Overview

This article explores the real estate investment trends that are shaping market dynamics in 2025, focusing on essential areas such as:

- Sustainable properties

- Hybrid workspaces

- Mixed-use developments

- Co-living spaces

- Digital infrastructure

Evidence of increasing demand for eco-friendly solutions, flexible office arrangements, and community-oriented living underscores these trends. Additionally, technological advancements are enhancing investment strategies, indicating a significant evolution in the real estate landscape driven by consumer preferences and market necessities.

As we look ahead, the implications of these trends are profound for investors. The shift towards sustainable properties not only meets consumer demand but also aligns with regulatory pressures for greener solutions. The rise of hybrid workspaces reflects changing work patterns, compelling investors to reconsider traditional office investments. Furthermore, mixed-use developments and co-living spaces cater to a growing desire for community-focused living, presenting new opportunities for investment.

In summary, understanding these trends is crucial for making informed investment decisions. By adapting to the evolving landscape, investors can leverage these insights to enhance their strategies and capitalize on emerging opportunities in the real estate market.

Introduction

As the real estate landscape evolves in 2025, investors are confronted with a myriad of transformative trends that are reshaping their strategies and opportunities. The growing emphasis on sustainability and climate resilience, alongside the surging demand for flexible workspaces and mixed-use developments, indicates that the market is adapting to the changing preferences of tenants and the broader economic environment. Notably, a shift towards co-living spaces is addressing affordability concerns, while the integration of advanced technologies such as AI and predictive analytics is enhancing investment decisions. The future of real estate promises not only financial returns but also significant social impact.

This article delves into these key trends, offering insights into how investors can navigate this dynamic landscape and capitalize on emerging opportunities for growth and innovation.

Increased Investment in Sustainable Properties

In 2025, the investment landscape increasingly favors sustainable properties, a trend driven by heightened awareness of climate change and evolving regulatory frameworks. Properties adhering to green building standards, such as LEED certification, are proving more appealing to tenants and are associated with higher rental rates. This shift is largely influenced by consumer demand for eco-friendly living environments and the potential for significant long-term savings through enhanced energy efficiency.

Statistics reveal that 77% of builders cite 'Lack of Customer Demand' as the primary obstacle to green construction, underscoring the necessity for improved education and awareness. The adoption of eco-friendly construction methods varies considerably across regions, reflecting diverse regulatory conditions and priorities. As sustainability becomes a focal point, the future of real estate valuation is expected to evolve, incorporating standardized metrics for assessing environmental performance, as discussed in the case study titled "The Future of Green Valuation."

This evolution positions investors who embrace sustainable practices to capitalize on economic opportunities.

Successful green building projects demonstrate the viability of this trend, with LEED-certified properties often yielding superior financial performance. As James Gray-Donald, Sustainability Vice President, observes, "Generally, in established sectors where you decide relatively early to pursue LEED, or in a current building that has been adequately maintained, the additional cost is minimal." This highlights the financial feasibility of sustainable funding.

Expert insights indicate that proactive investment in sustainable assets not only mitigates risks associated with climate change but also enhances overall competitiveness. As the real estate sector adapts to these dynamics, a focus on renewable energy sources and sustainable materials will be crucial for maximizing returns and ensuring resilience, particularly in light of current real estate investment trends in an increasingly eco-conscious market.

Hybrid Work Drives Demand for Flexible Spaces

The shift towards hybrid work models is significantly increasing the demand for flexible office spaces. These environments enable businesses to adjust their real estate commitments in response to fluctuating workforce needs, making them an appealing choice for many organizations. In 2025, recent data from Coworking Café indicates that the number of flexible office spaces in the U.S. has increased, reflecting this trend.

Investors should focus on properties that feature co-working spaces or adaptable layouts, as these can cater to diverse tenant requirements. Furthermore, many coworking spaces are enhancing their appeal by incorporating amenities that promote a healthier work-life balance, such as:

- Yoga rooms

- Wellness programs

This comprehensive strategy not only draws in professionals looking for nurturing work settings but also establishes these areas as prime opportunities for financial growth.

As companies continue to optimize their real estate portfolios, the demand for flexible office spaces is expected to persist, reflecting current real estate investment trends that create significant opportunities for investment.

Rising Popularity of Mixed-Use Developments

Mixed-use developments are gaining significant traction in 2025, offering a harmonious blend of residential, commercial, and recreational spaces. This innovative method not only promotes community engagement but also boosts real estate values by creating lively neighborhoods. Investors should actively seek opportunities in regions where zoning laws favor mixed-use projects, as these developments are poised to attract a diverse tenant base and generate stable income streams.

The integration of amenities such as parks, shops, and dining options further enhances the attractiveness of these locations. Current statistics indicate a marked increase in the popularity of mixed-use developments, exemplified by the Midstad Frankfurt project, which involves a 35,000 m² rehabilitation of an existing department store. Many investors recognize the potential for long-term returns in such projects. Expert viewpoints emphasize that these assets not only satisfy the changing needs of urban life but also positively impact local economies.

Tatiana Filatova notes, "The finding of the research is not only useful for understanding the spatial patterns of land values, but also beneficial for the policy-makers concerning land administration and urban planning." This emphasizes the significance of mixed-use developments in influencing real estate values.

Successful case studies show that mixed-use projects have resulted in increased foot traffic and elevated asset values in surrounding areas, especially in the context of 'Investment Strategies Amid Economic Uncertainty,' where obtaining favorable financing and mitigating risks have become essential. Moreover, chances for obtaining or creating assets in Opportunity Zones can offer advantageous tax tactics, further boosting the allure of mixed-use developments.

As urban centers continue to evolve, the strategic investment in mixed-use developments aligns with current real estate investment trends, offering a compelling opportunity for individuals seeking to capitalize on the changing landscape of real estate. The advantages of these assets extend beyond short-term financial rewards, as they play an essential role in developing sustainable and prosperous communities.

Co-Living Spaces Meet Affordability Demands

Co-living spaces are emerging as a vital solution to the affordability crisis faced by young professionals and students. These shared living arrangements not only reduce rental costs but also foster a strong sense of community, which is increasingly valued by today’s renters. As the demand for affordable housing continues to rise, particularly in metropolitan regions, investors should contemplate the development or acquisition of co-living spaces to align with real estate investment trends.

These financial commitments can yield higher occupancy rates and rental returns compared to conventional apartments, driven by the flexibility of lease terms that accommodate transient populations.

In 2025, the co-living sector is anticipated to grow considerably, with occupancy rates for co-living properties frequently exceeding those of traditional apartments. This trend is supported by a growing preference for community-oriented living, reflecting real estate investment trends, especially among younger demographics. Furthermore, co-living spaces are increasingly incorporating sustainability features, as highlighted in the case study titled "Sustainability in Co-Living," which showcases how these spaces promote energy-efficient designs and resource sharing.

This focus not only addresses housing challenges but also contributes to a greener future, making co-living an attractive investment opportunity.

As the European co-living sector continues to expand, fueled by housing affordability challenges, it is expected to align with real estate investment trends and experience significant growth in 2025. Investors who support these trends can play a crucial role in shaping the future of urban housing. By prioritizing community-building and exceptional resident experiences, they can ensure the success of their co-living ventures in this evolving landscape.

With more than 30,000 subscribers, Zero Flux offers valuable insights into these trends, underscoring the importance of co-living spaces for real estate stakeholders.

AI and Predictive Analytics Shape Investment Decisions

Artificial intelligence and predictive analytics are fundamentally transforming real estate investment strategies by providing profound insights into market trends and asset valuations. These advanced technologies empower investors to navigate extensive datasets, identify emerging opportunities, and effectively manage risks. For instance, AI is increasingly utilized to automate tasks such as asset management and market analysis, thereby streamlining operations and enhancing efficiency.

Looking ahead to 2025, the integration of predictive analytics is expected to play a pivotal role in real estate valuation, enabling stakeholders to leverage data-driven insights for more accurate evaluations. This methodology not only assists in pinpointing undervalued properties but also strengthens portfolio management strategies. As competition intensifies, those who embrace these technologies will likely secure a significant edge over their peers.

Additionally, the deployment of AI chatbots facilitates seamless communication, delivering immediate responses to inquiries and enhancing customer engagement. These chatbots simplify communication processes, ensuring users can swiftly access the information they need. A case study reveals that North America commands the largest share of AI in real estate at 41%, followed by Asia Pacific at 32% and Europe at 23%.

This trend highlights the increasing dependence on AI-driven solutions, particularly regarding real estate investment trends across diverse regions.

As noted by Dave Andre, a Senior Writer, "AI is anticipated to revolutionize leasing processes within the next five years," underscoring the imperative for investors to adapt to these technological advancements. The synergy of human expertise and AI capabilities will be crucial in navigating the complexities of real estate investment trends, ensuring that strategies remain robust and responsive to market fluctuations.

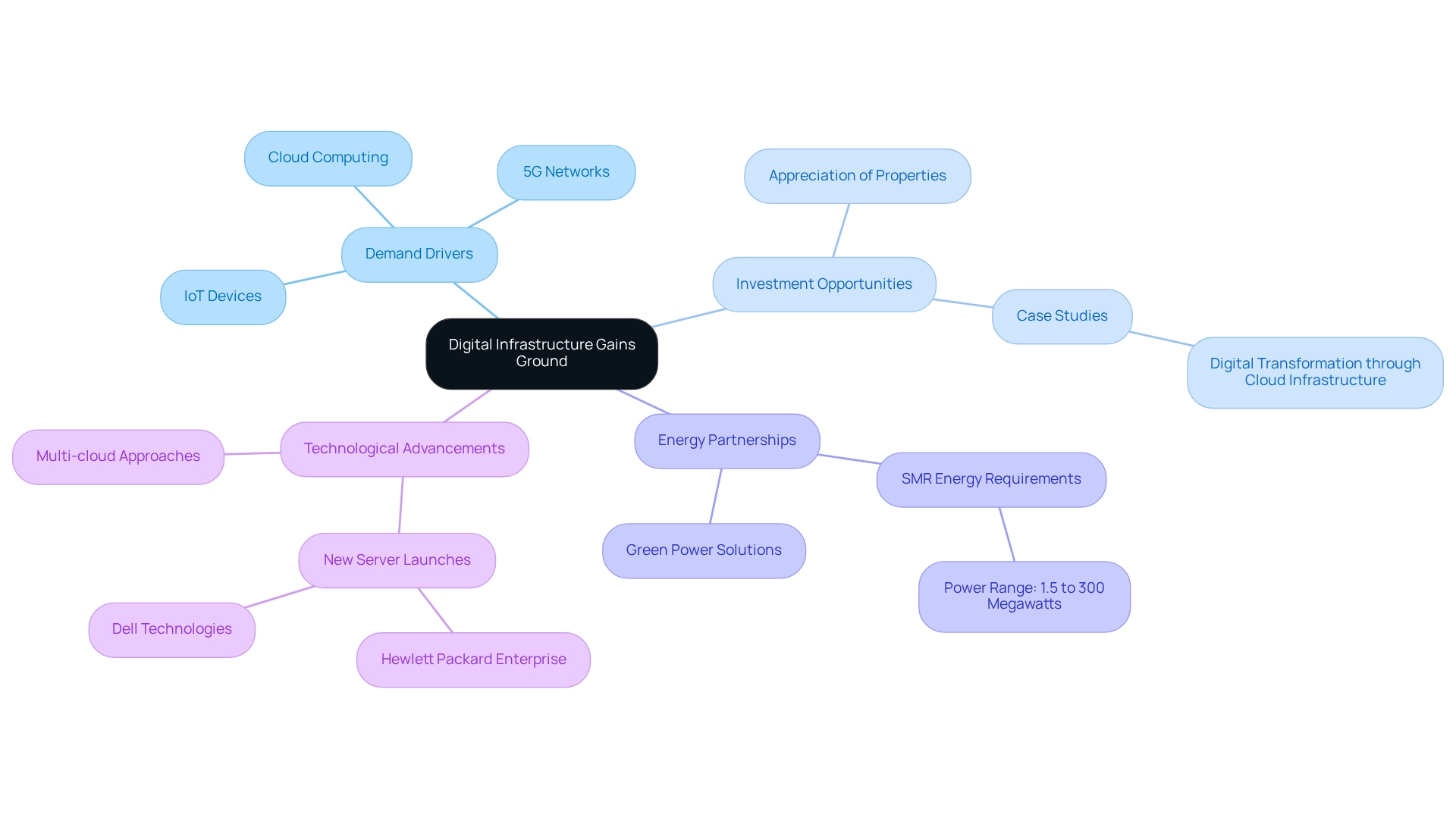

Digital Infrastructure Gains Ground

The demand for digital infrastructure—particularly data centers and telecommunications facilities—is surging as technology and digital services evolve. Investors must recognize the significant opportunities within this sector; these assets are essential for sustaining the digital economy. The proliferation of cloud computing, the rollout of 5G networks, and the expansion of IoT devices are driving an unprecedented need for robust digital infrastructure.

Consequently, properties designed to meet these demands are projected to appreciate considerably in value. Some estimates suggest that small modular reactors (SMRs) can provide between 1.5 to 300 megawatts of power, underscoring the energy requirements of these facilities.

By 2025, growth statistics for data centers and telecommunications facilities indicate a promising market, with funding in digital infrastructure expected to surge. Industry experts emphasize that partnerships between energy providers and data center operators will become increasingly common, reflecting a shift towards reliable green power solutions. This trend highlights the critical role of data centers in real estate, as they not only support technological advancements but also align with sustainability goals.

Gordon Dolven, Director of Americas Data Center Research, notes, "Partnerships between energy providers, nuclear technology companies, and data center operators will become more common as the industry shifts toward reliable green power."

Successful investments in digital infrastructure are already being observed. Case studies illustrate how companies leveraging cloud infrastructure, as detailed in the case study titled "Digital Transformation through Cloud Infrastructure," are gaining a competitive edge. The shift to multi-cloud approaches is fostering innovation and enhancing operational flexibility, positioning this sector as an appealing opportunity for real estate stakeholders interested in investment trends influenced by the digital transformation of the economy. Furthermore, the recent launch of new servers by Hewlett Packard Enterprise and Dell Technologies—designed for training large language models—underscores the increasing demand for data centers, as technological advancements drive the need for such infrastructure.

Second-Tier Market Growth

As demand for housing in major urban regions rises, stakeholders are increasingly focusing on real estate investment trends in secondary markets. These regions often provide more affordable real estate options and the potential for substantial appreciation as they evolve. Notably, cities like Jacksonville, Florida, which has experienced a population increase of 13.71% since 2010, are emerging as significant business hubs due to their diverse industries and recreational opportunities.

Investors should target cities experiencing robust population growth, job creation, and infrastructure enhancements. For instance, Houston, with an occupied housing unit ownership rate of 61%, indicates stable demand for housing, making it an appealing choice for investors. The presence of over 40 colleges and universities in Houston fosters a vibrant community that attracts new residents, further enhancing its appeal for funding.

By diversifying portfolios with properties in these secondary regions, investors can effectively mitigate risks associated with economic fluctuations in larger cities. The trend of eliminating parking minimums in various cities, as highlighted by Robert Ferrin, aligns with real estate investment trends that support the development of these areas, making them increasingly attractive for investment. As Bill Hunt, president and CEO of Elmhurst Group, states, "At the end of the day, high-quality malls are going to remain in demand," emphasizing the ongoing need for quality real estate in evolving environments.

As the landscape of real estate continues to change, investment trends indicate that the potential for growth in second-tier markets remains promising, providing a wealth of opportunities for astute individuals.

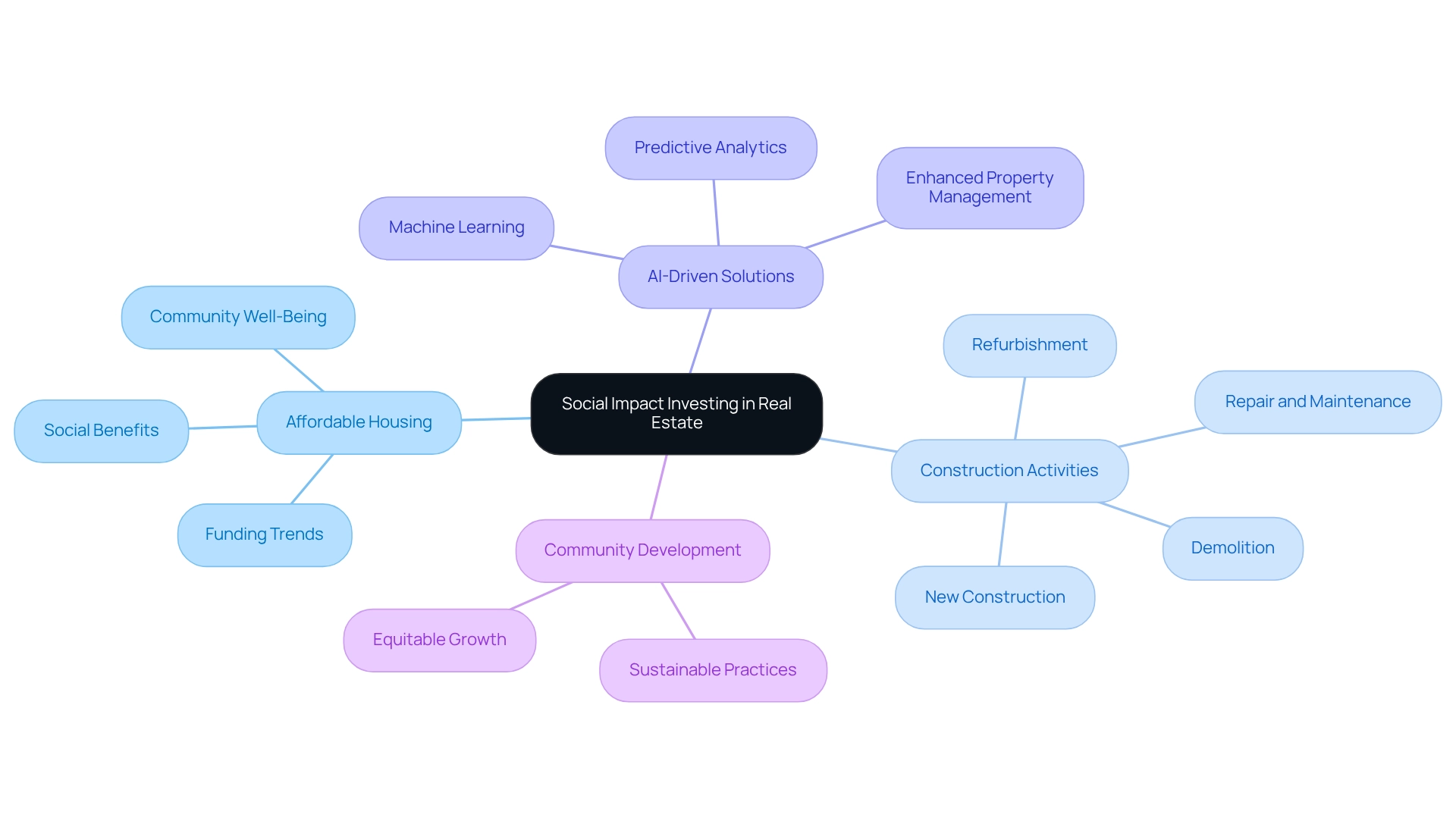

Social Impact Investing Takes Center Stage

Social impact investing is increasingly becoming a focal point for real estate investment trends, particularly in the realms of affordable housing and community development. This shift signifies a growing awareness of the social responsibilities tied to real estate investments. Investors are now actively pursuing real estate opportunities that not only yield financial returns but also promote social good.

In 2025, the affordable housing sector is anticipated to attract substantial funding, driven by the urgent need to address housing shortages and enhance community well-being.

The multifamily housing construction sector encompasses various activities, including new construction, repair and maintenance, refurbishment, and demolition. As of September 2024, completions of multifamily buildings reached a remarkable rate of 671,000, highlighting the demand for housing solutions that meet diverse community needs. Drew DeSilver, a senior writer at Pew Research Center, observed that in a recent year, 438,300 privately owned housing buildings were completed, marking the highest figure since 1987.

Furthermore, innovative approaches such as AI-driven platforms are revolutionizing real estate investment trends. Appfolio Inc. stands out as a leader in the Affordable Housing market, leveraging AI-powered solutions for enhanced property management. These technologies harness predictive analytics and machine learning to analyze extensive datasets, enabling stakeholders to make informed decisions and identify emerging hotspots before saturation occurs.

This data-driven approach not only mitigates risks but also aligns with the rising trend of social impact investing within real estate.

The case study titled "AI and Predictive Analytics Shape Financial Choices" illustrates how the emergence of AI-driven platforms is reshaping real estate investment strategies. By employing predictive analytics, investors can scrutinize large datasets, facilitating more informed decision-making and risk reduction. Successful affordable housing initiatives are increasingly recognized for their social benefits, demonstrating that funding can yield both economic and community returns.

Expert opinions underscore the importance of integrating social impact into real estate investment strategies, as this alignment enhances financial performance and contributes to sustainable community development. As the landscape evolves, real estate stakeholders are poised to play a crucial role in fostering a more equitable and socially responsible environment.

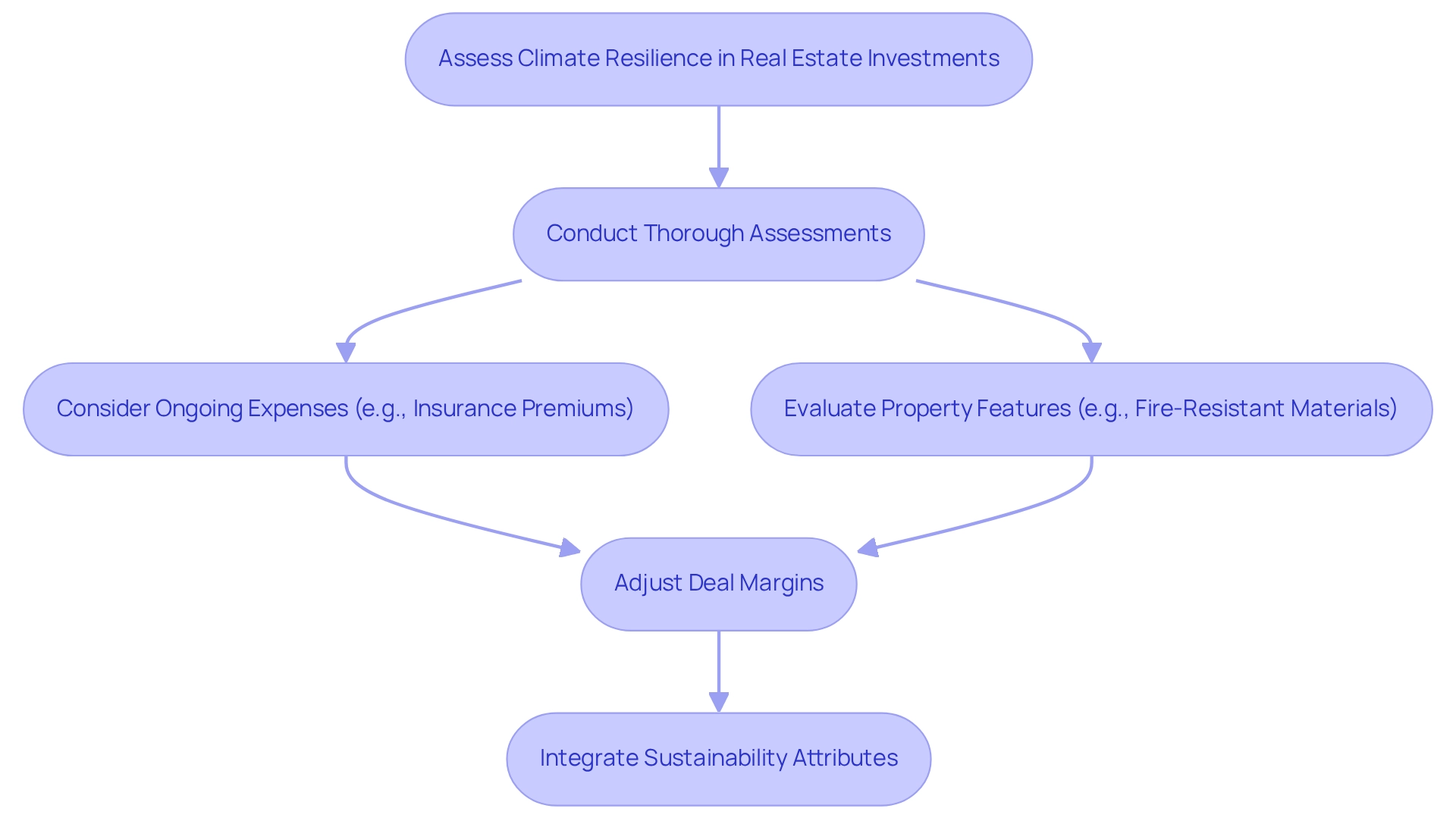

Focus on Climate Resilience

As climate change increasingly threatens real estate investment trends, investors are prioritizing climate resilience in their portfolios. Properties engineered or retrofitted to endure extreme weather events are gaining traction, reflecting a significant shift in market demand. For instance, utilizing fire-resistant materials and maintaining cleared perimeter areas can substantially reduce the risk of wildfire spread, making such locations more appealing to investors.

Investors must conduct thorough assessments of potential acquisitions to evaluate their climate resilience. This includes considering ongoing expenses such as rising insurance premiums and taxes, particularly in high-risk regions where some insurers have withdrawn. A notable case study titled "Factor in Rising Insurance Premiums" illustrates that as climate risks escalate, insurance premiums in these areas have surged dramatically. This trend necessitates adjustments in deal margins for investors, emphasizing the importance of integrating sustainability attributes.

Integrating these attributes not only enhances the long-term viability of ventures but also aligns with evolving regulatory requirements and consumer preferences, reflecting current trends towards eco-friendly properties. As Pedro aptly stated, "The climate crisis will affect the real estate sector, the banking industry, and the broader economy." This proactive strategy is crucial for safeguarding investments against climate-related risks and ensuring competitiveness in a rapidly changing market landscape.

Moreover, data platforms that merge real estate information with climate risk modeling are empowering investors to make informed decisions based on shared information across sectors. This integration of data and insights is essential for navigating the complexities of climate resilience in real estate investments.

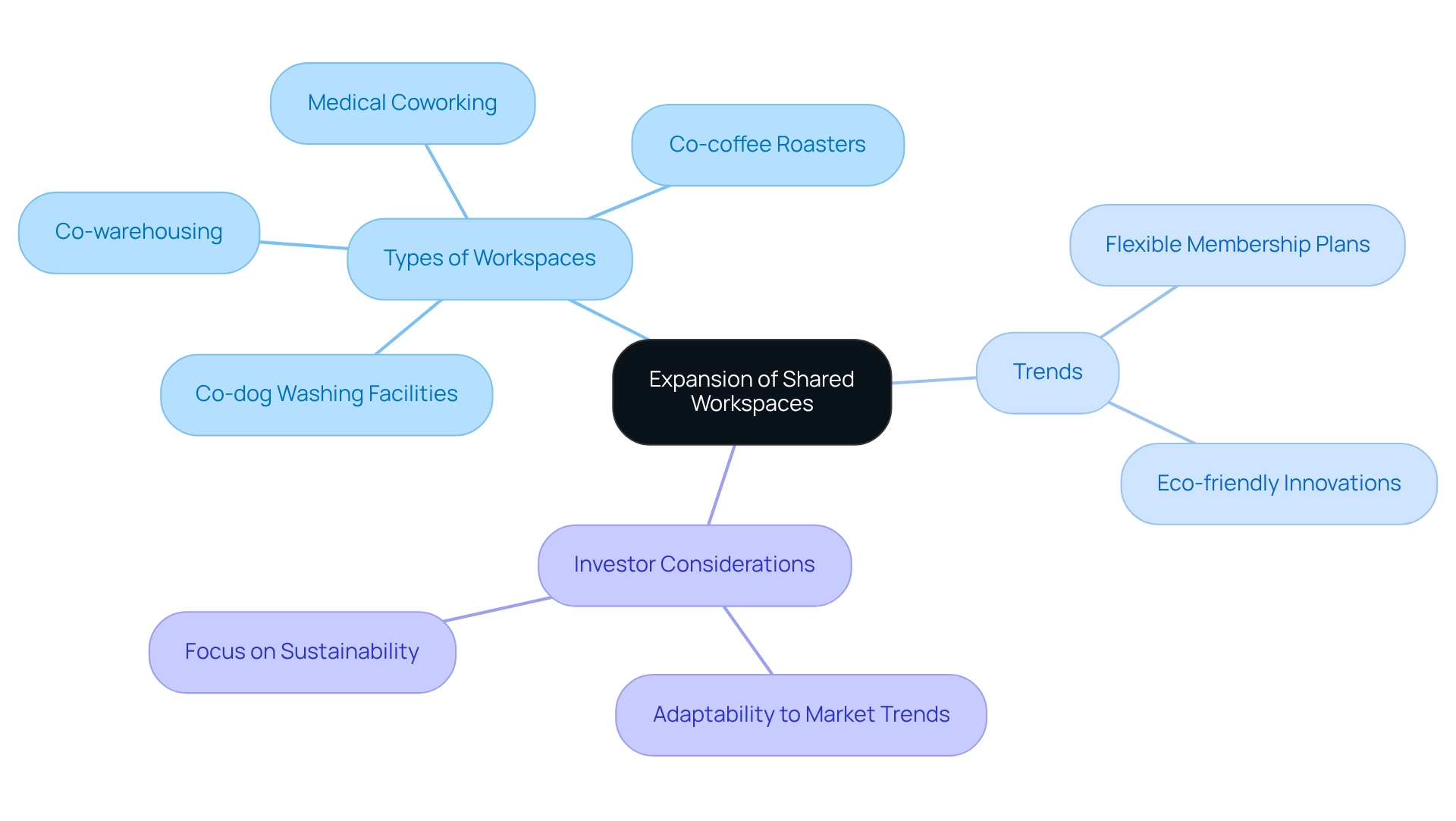

Expansion of Shared Workspaces

The expansion of shared workspaces is fundamentally reshaping the commercial real estate landscape, as businesses increasingly embrace flexible work arrangements. These versatile spaces, which range from co-working environments to private offices, enable companies to scale operations efficiently while adapting to changing workforce dynamics. With larger coworking spaces achieving an impressive 75% occupancy rate, the demand for such innovative solutions is undeniably evident.

Investors should prioritize properties that incorporate shared workspace options, as they are poised to attract a diverse array of tenants seeking flexibility. The rise of remote work, coupled with the growing need for collaborative environments, underscores the importance of these adaptable spaces. Notably, the coworking niche has expanded beyond traditional offerings to include:

- Co-warehousing

- Medical coworking

- Unique concepts like co-coffee roasters

- Co-dog washing facilities

This diversification reflects a competitive market driven by community desires and shared interests.

As we look toward 2025, the trend of flexible membership plans is gaining traction, allowing businesses to tailor their workspace needs to fluctuating demands. This adaptability not only enhances tenant satisfaction but also positions shared workspaces as a vital component of commercial real estate investment trends. Moreover, the incorporation of eco-friendly innovations in coworking spaces is becoming increasingly significant, as sustainability is an escalating issue for both occupants and stakeholders.

Investors who recognize and act on real estate investment trends—such as the push for environmentally friendly workspaces—will be well-equipped to navigate the evolving market dynamics. As Arabella Anderson, a former Senior Copywriter at North One, notes, "The shift towards flexible work arrangements is not just a trend; it's a fundamental change in how businesses operate and invest in their spaces." This perspective highlights the necessity for investors to adapt their strategies in response to these emerging trends.

Conclusion

The real estate landscape of 2025 presents transformative opportunities for investors, marked by a pronounced shift towards sustainability in property investments. Green building practices are gaining traction as tenants increasingly seek eco-friendly options. This trend not only enhances property appeal but also promises long-term financial benefits through energy efficiency and compliance with evolving regulations.

Simultaneously, the rise of hybrid work models has driven demand for flexible office spaces, prompting investors to consider properties that can adapt to the changing needs of businesses. Mixed-use developments are flourishing, fostering vibrant communities that appeal to diverse tenant bases and contribute to local economies.

Co-living spaces are emerging as a viable solution to the affordability crisis, particularly among younger demographics. Furthermore, advanced technologies like AI and predictive analytics are revolutionizing investment strategies. These tools enable more informed decision-making, offering a competitive edge in identifying opportunities and managing risks.

Moreover, the growing emphasis on social impact investing reflects a broader commitment to addressing community needs, especially in the affordable housing sector. As investors prioritize climate resilience in their portfolios, integrating sustainable features becomes critical in safeguarding against climate-related risks.

In summary, the evolving real estate market in 2025 necessitates a proactive approach that embraces sustainability, flexibility, and technological innovation. By aligning investment strategies with these key trends, investors can achieve not only financial success but also contribute positively to societal and environmental outcomes, ensuring their relevance in a rapidly changing landscape.