Overview

Generating passive real estate income effectively requires a strategic approach.

Begin by setting clear investment goals that align with your financial objectives.

Educate yourself on various investment options, including:

- Rental properties

- REITs

- Crowdfunding

Understanding market dynamics and the risks associated with each investment type is crucial. This knowledge empowers investors to make informed decisions, optimizing income potential while minimizing the need for active management.

By focusing on these steps, you can navigate the real estate landscape with confidence and clarity.

Introduction

In the realm of wealth-building, passive real estate income emerges as a compelling avenue for investors pursuing financial freedom without the burden of constant management. This approach encompasses a variety of income streams, including:

- rental payments

- dividends from Real Estate Investment Trusts (REITs)

- profits from crowdfunding initiatives

As the landscape of real estate investing evolves, understanding the key components and strategies for generating passive income becomes essential. With projections indicating that a significant percentage of investors will rely on these income sources in the near future, now is the time to explore the possibilities and navigate the complexities of passive real estate investments.

Understand Passive Real Estate Income

Passive real estate income includes profits generated from property investments that require minimal active oversight. This income can stem from various sources, including rental payments from assets, dividends from Real Estate Investment Trusts (REITs), and profits accrued through crowdfunding platforms for realty. The essence of passive real estate income lies in its ability to generate revenue while minimizing the investor's involvement in daily operations, making it a vital concept for individuals aiming to build wealth through property.

Key Components of Passive Income

- Rental Properties: Investing in rental properties can yield a steady income stream through monthly rent, providing financial stability.

- REITs: These entities own, operate, or finance income-generating properties, allowing investors to receive dividends without the burdens of property management.

- Crowdfunding: This method enables investors to pool resources with others to finance property projects, facilitating access to larger investments without requiring significant capital.

By 2025, approximately 70% of property investors are expected to generate passive real estate income, highlighting the growing trend toward this financial strategy. Moreover, understanding net operating income (NOI) is essential for assessing the profitability of these assets, as it reflects the income generated from property operations after deducting operating costs.

The case study of First National Realty Partners exemplifies a successful implementation of passive income strategies. This notable private equity commercial property firm focuses on acquiring undervalued, multi-tenanted assets to deliver superior returns while fostering robust economic resources for communities.

Understanding these elements equips investors to navigate the evolving landscape of passive real estate income effectively, seizing opportunities that align with their financial goals. As Samantha Ankney notes, "The property market in 2025 presents numerous opportunities for those bold enough to engage." By leveraging these strategies, investors can amplify their income potential while minimizing active involvement.

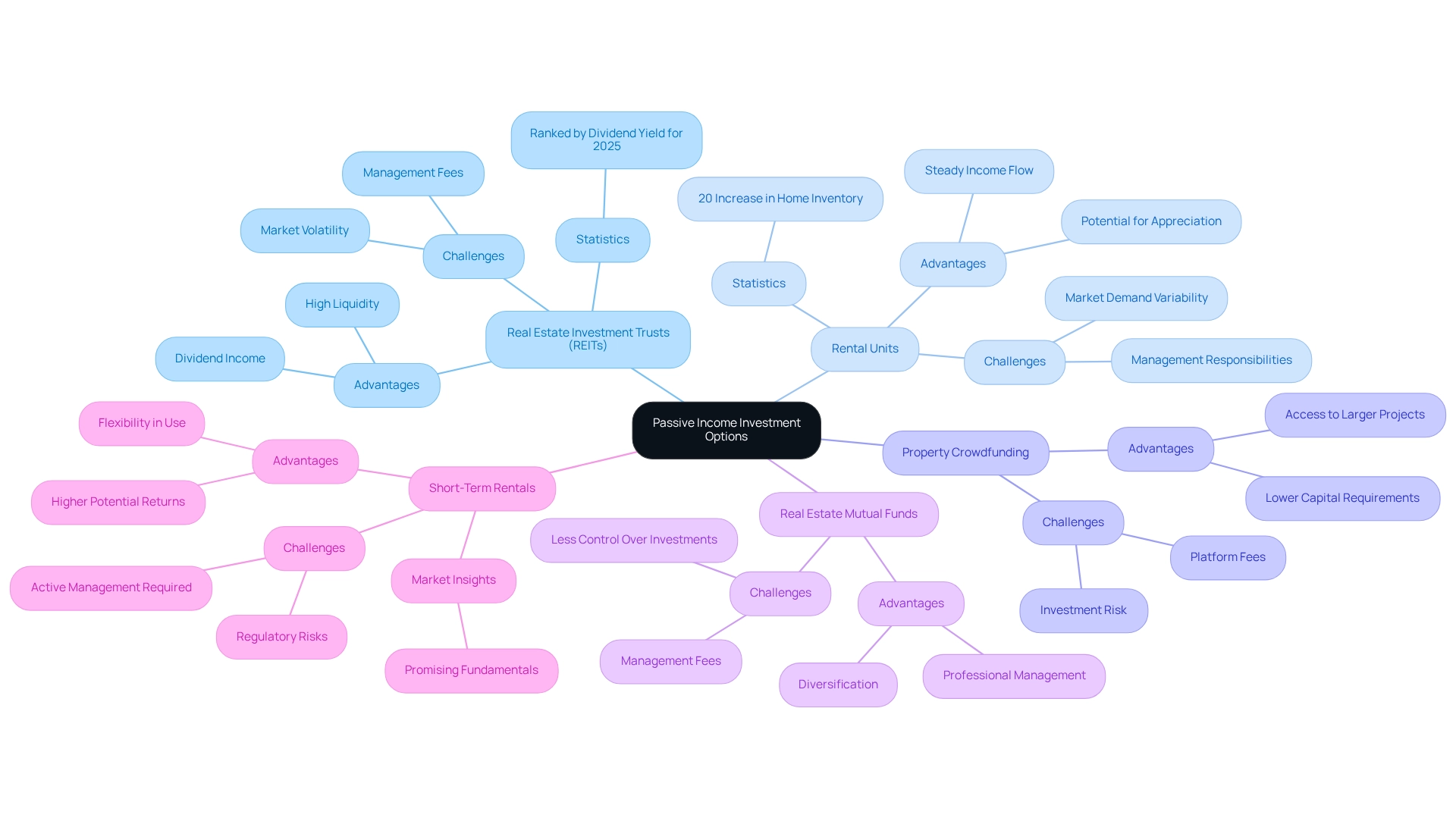

Explore Passive Income Investment Options

Investing in property for passive real estate income offers various avenues for generating revenue, each presenting unique advantages and challenges. Here are some of the most popular options:

-

Real Estate Investment Trusts (REITs)

REITs are companies that own and manage income-producing real estate. Investors can acquire shares in these companies, earning dividends based on the revenue generated by the assets. With a growing interest in REITs, particularly in 2025, they provide a highly liquid investment option, as shares can be easily bought and sold on stock exchanges. Notably, the largest retail REITs in the U.S. are ranked by their dividend yield, making them an attractive choice for income-focused investors. This ranking serves as a benchmark for evaluating potential investments. -

Rental Units

Investing in rental units involves acquiring residential or commercial spaces to lease to tenants. This strategy can generate a steady income flow, although it necessitates some level of oversight unless a management firm is involved. The average returns on rental properties can vary, but they often compete favorably with REITs, especially in markets with strong demand. Recent statistics indicate that single-family existing home inventory has increased by 20% annually, reflecting a robust market that may provide opportunities. -

Property Crowdfunding

Crowdfunding platforms allow investors to pool resources to invest in property projects. This approach lowers individual capital requirements, making it accessible for new investors. As the popularity of crowdfunding continues to rise, it offers a unique opportunity to participate in larger investments without the need for substantial upfront capital. -

Real Estate Mutual Funds

These funds invest in a diverse collection of assets related to properties, enabling investors to access the market without the responsibilities of managing assets. Managed by experts, property mutual funds can alleviate the burden on individual investors while still offering potential returns. -

Short-Term Rentals

Platforms such as Airbnb have transformed the rental market, allowing homeowners to lease out houses or spare rooms for brief periods. This option can yield higher returns compared to traditional long-term rentals, although it may require more active management and responsiveness to guests. Residential properties exhibit encouraging fundamentals due to consistent household formation, aligning housing completions, and value-enhancing renovations that increase appreciation. This presents an opportune moment for short-term rental investments, as investors can assess these options to ensure a strategic approach to generating passive real estate income that aligns with their financial objectives and lifestyle.

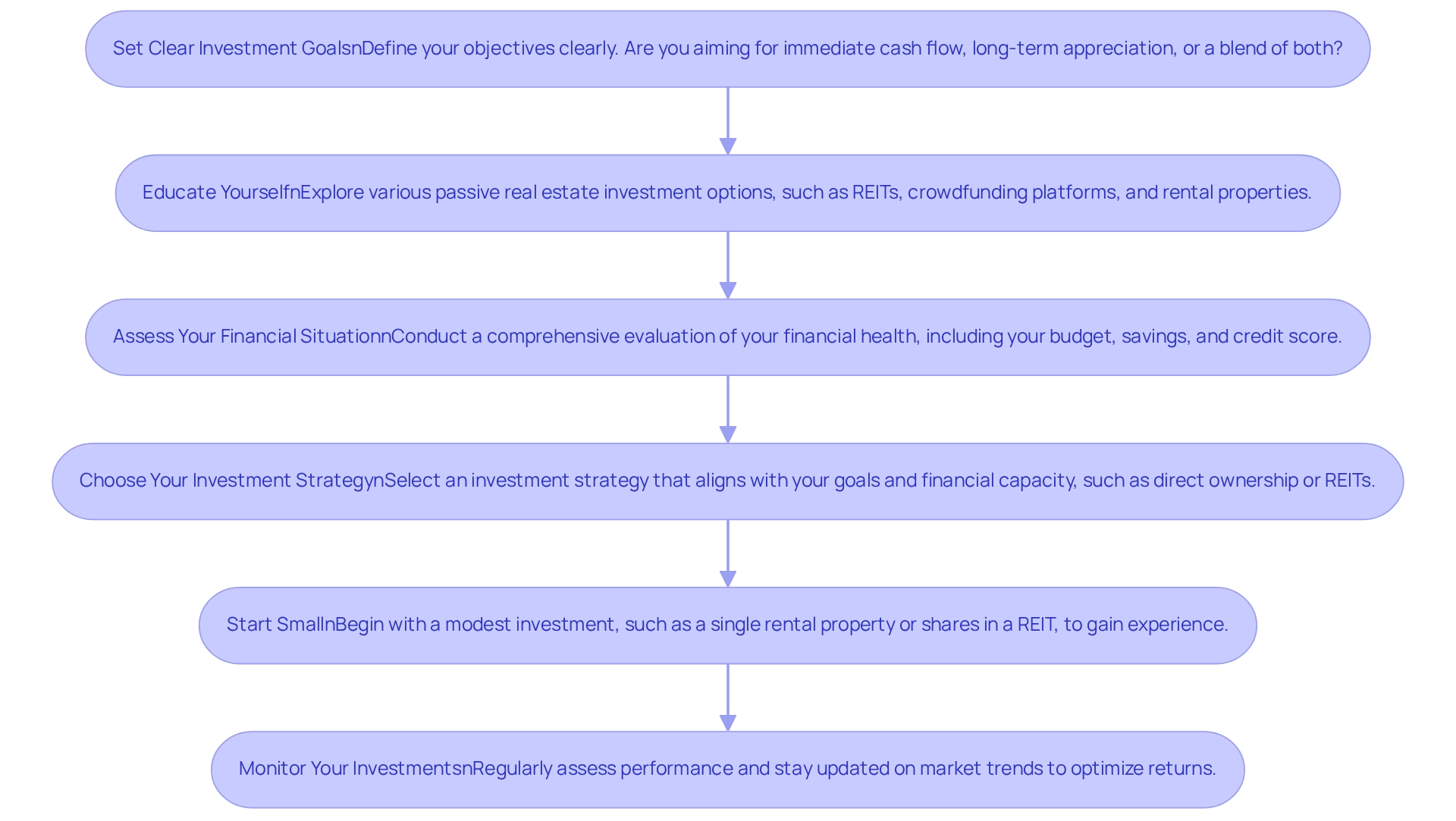

Follow Steps to Start Investing in Passive Real Estate

Starting your journey in passive real estate investing involves several key steps:

- Set Clear Investment Goals

Define your objectives clearly. Are you aiming for immediate cash flow, long-term appreciation, or a blend of both? Setting clear objectives will guide your financial choices effectively. According to expert advice, having well-defined goals is crucial for successful investing. - Educate Yourself

Explore various passive real estate investment options, such as Real Estate Investment Trusts (REITs), crowdfunding platforms, and rental properties. A thorough understanding of the advantages and disadvantages of each will empower you to make informed choices. As Baker observes, "REITs can be an appealing method to invest in real estate without the typical challenges of overseeing physical assets, such as handling unreasonable or disrespectful tenants." - Assess Your Financial Situation

Conduct a comprehensive evaluation of your financial health, including your budget, savings, and credit score. This analysis will clarify how much you can invest and which financing avenues are accessible to you. - Choose Your Investment Strategy

Select an investment strategy that aligns with your goals and financial capacity. Options may include direct asset ownership, investing in REITs, or engaging in crowdfunding opportunities. Notably, portfolios with a 30% allocation in REITs have demonstrated reduced losses while maintaining competitive returns. Additionally, consider the case study on investing in REITs, which illustrates their potential for providing liquidity and regular dividends, despite the risks associated with fluctuating stock prices. - Start Small

For newcomers to real estate investing, beginning with a modest investment—such as a single rental property or shares in a REIT—can be beneficial. This strategy allows you to gain valuable experience without overextending your financial resources. - Monitor Your Investments

After making your investments, regularly assess their performance. Stay updated on market trends and be ready to adjust your strategy as necessary to optimize returns. The rental vacancy rate in metro areas was 6.9 percent in Q4 2023, highlighting the importance of staying informed about market dynamics.

Disclaimer: This blog content is for informational purposes only and does not constitute financial advice.

By following these steps, you can effectively navigate the domain of passive real estate income and work towards achieving your financial goals.

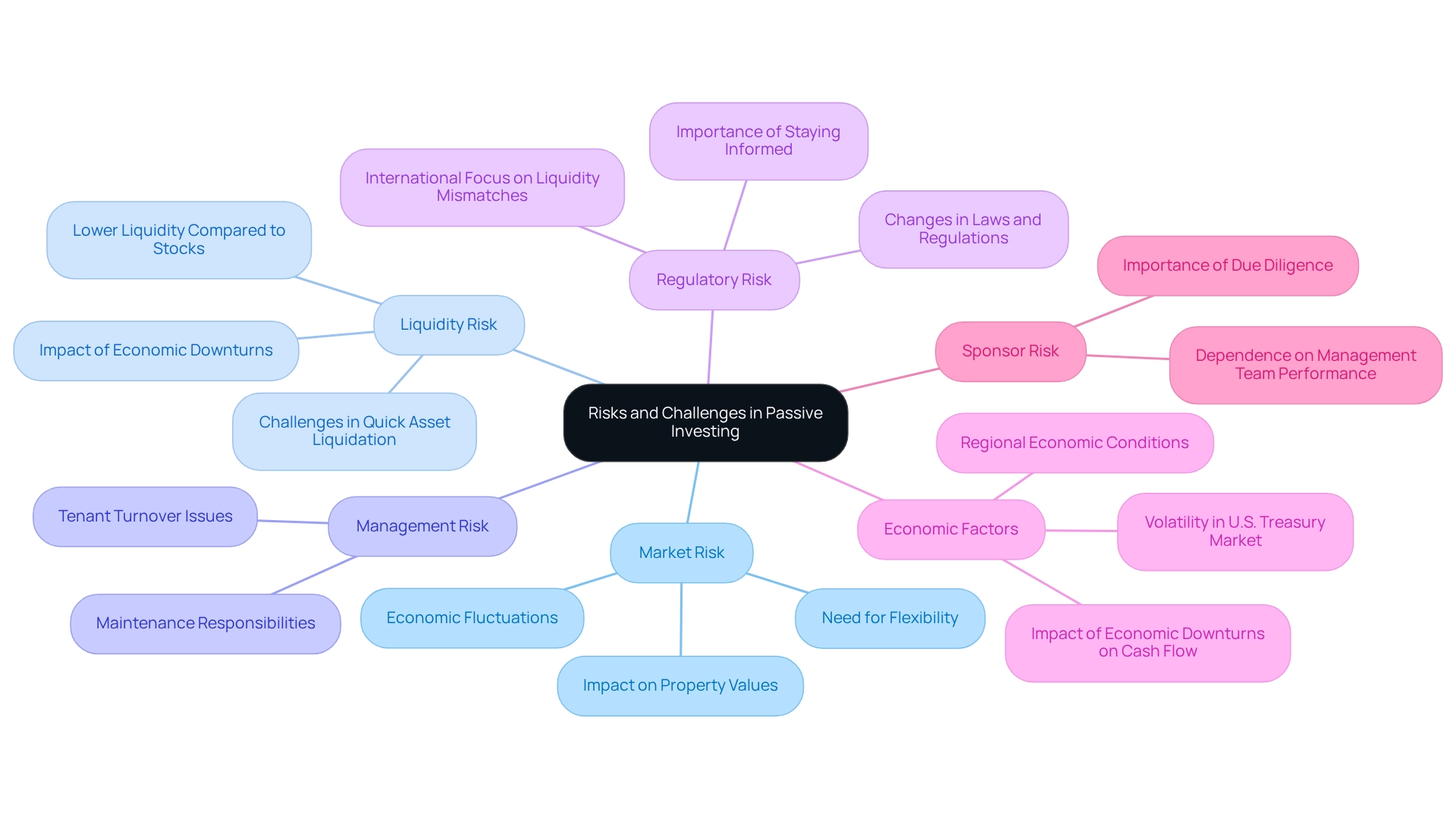

Identify Risks and Challenges in Passive Investing

While generating passive real estate income through property investing presents numerous advantages, it also entails significant risks that investors must navigate. Understanding these challenges is essential for making informed decisions:

-

Market Risk

Real estate markets are sensitive to fluctuations influenced by economic conditions, interest rates, and local demand. For instance, a downturn can lead to decreased property values and reduced rental income, ultimately impacting overall returns on capital. As we approach 2025, market volatility is expected to continue, necessitating vigilance from investors. Companies that adapt to liquidity changes will gain a strategic advantage in this unpredictable landscape, highlighting the importance of flexibility in financial strategies. -

Liquidity Risk

In comparison to stocks or bonds, real estate investments generally exhibit lower liquidity. In situations requiring quick access to funds, selling an asset or shares in a Real Estate Investment Trust (REIT) can be a lengthy process, potentially hindering financial recovery. Specific instances of liquidity challenges include the difficulties in liquidating assets during economic downturns or the constraints faced by investors in accessing funds tied up in long-term investments. -

Management Risk

Even passive investments may necessitate some level of management oversight. For rental units, issues such as tenant turnover and maintenance can arise, directly impacting income streams. Investors should be prepared to address these operational aspects in order to protect their passive real estate income. -

Regulatory Risk

Shifts in laws and regulations can profoundly affect property values and rental income. Staying informed about local zoning laws, tax regulations, and tenant rights is crucial for mitigating potential losses stemming from regulatory changes. Furthermore, there is a growing international focus on resolving liquidity mismatches in open-ended funds, which underscores the necessity for investors to remain cognizant of regulatory challenges in the current market environment. -

Economic Factors

Economic downturns can result in heightened vacancies and decreased rental rates, adversely impacting cash flow. Investors should assess the economic conditions of their target regions, as these factors play a pivotal role in the viability of funding. The vulnerability of the U.S. Treasury market, once regarded as the most liquid globally, has exhibited increased volatility, which can create ripple effects on real estate investments. -

Sponsor Risk

In crowdfunding and REITs, the success of investments often hinges on the performance of the management team. Poor decisions by sponsors can lead to substantial losses, emphasizing the importance of thorough due diligence when selecting funding opportunities.

By recognizing these risks and challenges, investors can implement proactive strategies to mitigate them, such as diversifying their portfolios and conducting comprehensive research prior to capital allocation. As Zachary Cohen, Managing Partner at Ridge Street Capital, observes, the robust performance of investment property purchases indicates a favorable outlook for the private lending market, provided that investors remain adaptable to liquidity dynamics in 2025.

Conclusion

Passive real estate income presents a compelling pathway to financial freedom, integrating diverse income streams such as rental payments, dividends from REITs, and profits from crowdfunding initiatives. This method enables investors to generate income with minimal active management, making it increasingly attractive in a market where nearly 70% of investors are expected to depend on passive income sources by 2025. Grasping the essential components—rental properties, REITs, crowdfunding, and other investment avenues—empowers investors with the knowledge needed to navigate this dynamic market effectively.

Nonetheless, while the potential for income generation is substantial, it is crucial to recognize the inherent risks associated with passive real estate investing. Factors such as market volatility, liquidity challenges, management responsibilities, regulatory changes, and economic fluctuations can significantly influence investment outcomes. By staying vigilant and informed, investors can adopt strategies to mitigate these risks, fostering a more stable investment experience.

Ultimately, passive real estate investing can be a lucrative endeavor for those committed to self-education and a strategic approach. By establishing clear goals, evaluating financial situations, and selecting suitable investment strategies, individuals can cultivate a sustainable income stream that aligns with their financial aspirations. Embracing the opportunities within passive real estate income not only promotes wealth creation but also lays the groundwork for achieving long-term financial independence.