Overview

This article delves into the Debt Service Coverage Ratio (DSCR) within the realm of commercial real estate, underscoring its critical role for investors in evaluating an asset's capacity to fulfill debt obligations. A higher DSCR is indicative of robust financial health and stability, which significantly influences investment decisions and lending terms. Furthermore, the article outlines effective strategies for enhancing DSCR, empowering investors to secure more favorable financing conditions. Understanding these dynamics is essential for making informed investment choices.

Introduction

In the intricate world of commercial real estate, understanding the Debt Service Coverage Ratio (DSCR) is paramount for both investors and lenders. This vital financial metric gauges a property's ability to generate sufficient income to meet its debt obligations and influences critical decisions regarding financing and investment strategies. A higher DSCR indicates robust financial health, while a lower ratio signals potential risks, underscoring the high stakes involved.

As the market evolves, particularly in the wake of recent economic challenges, mastering DSCR calculations and benchmarks is essential for navigating the complexities of real estate investments. This article delves into the significance of DSCR, offering insights into its calculation, implications for various property types, and strategies for enhancing this crucial ratio. Ultimately, it equips stakeholders with the knowledge needed to thrive in a competitive landscape.

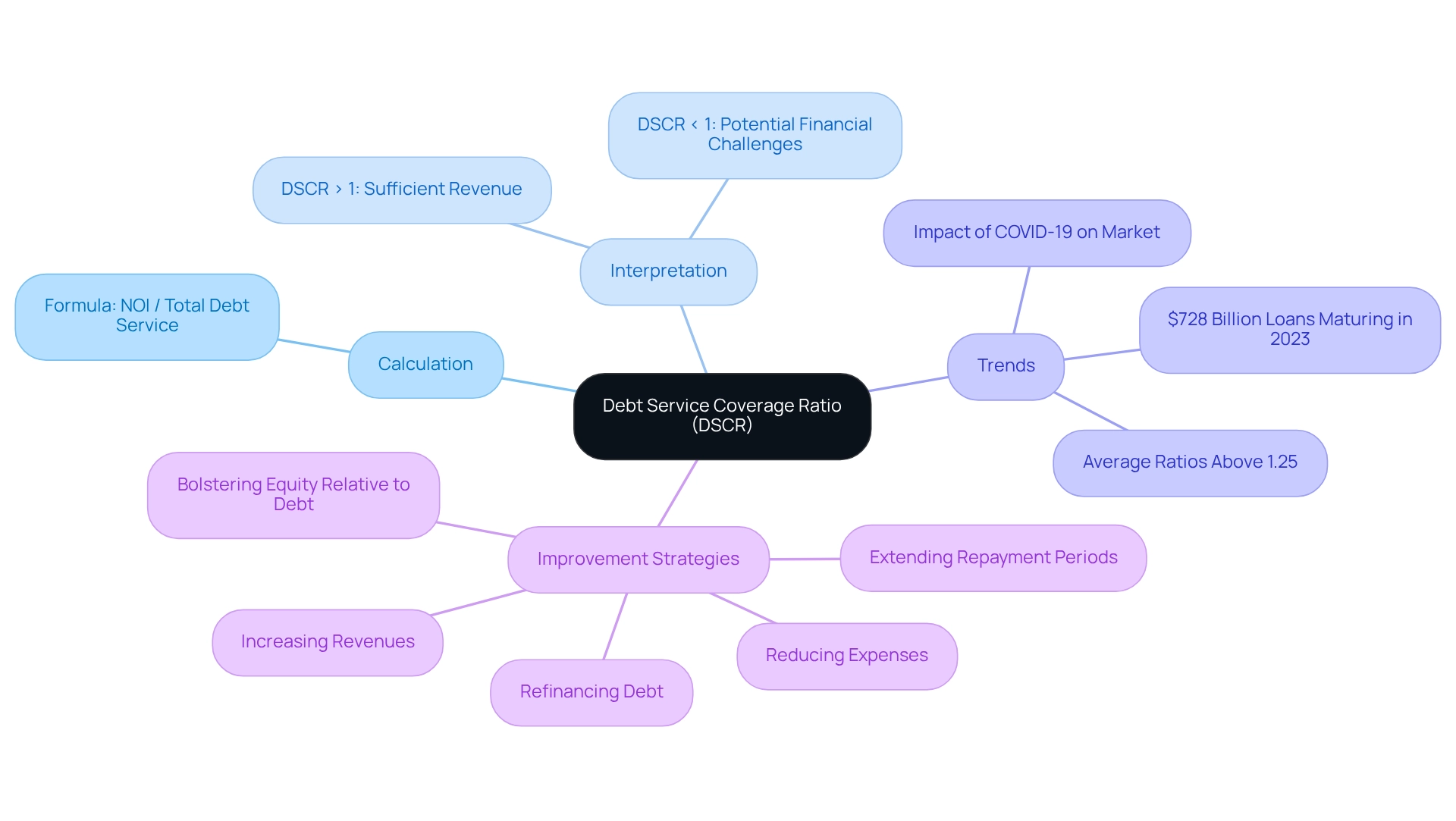

What is Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) serves as a critical financial metric that assesses an asset's capacity to generate sufficient income to meet its debt obligations. This ratio is calculated by dividing the asset's annual net operating income (NOI) by its total annual debt service, which includes both principal and interest payments. A DSCR greater than 1 signifies that the asset is generating enough revenue to cover its obligations, while a ratio below 1 may indicate potential financial challenges.

Consider an asset with a net operating income of $120,000 and annual debt servicing of $100,000. In this scenario, the debt service coverage ratio would be 1.2, reflecting a robust cash flow situation. This metric is particularly crucial for investors in DSCR commercial real estate, as it not only impacts credit approval but also shapes investment decisions and risk assessments.

As of 2025, average debt service coverage ratios for commercial properties have demonstrated a notable trend, with many properties maintaining ratios above the vital threshold of 1.25, often required for Commercial Mortgage-Backed Securities (CMBS) financing. Properties exhibiting high DSCR values typically include well-managed multifamily units and commercial spaces located in prime areas, where steady rental income is more assured.

A case study emphasizing the importance of enhancing the Debt Service Coverage Ratio for CMBS loan qualification reveals effective strategies such as:

- Increasing revenues

- Reducing expenses

- Refinancing debt

- Extending repayment periods

- Bolstering equity relative to debt

By implementing these strategies, borrowers can elevate their debt service coverage ratio, thereby improving their chances of securing financing. For instance, if a property owner successfully increases rental income or reduces operational costs, they can significantly enhance their debt service coverage ratio, making their property more attractive to lenders.

Recent analyses underscore the growing importance of the debt service coverage ratio in today's DSCR commercial real estate landscape, particularly as the market navigates challenges stemming from government actions and the impact of low interest rates during the COVID-19 crisis. The Mortgage Bankers Association projects that $728 billion in loans will mature in 2023, highlighting the urgency for stakeholders to understand and improve their debt service coverage ratio in this evolving market. Furthermore, as noted by Jason A. Yablon, active managers of listed real estate funds have historically outperformed their passive counterparts, reinforcing the necessity for strategic management in addressing these complexities.

Understanding and enhancing the debt service coverage ratio is essential for individuals aiming to make informed decisions in this competitive environment.

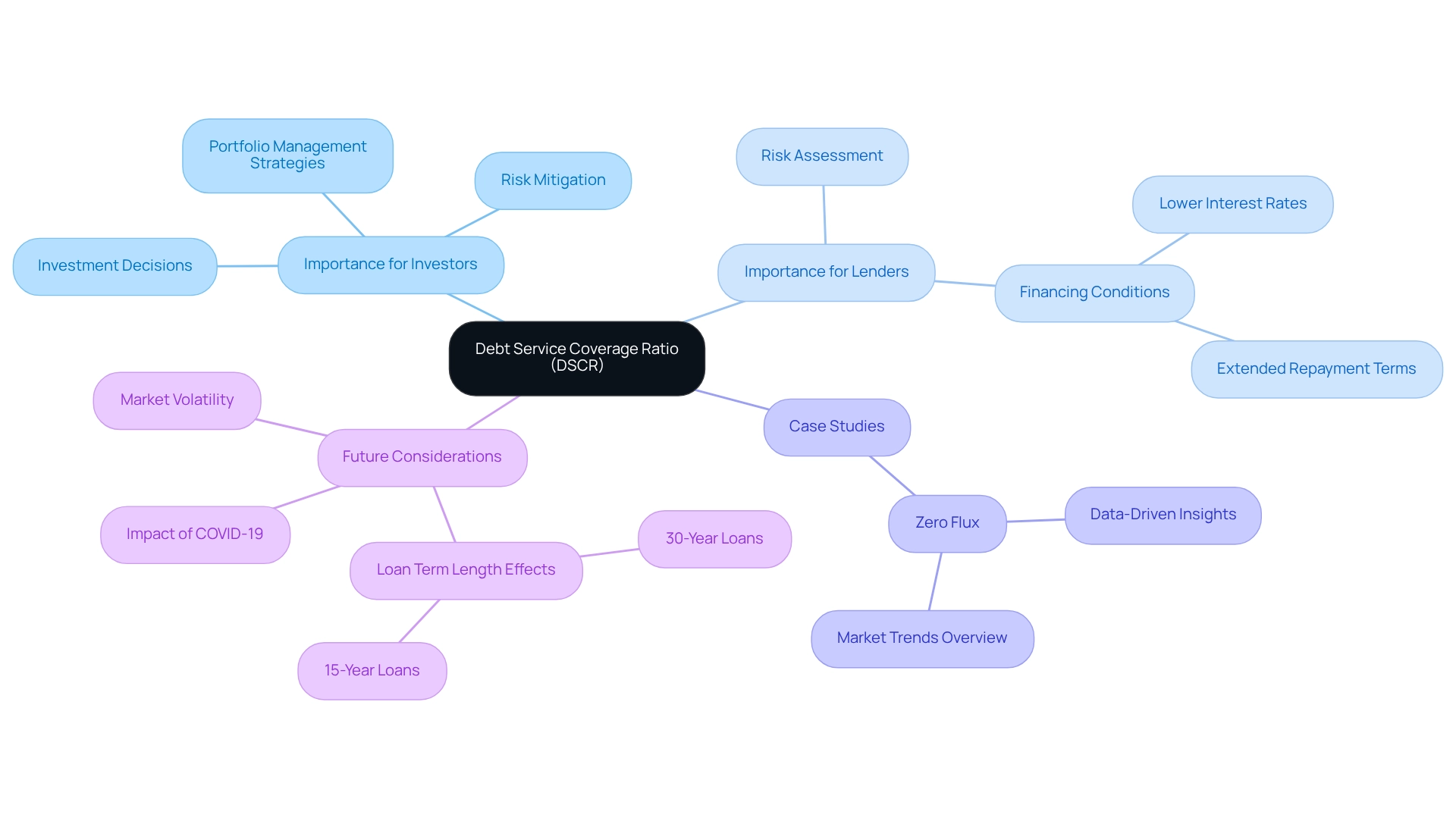

The Importance of DSCR in Commercial Real Estate

The Debt Service Coverage Ratio (DSCR) is an essential metric for stakeholders and lenders in the realm of commercial real estate. For investors, a robust DSCR signals that a property is likely to generate sufficient income to meet its debt obligations, thereby mitigating the risk of default. This key indicator of financial health not only influences investment decisions but also shapes overall portfolio management strategies.

Conversely, lenders utilize the DSCR to evaluate the risks associated with extending credit. A higher DSCR typically results in more favorable financing conditions, such as lower interest rates and extended repayment terms. For instance, assets boasting a DSCR greater than 1.25 are often deemed lower risk, prompting lenders to offer better financing options.

In contrast, a DSCR falling below 1.0 indicates that an asset is failing to generate adequate revenue to cover its obligations, which can lead to increased interest rates or even credit denial.

As we look to 2025, the importance of the DSCR in commercial real estate is underscored by ongoing challenges within the sector, particularly in the aftermath of the COVID-19 crisis. While government interventions have facilitated the provision of DSCR financing, the sector grapples with escalating issues, making it crucial for both investors and lenders to closely monitor DSCR metrics. Data reveals that assets with a DSCR below 1.0 face significantly higher loan default rates, underscoring the necessity for thorough financial assessments prior to investment decisions.

Notably, the listed Real Estate Investment Trust (REIT) market experienced a 25% decline in 2022, further highlighting the volatility and risks inherent in the current landscape.

Case studies illustrate the pivotal role of the DSCR in commercial real estate investments. Properties maintaining a consistent DSCR above 1.2 have demonstrated resilience during market downturns, whereas those with fluctuating or low ratios have struggled to maintain their value. Expert insights reinforce this perspective, with Jason A. Yablon noting that active managers of listed real estate funds have historically outperformed passive strategies, emphasizing the critical nature of active management in relation to DSCR, particularly in unpredictable markets.

Moreover, the length of the loan term significantly impacts the DSCR, as 30-year loans generally present lower monthly payments and higher ratios compared to 15-year loans. This factor is vital for stakeholders to consider when structuring their financing options. Ultimately, understanding and leveraging the DSCR is imperative for both stakeholders and lenders in commercial real estate.

Not only does it inform lending practices, but it also directs strategic investment choices, enabling stakeholders to navigate the complexities of the market effectively. The case study of Zero Flux exemplifies how a data-driven approach can aid investors in grasping market dynamics, particularly concerning the DSCR.

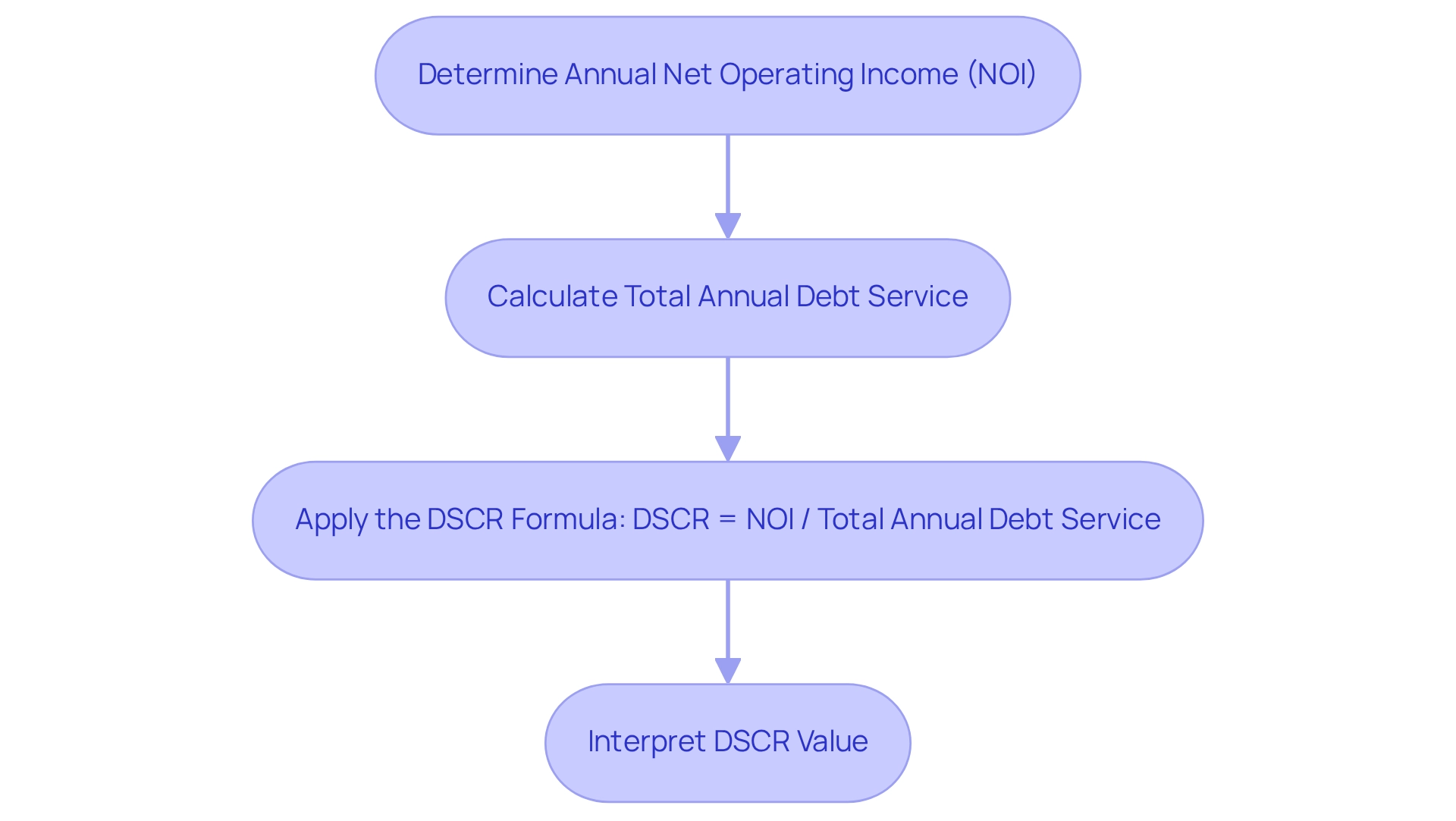

How to Calculate Your DSCR

Calculating the Debt Service Coverage Ratio (DSCR) is essential for assessing the financial health of commercial real estate. To accurately determine your DSCR, follow these steps:

-

Determine Annual Net Operating Income (NOI): Start by calculating your asset's annual net operating income. This figure represents the total income generated from the asset after deducting operating expenses, such as maintenance, management fees, and utilities.

-

Calculate Total Annual Debt Service: Next, compute your total annual debt service. This encompasses all principal and interest payments on any loans related to the asset.

-

Apply the DSCR Formula: Use the formula:

DSCR = NOI / Total Annual Debt ServiceFor instance, if your property generates an NOI of $150,000 and has a total debt service of $120,000, the calculation would be:

DSCR = $150,000 / $120,000 = 1.25A DSCR of 1.25 indicates that the property generates 25% more income than is required to cover its debt obligations, suggesting a healthy cash flow position. In contrast, an asset with an NOI of $100,000 and a debt service of $125,000 leads to a debt service coverage ratio of 0.8, indicating that the asset does not produce sufficient income to meet its debt obligations, which could signal financial distress.

Understanding how to compute the debt service coverage ratio is essential for stakeholders, as it offers insight into the property's capacity to fulfill its financial responsibilities. However, while the debt service coverage ratio is a valuable metric, it does not account for all expenses, such as taxes or interest costs, which may limit its effectiveness as a financial indicator. By mastering this calculation, individuals can make more informed choices regarding their commercial real estate investments.

Additionally, various real estate financial modeling approaches can influence debt service coverage ratio calculations. Comprehending these modeling categories enables individuals to customize their analyses according to asset types and investment approaches, ultimately assisting them in making well-informed investment suggestions. As Brian DeChesare, creator of Mergers & Inquisitions, points out, "With the IRR calculation, all that matters is the interval between cash flows," emphasizing the significance of grasping cash flow intervals concerning debt service coverage.

Typical DSCR Requirements for Various Property Types

Various types of DSCR commercial real estate exhibit distinct Debt Service Coverage Ratio criteria, which are crucial for investors to understand in order to align their financial strategies with lender expectations. For multifamily assets, the typical debt service coverage ratio benchmark ranges from 1.20 to 1.25, indicating that these assets generate sufficient income to comfortably meet their debt obligations. In contrast, office buildings generally require a slightly higher debt service coverage ratio, typically between 1.25 and 1.35, reflecting the stability and predictability of income within this sector.

Retail properties, on the other hand, often necessitate a debt service coverage ratio of 1.30 or greater. This heightened requirement signals the increased risks associated with retail investments, particularly in a fluctuating economic landscape. As the DSCR commercial real estate environment evolves, understanding these benchmarks becomes increasingly vital for individuals seeking favorable financing terms.

The commercial real estate market is significantly affected by interest rates, inflation, and geopolitical events, which can lead to varied performance across sectors. Recent trends underscore the importance of these debt service coverage ratio benchmarks. Cities like Nashville and Austin have emerged as attractive markets for DSCR commercial real estate, demonstrating low vacancy rates and rising asking rents.

These factors contribute to a more favorable investment climate in DSCR commercial real estate, enabling stakeholders to meet or exceed debt service coverage ratio standards while seizing expansion opportunities.

Moreover, NAIC 2 rated public corporate bonds carry capital charges ranging from 1.26% to 2.17%, providing a financial context relevant to investors assessing debt service coverage ratios. As Stephen M. Renna, CEO of CREFC, remarked, "I am excited that we have now completed our second performance survey. This previously unavailable information helps us as an Association provide value to the insurance company sector," highlighting the significance of data in navigating the current market.

In summary, the average debt service coverage ratio benchmarks for multifamily, office, and retail real estate vary considerably, with multifamily assets typically requiring a lower ratio than retail, especially within the context of DSCR commercial real estate. Investors should stay informed about these benchmarks and incorporate them into their investment evaluations, as they play a critical role in securing financing and ensuring long-term profitability.

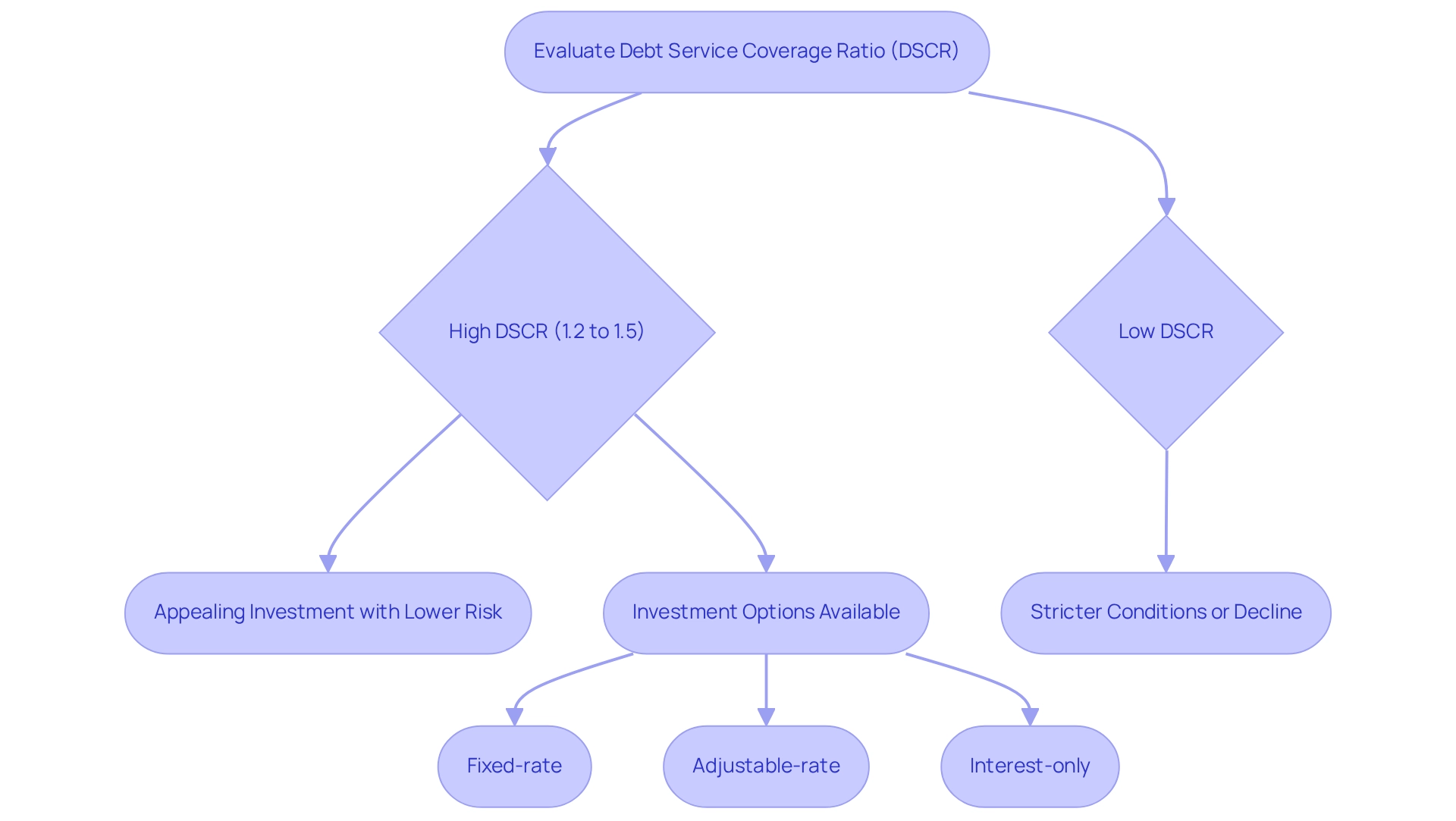

DSCR's Role in Loan Underwriting Decisions

In the loan underwriting process, lenders meticulously evaluate the Debt Service Coverage Ratio (DSCR) to gauge the risk of default associated with an asset. An elevated debt service coverage ratio signifies that an asset generates ample income to meet its debt obligations, rendering it a more appealing investment for lenders. Indeed, many lenders establish minimum debt service coverage ratios, typically ranging from 1.2 to 1.5, contingent upon the type of commercial asset and prevailing market conditions.

This implies that for every dollar of debt, the property must yield at least $1.20 to $1.50 in income.

Conversely, a diminished debt service coverage ratio may raise red flags, prompting lenders to impose stricter conditions or potentially decline the financing application. As we approach 2025, the evolving landscape of commercial real estate underscores the critical role of the debt service coverage ratio in underwriting decisions. Lenders are increasingly depending on the DSCR metric to assess the viability of financing options, particularly in a market marked by fluctuating interest rates and economic uncertainty.

Real-world examples illustrate how lenders incorporate the debt service coverage ratio into their financing strategies. For instance, First Florida Financial has streamlined its application process for DSCR financing, allowing investors to secure funding amounts up to $3 million without the need for personal income verification. This approach not only simplifies the borrowing experience but also underscores the importance of the debt service coverage ratio in determining eligibility for financing in DSCR commercial real estate.

Investors have the flexibility to choose from various repayment options for debt service coverage ratio loans, including adjustable-rate, fixed-rate, or interest-only payments, enabling them to manage their financial commitments effectively.

For those looking to enhance their debt service coverage ratio, strategic investment choices are essential. Focusing on multi-family units rather than single-family homes can yield better cash flow and improved debt service coverage ratios, making them a more viable option for DSCR commercial real estate lending requirements. As Bill Lyons, President & CEO, articulates, 'Our aim is to enable over $500 million in investment property financing via DSCR commercial real estate financing in 2025,' highlighting the significance of this metric in the current market.

Benefits of a Higher DSCR for Investors

Maintaining a higher Debt Service Coverage Ratio (DSCR) offers numerous advantages for investors in DSCR commercial real estate. Primarily, it significantly increases the chances of obtaining favorable loan terms, such as lower interest rates and reduced fees. Investors with a strong debt service coverage ratio in DSCR commercial real estate are often viewed as lower-risk borrowers, resulting in more competitive financing opportunities.

With over 30,000 subscribers, Zero Flux provides credible insights into these market dynamics. Furthermore, in DSCR commercial real estate, a robust debt service coverage ratio serves as a financial buffer against market variations, allowing stakeholders to manage economic declines with enhanced resilience. This stability is crucial, especially in volatile markets where cash flow can be unpredictable. For example, as mentioned by a real estate investor, "If they wish to enhance their debt service coverage ratio, investors ought to contemplate exploring two to four unit buildings."

With single-family residences, particularly when considering purchase prices over $400,000, meeting the 1:1 ratio can be challenging with a 20% down payment. Based on my experience, if we consider two, three, and especially four-unit buildings, those multiple-unit structures will demonstrate much better cash flow and debt service coverage than single-family homes. This illustrates the benefits of DSCR commercial real estate in enhancing debt service coverage ratios.

Moreover, a greater debt service coverage ratio in DSCR commercial real estate enhances an investor's overall financial profile, simplifying the qualification process for future funding. This is particularly pertinent in the context of Global Debt Service Coverage Ratio evaluations, which account for both the property’s income and the borrower’s personal financial circumstances. Depending on these factors, a strong Global Debt Service Coverage Ratio can either facilitate access to financing or complicate it, underscoring the importance of maintaining a favorable ratio.

Conversely, a low debt service coverage ratio in DSCR commercial real estate poses significant risks for borrowers, indicating potential struggles to meet debt obligations. Thus, it is essential for investors to prioritize a higher ratio.

Statistics show that DSCR commercial real estate assets with a high Debt Service Coverage Ratio not only secure superior financing conditions but also benefit from enhanced flexibility in funding choices. For instance, debt service coverage ratio loans might permit unlimited cash-out, which can be advantageous for addressing unforeseen or substantial property costs. Therefore, sustaining a higher debt service coverage ratio is not merely advantageous; it is crucial for stakeholders seeking to enhance their financial strategies and safeguard their investments.

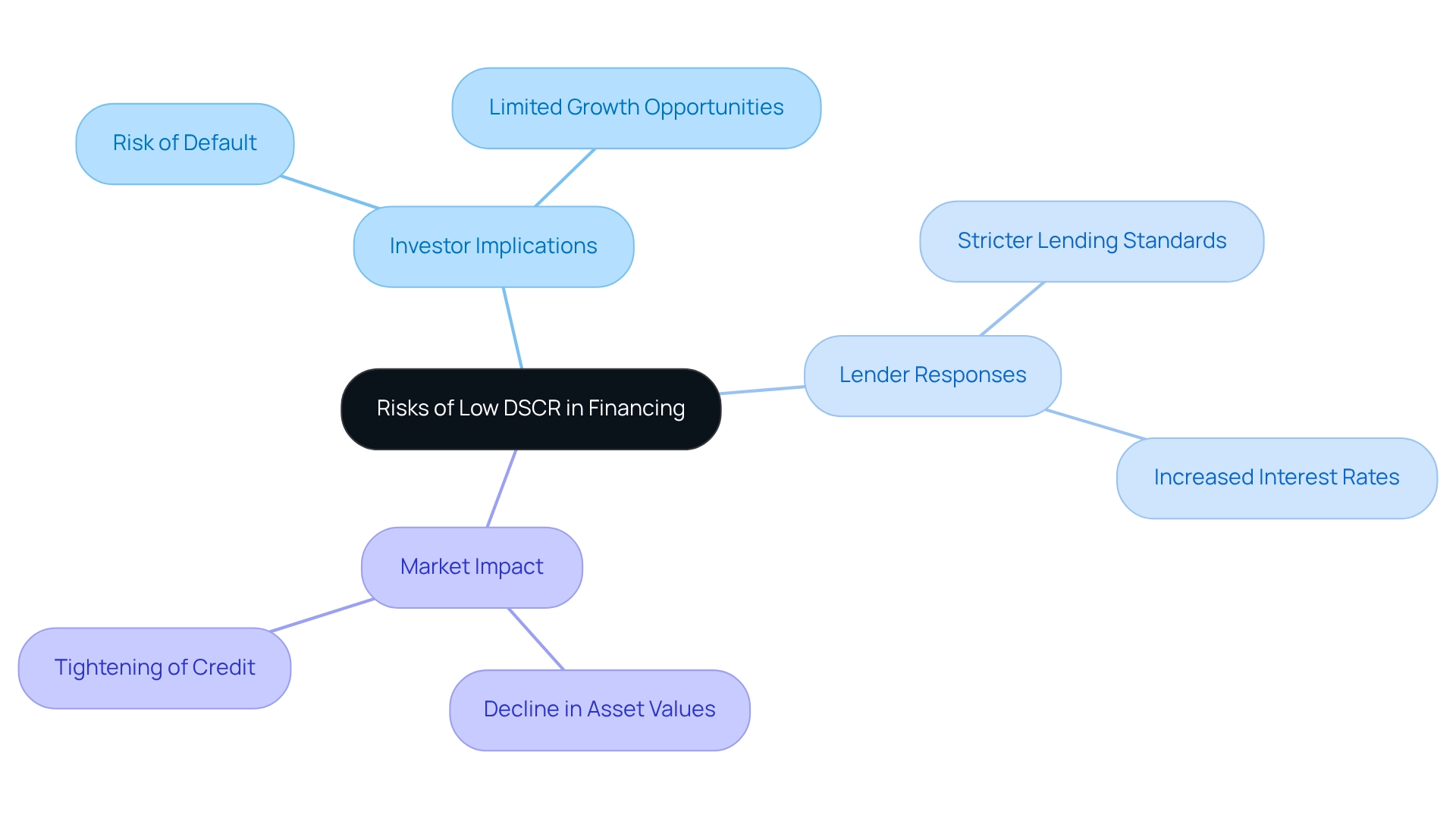

Risks of a Lower DSCR in Financing

A low Debt Service Coverage Ratio (DSCR) in commercial real estate presents significant risks for investors. This essential metric assesses a company's ability to meet its debt obligations with available cash flow. A low DSCR indicates potential challenges in generating sufficient income to cover these obligations, thus heightening the risk of default.

Lenders typically respond to a low DSCR by imposing stricter lending standards. This may manifest as increased interest rates, larger down payments, or even outright rejection of credit applications. For instance, recent trends reveal that loan denial rates have surged among individuals with a DSCR below the recommended threshold, underscoring lenders' heightened caution in the current market environment.

Maintaining a healthy DSCR is crucial for fostering lender trust and ensuring financial stability. Furthermore, a low DSCR can severely restrict an individual's capacity to leverage their assets for future investments. This limitation can stifle growth opportunities, complicating efforts to expand portfolios or seize emerging market trends.

The tightening of lending standards serves as a primary indicator of potential declines in commercial real estate prices, with forecasts suggesting a reduction of 20-25% in asset values due to these constraints. This is particularly relevant in the current market, where government actions during the COVID-19 pandemic facilitated the distribution of commercial real estate loans but also led to a burgeoning crisis in the sector.

Real-world examples illustrate the challenges faced by stakeholders with low DSCRs. Many have struggled to secure financing, hindering their ability to pursue new projects or refinance existing properties. The BiggerPockets community, comprising over 3 million real estate investors, emphasizes the importance of understanding DSCR within a broader network of investors.

Expert opinions underscore that sustaining a healthy DSCR is vital not only for establishing lender trust but also for ensuring long-term financial security in an increasingly competitive market.

In summary, the risks associated with a low DSCR in commercial real estate financing are multifaceted, impacting loan applications, interest rates, and overall investment strategies. Investors must remain vigilant and proactive in managing their DSCR to effectively navigate the complexities of the market.

Strategies to Improve Your DSCR

To effectively enhance your Debt Service Coverage Ratio (DSCR), consider implementing the following strategies:

- Increase Net Operating Income (NOI): Focus on raising rents where feasible and minimizing vacancies. This can be achieved through targeted marketing efforts and property improvements that attract quality tenants. Companies that have successfully boosted their NOI through strategic enhancements have reported improved debt service coverage ratios, which are critical in DSCR commercial real estate for obtaining more advantageous financing conditions.

- Reduce Operating Expenses: Identify areas for cost-cutting by streamlining operations and enhancing efficiency. This could involve renegotiating service contracts or investing in energy-efficient upgrades that lower utility costs.

- Refinance Existing Debt: Explore refinancing options to secure lower interest rates, which can significantly reduce monthly payments and improve cash flow.

- Establish Long-Term Leases: Consider securing long-term leases with reliable tenants. This not only stabilizes cash flow but also reduces turnover costs and enhances predictability in income.

It's important to note that borrowers who secure financing for DSCR commercial real estate with Griffin Funding have an average credit score of 732, indicating a strong profile for participants engaging with these options. Essential criteria for financing DSCR commercial real estate involve a minimum credit score of 620, a minimum borrowing amount of $100,000, and the property must be an investment property not occupied by the owner.

As Jason Nichols, a property developer, states, "By enhancing your comprehension of debt service coverage ratio loan rates and applying strategies to elevate your home's ratio, you can confidently enter negotiations with lenders, obtain the most favorable terms, and set your business on the road to success."

By implementing these tactics, individuals can enhance their debt service coverage ratio, resulting in better financial well-being and improved standing in discussions with lenders. This proactive approach not only strengthens financial standing but also paves the way for future investment opportunities.

Key Takeaways on DSCR for Real Estate Investors

The Debt Service Coverage Ratio (DSCR) serves as a vital metric for stakeholders in commercial real estate, acting as a barometer for a property's capacity to generate enough income to meet its debt obligations. This ratio is instrumental in shaping investment strategies and practices within the sector. A higher DSCR indicates robust financial health and stability, significantly enhancing a property's attractiveness to lenders and investors alike.

On the flip side, a lower DSCR can signal potential risks, which may limit investment opportunities and complicate financing options. Understanding and effectively managing the DSCR is essential for those looking to improve their financial positions. For instance, in commercial real estate, properties boasting a DSCR above 1.25 are often viewed favorably by lenders, as they indicate that the property generates 25% more revenue than necessary to cover debt obligations. This not only paves the way for more favorable financing terms but also positions stakeholders to take advantage of advantageous market conditions.

Given recent market trends, it is imperative to note that the listed REIT market experienced a 25% decline in 2022, which may influence DSCR considerations for stakeholders. Institutional investors are encouraged to maintain their investments in commercial real estate, underscoring the importance of sustaining a healthy DSCR to navigate current market challenges.

Real-world examples underscore the importance of managing the DSCR. Investors who proactively monitor and adjust their DSCR in commercial real estate can unlock new funding avenues, allowing them to chase further investment opportunities. Expert opinions echo this sentiment, with industry leaders like Jason A. Yablon advocating for a strategic focus on DSCR as a means to maneuver through the complexities of the real estate market.

Yablon emphasizes, "Active managers of listed real estate funds have historically outperformed passive," highlighting the necessity for diligent management in investment strategies.

Statistics bolster the connection between the DSCR and the success of commercial real estate investments. Historical data indicates that properties with strong DSCRs tend to yield higher overall returns, particularly following market downturns. This trend suggests that long-term stakeholders should prioritize maintaining a robust DSCR to safeguard their assets against market volatility.

In conclusion, a thorough understanding of the Debt Service Coverage Ratio is crucial for stakeholders in commercial real estate by 2025. By emphasizing this metric, investors can refine their decision-making processes, secure favorable financing options, and ultimately achieve greater success in their commercial real estate endeavors. Zero Flux's dedication to factual information highlights the significance of comprehending the DSCR and making informed investment choices, positioning it as a leading authority in real estate insights.

Conclusion

Understanding the Debt Service Coverage Ratio (DSCR) is not just beneficial; it is essential for success in the commercial real estate sector. This vital metric measures a property's ability to generate income sufficient to meet its debt obligations, significantly influencing investment strategies and lending practices. A higher DSCR reflects financial health, attracting favorable loan terms and investment opportunities. In contrast, a lower DSCR raises concerns for lenders, complicating financing options and increasing the risk of default.

Investors must remain vigilant about the specific DSCR requirements for various property types, as these benchmarks are crucial for guiding strategic decisions in a fluctuating market. By implementing effective strategies to improve DSCR—such as increasing net operating income, reducing operating expenses, and refinancing debt—investors can enhance their financial profiles and better position themselves for future opportunities.

In the ever-evolving landscape of commercial real estate, maintaining a robust DSCR is essential for navigating challenges and securing long-term profitability. As the market continues to respond to economic fluctuations, prioritizing DSCR will empower investors to make informed decisions and thrive amidst uncertainty. Ultimately, a thorough understanding of this critical metric equips stakeholders with the necessary tools to succeed in a competitive environment.