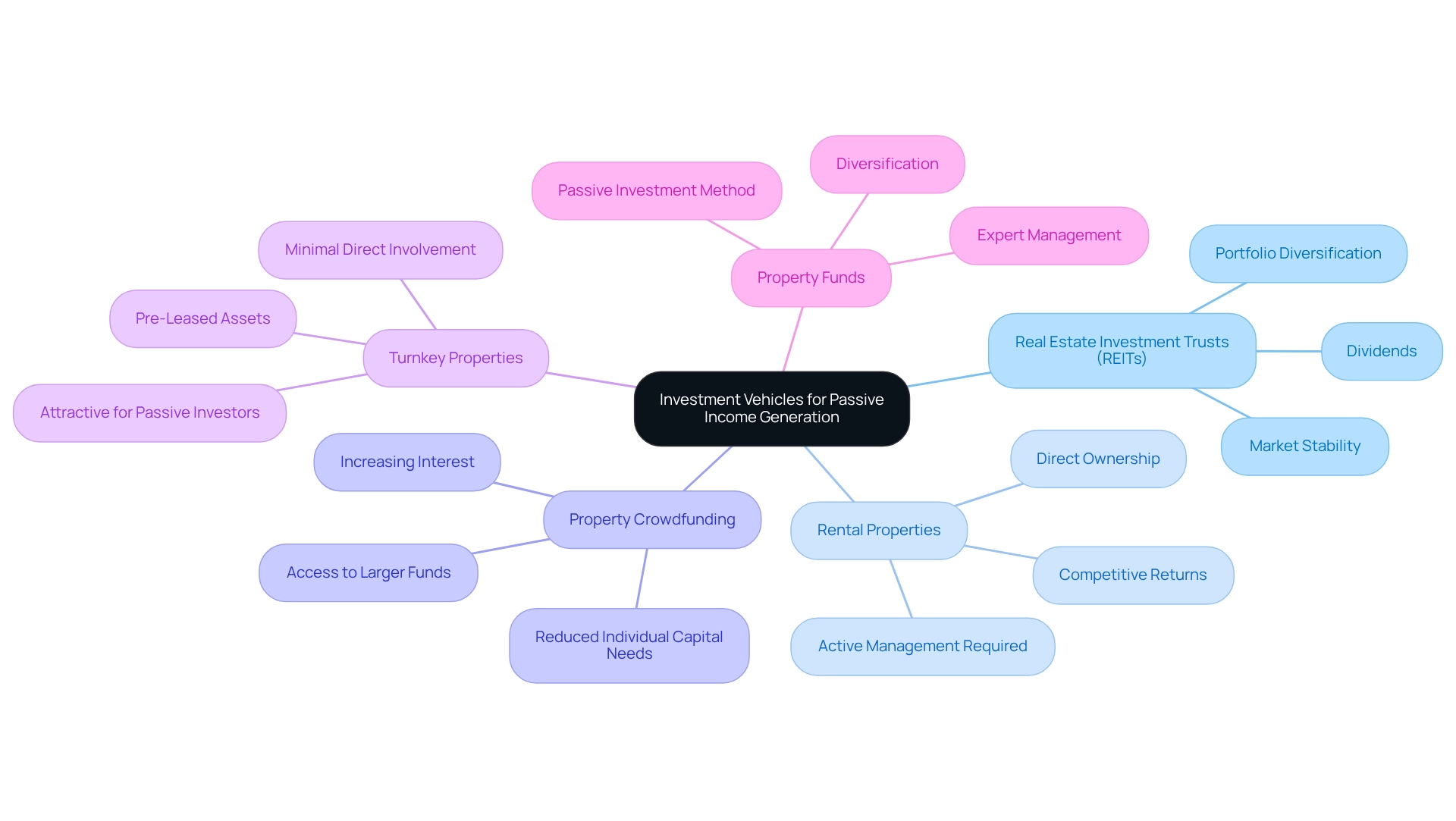

Investment Vehicles for Passive Income Generation

Several investment vehicles can effectively generate passive income in real estate, each offering unique advantages:

- Real Estate Investment Trusts (REITs): These companies own, operate, or finance income-producing real estate. Investors can purchase shares and receive dividends without the responsibilities of property management. In 2025, the performance of REITs has shown notable trends, with large-cap REITs commanding a premium, evidenced by a 37.6% higher valuation compared to small-cap counterparts. This preference suggests a market tendency towards stability and reliability in larger financial commitments. Furthermore, John Barwick notes that "their comparatively low correlation with other assets also makes them an excellent portfolio diversifier that can help reduce overall portfolio risk and increase returns."

- Rental Properties: Direct ownership of rental properties gives investors authority over their assets and the possibility of greater returns. However, this route requires active management unless a property manager is employed. The typical returns on rental properties in 2025 are expected to stay competitive, making this a viable choice for those willing to participate actively in their finances.

- Property Crowdfunding: This creative method enables investors to combine resources for particular property projects, providing access to larger funds with reduced individual capital needs. Current trends suggest an increasing interest in crowdfunding platforms, which are making property financing opportunities more accessible.

- Turnkey Properties: These completely managed assets come pre-leased, allowing investors to generate revenue without direct involvement. This choice is especially attractive for those looking for a passive approach to earning income from property.

- Property Funds: These funds pool resources from various investors to support property projects, providing diversification and expert management. They are becoming more favored by investors seeking a more passive method for real estate.

As the market develops, comprehending these vehicles and their performance metrics is essential for making informed financial choices. For example, First Industrial Realty Trust and Xenia Hotels & Resorts recently declared dividend increases of 20.3% and 16.7%, respectively, highlighting the potential for revenue growth within the REIT sector. Additionally, concerns remain regarding the recent rise in the ten-year yield and uncertainty about the Federal Reserve's future actions, which may influence investor strategies, particularly in relation to REIT valuations and overall market sentiment.

With the appropriate strategy, these financial instruments can function as efficient methods of creating real estate passive income in the evolving property market.

Navigating Risks and Challenges in Passive Real Estate Investing

While passive real estate investing offers numerous benefits, it is crucial to acknowledge the inherent risks involved:

- Market Fluctuations: Real estate values are vulnerable to economic changes, which can greatly affect returns. For instance, the national median resale home price recently rose by 4% to $407,200, marking the 16th consecutive month of year-over-year price growth. However, fluctuations in the market can lead to unpredictable outcomes for investors. As Lawrence Yun, Chief Economist at the National Association of Realtors, points out, increased home prices and higher mortgage rates have pressured affordability, which could affect future funding choices.

- Property Management Challenges: Even in passive assets, some degree of property management is required. Problems like tenant disagreements or maintenance issues can occur, complicating the process of acquiring assets. For example, experts have noted that property aesthetics play a crucial role in value perception, with 85% of professionals indicating that appealing designs can enhance selling prices, while poor aesthetics can deter potential buyers. This insight highlights the significance of preserving property attractiveness to optimize financial returns.

- Liquidity Concerns: Unlike stocks or bonds, real estate holdings generally lack liquidity, making it difficult to access funds swiftly when necessary. This can be especially challenging during economic declines when rapid cash flow may be crucial.

- Regulatory Risks: Changes in laws and regulations can significantly impact rental revenue and property values. Investors must stay informed about potential legislative shifts that could impact their investments, particularly in real estate passive income strategies, as many of these necessitate a substantial upfront investment, which can pose a barrier for some investors. Grasping the financial obligation necessary is vital prior to entering the market.

In 2025, the environment of passive property investing keeps changing, with experts highlighting the significance of being conscious of these risks. Additionally, sustainability is becoming a growing trend, with buyers increasingly prioritizing eco-friendly homes with energy-efficient designs and solar panels. As the market fluctuates, investors must remain vigilant and adaptable to navigate these challenges effectively.

Additionally, Zero Flux gathers 5-12 selected property insights each day, offering subscribers critical information to make informed choices in this dynamic environment.

Conducting Market Research and Financial Analysis

Conducting thorough market research and financial analysis is essential for successful passive real estate investing.

- Identify Market Trends: Begin by analyzing local market conditions, focusing on supply and demand dynamics, rental rates, and key economic indicators. Understanding these elements helps investors anticipate shifts in the market and make informed decisions. Notably, Market Risk Indicators provide a probability score from 1 to 100 for the likelihood of a greater than 10% price reduction in major metros, which is crucial for evaluating market risks.

- Evaluate Property Values: Utilize comparable sales data to assess property values accurately. This method not only helps in assessing potential appreciation but also offers a clearer view of the financial landscape. Recent statistics indicate that median home values have been calculated for over 3,100 counties, offering a robust framework for evaluating property worth across various regions. The case study titled "Housing Statistics and Real Estate Market Trends" provides national, regional, and metro-market level housing statistics, which can serve as a valuable resource for understanding local housing markets.

- Assess Financial Metrics: It is essential to compute key financial metrics such as cash flow, return on capital (ROC), and capitalization rates. These metrics function as standards for assessing the financial feasibility of possible ventures. For example, grasping the present trends in financial analysis for property ventures in 2025 can greatly influence strategy approaches. As Scott Bridges, senior managing director at PennyMac, states, "Getting pre-approved will give you a much clearer understanding of your budget and what you can afford; it shows sellers that you’re a qualified buyer and it strengthens your offers."

- Consider Demographics: A comprehensive understanding of the area's demographics—including population growth, income levels, and employment rates—is vital for gauging future demand for rental properties. Notably, a recent report highlighted that 66% of renters prioritize lease terms, rent amounts, and associated fees when selecting a rental home, underscoring the importance of aligning investment strategies with tenant preferences.

- Utilize Technology: Leverage advanced property analytics tools and platforms to gather data and insights efficiently. These technologies can streamline the research process, allowing investors to focus on actionable insights rather than getting lost in data overload.

By incorporating these strategies, investors can improve their market analysis efforts, resulting in better-informed choices and successful real estate passive income from property.

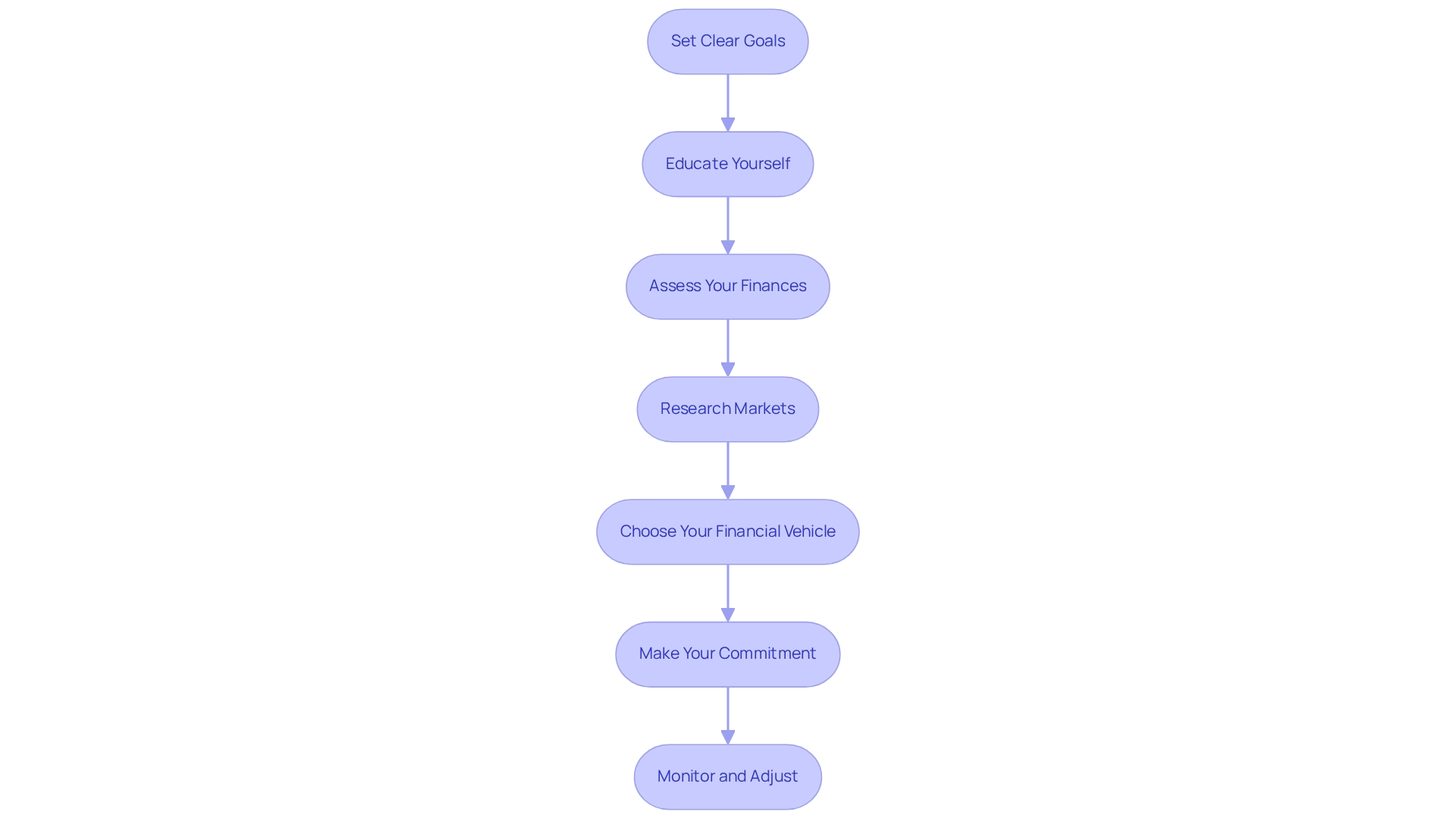

Step-by-Step Guide to Starting Your Passive Income Journey

To embark on your passive revenue journey in property, consider the following organized steps:

- Set Clear Goals: Begin by defining your financial objectives. Identify the exact sum of passive income you intend to produce, which will direct your financial choices.

- Educate Yourself: Spend time comprehending different financial strategies, market trends, and essential economic metrics that impact property. Knowledge is crucial for making informed decisions.

- Assess Your Finances: Conduct a thorough evaluation of your financial situation. This encompasses comprehending your available funds for ventures and your risk tolerance, which will assist you in recognizing your capacity for investing.

- Research Markets: Investigate potential real estate markets by analyzing economic indicators, rental demand, and property values. Look for areas with growth potential and favorable conditions for investment.

- Choose Your Financial Vehicle: Decide on the type of asset that aligns with your goals. Options include rental properties, Real Estate Investment Trusts (REITs), crowdfunding platforms, or other financial vehicles. Each has its own risk and return profile.

- Make Your Commitment: After thorough research and strategy selection, proceed with your financial commitment. Ensure you have a comprehensive plan that outlines your expected returns and risk management strategies.

- Monitor and Adjust: Regularly review your assets and stay informed about market conditions. Be prepared to make adjustments to your strategy as necessary to optimize your passive income. This proactive approach can help you navigate changes in the market effectively.

In 2025, with over 30,000 subscribers relying on Zero Flux for insights, it’s essential to consider the current market dynamics. For instance, the market action index is at 37, indicating a slight seller’s advantage, which could affect your financial choices. Additionally, potential housing policy changes under Trump may impact the market significantly, particularly regarding labor supply and zoning processes. It’s also significant that 75% of seller's agents received payment from the seller, and 52% of buyer's agents were similarly rewarded by the seller, which can influence your financial approach. Furthermore, be aware that potential inflation from these policies could lead to higher mortgage rates, further dampening housing demand. By adhering to these steps and taking these factors into account, you can create a strong base for generating passive income through property.

Managing and Evaluating Your Real Estate Investments

Successfully overseeing and assessing your properties is essential for attaining sustained success in the market. Key strategies to consider include:

- Regularly Review Financial Performance: Consistently monitor cash flow, expenses, and overall profitability. This practice ensures that your assets meet performance expectations and allows for timely adjustments if needed.

- Stay Informed on Market Trends: Keeping abreast of local market conditions and economic indicators is vital. For instance, Florida currently features two cities within the top five real estate markets, underscoring the importance of regional awareness in financial choices. Understanding these dynamics is essential, especially as public sentiment is divided regarding the impact of Trump’s policies on inflation and tariffs. Notably, 36.25% of people believe these policies will negatively affect market recovery in 2025, according to Sharad Mehta.

- Engage Professional Management: If you are managing properties directly, consider hiring a property management company. This can alleviate the burden of tenant relations and maintenance, allowing you to focus on strategic growth.

- Evaluate Financial Objectives: Periodically reassess your financial goals and strategies. This ensures alignment with your financial objectives, particularly in a dynamic market where conditions can shift rapidly.

- Adjust Strategies as Needed: Be prepared to pivot your financial strategies based on market changes, performance metrics, and personal financial goals. With the property market expected to expand considerably—its valuation exceeding $3.9 trillion and predicted to increase to $5,388.87 billion by 2026—adapting to trends is vital for optimizing returns.

In 2025, grasping the subtleties of assessing property performance will be more crucial than ever. Statistics indicate that real estate contributes nearly 17% to the U.S. GDP, underscoring its economic significance. As you navigate this landscape, maintaining awareness of current trends and expert insights will empower you to make informed decisions that enhance your investment portfolio.

Conclusion

Passive income through real estate presents a remarkable opportunity for financial growth and stability, enabling investors to earn returns with minimal ongoing effort. The various strategies outlined—rental properties, REITs, crowdfunding, turnkey properties, and short-term rentals—each offer distinct pathways to generate income. By understanding these options, investors can tailor their approach to align with their financial goals and lifestyle preferences.

The benefits of investing in real estate for passive income are substantial, encompassing:

- Financial freedom

- Wealth building

- Tax advantages

- Diversification

- Serving as a hedge against inflation

As market dynamics continue to evolve, staying informed about trends and adapting to changes is crucial for success. The landscape of real estate investing is increasingly favorable, making this an opportune time for investors to explore these strategies.

However, it is essential to remain cognizant of the risks and challenges inherent in passive real estate investing. From market fluctuations and property management issues to liquidity concerns and regulatory risks, understanding these factors enables investors to navigate the complexities of the market effectively. By conducting thorough market research and financial analysis, investors can make informed decisions that optimize their passive income potential.

Ultimately, embarking on a passive income journey in real estate necessitates clear goal-setting, education, and a proactive approach to managing investments. By following a structured path and remaining adaptable, investors can build a sustainable income stream that contributes to long-term financial independence. Embracing the opportunities within the real estate sector can lead to significant rewards, positioning investors for success in a dynamic financial landscape.