Overview

Starting a real estate business without capital is achievable through essential steps such as:

- Conducting thorough market research

- Defining clear business goals

- Creating a financial plan

- Exploring various financing options

These foundational actions are crucial for aspiring entrepreneurs. Identifying target markets and potential funding sources, including seller financing and crowdfunding, equips individuals with the strategies needed to navigate the real estate landscape effectively, even in the absence of initial capital. By understanding these steps, you can position yourself for success in the competitive real estate market.

Introduction

Navigating the real estate market can be a daunting endeavor, particularly for newcomers aiming to establish a foothold in this competitive landscape. Understanding market dynamics and setting clear business goals are crucial for aspiring investors. They must equip themselves with a comprehensive strategy that encompasses every essential aspect of launching a successful real estate venture. This article explores the critical steps necessary for building a solid foundation. Key actions include:

- Conducting thorough market research

- Crafting a robust financial plan

- Exploring diverse financing options

By adhering to these guidelines, individuals can position themselves not merely to survive but to thrive in the ever-evolving world of real estate.

Conduct Market Research and Analysis

- Identify Your Target Market: Start by accurately identifying the specific demographic or geographic area you aim to target. Take into account factors such as income levels, age groups, and local economic conditions to sharpen your focus.

- Collect Information: Leverage a variety of online resources, including property platforms, local government databases, and comprehensive industry reports. Accumulate information on property prices, sales trends, and neighborhood statistics to cultivate a robust understanding of the landscape. Notably, the average home price in the USA can be explored through NAR's reports, offering valuable context for your analysis.

- Analyze Competitors: Examine existing real estate firms within your selected area. Evaluate their service offerings, pricing strategies, and customer feedback to uncover opportunities you can capitalize on. This competitive analysis is vital for positioning your business effectively.

- Conduct Surveys: Connect with potential clients through surveys or interviews to gather insights into their needs and preferences. This qualitative data will enhance your quantitative research, providing a comprehensive view of the market.

- Utilize Technology: Implement tools such as Google Trends, Zillow, and local MLS (Multiple Listing Service) to track fluctuations and pinpoint emerging trends. Staying informed about current economic dynamics is crucial, particularly as homes are taking longer to sell, reflecting an improvement in inventory levels. Furthermore, builder confidence has risen, with 59 percent of builders offering sales incentives to buyers, indicating optimism about easing regulatory burdens that can impact conditions.

Stay Informed on Seasonal Trends: Recognize that the spring season typically witnesses a surge in housing activity, with approximately 29 percent of yearly home sales occurring between April and June. This seasonal uptick is driven by families eager to settle before the school year, making it an essential time for engagement. This year, the increase in activity is projected to be more pronounced than last year, although the pace of growth will differ by location due to varying local market conditions. By comprehending how to initiate a real estate business with no money, you can adeptly navigate the complexities of the real estate market, positioning yourself for success even without initial capital.

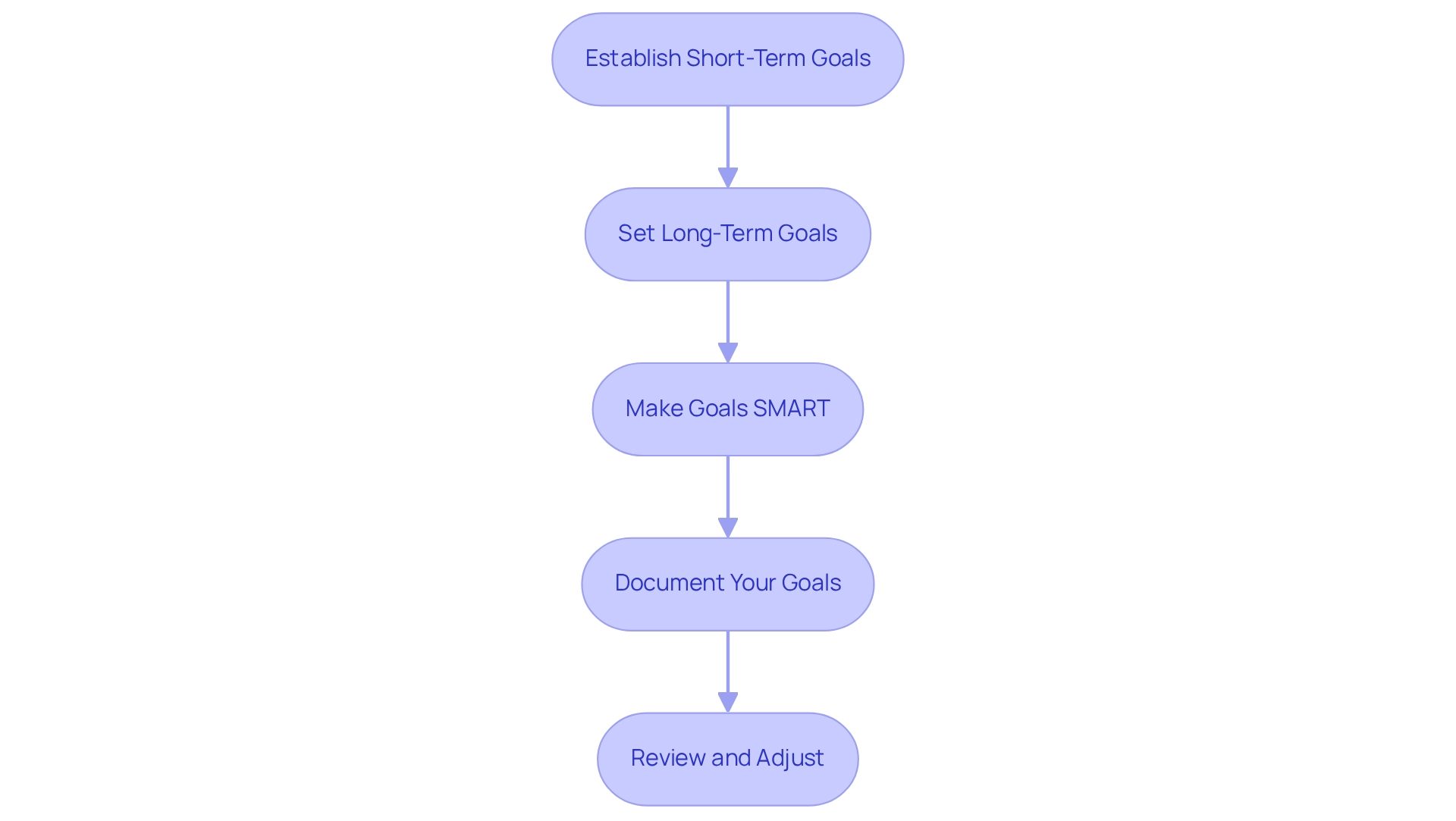

Define Your Business Goals

- Establish Short-Term Goals: Clearly define your objectives for the next 6-12 months. This might include acquiring your first property, building a client base, or achieving a specific revenue target. By establishing precise short-term objectives, you can sustain focus and momentum during the initial phases of your venture.

- Set Long-Term Goals: Envision where you want your business to be in 3-5 years. Long-term objectives may involve expanding your portfolio, entering new sectors, or reaching a specific level of profitability. These goals provide essential direction and a framework for strategic planning.

- Make Goals SMART: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of a vague aim like "I want to sell properties," specify, "I aim to sell 10 properties within the next year." This clarity enhances your ability to track progress and maintain motivation. Notably, listings with descriptive, keyword-rich property descriptions sell 23% faster, illustrating how measurable goals can lead to tangible results.

- Document Your Goals: Write down your goals and keep them visible. This practice serves as a constant reminder and fosters accountability, making it easier to stay committed to your objectives.

- Review and Adjust: Regularly assess your goals to evaluate progress and make necessary adjustments. Given the dynamic nature of the property sector, this flexibility is crucial for adapting to new challenges and opportunities. A recent report from the National Association of Realtors emphasized that understanding trends in the industry can greatly impact goal accomplishment. Furthermore, as noted by Sharad Mehta, homes with drone photography are 68% more likely to sell faster, highlighting the influence of creative marketing techniques on achieving property objectives. Insights from the case study titled "Real Estate and Economic Outlook" presented by NAR Chief Economist Lawrence Yun can guide your strategic planning and decision-making, underscoring the importance of staying informed about market trends.

By creating a clear structure for your objectives, you position yourself for success in the competitive property market.

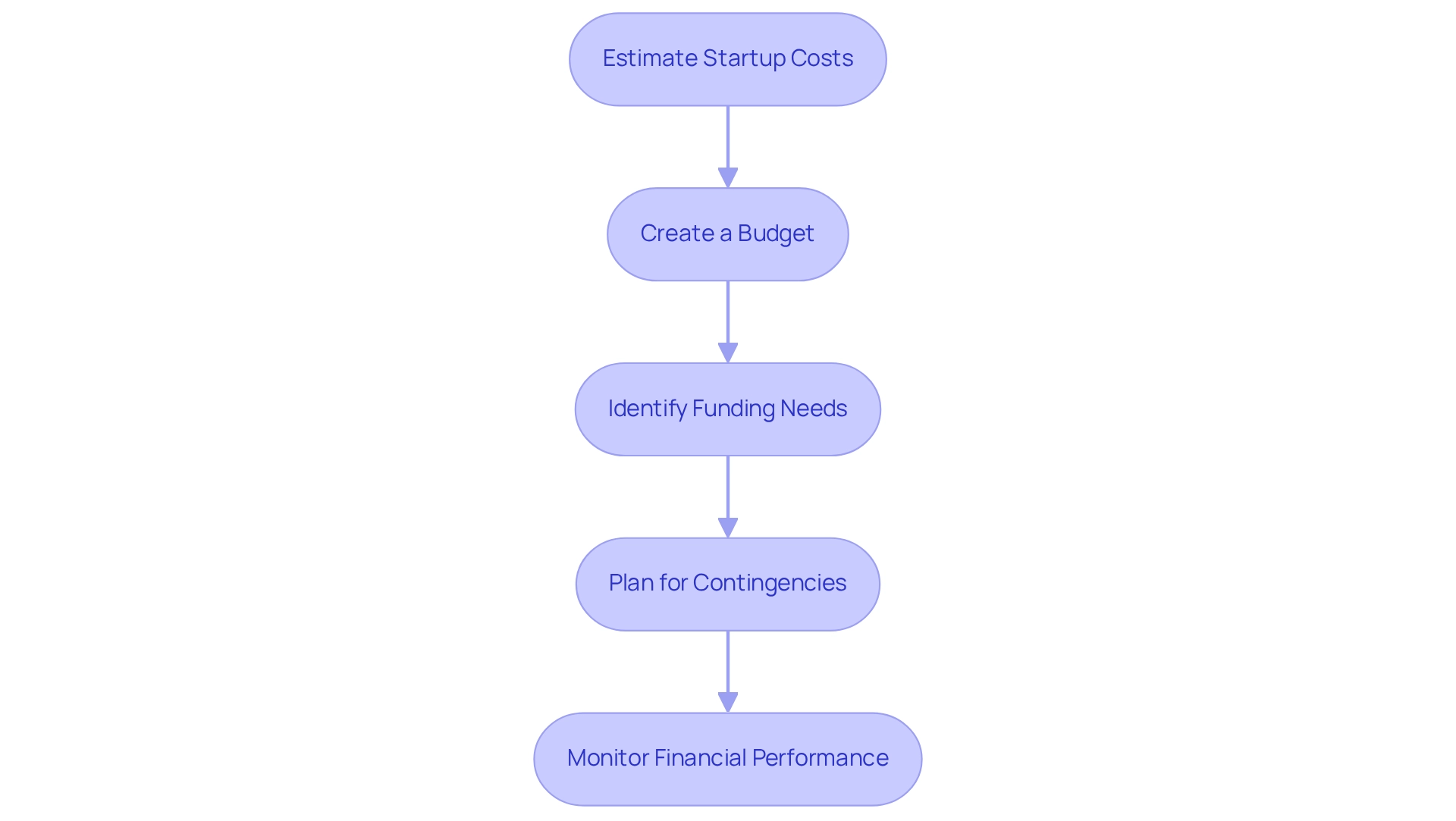

Create a Financial Plan

- Estimate startup costs by identifying all potential expenses associated with starting a real estate business with no money. This includes licensing fees, marketing costs, operational expenses, and any legal fees, which can range from $150 to $1,500 per hour depending on the complexity of your needs. Research typical costs in your area to develop a realistic budget that reflects the current market landscape in 2025.

- Create a Budget: Formulate a detailed monthly budget that outlines your expected income and expenses. This structured approach will enable you to manage cash flow effectively, ensuring that you can cover essential costs while pursuing growth opportunities.

- Identify Funding Needs: Evaluate the amount of capital required to start your venture and maintain operations until profitability is reached. This encompasses not just startup costs but also recurring expenses that may emerge during the early stages of starting a real estate business with no money.

- Plan for Contingencies: Allocate a portion of your budget for unexpected expenses. Establishing a contingency fund is crucial for navigating financial challenges without jeopardizing your business's stability.

- Monitor Financial Performance: Regularly compare your financial plan against actual performance metrics. This practice allows you to adjust your budget and strategies as needed, ensuring that you remain aligned with your financial goals. Incorporating insights from case studies on financial planning for property startups, such as the elements outlined in the case study titled "Components of a Typical Business Financial Plan," can provide valuable guidance on best practices and common pitfalls to avoid. Moreover, examine the structure presented by the Real Life Planning Blog, which investigates personal financial planning for property investors over the next three months.

By following these steps, you can create a strong financial plan that not only supports your immediate needs but also positions your property business for long-term success. Keep in mind, both routes in property provide adaptable hours and the opportunity to harmonize work with personal responsibilities, making it an appealing pursuit for many.

Explore Financing Options

- Consider Seller Financing: Engage directly with property sellers to negotiate financing options. This method can significantly lower your initial costs and offer more adaptable repayment terms, making it an attractive choice for new investors. The rising trend of owner financing, as stated by CRE Daily, emphasizes its growing importance in the current landscape.

- Look into Partnerships: Form alliances with seasoned investors who can contribute the necessary capital in exchange for a share of the profits. This collaborative approach not only mitigates financial risk but also leverages the expertise of your partners, creating a mutually beneficial arrangement.

- Explore Crowdfunding: Take advantage of real estate crowdfunding platforms, which allow you to gather funds from a diverse group of investors. This strategy illustrates how to start a real estate business with no money by enabling you to pool resources without the burden of substantial upfront capital, making it easier to enter the market.

- Research Grants and Loans: Investigate local grants available for first-time homebuyers or small business loans that offer favorable terms for new entrepreneurs. These financial assets can provide crucial assistance as you embark on your property journey.

- Utilize Home Equity: If you possess a house, consider using a Home Equity Line of Credit (HELOC) to fund your property projects. This option provides quick access to cash at relatively low interest rates, allowing you to seize investment opportunities as they arise.

In light of the recent statistic that all but two of California’s major metros experienced annual job losses in January, it is crucial to remain adaptable in your investment strategies. As property developer Akira Mori states, 'In my experience, in the property sector, previous success narratives are typically not relevant to new circumstances.' We must continually reinvent ourselves, responding to changing times with innovative new business models.

A clearly outlined approach and the correct mentality are essential for assessing risks and reaching financial objectives, especially when considering how to start a real estate business with no money. By focusing on strategy and mindset, investors can optimize their potential risk-adjusted returns and navigate the complexities of the real estate market.

Conclusion

Establishing a successful real estate venture requires a strategic approach that encompasses thorough market research, clear goal setting, and sound financial planning. By identifying target markets and gathering pertinent data, aspiring investors can gain valuable insights that inform their decisions. Understanding the competitive landscape and engaging with potential clients further enriches this knowledge, allowing for effective positioning in a crowded marketplace.

Setting both short-term and long-term business goals is essential for maintaining focus and direction. Utilizing the SMART criteria ensures that these goals are actionable and measurable, fostering accountability and motivation. Regularly reviewing and adjusting these objectives in response to market trends is vital for navigating the dynamic nature of real estate.

Creating a robust financial plan is equally important, as it lays the groundwork for managing expenses and securing necessary funding. By estimating startup costs, budgeting effectively, and planning for contingencies, investors can safeguard their business against unforeseen challenges. Exploring diverse financing options, such as seller financing, partnerships, and crowdfunding, opens up pathways to capital that can facilitate growth and innovation.

In summary, by conducting diligent research, defining clear objectives, and crafting a comprehensive financial strategy, aspiring real estate investors can position themselves for success in an ever-evolving market. Embracing these critical steps not only enhances the likelihood of achieving business goals but also fosters resilience in the face of challenges, ultimately paving the way for a thriving real estate career.