Overview

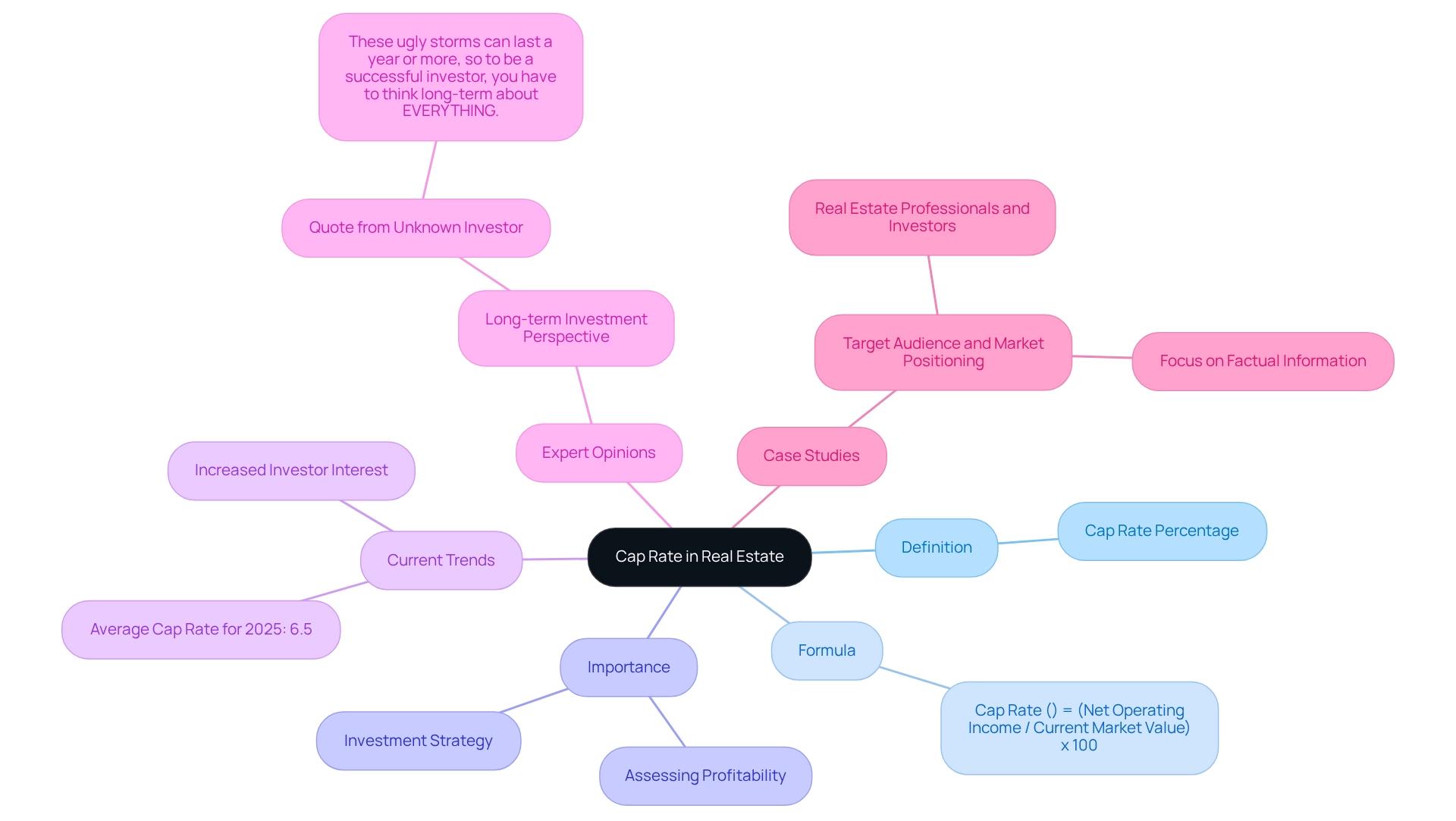

The article emphasizes the critical importance of mastering commercial real estate cap rates, which are essential for evaluating the profitability and risk associated with real estate investments. It serves as a comprehensive guide that details the calculation of cap rates, explores the various factors that influence them, and illustrates their significance through real-world examples and expert insights.

A thorough understanding of cap rates is paramount; it not only enhances investment strategies but also improves decision-making processes for investors. By grasping these concepts, readers can position themselves to make informed and strategic investment choices.

Introduction

In the dynamic realm of real estate investment, the capitalization rate—commonly known as the cap rate—emerges as a pivotal metric that investors rely on to gauge potential returns. This essential tool not only simplifies the assessment of a property's profitability but also serves as a compass for navigating the complexities of the market.

As trends shift and the landscape evolves, understanding cap rates becomes increasingly critical, particularly in a year like 2025, where average rates are signaling new opportunities and challenges.

By delving into the calculation, the factors influencing cap rates, and real-world examples, investors can equip themselves with the knowledge necessary to make informed decisions that align with their financial goals and risk tolerance.

Define Cap Rate and Its Importance in Real Estate

The capitalization percentage, or cap percentage, serves as a pivotal metric in evaluating commercial real estate cap rates and the anticipated return on an asset. It is calculated using the formula:

Cap Rate (%) = (Net Operating Income / Current Market Value) x 100

Cap rates provide a quick reference for assessing a property's profitability. A higher capitalization often indicates a potentially greater return on capital, whereas a lower capitalization may signify a more stable, lower-risk asset. This metric becomes particularly critical in 2025, as current cap statistics reveal trends that can significantly influence investment strategies. For instance, the average commercial real estate cap rates for 2025 are reported to be approximately 6.5%, reflecting a slight increase from previous years, which may attract investors seeking higher returns.

Understanding commercial real estate cap rates empowers investors to effectively evaluate various assets, ensuring their choices align with financial objectives and risk tolerance. For example, assets with capitalization figures exceeding the national average have garnered increased interest from investors, underscoring the cap figure's role in shaping financial decisions.

Expert opinions highlight the significance of commercial real estate cap rates in real estate valuation, with many specialists advocating for their use as a fundamental tool in financial analysis. As one investor insightfully remarked, "These ugly storms can last a year or more, so to be a successful investor, you have to think long-term about EVERYTHING." This perspective underscores the importance of viewing capitalization figures not merely as a snapshot but as a component of a broader investment strategy.

Case studies further illustrate the importance of commercial real estate cap rates; properties with well-analyzed commercial real estate cap rates consistently outperform those lacking thorough evaluations. By focusing on factual data and avoiding personal biases, investors can leverage capitalization measures to make informed decisions that enhance their portfolios. Zero Flux, committed to delivering quality content to over 30,000 subscribers, provides valuable insights that aid investors in navigating the complexities of capitalization and making sound investment choices.

Calculate Cap Rate: Step-by-Step Formula

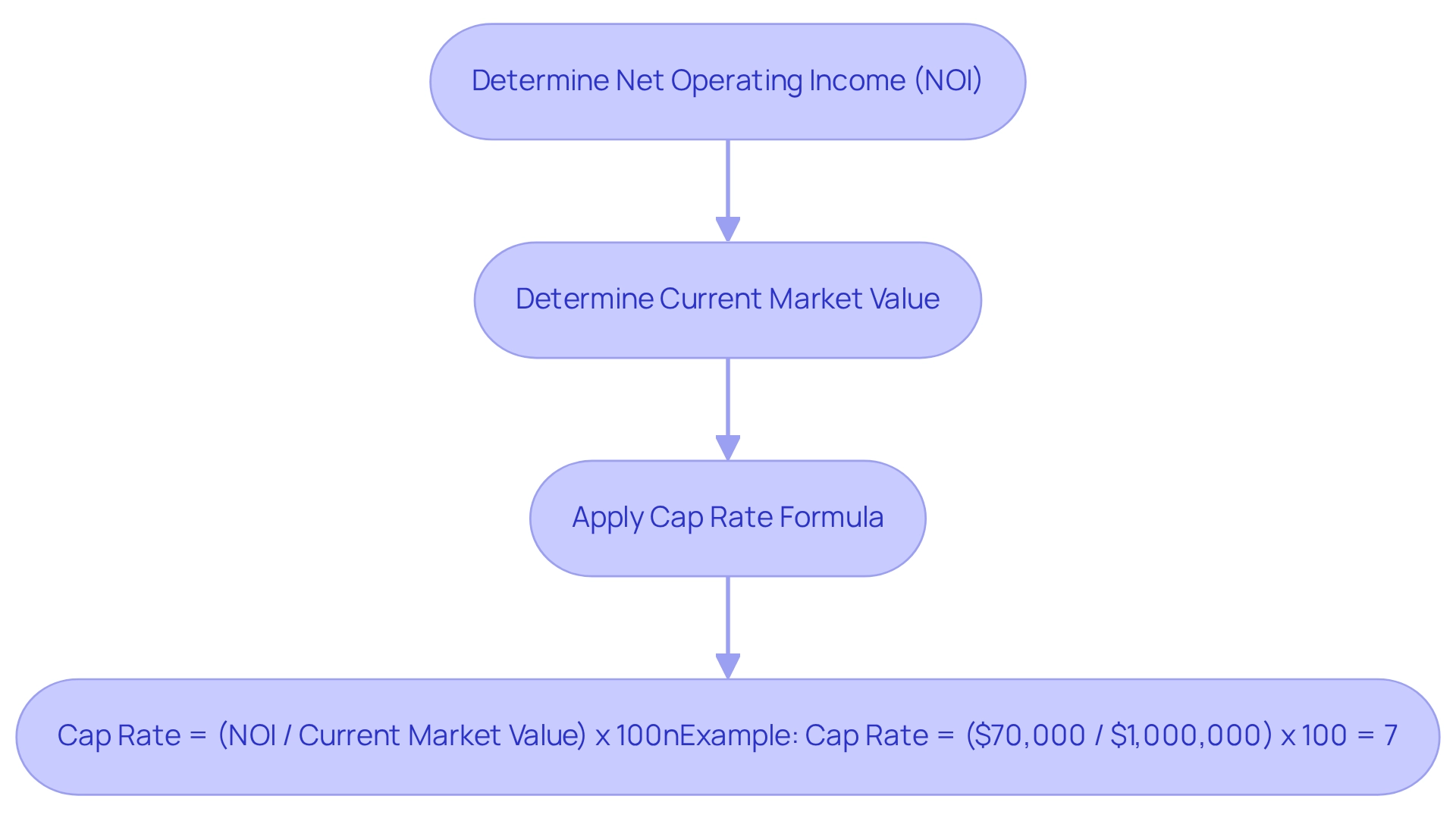

Calculating the cap rate involves a straightforward process that can be broken down into three essential steps:

-

Determine the Net Operating Income (NOI): This figure represents the total income generated by the asset, such as rental income, minus all operating expenses, including maintenance, management fees, and taxes. For instance, if a property generates $100,000 in rental income and incurs $30,000 in operating expenses, the NOI is calculated as follows:

NOI = $100,000 - $30,000 = $70,000

-

Determine the Current Market Value: This value can either be the purchase price or the assessed value of the asset. For example, if the asset is appraised at $1,000,000, this figure serves as your market value.

-

Apply the Cap Rate Formula: The cap rate is calculated using the following formula:

Cap Rate = (NOI / Current Market Value) x 100

Using the figures from the previous steps:

Cap Rate = ($70,000 / $1,000,000) x 100 = 7%

This calculation yields a percentage that indicates the expected return on investment for the property. Understanding commercial real estate cap rates is essential for evaluating financial opportunities, as they serve as a standard for gauging potential risks and returns. Higher commercial real estate cap rates generally imply greater investment risk, while lower commercial real estate cap rates indicate a more stable investment. Investors should consider their risk tolerance when analyzing these figures related to commercial real estate cap rates, as there are no universally accepted ranges for what defines a 'good' or 'bad' capitalization; context is crucial. As stated, "There are no distinct ranges for a good or bad cap value, and they largely depend on the context of the property and the market." Furthermore, the capitalization proportion, which is closely associated with commercial real estate cap rates, is regarded as a sign of financial risk, with higher proportions implying greater risk and lower proportions signifying less risk. Investors must assess their risk profiles to determine if a higher or lower capitalization figure aligns with their investment strategy. Additionally, Green Street maintains hundreds of distinct cap series for all major property sectors and U.S. metros, providing valuable context for comprehending these metrics.

Identify Factors Affecting Cap Rates

Cap rates in commercial real estate are influenced by several key factors:

- Location: Properties located in high-demand areas typically exhibit lower capitalization values due to their desirability. Conversely, assets in less desirable areas often show higher capitalization ratios, reflecting the increased risk associated with diminished demand. As Barbara Corcoran aptly noted, "Buyers decide in the first eight seconds of seeing a home if they’re interested in buying it." This underscores the importance of first impressions, which can significantly impact property valuation and commercial real estate cap rates.

- Property Type: The category of property—whether residential, commercial, or industrial—plays a crucial role in determining capitalization values. Each category possesses distinct risk profiles and income potentials, directly affecting their valuation.

- Market Conditions: Economic indicators such as interest rates, inflation, and overall market health are vital in shaping capitalization metrics. For instance, as interest rates rise, cap rates often increase as well, driven by the higher borrowing costs that investors face. Additionally, the strength of the U.S. dollar may present challenges for foreign investors, influencing their investment strategies in the current market landscape.

- Tenant Quality: The creditworthiness of tenants significantly affects the perceived risk of an asset. Properties with stable, long-term occupants generally enjoy lower capitalization values, while those with higher vacancy rates or less reliable tenants may experience increased capitalization values due to heightened risk.

- Asset Condition: The physical state of an asset also influences capitalization percentages. Well-maintained assets are likely to attract lower capitalization percentages, as they pose a reduced risk of unforeseen costs. In contrast, assets requiring substantial repairs may have elevated capital returns to offset the associated risks.

Understanding these factors is essential for investors looking to navigate the complexities of commercial real estate cap rates in 2025. By examining location, type of real estate, market conditions, tenant quality, and asset condition, investors can make informed choices that align with their financial strategies. Furthermore, real estate funding plays a vital role in community growth and renewal, transforming neglected regions into vibrant areas, which can also impact capitalization ratios. As highlighted by CBRE, the current financial climate is markedly different from that preceding the pandemic, with structural changes affecting demand for various real estate types.

Review Cap Rate Calculation Examples

Here are several practical examples of cap rate calculations that illustrate how income levels and property values influence potential investment returns:

-

Example 1: A commercial asset generates $150,000 in annual rental income with $50,000 in operating expenses, valued at $2,000,000.

- NOI = $150,000 - $50,000 = $100,000

- Cap Rate = ($100,000 / $2,000,000) x 100 = 5%

-

Example 2: A residential rental asset has an NOI of $30,000 and is valued at $500,000.

- Cap Rate = ($30,000 / $500,000) x 100 = 6%

-

Example 3: An industrial asset with an NOI of $200,000 and a market value of $3,000,000.

- Cap Rate = ($200,000 / $3,000,000) x 100 = 6.67%

These examples highlight how varying income levels and property valuations can impact cap rates, offering a clearer understanding of potential investment returns across different property types. Furthermore, it is essential to contemplate strategies for reducing cap exposure risk, as detailed in the case study named 'Mitigating Cap Exposure Risk.' This research underscores the significance of avoiding excessive payments for properties and adopting cautious proforma assumptions to safeguard returns. Additionally, understanding cap rates is foundational to Net Asset Value-based pricing methodologies, as noted by Green Street, which forms the basis for return expectations in market selection. By incorporating these strategies and insights, you can enhance your approach to evaluating investment opportunities in commercial real estate.

Conclusion

The capitalization rate stands as an indispensable tool for real estate investors, offering a clear picture of potential returns and guiding strategic investment decisions. By mastering the calculation of cap rates and understanding the various factors that influence them—such as location, property type, tenant quality, and market conditions—investors can position themselves to seize opportunities within the evolving landscape of 2025.

Real-world examples vividly illustrate the practical applications of cap rate calculations, reinforcing the critical importance of thorough analysis in achieving successful outcomes. As trends shift and market dynamics evolve, staying informed about cap rate fluctuations empowers investors to navigate uncertainties and enhance their portfolios.

Ultimately, leveraging the cap rate effectively not only facilitates informed investment decisions but also fosters a long-term perspective in property valuation. By prioritizing a comprehensive understanding of cap rates, investors can align their strategies with their financial goals, ensuring they are well-equipped to thrive in the competitive real estate market.