Overview

Leveraging real estate to build wealth requires a strategic approach to utilizing borrowed funds, aiming to enhance investment returns while acknowledging the associated risks. Due diligence in property selection is paramount. This article outlines essential steps for investors:

- Define clear investment criteria

- Conduct comprehensive market research

- Utilize robust property evaluation metrics

- Implement effective property management strategies

These actions are crucial for maximizing profitability and ensuring tenant satisfaction.

Introduction

Mastering the intricacies of real estate investment is essential for unlocking substantial wealth. Yet, many investors underestimate the power of leverage. By strategically employing borrowed capital, investors can acquire properties that far exceed their initial financial input, thereby amplifying potential returns. However, this opportunity is accompanied by significant risks.

How can one effectively navigate the delicate balance between leveraging assets for profit and succumbing to the pitfalls of debt? This guide explores essential steps for leveraging real estate effectively, empowering investors to build wealth while adeptly managing the inherent challenges of the market.

Understand the Basics of Real Estate Leverage

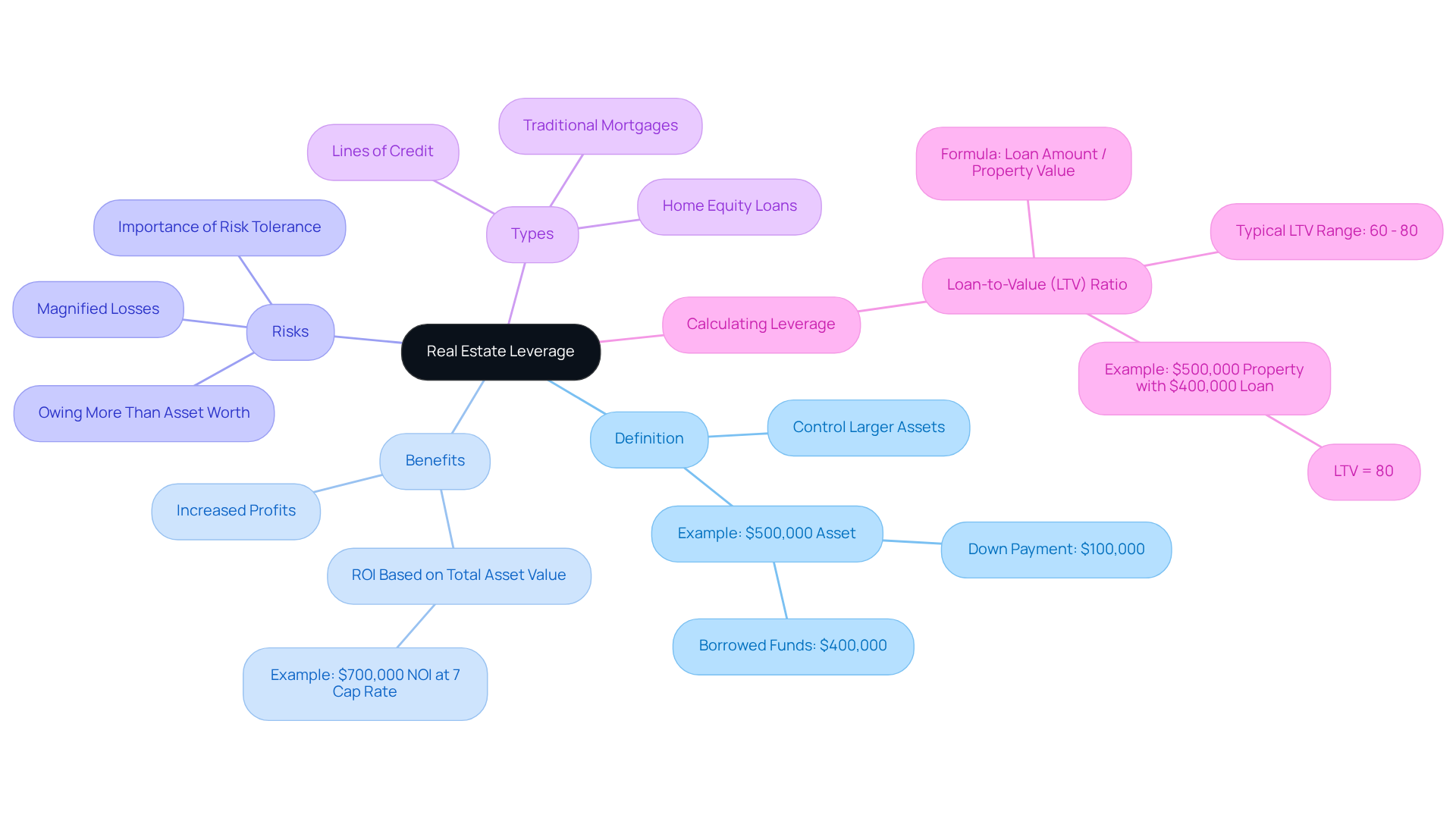

Leverage in real estate signifies the strategic use of borrowed capital to amplify potential returns on investment. By tapping into external funds, such as loans or mortgages, investors can acquire properties that might otherwise be out of reach. Understanding the following key concepts is essential:

-

Definition of Leverage: Leverage empowers you to control a larger asset with a smaller portion of your own capital. For instance, purchasing an asset valued at $500,000 with a down payment of $100,000 means leveraging $400,000 in borrowed funds.

-

Benefits of Leverage: The primary advantage of leverage lies in its potential for increased profits. When an asset appreciates in value, your return on investment (ROI) is based on the total asset value rather than just your initial input. Consider an asset generating $700,000 in net operating income at a 7% cap rate; this can significantly boost your returns.

-

Risks of Leverage: While leverage can enhance gains, it also has the potential to magnify losses. In the event of declining real estate values, you might find yourself owing more than the asset's worth. It is crucial to comprehend your risk tolerance and establish a robust financial strategy, particularly in a 6% interest rate environment where market conditions are evolving.

-

Types of Leverage: Common forms of leverage encompass traditional mortgages, home equity loans, and lines of credit. Each type presents unique terms and implications for your investment approach.

-

Calculating Leverage: The Loan-to-Value (LTV) ratio serves as a vital metric for assessing leverage. This ratio is computed by dividing the loan amount by the property's appraised value. In 2025, typical LTV ratios in real estate range from 60% to 80%. A lower LTV indicates reduced risk, while a higher LTV suggests increased risk but potentially greater returns. For example, if an asset is valued at $500,000 and the loan amount is $400,000, the LTV stands at 80%.

By grasping these concepts, you will be better equipped to make informed decisions regarding leveraging real estate to build wealth.

Identify and Evaluate Investment Properties

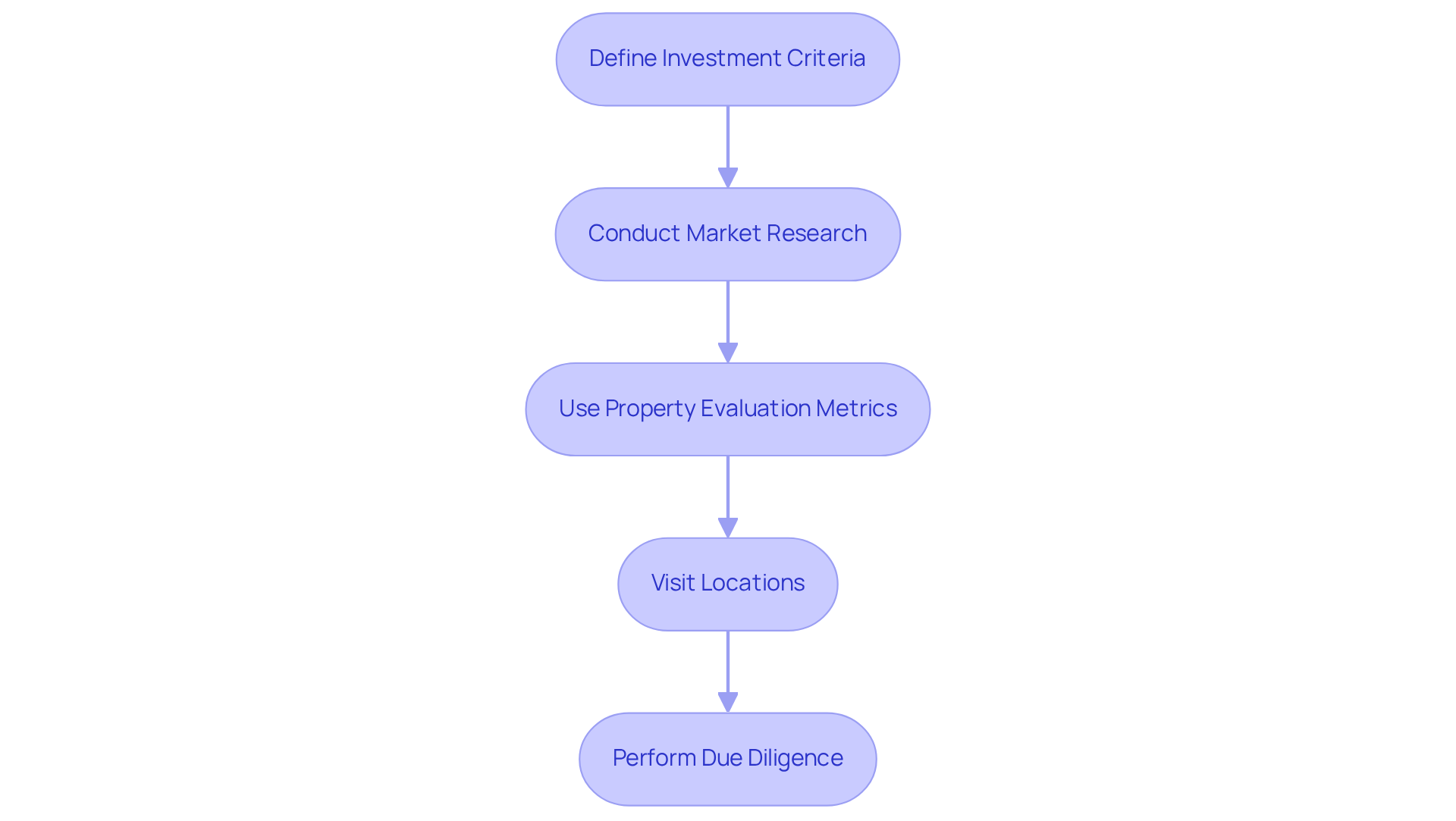

To effectively engage in real estate, it is vital to recognize assets that align with your financial objectives. Here’s a structured approach to achieving this:

-

Define Your Investment Criteria: Begin by determining the type of asset you wish to invest in—be it residential, commercial, or otherwise. Establish your budget alongside your desired return on investment (ROI). Key considerations should include location, land size, and the potential for appreciation, especially in markets where the median home price has climbed to $375,000, reflecting a 5% rise from the previous year.

-

Conduct Market Research: Delve into local property markets to identify emerging trends. Focus on regions experiencing robust job expansion, low vacancy rates, and rising real estate values. Leverage resources such as local real estate reports, online databases, and market analysis tools. For instance, the U.S. housing market recorded approximately 4.1 million transactions in 2025, highlighting sustained demand despite economic pressures.

-

Use Property Evaluation Metrics: Familiarize yourself with essential metrics such as:

- Capitalization Rate (Cap Rate): This metric measures the property’s potential return based on its net operating income (NOI) divided by the property value. A higher cap rate suggests a potentially more lucrative venture.

- Cash Flow: Calculate expected cash flow by subtracting all expenses (mortgage, taxes, maintenance) from rental income. With average rents for single-family homes at $2,256 per month, understanding cash flow is crucial for profitability.

- Return on Investment (ROI): Assess ROI by comparing the profit from the capital to the total sum allocated. The average yield on property was reported at 29.6%, underscoring the potential for profitable returns.

-

Visit Locations: Schedule tours of potential asset locations. Evaluate their condition, location, and surrounding amenities. Take detailed notes and photographs to assist in your assessment, ensuring you capture critical details that may influence your decision.

-

Perform Due Diligence: Prior to making an offer, conduct thorough due diligence. This process includes examining land records, checking for necessary repairs, and understanding local zoning regulations. Engaging a qualified inspector can reveal hidden issues that may affect your financial commitment.

By following these steps, you can effectively identify and assess real estate assets that align with your financial objectives. Leverage the current market dynamics by leveraging real estate to build wealth through strategic investments.

Manage Properties and Foster Tenant Relationships

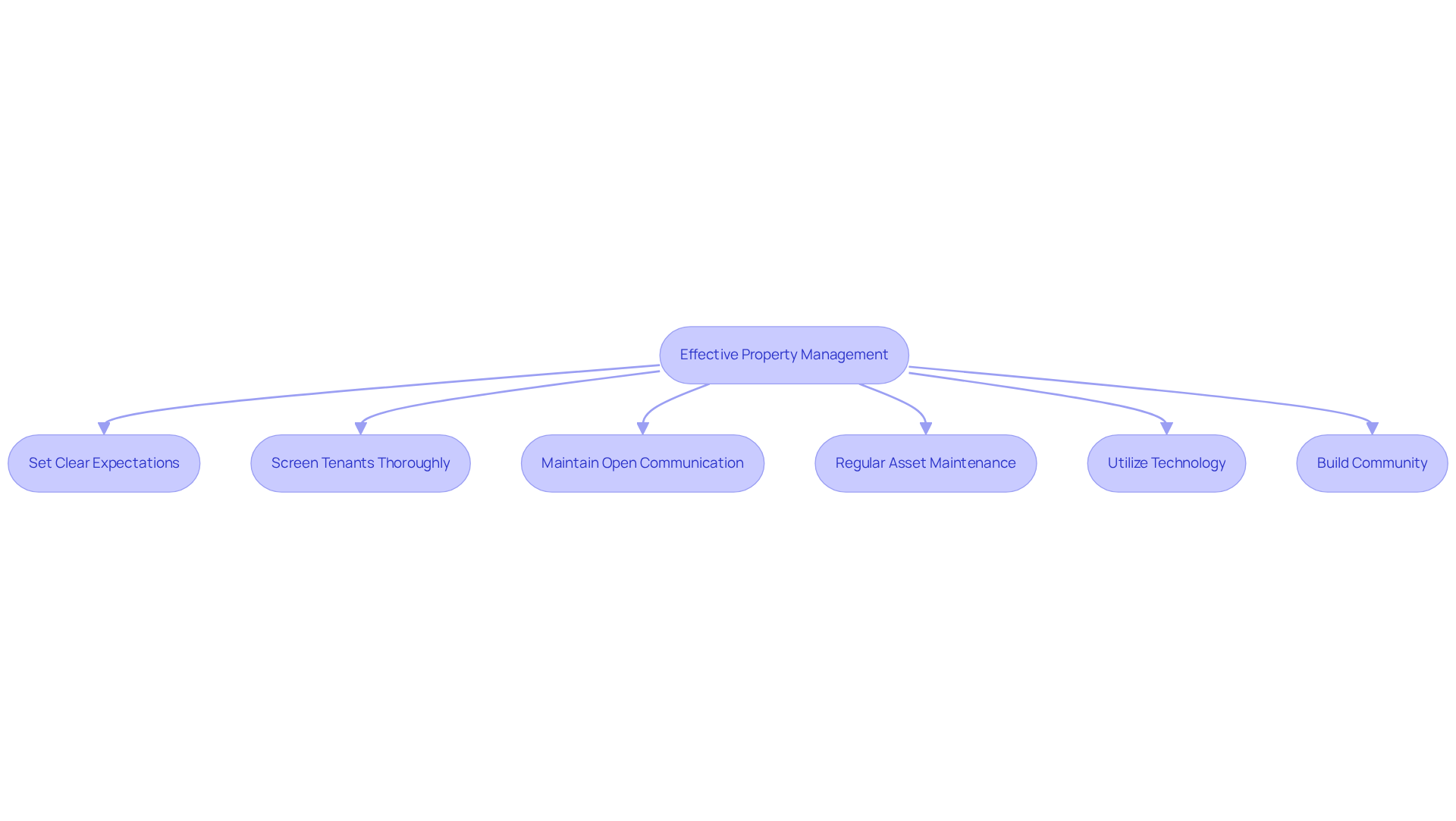

Once investment assets are acquired, effective management becomes crucial for maximizing returns. To achieve this, consider implementing the following key strategies:

-

Set Clear Expectations: Establish comprehensive lease agreements that clearly outline tenant responsibilities, rent due dates, and maintenance obligations. Ensure tenants fully understand these terms before signing to prevent misunderstandings.

-

Screen Tenants Thoroughly: Implement a rigorous tenant screening process to identify reliable renters. This should include checking credit scores, rental history, and conducting background checks to minimize risks associated with tenant defaults.

-

Maintain Open Communication: Foster positive relationships with tenants by keeping communication lines open. Be attentive to their concerns and questions, and offer regular updates related to management to foster trust and transparency.

-

Regular Asset Maintenance: Schedule routine upkeep inspections to keep the premises in excellent condition. Promptly addressing repairs not only prevents larger issues but also enhances tenant satisfaction, which is crucial as 54% of apartments turnover every year.

-

Utilize Technology: Leverage management software to streamline operations. These tools can facilitate rent collection, maintenance requests, and tenant communication, significantly improving management efficiency. The growing use of AI-driven analytics and automated methods in real estate management can further enhance these efforts.

-

Build Community: Encourage a sense of community among tenants by organizing events or creating shared spaces. Happy tenants are more likely to renew leases and recommend your properties, contributing to lower turnover rates.

As noted by Michael Miedler, CEO of Century 21, "Success in property comes down to two factors: taking care of and valuing the customer." By implementing these management strategies, you can enhance tenant satisfaction, reduce turnover, and ultimately increase the profitability of your real estate investments.

Conclusion

Effectively leveraging real estate serves as a powerful strategy for building wealth, enabling investors to maximize returns while managing risk. By grasping the fundamentals of leverage, meticulously evaluating investment properties, and implementing robust management practices, investors can navigate the complexities of the real estate market with confidence.

Key insights include:

- The importance of defining investment criteria

- Conducting thorough market research

- Utilizing essential evaluation metrics such as cap rates and cash flow

Furthermore, the necessity for effective property management and tenant relations is emphasized to ensure sustained profitability. By:

- Setting clear expectations

- Maintaining open communication

- Utilizing technology

Landlords can enhance tenant satisfaction and reduce turnover, ultimately contributing to a more successful investment portfolio.

Real estate investment offers a pathway to financial growth; however, it requires diligence, strategic planning, and a proactive approach. As the market continues to evolve, staying informed and adapting to changes will be crucial. Embrace the opportunities that real estate presents, and consider implementing the strategies outlined to elevate your investment journey and achieve lasting wealth.