Overview

Mastering national real estate news is vital for investors aiming to make informed investment decisions. This knowledge provides critical insights into market dynamics, pricing trends, and economic indicators that directly affect property values. By staying updated on essential factors, such as shifts in interest rates and housing demand, investors can strategically identify opportunities and manage risks. This is illustrated through case studies and expert insights throughout the article, reinforcing the importance of being well-informed in the ever-evolving real estate landscape.

Introduction

In the dynamic world of real estate, staying updated with the latest news is not just beneficial—it's essential for investors aiming to navigate the complexities of the market. Trends are shifting rapidly due to factors like remote work, sustainability, and demographic changes. Understanding the nuances of real estate news provides a competitive edge. Investors must analyze market indicators and recognize emerging opportunities, adopting effective strategies to interpret the constant flow of information.

As challenges such as rising interest rates and inventory shortages loom, the ability to adapt and make informed decisions becomes paramount. This article delves into the importance of real estate news, examines key trends shaping the landscape, and offers strategies for effective analysis, all while addressing the pressing challenges investors face in 2025 and beyond.

Clarify the Importance of Real Estate News for Investors

National real estate news serves as a crucial resource for stakeholders, providing essential insights into industry dynamics, pricing trends, and economic indicators that directly impact property values. Staying informed empowers investors to pinpoint emerging opportunities and adeptly manage risks associated with economic fluctuations. For instance, awareness of shifts in interest rates or housing demand can profoundly affect investment timing and strategy, leading to more informed and potentially profitable decisions, while national real estate news provides insights into regulatory changes and demographic trends that can alter market conditions. A recent case study involving the underwriting of Community Facilities District (CFD) bonds for a large-scale development in Sacramento exemplifies this. The analysis conducted by the City’s consultant team utilized findings from research to substantiate the financing of the project, showcasing how strategic, data-driven insights can facilitate successful investment outcomes.

With over 30,000 subscribers, Zero Flux illustrates how engaging with reliable news sources equips investors to adapt to new information. Investors who regularly interact with curated property insights are better positioned to navigate the complexities of the market. As the landscape evolves in 2025, the ability to adjust to new information will be crucial for making sound investment decisions. As noted by JLL, 'Their knowledge and their capacity to advance the process was clear from the outset,' underscoring the vital role that informed decision-making plays in successful property investment.

Examine Key Trends Shaping the National Real Estate Landscape

Several pivotal trends are currently influencing the national property market, as reported in national real estate news. The rise of remote work has significantly increased the demand for suburban and rural properties, as individuals prioritize space and affordability in their living environments. This shift is evident in the growing interest in homes beyond urban centers, where buyers are seeking larger properties that can accommodate home offices and outdoor spaces.

Sustainability is emerging as a vital consideration in real estate investment decisions. Investors are increasingly attracted to eco-friendly developments and properties that meet green building standards, reflecting a broader societal shift towards environmental awareness. This trend not only aligns with consumer preferences but also enhances long-term value for stakeholders.

Demographic changes further shape the dynamics of the market, with aging populations and millennials entering the housing sector. These groups demonstrate distinct preferences that influence demand patterns, such as a desire for multi-generational living spaces and urban amenities.

Understanding these trends is essential for individuals aiming to make informed decisions regarding resource allocation and audience targeting, particularly in national real estate news. As Sharad Mehta notes, "Inventory shortages are driven by homeowners’ reluctance to sell in a high-interest-rate environment," emphasizing the challenges in supply that impact demand. Furthermore, the global property sector is projected to reach $5,388.87 billion by 2026, expanding at a CAGR of 9.6%. Recognizing and adapting to these evolving trends will be crucial for capitalizing on emerging opportunities.

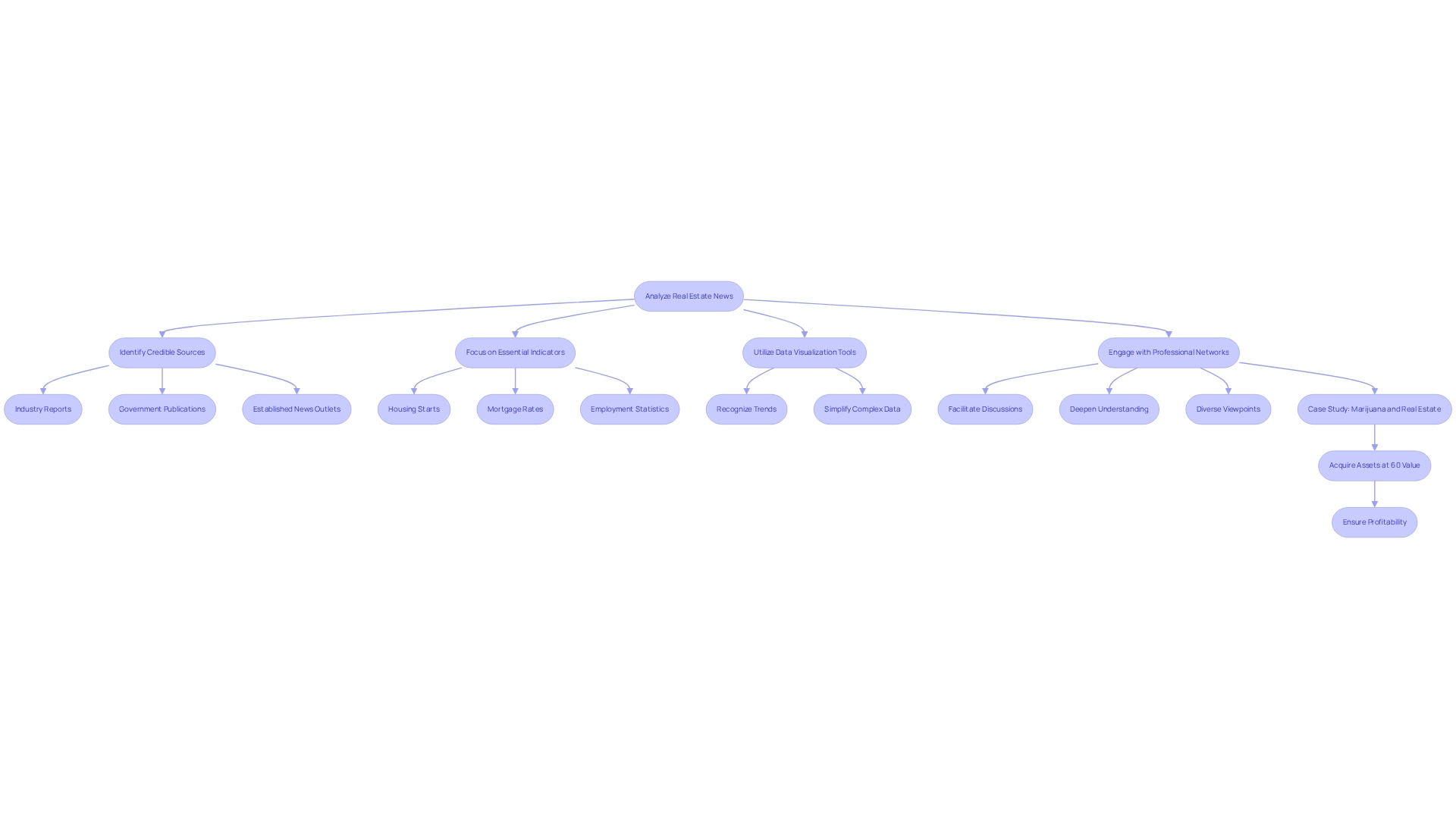

Implement Strategies for Analyzing Real Estate News Effectively

To effectively analyze national real estate news, investors should adopt a systematic strategy. Start by identifying credible sources such as industry reports, government publications, and established news outlets. Focus on essential indicators, including:

- Housing starts

- Mortgage rates

- Employment statistics

As these metrics provide valuable insights into economic health. Utilizing data visualization tools can further assist in recognizing trends over time, simplifying complex data for better comprehension.

Consistently examining and cross-checking details from various sources enhances precision and offers a comprehensive perspective of the industry landscape. Engaging with professional networks or forums can also facilitate discussions that deepen understanding and reveal diverse viewpoints. For instance, a recent survey by the National Association of Realtors (NAR) conducted on April 15, 2025, explored the evolving relationship between the property sector and the legalization of marijuana, highlighting how industry practices are adapting to new legal frameworks. This case study underscores the importance of staying informed about changing economic conditions.

Moreover, industry specialists, including Terry Mrochko, who boasts over 15 years of experience in the property sector, emphasize the importance of acquiring assets at approximately 60% of their value to ensure profitability, even if sold at a reduced price. This strategy aligns with findings from IBISWorld, which indicates that the property sector has an economic impact of around $16 trillion, making thorough sector analysis vital for success in national real estate news. By implementing these optimal approaches, individuals can navigate the complexities of the property sector with increased confidence and understanding.

Address Challenges in the Current Real Estate Market

The current property sector poses significant challenges for investors. Rising interest rates are a major concern, as they increase borrowing costs, potentially dampening buyer demand. The U.S. Federal Reserve's expected policy rate reduction to 4% by 2025 could provide some relief; however, this adjustment may also lower borrowing costs, potentially rekindling buyer interest and opening up new investment avenues. Nonetheless, the residual effects of past rate hikes continue to influence investment choices. Furthermore, many markets are facing inventory shortages, resulting in intensified competition and rising prices, complicating the search for suitable properties.

Economic uncertainties, including inflation and the risk of recessions, further intensify these obstacles. Data shows that families who have held onto their real estate investments over the last 200 years have preserved their wealth, highlighting the enduring value of real estate despite short-term market fluctuations.

To successfully navigate this intricate landscape, individuals should consider diversifying their portfolios by exploring various asset classes, such as commercial properties or REITs, which McGowan noted play a more crucial role in the economy than many recognize. Additionally, alternative financing methods, such as seller financing or partnerships, can offer flexibility in property acquisitions. Staying informed about national real estate news is essential for identifying opportunities, even in a constrained environment. As John Jacob Astor wisely advised, "Buy on the fringe and wait. Buy land near a growing city!" By adopting a proactive strategy and leveraging available resources, investors can position themselves to thrive amid the challenges of 2025.

Conclusion

Navigating the real estate market in 2025 requires a keen understanding of the latest news and trends that shape the landscape. Investors must prioritize staying informed to identify emerging opportunities and mitigate risks associated with market fluctuations. Real estate news provides critical insights into pricing trends, regulatory changes, and demographic shifts that can significantly impact investment strategies.

Key trends such as the rise of remote work, a growing emphasis on sustainability, and changing demographic preferences are reshaping buyer behavior and property demand. Investors who recognize these shifts will be better equipped to make informed decisions regarding resource allocation and market targeting. Moreover, the anticipated growth of the global real estate market presents a wealth of opportunities for those ready to adapt.

Implementing effective strategies for analyzing real estate news is essential for success. By utilizing credible sources, focusing on key market indicators, and engaging with professional networks, investors can enhance their understanding of the ever-evolving landscape. Additionally, addressing challenges such as rising interest rates and inventory shortages through diversification and alternative financing options will be crucial for thriving in this complex environment.

Ultimately, the ability to adapt and make informed decisions based on reliable information will define successful investors in the years to come. By prioritizing continuous learning and strategic planning, investors can navigate the complexities of the real estate market and seize the opportunities that arise in 2025 and beyond.