Overview

The article presents effective investment strategies for Central Business Districts (CBDs), emphasizing their role as economic hubs that offer unique opportunities for high returns. It begins by outlining the key characteristics of CBDs, providing a foundation for understanding their significance in the market. By analyzing the economic and social dynamics at play, the article builds interest and highlights the complexities involved in CBD investments. To navigate these challenges, it recommends strategies such as:

- Thorough market research

- Diversification

- Leveraging technology

These actionable insights are designed to empower investors to make informed decisions in this lucrative sector.

Introduction

Central Business Districts (CBDs) serve as the lifeblood of urban economies, teeming with activity and opportunity. These dynamic hubs not only accommodate a multitude of businesses and services but also play a critical role in shaping a city’s economic landscape.

For investors, grasping the intricacies of CBDs is paramount, as they offer unique opportunities for substantial returns amidst ever-evolving market dynamics. Yet, the pressing question persists: how can one adeptly navigate the complexities of investing in these bustling districts while capitalizing on emerging trends and overcoming potential challenges?

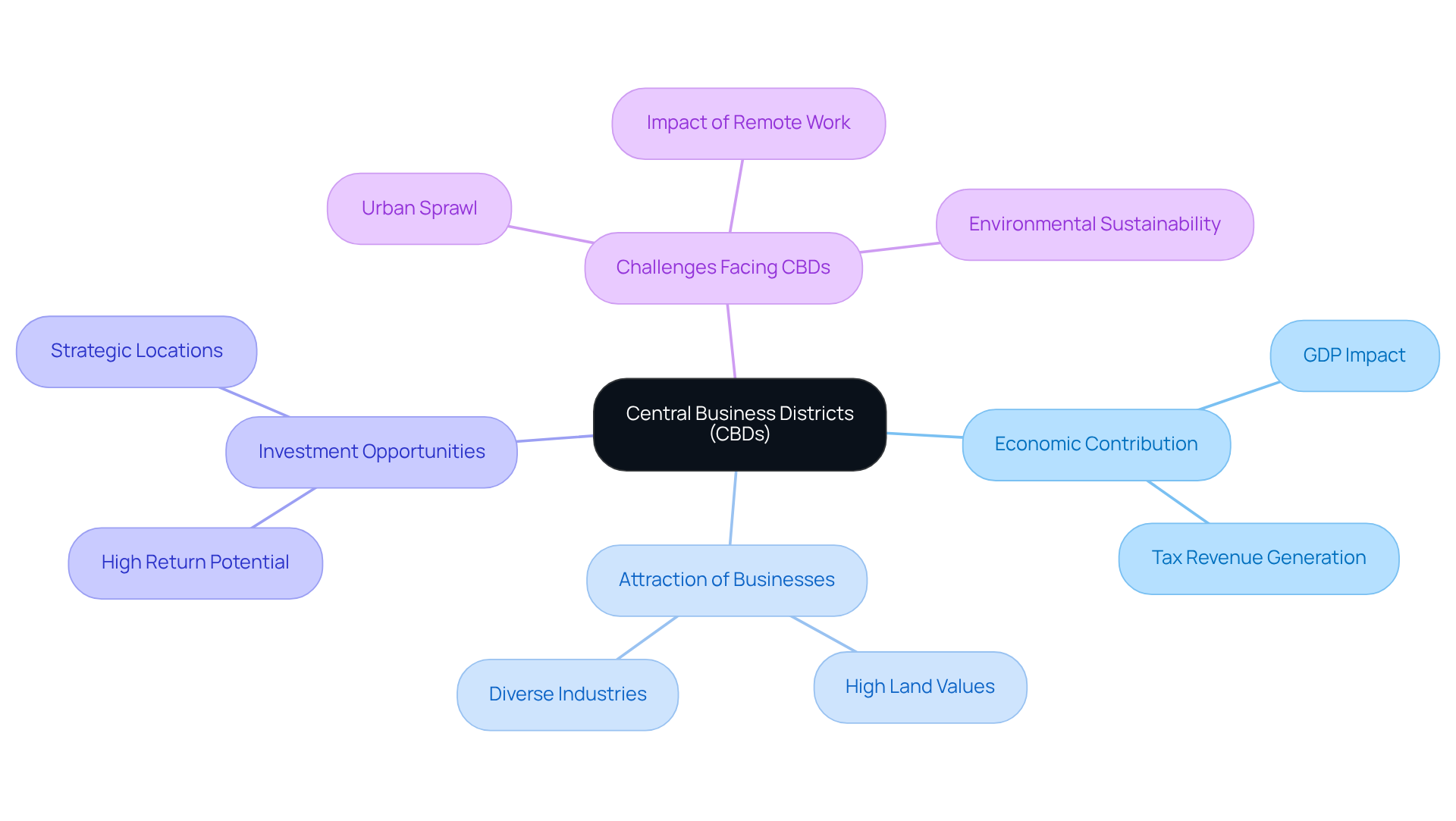

Define Central Business Districts (CBDs) and Their Importance

Central Business Districts (CBDs), known as the cbd business district, serve as the commercial and business hubs of cities, featuring a high concentration of retail shops, offices, and cultural institutions. They serve as the economic heart of urban areas, driving growth and innovation.

Essential for attracting companies and skilled individuals, the cbd business district plays a significant role in contributing to a city's GDP and tax revenue. Understanding the importance of these districts is crucial for investors, as they often present unique opportunities for high returns due to their strategic locations and robust infrastructure.

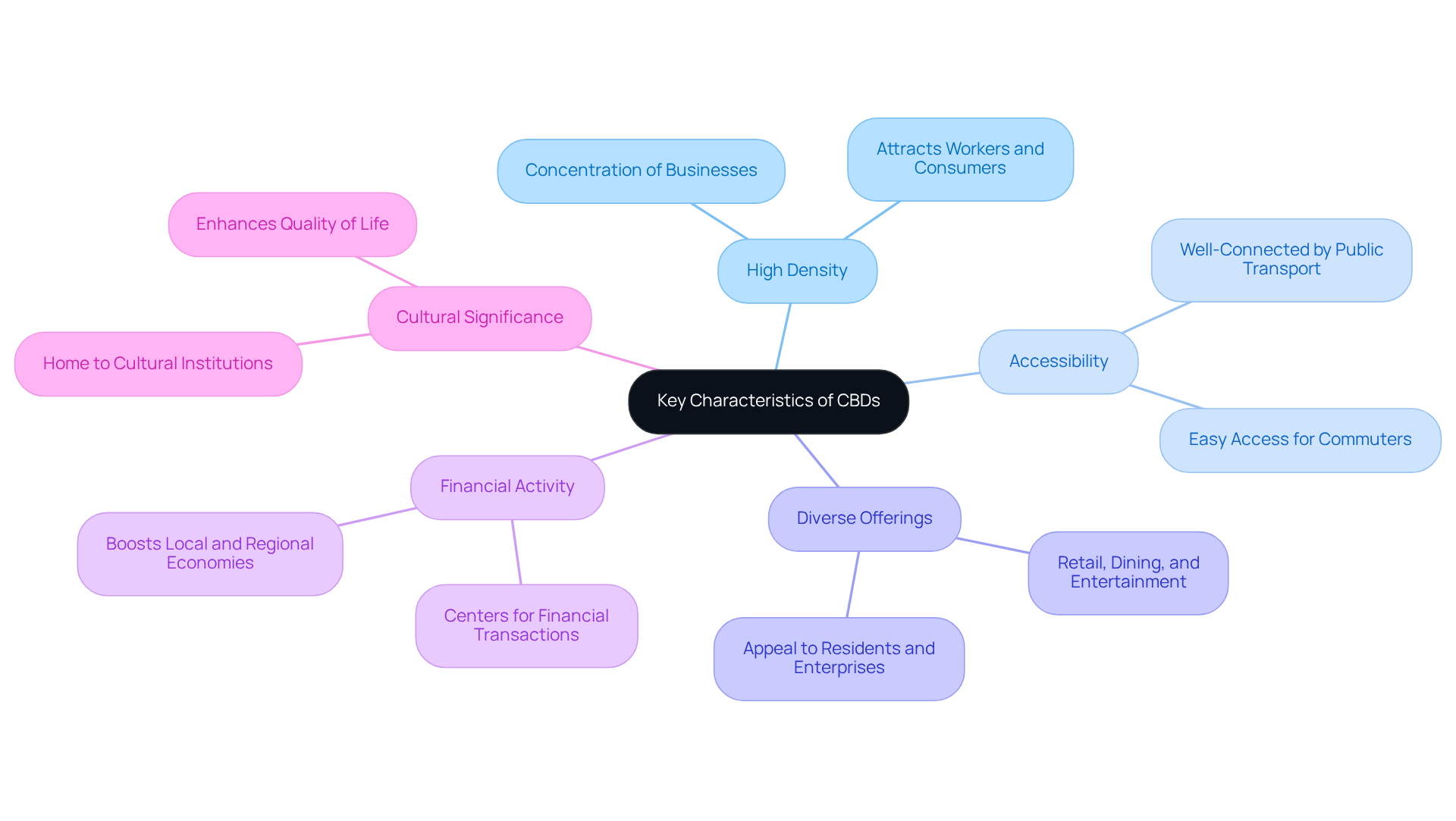

Explore Key Characteristics of CBDs

Key characteristics of Central Business Districts (CBDs) are pivotal for understanding their significance in urban landscapes:

- High Density: CBDs are characterized by a dense concentration of businesses and services, transforming them into bustling hubs of activity that attract both workers and consumers.

- Accessibility: These districts are typically well-connected by public transportation, ensuring easy access for individuals commuting to work or seeking services.

- Diverse Offerings: Central Business Districts boast a rich blend of retail, dining, and entertainment options, which enhances their appeal to both enterprises and local residents.

- Financial Activity: Serving as vital centers for financial transactions, CBDs play a crucial role in bolstering local and regional economies.

- Cultural Significance: Often home to cultural institutions, parks, and public spaces, Central Business Districts not only elevate the quality of life for residents but also attract visitors, enriching the urban experience.

Understanding these characteristics is essential for investors aiming to capitalize on the unique opportunities presented by CBDs.

Analyze Economic and Social Dynamics in CBDs

The economic and social dynamics in the cbd business district are influenced by a variety of interrelated factors.

- Demographic Trends: Shifts in population demographics, including age and income levels, significantly influence the demand for housing and commercial spaces within CBDs. As Simon Kuestenmacher notes, "With Australia’s population expected to grow substantially not only in 2025 but over the next decade, housing demand will continue to outpace supply." This necessitates a keen understanding of these trends for effective investment.

- Financial Changes: The overall financial landscape, characterized by employment rates and consumer spending patterns, plays a crucial role in determining the vitality of central business districts. Strong economic growth typically correlates with increased demand for office space and retail establishments, while economic downturns can lead to higher vacancy rates and declining property values. For instance, Kuestenmacher emphasizes that "Constructing homes on the outskirts is significantly cheaper, often costing only a third of what it takes to build medium- or high-density housing in inner-city locations."

- Urbanization: The ongoing trend of urban migration results in heightened demand for both residential and commercial properties in the cbd business district. As more individuals relocate to urban centers for employment and lifestyle opportunities, the pressure on housing supply intensifies, often leading to increased property values and rental rates. This trend is evident in cities like Tokyo, where the Marunouchi district has seen a 20% increase in office space occupancy rates over the past five years.

- Technological Advancements: The rise of remote work and e-commerce is fundamentally transforming the operational landscape of central business districts. Investors must adapt to these changes by considering mixed-use developments and flexible office spaces in the cbd business district that cater to the evolving needs of businesses and residents alike. Kuestenmacher also points out that "The work-from-home revolution isn’t fading; it’s evolving," emphasizing the necessity for flexibility in financial strategies.

- Social Factors: The cultural and social environment within CBDs significantly impacts their attractiveness to businesses and residents. A lively social environment, defined by features like parks, eateries, and entertainment choices, can improve property values and financial potential. As Kuestenmacher notes, "Governments may encourage remote work to ease strain on road and rail networks," indicating the importance of a supportive social infrastructure.

Comprehending these dynamics is crucial for investors seeking to maneuver effectively through the intricacies of funding in the cbd business district. By understanding how demographic trends, financial changes, and social factors interact, stakeholders can make informed decisions that align with the future trajectory of urban development.

Implement Strategies for Investing in CBDs

To effectively invest in Central Business Districts (CBDs), consider the following strategies:

- Conduct Thorough Market Research: Analyze local market trends, demographic shifts, and economic indicators to identify promising investment opportunities. Grasping the dynamics of the CBD sector is vital, particularly as vacancy rates hit 19.2% in April 2025, while the national office vacancy rate stood at 19.7%. This indicates weak demand and high vacancy levels, providing essential context for informed decision-making. Focus on emerging areas in the CBD business district that are undergoing revitalization or gentrification, as these areas often present significant upside potential. For instance, cities like Austin and Dallas are experiencing shifts that could lead to increased demand and property values.

- Diversify Investments: Consider a mix of residential, commercial, and mixed-use properties to spread risk and take advantage of various segments. This approach can mitigate the impact of declining property values, which have dropped by 7% in the past year and 20% over two years across the commercial real estate sector.

- Leverage Technology: Utilize data analytics tools to gain insights into industry trends and consumer behavior, enhancing decision-making processes. With the rise of e-commerce, understanding consumer preferences has never been more critical.

- Network with Local Stakeholders: Build relationships with local businesses, government officials, and real estate professionals to stay informed about upcoming developments and opportunities. Engaging with the community can provide significant insights into changes in trends and funding opportunities.

- Incorporate Expert Insights: As David Smith, Head of Americas Insights at Global Research, emphasizes, staying informed about market dynamics is crucial for navigating the complexities of the CBD business district. Incorporating expert viewpoints can enhance the credibility of your financial strategies.

- Utilize Case Studies: Referencing successful case studies, such as the "Urban Comeback" study that explores the post-pandemic resurgence of CBD multifamily living, can offer practical insights and reinforce the strategies discussed. This method not only demonstrates the potential for growth in revitalized regions but also provides concrete examples of successful funding.

- Explore Research Techniques: Employ specific research methods, such as surveys, focus groups, and data analysis, to gather actionable insights that can guide your financial decisions. Understanding customer demographics and market trends is essential for success in CBD investments.

Conclusion

Central Business Districts (CBDs) stand as the cornerstone of urban economies, embodying a distinctive investment landscape brimming with opportunities for growth and innovation. For investors aiming to navigate the complexities of urban development, grasping the intricacies of these districts is paramount. Their strategic locations and vibrant ecosystems present a wealth of possibilities that should not be overlooked.

In this article, we have delved into the key characteristics of CBDs, uncovering their:

- High density

- Accessibility

- Diverse offerings

- Cultural significance

Furthermore, we have analyzed the economic and social dynamics that shape these districts, shedding light on how demographic trends, urbanization, and technological advancements influence investment potential. Effective strategies for investing in CBDs have also been highlighted, underscoring the necessity of:

- Thorough market research

- Diversification

- Leveraging technology to make informed decisions

As urban centers continue to evolve, the role of CBDs in driving economic growth and community development cannot be overstated. Investors are urged to adopt a proactive stance, staying attuned to emerging trends and adjusting their strategies to meet the shifting landscape. By doing so, they not only enhance their investment portfolios but also play a vital role in the revitalization and prosperity of urban environments, leaving a lasting impact on the cities in which they invest.