Overview

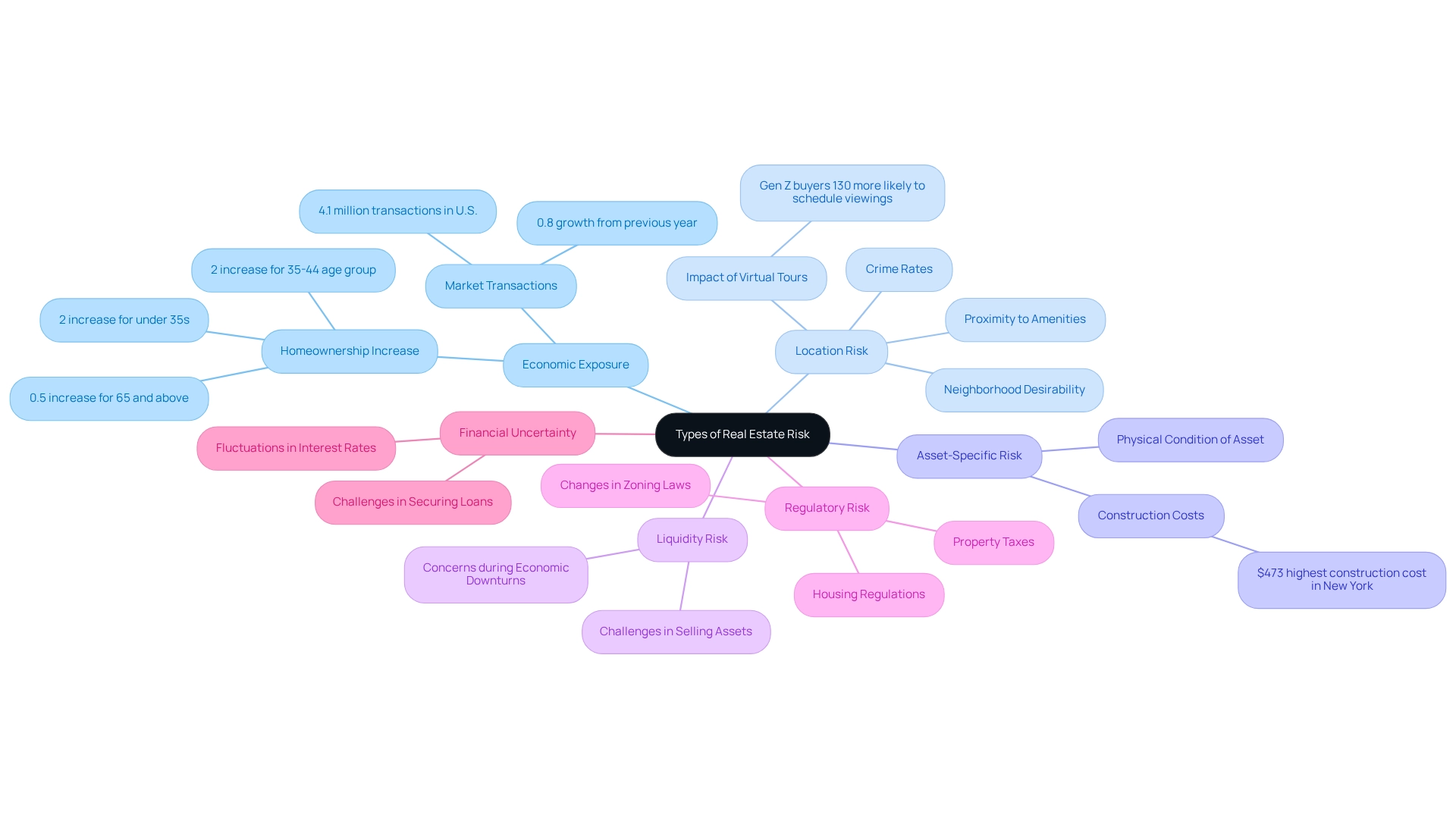

Real estate risk encompasses a range of critical factors, including:

- Economic exposure

- Location risk

- Asset-specific risk

- Liquidity risk

- Regulatory risk

- Financial uncertainty

Each of these elements can significantly impact investment outcomes. Understanding these risks is paramount for investors. By employing strategies such as:

- Diversification

- Thorough due diligence

- Regular monitoring

investors can effectively mitigate potential losses. These strategies not only enhance financial stability but also empower investors to navigate a volatile market with confidence.

Introduction

Navigating the complexities of real estate investment demands a keen understanding of the myriad risks involved. Market fluctuations and location-specific challenges present significant potential for financial loss for investors. As the landscape evolves—particularly with shifting demographics and economic conditions—recognizing the various types of risks becomes paramount. These include:

- Systematic risks

- Unsystematic risks

These risks can impact investment outcomes. This article delves into the intricacies of real estate risk, offering insights into effective assessment tools and proactive strategies designed to safeguard investments. By equipping themselves with this knowledge, investors can make informed decisions, ultimately enhancing their potential for success in an ever-changing market.

Define Real Estate Risk: Types and Implications

Real estate uncertainty encompasses the potential for financial loss or adverse outcomes associated with real estate ventures, and it can be categorized into several distinct types:

- Economic Exposure: This uncertainty stems from fluctuations in property values driven by economic conditions, interest rates, and demand. As we approach 2025, the real estate sector continues to experience volatility, which carries significant implications for investment strategies. Current trends indicate that homeownership percentages have increased by 2% for individuals under 35 and those aged 35 to 44, along with a 0.5% rise for individuals aged 65 and above. This shift suggests evolving dynamics that could introduce various challenges. The U.S. housing sector recorded approximately 4.1 million transactions, reflecting a modest growth of 0.8% from the previous year, despite economic pressures such as high mortgage rates. This stability, paired with rising median home prices, underscores the importance of understanding real estate risk and its impact on financial strategies.

- Location Risk: The geographical context of an asset is pivotal in determining its value and rental income potential. Factors such as neighborhood desirability, crime rates, and proximity to amenities can significantly influence investment outcomes. Notably, tech-savvy Gen Z buyers are 130% more likely to schedule a viewing if the listing features a virtual tour, highlighting how technological elements can shape buyer behavior and desirability.

- Asset-Specific Risk: This category encompasses risks associated with the physical condition of the asset, including structural issues or the necessity for substantial repairs. For instance, the highest construction expense for shopping center facilities reached $473 in New York as of late 2022 or early 2023, illustrating the financial ramifications of construction costs in specific areas. Investors must evaluate these factors to mitigate unexpected expenses related to real estate risk.

- Liquidity Risk: This refers to the challenges of quickly selling an asset without incurring a loss, particularly in a declining market. The current landscape reveals that liquidity can pose a significant concern for investors during economic downturns.

- Regulatory Risk: Changes in zoning laws, property taxes, or housing regulations can affect the profitability of an investment. Staying informed about regulatory changes is essential for effective management of uncertainties.

- Financial Uncertainty: This includes challenges related to financing, such as fluctuations in interest rates or difficulties in securing favorable loan terms. As interest rates remain a critical factor in investment decisions, understanding financial uncertainties is vital.

By thoroughly understanding these uncertainties surrounding real estate risk, investors can develop effective strategies to mitigate them, ultimately ensuring more stable returns on their investments.

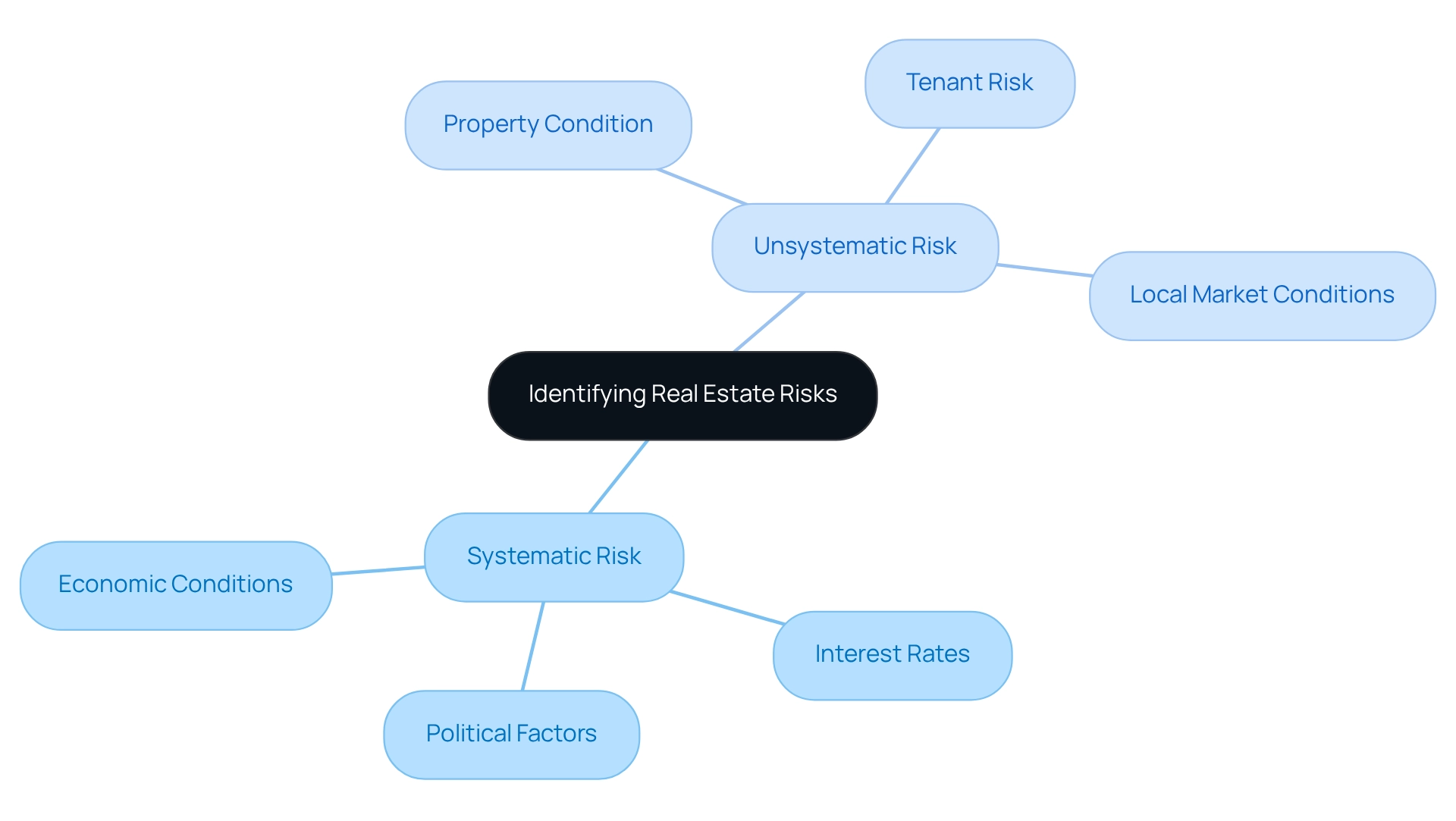

Identify Systematic and Unsystematic Risks in Real Estate

Real estate uncertainties can be categorized into two main types of risk: systematic and unsystematic challenges, each presenting unique implications for investors.

Systematic Risk encompasses elements that influence the entire financial system, often beyond the control of individual investors. Key contributors include:

- Economic Conditions: Economic downturns can significantly reduce property values and rental income. For instance, during the 2008 financial crisis, the Dow Jones Industrial Average experienced a notable market drop, leading to considerable decreases in the real estate sector, which underscores the susceptibility of property holdings to broader economic changes.

- Interest Rates: Fluctuations in interest rates directly affect mortgage expenses, influencing the overall feasibility of real estate ventures. As interest rates rise, borrowing becomes more expensive, potentially discouraging capital allocation.

- Political Factors: Changes in government policies or regulations can introduce uncertainty, impacting economic stability and investor confidence.

Unsystematic Risk, in contrast, pertains to specific assets or investments. Examples include:

- Property Condition: Structural issues or outdated facilities can adversely affect a property's market value and appeal.

- Tenant Risk: The reliability of tenants in meeting rental obligations is critical; high vacancy rates or tenant defaults can severely impact cash flow.

- Local Market Conditions: Fluctuations in neighborhood desirability or local economic health can significantly influence property performance.

Understanding these distinctions empowers investors to implement targeted strategies for minimizing potential losses and addressing real estate risk. For example, diversifying portfolios can help mitigate exposure to non-systematic uncertainties, while remaining vigilant to broader economic trends is essential for managing systematic challenges. Regular portfolio assessments and adjustments in response to evolving economic circumstances are also recommended strategies to align investments with risk tolerance and market dynamics. As Zarah Mae Torrazo states, "An investor who exercises caution and thoroughness prior to investing can gain from the stability, protection, and low volatility of this asset category while steering clear of excessive exposure." Furthermore, the case study titled "Eliminating Systematic Threats from Investment Portfolios" illustrates that while systematic exposure cannot be entirely eliminated, strategies such as diversification and asset allocation can aid in managing vulnerability. By recognizing both systematic and unsystematic uncertainties, investors can navigate the complexities of real estate risk in the market more effectively. Additionally, tools like Conditional Value at Risk (CVaR) can assist investors in preparing for unlikely yet significant losses.

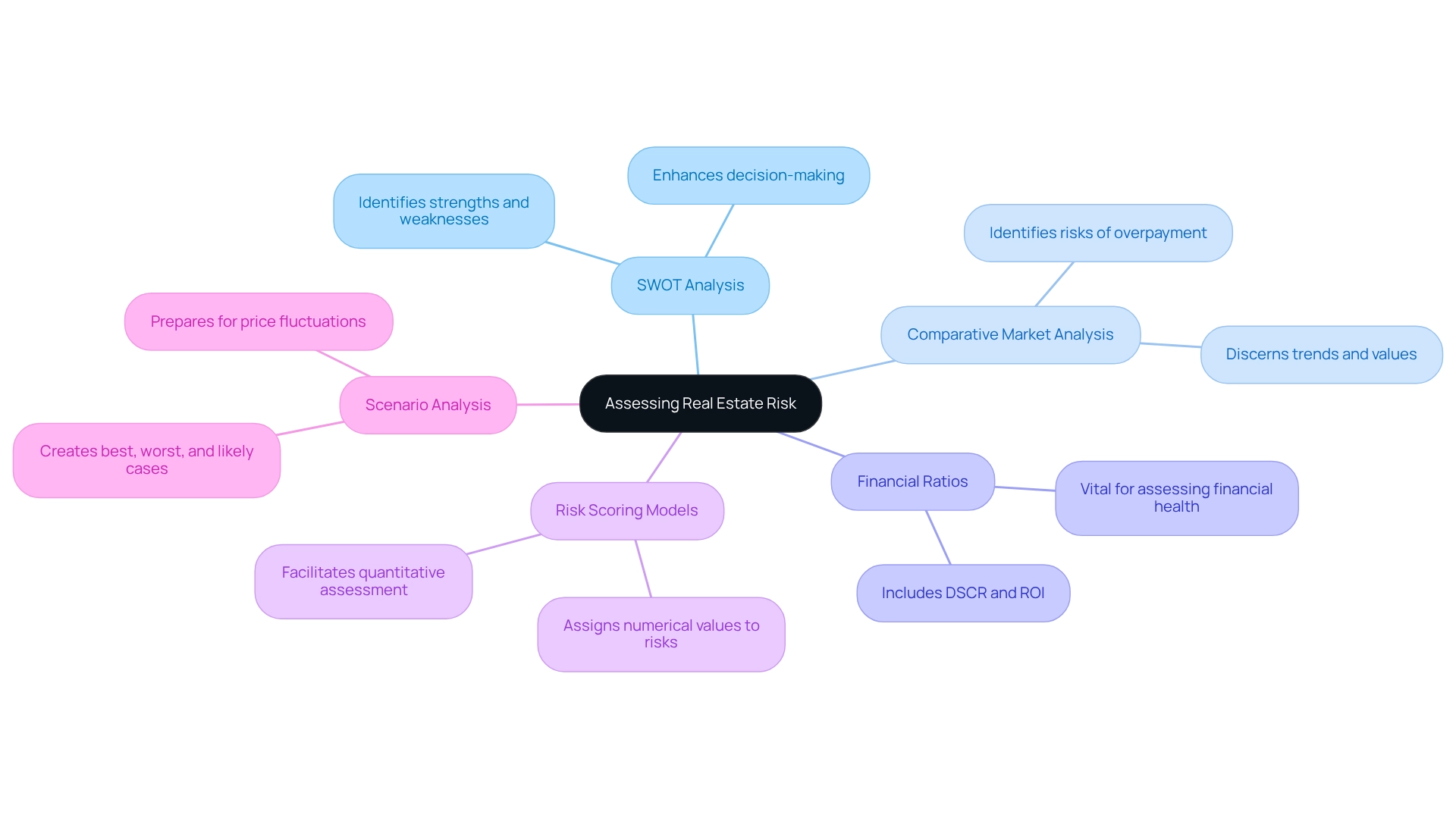

Assessing Real Estate Risk: Tools and Techniques

Evaluating real estate risk necessitates a diverse array of instruments and methods that empower investors to gauge potential threats to their assets. Key methods include:

- SWOT Analysis: This strategic approach identifies the Strengths, Weaknesses, Opportunities, and Threats associated with an asset, enabling investors to comprehend both internal and external factors that could impact their investment outcomes. Recent studies suggest that employing SWOT analysis can significantly enhance decision-making processes in real estate investments.

- Comparative Market Analysis (CMA): By scrutinizing comparable assets in the vicinity, investors can discern trends and values, aiding in the identification of risks related to overpayment. This method proves especially effective in volatile environments where asset values fluctuate rapidly.

- Financial Ratios: Essential financial ratios, such as the Debt Service Coverage Ratio (DSCR) and Return on Investment (ROI), provide insights into a property's financial health and its ability to generate income. Grasping these ratios is vital, particularly in a market where 29.7% of Millennial renters are poised to purchase homes, indicating shifting dynamics in buyer behavior. Moreover, considering a marginal tax rate of 22% and a general inflation rate of 3% can furnish additional context for these financial evaluations, as they directly affect returns and cash flow.

- Risk Scoring Models: Investors frequently employ scoring models that assign numerical values to various risk factors, facilitating a quantitative assessment of overall risk. This methodology allows for a more structured evaluation of potential threats.

- Scenario Analysis: This technique involves creating various scenarios—best case, worst case, and most likely case—to understand how different factors might influence the asset's performance. Such analyses are critical in preparing for price fluctuations and unforeseen challenges.

Incorporating insights from the REALTORS® Confidence Index, which examines buyer motivations and financial backgrounds, can further enrich the understanding of economic dynamics. By leveraging these tools, investors can make informed decisions and devise strategies to mitigate identified challenges and manage real estate risk, ultimately enhancing their financial outcomes in an ever-evolving landscape. As Jon Wade, a real estate specialist, notes, 'Forecasting property values and trends is always challenging, but reviewing historical data can assist in developing a more precise strategy for future fluctuations.' This perspective emphasizes the necessity of utilizing historical data alongside these assessment tools.

Mitigating Real Estate Risks: Strategies for Investors

Reducing real estate risk necessitates proactive approaches that protect assets. Consider several effective strategies:

- Diversification: Investing across various property types and locations can significantly mitigate exposure to economic fluctuations and specific property risks. Statistics indicate that diversified real estate portfolios are gaining traction, with crowdfunding platforms attracting nearly $20 billion in global real estate financing in 2023. This trend underscores the shift towards varied financial strategies.

- Thorough Due Diligence: Conducting comprehensive research on properties—including inspections, title searches, and industry analysis—can uncover potential issues before purchase. For instance, a case study involving a group of investors who meticulously analyzed market conditions in a declining neighborhood enabled them to avoid a costly venture that others pursued without sufficient research. This illustrates that thorough due diligence is essential in real estate ventures.

- Insurance: Securing appropriate insurance coverage, encompassing assets, liability, and loss of income insurance, safeguards against unforeseen events that could jeopardize investments.

- Professional Management: Engaging skilled asset managers ensures that real estate is well-maintained and tenant concerns are addressed effectively, thereby minimizing operational risks.

- Regular Monitoring: Continuously tracking industry trends, property performance, and regulatory changes allows investors to remain informed and adapt their strategies accordingly. This vigilance is particularly crucial in dynamic environments like San Francisco, which remains the most expensive city for renters worldwide, driven by high demand and limited housing supply. As a Realtor observed, "With the potential for reduced mortgage rates and gradual market stabilization, there could be improvements in affordability and appeal for investors."

By implementing these strategies, investors can significantly mitigate risk exposure and enhance their chances of achieving investment goals, reinforcing the importance of diversification in real estate investing.

Conclusion

Real estate investment inherently presents risks; however, a comprehensive understanding of these risks empowers investors to make informed decisions. This article has examined various risk types, including:

- Market risk

- Location risk

- Property-specific risk

- Liquidity risk

- Regulatory risk

- Financial risk

Elucidating their potential impact on investment outcomes. Furthermore, distinguishing between systematic and unsystematic risks highlights the necessity for tailored strategies to navigate the market's complexities.

Effective risk assessment tools—such as SWOT analysis, comparative market analysis, financial ratios, risk scoring models, and scenario analysis—serve as essential resources for investors. These tools facilitate a thorough evaluation of potential threats, informing investment strategies and enhancing decision-making processes. By leveraging these techniques, investors can better prepare for the unpredictable nature of the real estate landscape.

Mitigating risk transcends mere identification of threats; it encompasses proactive strategies that safeguard investments. Practices such as:

- Diversification

- Thorough due diligence

- Appropriate insurance

- Professional management

- Regular monitoring

are vital in significantly reducing exposure to potential pitfalls. As the real estate market continues to evolve, investors who adopt these strategies will be better positioned to achieve their financial goals while adeptly navigating the inherent uncertainties of property investment.

In conclusion, a robust understanding of real estate risks, coupled with effective assessment and mitigation strategies, is crucial for any investor aiming to thrive in this dynamic environment. By remaining informed and proactive, investors can enhance their potential for success and secure more stable returns in an ever-changing market.