Overview

Real estate debt funds represent sophisticated investment vehicles that extend loans secured by property assets, generating income primarily through interest payments. This characteristic appeals to investors seeking stable returns with a lower risk profile compared to equity investments.

The article elucidates the advantages of these funds, including:

- Liquidity

- Risk diversification

However, it also addresses inherent limitations, such as:

- Lower growth potential

- Credit risk

This comprehensive analysis provides a nuanced understanding of their pivotal role in property financing strategies, equipping investors with essential insights for informed decision-making.

Introduction

In the evolving landscape of real estate investments, debt funds have emerged as a compelling option for investors seeking stability and income. Unlike traditional equity investments that hinge on property appreciation, real estate debt funds focus on providing loans secured by real estate assets, offering a more predictable return profile.

This article delves into the purpose and function of these specialized investment vehicles, highlighting their growing significance in today’s market. As the appetite for stable income opportunities increases amidst economic fluctuations, understanding the mechanics, benefits, and risks associated with real estate debt funds becomes essential for investors looking to navigate this complex terrain effectively.

Define Real Estate Debt Funds and Their Purpose

Property financing vehicles, such as real estate debt funds, serve as specialized investment instruments that accumulate capital from multiple investors to provide loans secured by property assets. These resources primarily aim to generate revenue through interest payments on the loans they extend, positioning them as an attractive option for individuals seeking to engage in the property market without the complexities associated with direct ownership. By focusing on loans rather than equity, investors in real estate debt funds can enjoy more stable income streams and potentially lower risk profiles, as loan holders take precedence in the event of borrower defaults.

The remarkable expansion of property financing vehicles in recent years is noteworthy, with liabilities constituting nearly 25% of capital raised across property strategies in the first quarter of last year, a significant increase from 15% the previous year. This trend underscores the growing reliance on borrowed funds as a strategic component of investment portfolios.

Investing in a real estate debt fund presents several substantial advantages, including enhanced liquidity compared to traditional property investments, risk diversification, and the potential for attractive risk-adjusted returns. Successful examples of property financing highlight their effectiveness; for instance, the luxury property market in New York has seen ultra-prime transactions reaching as high as $38 million, emphasizing the demand for high-value assets and the pivotal role of financing in facilitating such deals. Borrowing has proven essential in enabling these high-value transactions, illustrating how property financing sources can support significant market activity.

As we look toward 2025, the market for property financing vehicles continues to thrive, driven by investor enthusiasm for dependable income options amid shifting economic conditions. The current landscape indicates that real estate debt funds are becoming an integral part of many investors' strategies, particularly for those aiming to navigate the complexities of the property market while minimizing the risks associated with direct asset investments. As a Realtor aptly noted, "The market remains sensitive to broader economic shifts, and stakeholders must carefully navigate these to capitalize on emerging opportunities and mitigate potential risks." Furthermore, understanding private financing hurdle rates and alternative structuring options can further enhance investors' strategies in this evolving landscape.

Differentiate Between Debt and Equity Investing

Debt investing entails providing loans to borrowers, typically secured by real estate collateral, with returns primarily derived from interest payments made to a real estate debt fund. In contrast, equity investing involves acquiring ownership stakes in properties, generating returns through property appreciation and rental income. While fixed-income investments are generally associated with lower risk and more stable income, equity investments can yield higher potential returns, albeit with greater volatility and risk of loss.

For instance, a debt-to-equity (D/E) ratio of 1.5:1 indicates that for every dollar of equity, there is $1.50 in liabilities, illustrating the leverage utilized by companies. A rising D/E ratio may signal potential financing challenges, making it crucial for investors to evaluate the risk levels tied to highly leveraged entities. The formula for calculating the long-term D/E ratio is:

- Long-term Liabilities divided by Total Shareholders' Equity.

In 2025, statistics reveal that loan investments typically deliver more consistent returns, while equity investments, despite their risks, can yield considerable gains during market upswings. As Melissa Ling observes, "However, if the extra cost of borrowing financing surpasses the additional income it produces, then the share price may decline." Understanding these distinctions is essential for investors to align their strategies with their financial goals, effectively balancing the advantages and disadvantages of each approach.

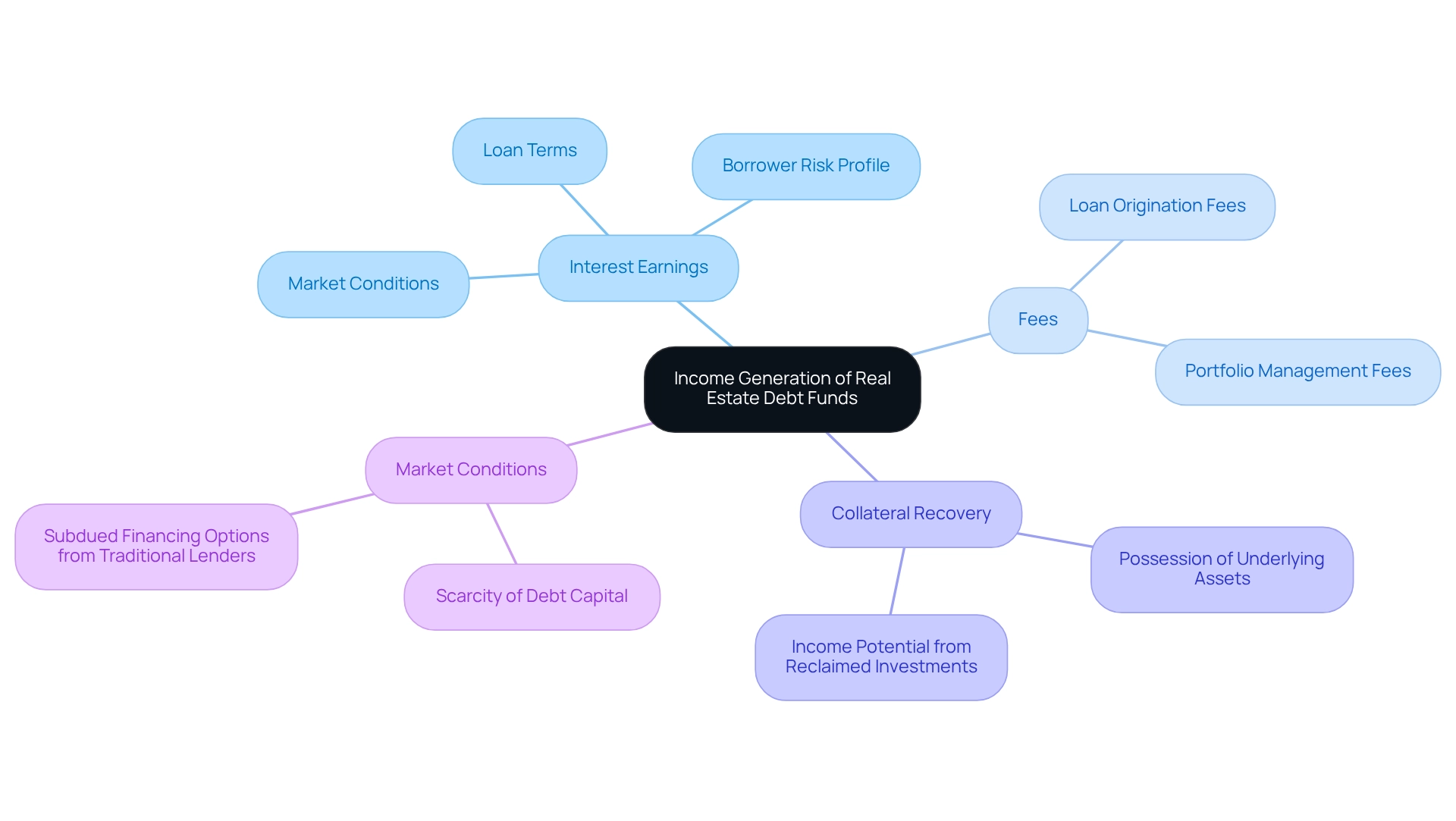

Explain How Real Estate Debt Funds Generate Income

A real estate debt fund primarily generates revenue through interest earnings on loans provided to borrowers, with these loans typically backed by property assets serving as collateral. The interest rates applied to these loans are influenced by various factors, including prevailing market conditions, the risk profile of the borrower, and the specific terms outlined in the loan agreements. In 2025, average interest rates for real estate financing sources are expected to remain competitive, mirroring the present economic environment and the limited availability of capital in the market. As highlighted by JLL, 'Since the Global Financial Crisis (GFC), lending pools increased substantial financing ability in the US market during the decline of commercial mortgage-backed securities (CMBS) activity.' This context emphasizes the essential role that credit pools play in the current financing landscape.

Alongside interest income, these resources may also generate fees linked to loan origination and portfolio management, further enhancing their revenue sources. The average loan-to-value ratio for loans originated in the U.S. since 2020 stands at 55%, indicating a more conservative lending approach compared to the 69% average seen in 2007. This reduced ratio reflects an increased emphasis on risk management within the sector.

In the event of borrower default, property financing pools possess the capacity to reclaim their investments by taking possession of the underlying collateral, which can significantly boost their income potential. This recovery mechanism is crucial, especially in a market where loan default rates are closely monitored. As the landscape evolves, the next few years are anticipated to provide an appealing setting for a real estate debt fund, driven by limited funding options from traditional lenders. This context underscores the importance of comprehending how property financing pools operate and the strategies they employ to generate income efficiently.

Evaluate the Pros and Cons of Real Estate Debt Fund Investments

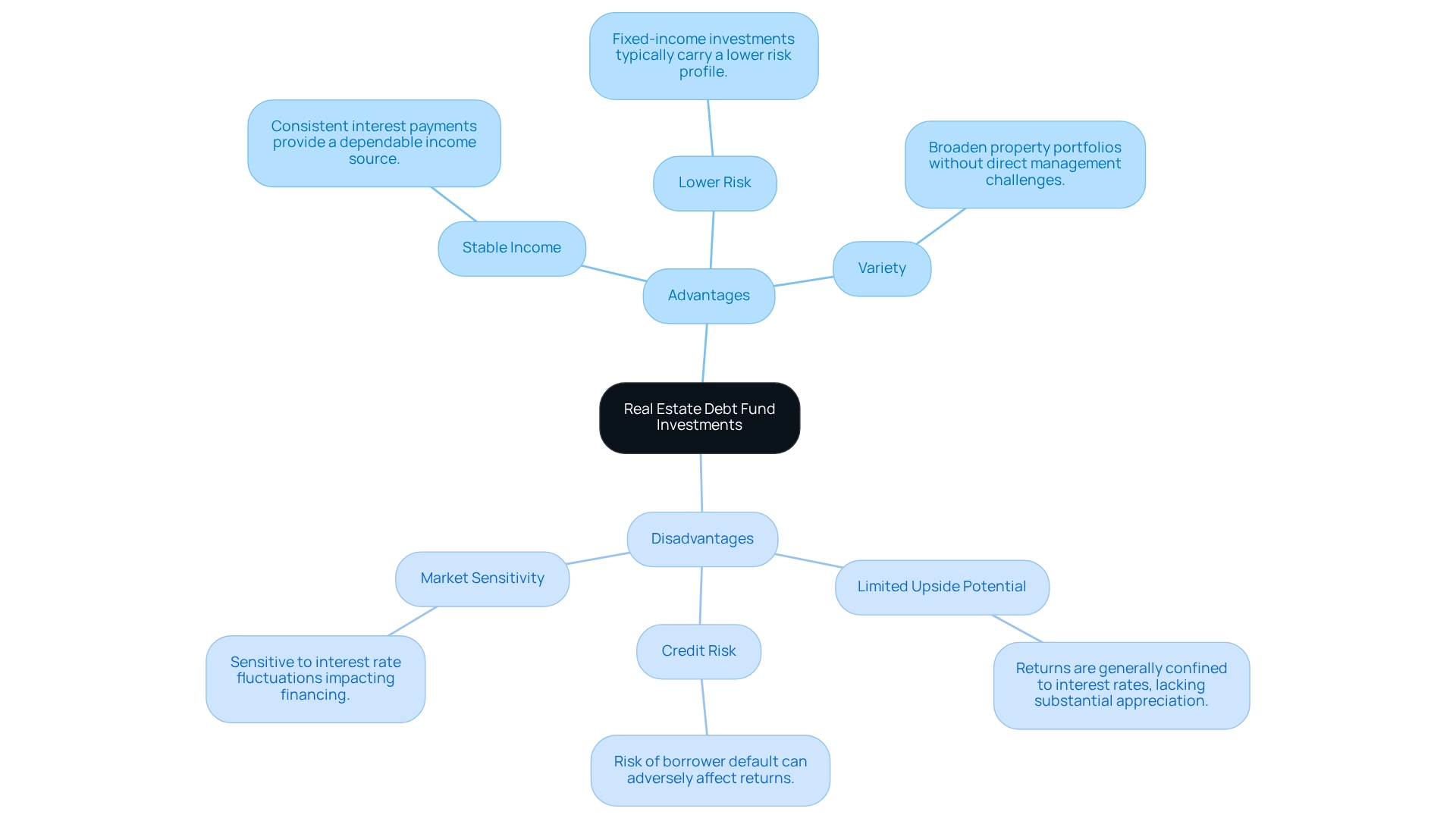

Investing in real estate debt funds offers several compelling advantages that warrant attention:

- Stable Income: Debt vehicles are recognized for delivering consistent interest payments, serving as a dependable income source for investors. This stability is particularly appealing in the markets associated with a real estate debt fund.

- Lower Risk: In contrast to equity investments, fixed-income investments typically carry a lower risk profile. Debt holders are prioritized in the event of defaults, providing a safety net during economic downturns.

- Variety: By investing in fixed-income assets, investors can broaden their property portfolios without the challenges of direct management. This method enables exposure to different real property sectors while reducing individual asset risks.

However, investors must also consider notable drawbacks:

- Limited Upside Potential: The returns from fixed-income investments are generally confined to the interest rate, lacking the substantial appreciation potential seen in equity investments. This limitation can be a disadvantage for those seeking high-growth opportunities.

- Credit Risk: The risk of borrower default poses a critical concern that can adversely affect returns, especially during economic downturns. Investors must carefully assess the creditworthiness of borrowers to mitigate this risk.

- Market Sensitivity: Investments in a real estate debt fund are sensitive to fluctuations in interest rates impacting real property financing. These fluctuations can influence the attractiveness of these investments, affecting overall returns and potentially leading to volatility in income streams.

Looking ahead to 2025, typical returns from property financing groups are anticipated to be competitive, although they remain lower than those of equity groups, which can generate higher returns due to their appreciation potential. Recent statistics indicate that while borrowing instruments may provide a stable income, they are expected to yield lower returns compared to equity portfolios. These portfolios are poised to benefit from a recovering housing market, which experienced approximately 4.1 million transactions in the previous year, reflecting a modest growth of 0.8% despite economic pressures.

Moreover, insights from Ten Capital Management’s Adams suggest that a more flexible fiscal policy is likely to bolster economic growth, benefiting commercial properties and, consequently, the real estate debt fund. Understanding these dynamics is essential for investors aiming to navigate the intricacies of property financing investments effectively. Case studies indicate that while credit portfolios can offer reliable income, the trade-offs regarding growth potential and risk must be thoroughly assessed to align with personal investment strategies.

Outline Steps to Start Investing in Real Estate Debt Funds

To embark on investing in real estate debt funds, adhere to these essential steps:

- Research Available Resources: Begin by investigating various real estate debt vehicles to grasp their investment strategies, historical performance, and fee structures. In 2025, average charges for these investments typically range between 1% and 2%, depending on the complexity and oversight involved. It is imperative to compare these fees against historical averages or those of equity portfolios to evaluate their competitiveness relative to a real estate debt fund.

- Assess Your Risk Tolerance: Carefully evaluate your risk appetite and investment goals to pinpoint options that align with your financial objectives. Understanding your risk tolerance is crucial, particularly in a market where the refinancing shortfall for real estate debt funds is anticipated to be between $270 billion and $570 billion due to value declines at maturity.

- Consult with a Financial Advisor: Seek the expertise of a financial advisor who specializes in real estate investments. Their knowledge of the real estate debt fund sector can assist you in navigating market complexities and making informed decisions.

- Open an Investment Account: If your portfolio necessitates a brokerage account, establish one with a reputable firm to facilitate your investments.

- Make Your Investment: After selecting a portfolio, adhere to its investment procedure to allocate your capital effectively. As Liz Bell, Managing Director and Co-Head of Real Estate on Hamilton Lane's Real Assets Team, remarked, "I'd rather go to the equity side right now, as an allocator, and get the upside." This statement underscores the competitive pressures faced by real estate debt funds as the commercial property market recovers, highlighting the importance of timing your entry.

- Monitor Your Investment: Regularly review your investment's performance and remain informed about market conditions that could influence your returns. The upcoming years are expected to present a favorable environment for real estate debt funds, making ongoing assessment crucial for maximizing your investment potential.

Conclusion

Investing in real estate debt funds provides a compelling combination of stability and income potential, making them an attractive option for those aiming to diversify their portfolios without the intricacies of direct property ownership. These funds primarily generate income through interest payments on secured loans, delivering a more predictable return profile compared to equity investments. As the market for real estate debt continues to grow, grasping the mechanics behind these funds—along with their benefits and risks—is essential for navigating today’s economic landscape.

While real estate debt funds offer numerous advantages, such as lower risk and consistent income, they also come with limitations, including capped returns and sensitivity to market fluctuations. Investors must meticulously evaluate their risk tolerance and investment objectives before entering this sector. Diligently researching available funds, consulting financial advisors, and keeping an eye on market conditions are critical steps to ensure alignment with personal financial goals.

In summary, real estate debt funds represent a valuable addition to investment strategies, particularly for those seeking stability amid market volatility. By understanding the distinctions between debt and equity investing and weighing the pros and cons, investors can make informed decisions that enhance their portfolios while mitigating risks. As the demand for stable income opportunities increases, real estate debt funds are poised to play an increasingly significant role in the investment landscape, presenting both challenges and opportunities for discerning investors.