Overview

This article delves into the current commercial real estate crisis, emphasizing critical driving factors such as rising interest rates, economic uncertainty, and evolving work patterns. Investors face significant challenges in this landscape, necessitating a strategic approach to navigate these complexities.

By targeting resilient sectors and leveraging opportunities in distressed assets, investors can position themselves favorably for potential market recovery. As the landscape shifts, adapting investment strategies becomes essential.

How will you adjust your approach to capitalize on these emerging opportunities?

Introduction

The commercial real estate market stands at a pivotal crossroads as it navigates the complexities of 2025, influenced by various economic factors and shifting consumer behaviors.

The aftermath of the pandemic has fundamentally reshaped demand across sectors.

- Office spaces are grappling with high vacancy rates, a direct result of the rise of remote work.

- In contrast, the retail and industrial sectors exhibit surprising resilience amidst changing market dynamics.

Investors now face a cautious landscape, marked by rising interest rates and economic uncertainty, prompting a thorough reevaluation of strategies and opportunities.

As the industry adapts, understanding the interplay of historical lessons, current challenges, and emerging trends is essential for making informed investment decisions in this volatile environment.

Current Landscape of Commercial Real Estate

In 2025, the commercial real estate sector is experiencing notable fluctuations driven by a variety of economic factors. The pandemic's aftermath has significantly altered demand dynamics across sectors. Office spaces are grappling with challenges stemming from the widespread adoption of remote work, leading to increased vacancy rates and a reevaluation of space utilization.

Conversely, the industrial and retail sectors are demonstrating resilience. Retail properties are maintaining a low vacancy rate of 4.1%, despite a 12% decline in foot traffic. This resilience is attributed to strict conditions and limited supply, leading to a 3.2% growth in retail properties. Significantly, the retail sector is adjusting to evolving consumer behaviors and economic conditions, as demonstrated by a case study emphasizing these dynamics.

Investors are entering the industry with increased caution, maneuvering through an environment defined by rising interest rates and persistent economic uncertainty. Key indicators such as vacancy rates, rental prices, and transaction volumes are essential metrics for evaluating economic health. For instance, the logistics and warehousing sectors are emerging as prime investment opportunities, with a focus on digital economy properties expected to thrive in the next 12 to 18 months.

Moreover, the need for deep energy retrofits in buildings has become increasingly apparent, with 76% of global survey respondents indicating plans to undertake such projects to meet sustainability goals. This trend indicates a wider movement towards eco-friendly investments, which are becoming essential in the present economic environment. The statistic from the Commercial Property Women Network, indicating that 76% of respondents noted their organizations have policies supporting mental health and well-being, further underscores the evolving demands in the workplace and its impact on commercial property. Expert opinions highlight the importance of adapting to these changes.

As Tim Coy, the research manager for the Commercial Real Estate industry within Deloitte’s Center for Financial Services, notes, understanding the evolving landscape is crucial for making informed investment decisions. The commercial property sector in 2025 is therefore characterized by a complex interaction of challenges and opportunities, requiring a strategic approach for investors aiming to navigate this dynamic environment.

Historical Context: Lessons from Past Real Estate Crises

Commercial property has historically navigated through significant crises, notably the commercial real estate crisis triggered by the 2008 financial downturn and the dot-com bubble collapse in the early 2000s. These crises were marked by excessive over-leveraging, speculative investments, and insufficient due diligence, resulting in widespread financial instability.

The 2008 financial crisis, in particular, precipitated a commercial real estate crisis, leading to a sharp decline in property values and a notable increase in vacancies. For instance, the percentage of available office space reached a record high of 16.4%, underscoring the challenges faced by property owners and stakeholders, as reported by CoStar Group. In the aftermath, stakeholders recognized the critical importance of maintaining liquidity and diversifying their portfolios to mitigate risks associated with price volatility.

Insights gleaned from these historical events emphasize the necessity for caution and strategic planning in today’s unpredictable market. Investors are increasingly inclined to conduct comprehensive evaluations of the industry and focus on investments in Class A properties, characterized by modern buildings in prime locations with long-term leases. These properties have proven to be the most liquid assets in commercial real estate, attracting a substantial pool of potential buyers due to their stable cash flows and strong demand.

Furthermore, recent statistics reveal that the demand for industrial property in the U.S. is anticipated to rise by 850 million square feet in 2023, indicating a shift in dynamics that stakeholders must adeptly navigate. Additionally, the multifamily sector is encountering challenges, with vacancies soaring to 7.8%, the highest level in a decade, and rent growth slowing to an average of just 1% from April 2023 to April 2024.

By analyzing these historical case studies and the lessons learned from prior crises, individuals can better equip themselves for potential downturns, such as the commercial real estate crisis, and make informed decisions that align with current market conditions.

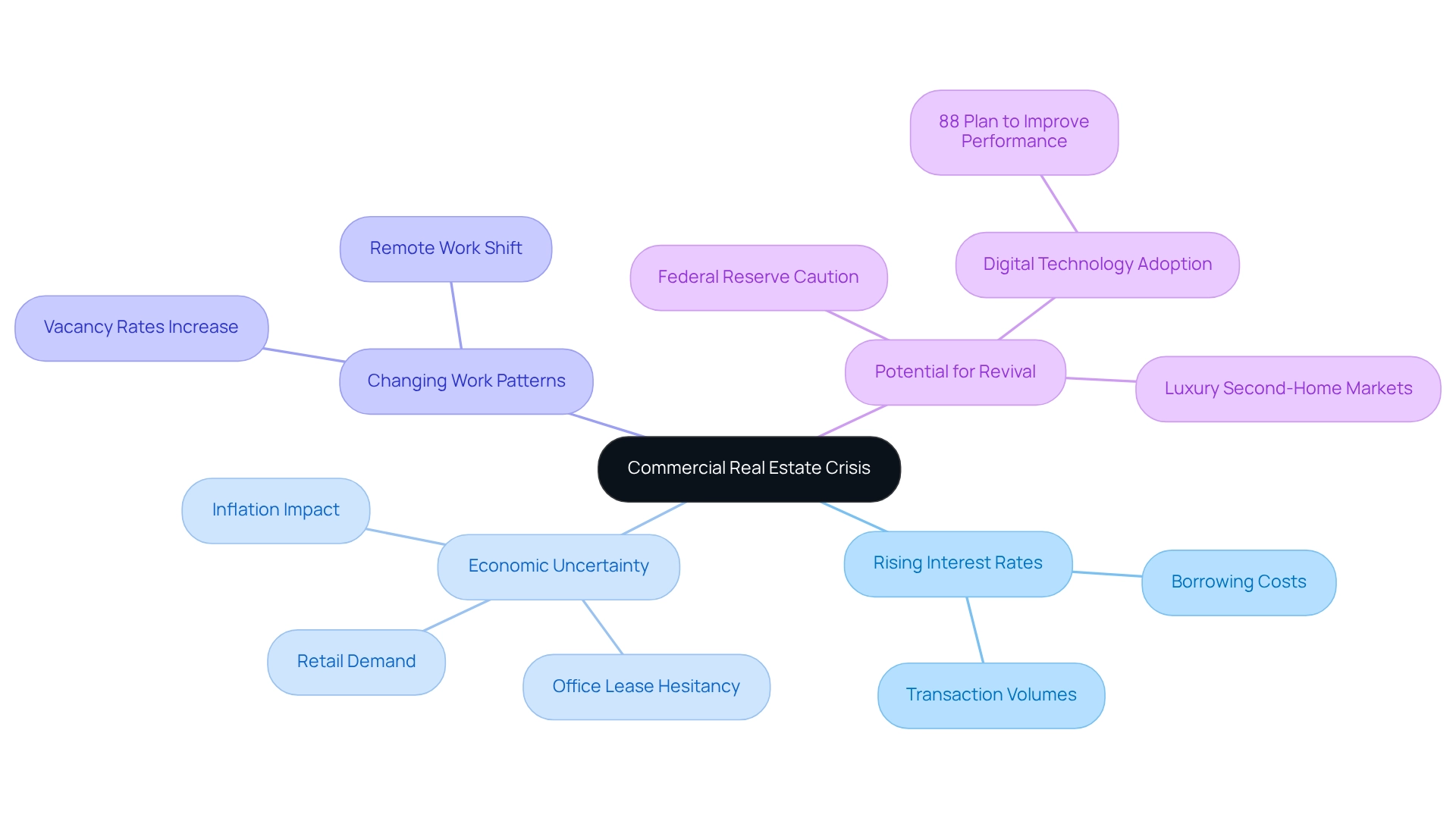

Key Factors Driving the Current Crisis

The current commercial real estate crisis is driven by several interrelated factors. One of the most significant is the rise in interest rates, which has escalated borrowing costs and made financing increasingly difficult for investors. This shift has generated a ripple effect across the industry, as increased costs discourage potential investments and reduce transaction volumes.

Economic uncertainty, driven by ongoing inflation and geopolitical tensions, has additionally weakened consumer confidence. This decline in confidence has particularly affected demand in the retail and office sectors, where businesses are hesitant to commit to long-term leases amid fluctuating market conditions. Furthermore, the continuous shift to remote work has fundamentally changed the commercial property landscape.

Numerous firms are choosing to reduce their office areas or embrace hybrid work models, resulting in a notable rise in vacancy rates in city regions.

Tim Coy, the research manager for the Commercial Property sector within Deloitte’s Center for Financial Services, observes that although immediate relief may not be forthcoming, there is potential for a revival in commercial property dealmaking. This optimism stems from the expectation that the Federal Reserve will carefully evaluate economic indicators before making policy changes, which could ultimately stimulate activity in the sector despite current challenges. The new presidential administration's proposed tax cuts, increased tariffs, and immigration reform may lead the Federal Reserve to exercise caution in its monetary policy, resulting in a period of stagnation in the market.

However, this situation implies that although prompt assistance may not be available, there is potential for a surge in commercial property dealmaking in the near future. Moreover, as 88% of industry respondents indicate plans to utilize digital technologies to improve performance within the next 12 to 18 months, the incorporation of innovative solutions may offer a route for recovery. For example, individuals who adjust to these changes and adopt technology could discover new opportunities in a shifting market.

In conclusion, the interaction of increasing interest rates, economic unpredictability, and changing work patterns are key factors driving the commercial real estate crisis in 2025. Furthermore, the recognized leading luxury second-home markets to observe in 2025 may provide insights into new opportunities for stakeholders. Comprehending these dynamics is essential for individuals aiming to navigate the complexities of the current landscape.

The Role of Interest Rates and Financing Challenges

Interest rates serve as a pivotal determinant in the commercial real estate crisis, significantly impacting borrowing costs and investment decisions. As rates continue to rise, financing costs increase, potentially deterring prospective stakeholders and contributing to a commercial real estate crisis through decreased transaction volumes. In 2025, the Federal Reserve's monetary policies are expected to sustain elevated interest rates, directly influencing cash flow and profitability for property owners.

For instance, Freddie Mac's small balance apartment loan rates for a five-year fixed term currently stand at 6.20%, reflecting the tightening financial environment.

The implications of these rising rates are profound, particularly in relation to the commercial real estate crisis. Mike Fratantoni, SVP and Chief Economist, remarked, "Given our forecast for interest rates and the broader economy, MBA is forecasting growth in commercial mortgage originations in the next two years. We expect an increase in originations across property types and capital sources, but certainly recognize the additional challenges posed by the large number of loans scheduled to mature in 2025." This insight underscores the necessity for stakeholders to recalibrate their strategies in response to evolving economic conditions.

Moreover, a recent survey revealed that 68% of commercial real estate executives anticipate increasing their mergers and acquisitions (M&A) activity in the coming year, emphasizing enhancements in organizational capabilities rather than merely expanding property portfolios. This shift illustrates how rising interest rates are influencing the commercial real estate crisis and reshaping the strategies of purchasers within the broader economic landscape.

Additionally, the correlation between interest rates and transaction volumes is evident; during the commercial real estate crisis, significant rate cuts typically stimulate sales volume, whereas hiking cycles tend to suppress it. Consequently, stakeholders must proactively explore alternative financing options, such as partnerships or private equity, to effectively navigate the challenges posed by high borrowing costs. Furthermore, the leading luxury second-home sectors to observe in 2025 have been identified, presenting additional opportunities for individuals seeking to diversify their portfolios.

By implementing these strategies, property investors can bolster their potential for success in a complex and dynamic market environment.

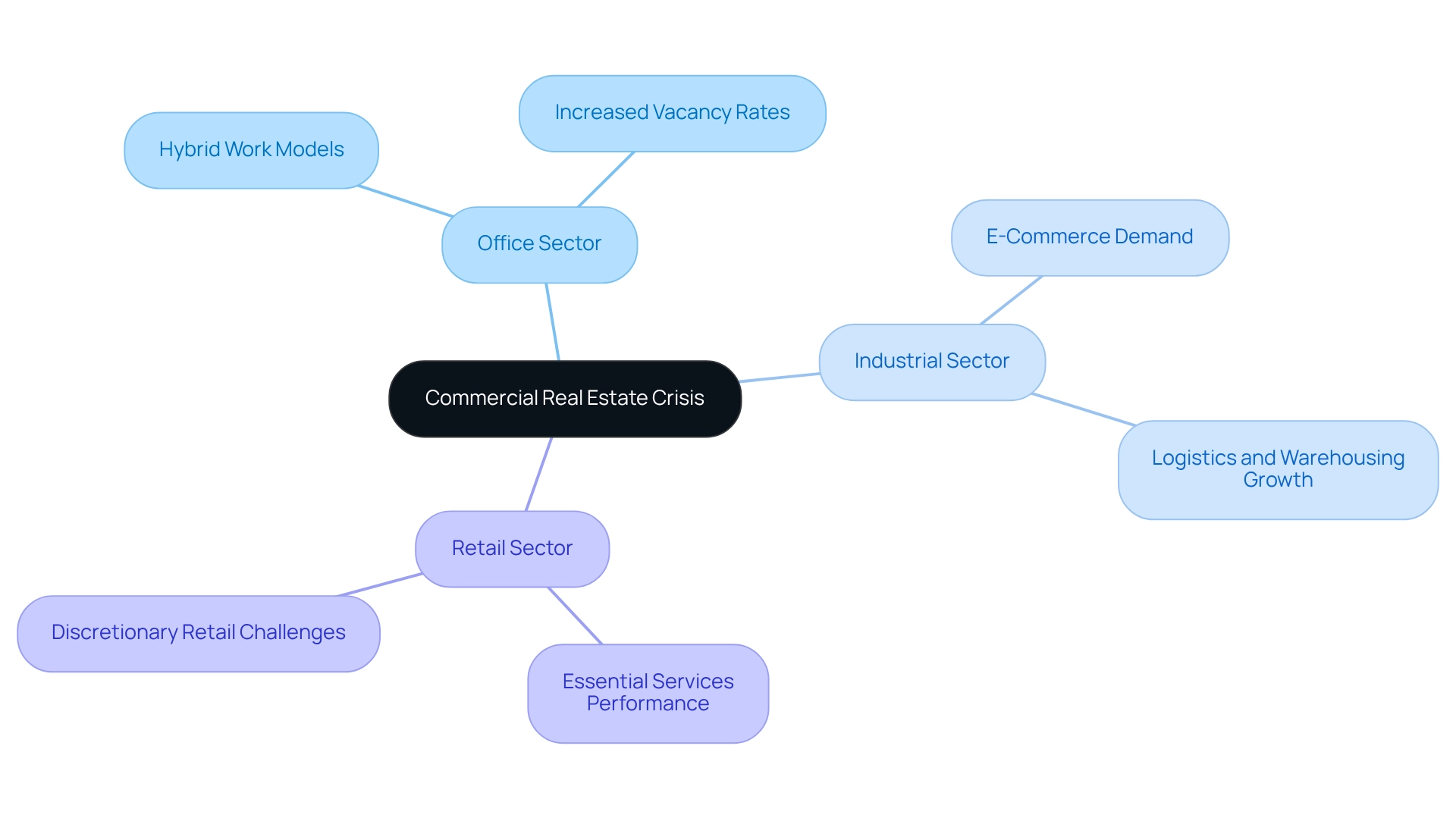

Sector-Specific Impacts: Who is Most Affected?

The ongoing commercial real estate crisis manifests in various forms across different sectors. The office sector faces substantial challenges, primarily driven by the widespread adoption of hybrid work models, leading to increased vacancy rates. In stark contrast, the industrial sector, particularly logistics and warehousing, is experiencing robust growth, fueled by the surge in e-commerce demand.

Retail properties present a more nuanced picture: essential services are performing well, while discretionary retail continues to encounter headwinds. Investors are encouraged to concentrate on sectors that exhibit resilience and adaptability in response to evolving consumer behaviors. As the landscape changes, recognizing opportunities within flourishing sectors, such as industrial property, can provide a strategic advantage. Furthermore, financial incentives and a reset of pricing structures will be crucial for making conversion projects financially viable, ensuring that investments align with market realities. This aligns with the key point that financial strategies must adapt to the current environment.

In 2023, the commercial real estate crisis has led to a significant rise in fraud attempts within the commercial property sector. Notably, 80% of organizations indicate they are targets of attempted or actual payments fraud, underscoring the need for caution in financial transactions. As Kathy Feucht, Global Property leader, remarked, "This year’s commercial property outlook seeks to assist leaders in overcoming the recent difficult years to improve their organizations' positioning for the future." As the industry navigates these complexities, understanding the specific impacts on each sector will be vital for making informed investment decisions.

The Zero Flux Newsletter serves as a vital resource for industry professionals, providing curated insights that help navigate these challenges effectively.

Opportunities Amidst the Crisis: Strategies for Investors

Amid the ongoing challenges of the commercial real estate crisis, discerning investors can uncover significant opportunities. One effective strategy within this context is to target distressed assets, which are frequently available at reduced prices. This approach not only facilitates immediate cost savings but also positions investors for potential value appreciation as the market stabilizes.

The newsletter curates 5-12 selected property insights daily, ensuring subscribers remain well-informed about these opportunities.

Furthermore, sectors such as logistics and healthcare are gaining recognition for their growth potential, rendering them attractive investment avenues. The logistics sector, in particular, is thriving due to the ongoing shift towards e-commerce, whereas healthcare real estate is supported by demographic trends and an aging population.

To further mitigate risks, diversifying investment portfolios is essential. This may involve exploring collaborations that enhance visibility and leverage shared resources. For example, partnering with firms specializing in distressed asset management can yield valuable insights and tailored strategies for navigating the complexities of the current environment.

As highlighted by Bethany Babcock, Founder & Principal of Foresite Commercial Real Estate, "They’re spending a lot more on finish-outs to create destinations within shopping centers," underscoring the trend towards enhancing consumer engagement in commercial spaces.

Moreover, the importance of proactive leadership succession planning in property management cannot be overstated, especially as a significant portion of the workforce approaches retirement. Organizations that prioritize knowledge-sharing and mentorship will be better equipped to manage leadership transitions and retain expertise within the company.

While there is general optimism regarding foreign investment in 2025, uncertainty persists, with most executives anticipating only slight increases. This broader economic perspective may influence investment strategies during the crisis. Additionally, addressing challenges in building a technically proficient workforce is crucial, as outdated compensation practices and reliance on legacy technologies can impede progress.

In summary, although the commercial property sector faces uncertainty due to the ongoing crisis, strategic investments in distressed assets and growth-oriented sectors can yield favorable returns, positioning investors advantageously for the future.

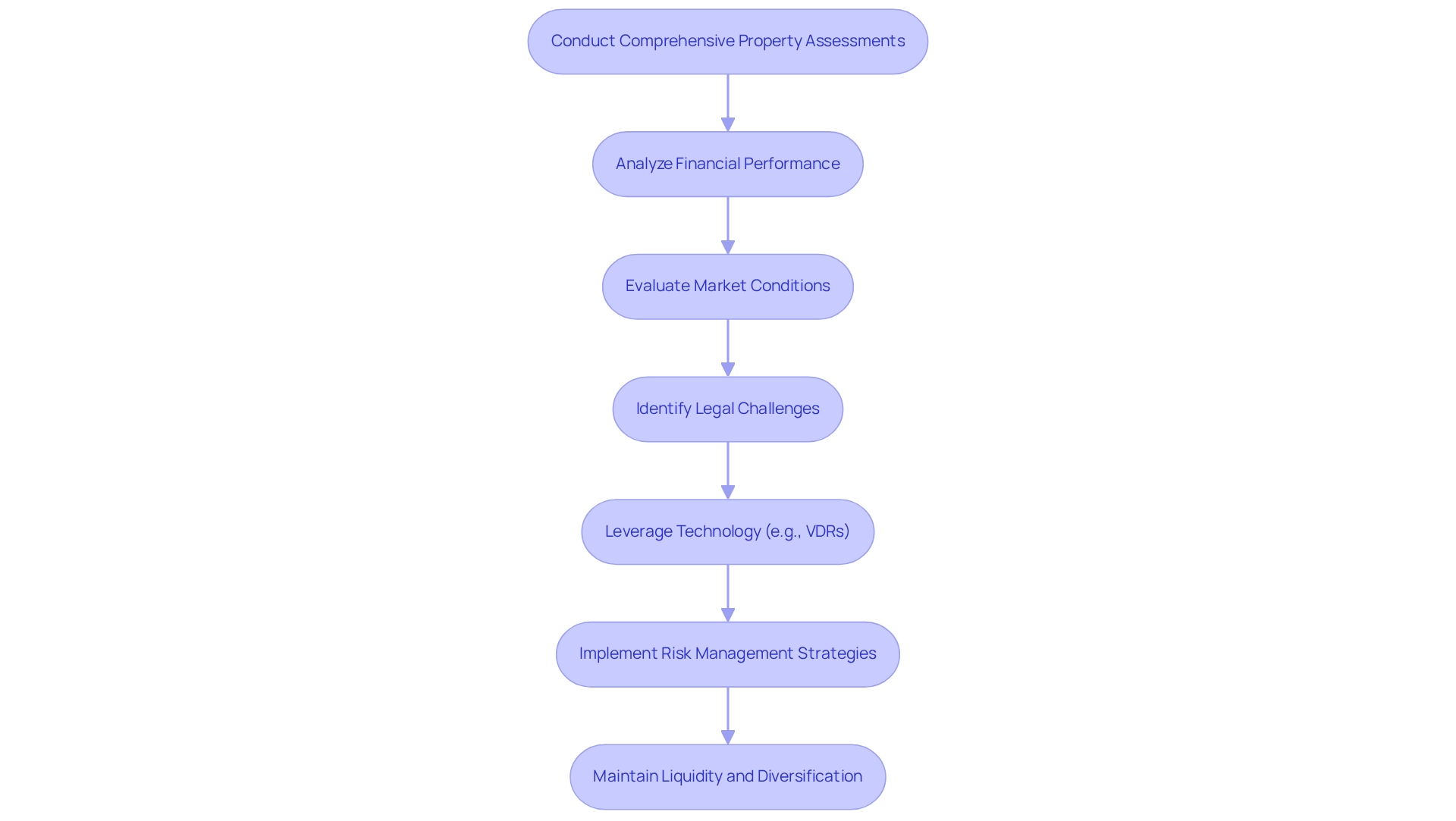

Due Diligence and Risk Management in a Volatile Market

In a fluctuating commercial property sector, the importance of thorough investigation cannot be overstated. Investors must conduct comprehensive property assessments that encompass financial performance, prevailing market conditions, and potential legal challenges. According to Deloitte’s 2025 commercial property outlook survey:

- 68% of respondents indicated that financing will be less costly.

- 69% stated that financing will be easier to acquire.

This data underscores the necessity for stakeholders to remain informed about financial conditions.

Leveraging technology and data analytics not only streamlines the due diligence process but also empowers investors to make more informed decisions. The incorporation of virtual data rooms (VDRs) has proven to enhance security and efficiency in managing crucial information during property transactions. This method ensures that all financial, legal, and physical elements are meticulously examined, as illustrated in the case study on the integration of VDRs in property due diligence.

Furthermore, implementing robust risk management strategies is essential for navigating potential downturns. Maintaining liquidity allows participants to respond swiftly to market fluctuations, while diversifying investments across different sectors can mitigate risks associated with any individual asset class. As the commercial real estate crisis unfolds, staying informed about best practices and emerging trends becomes imperative.

Ongoing education and career advancement are vital for individuals aiming to stay ahead in this rapidly evolving environment, ensuring they are well-prepared to tackle the challenges that may arise. This commitment to continuous learning aligns with Zero Flux's dedication to delivering quality content, which enhances subscriber engagement and establishes it as a trustworthy source for individuals navigating a fluctuating environment.

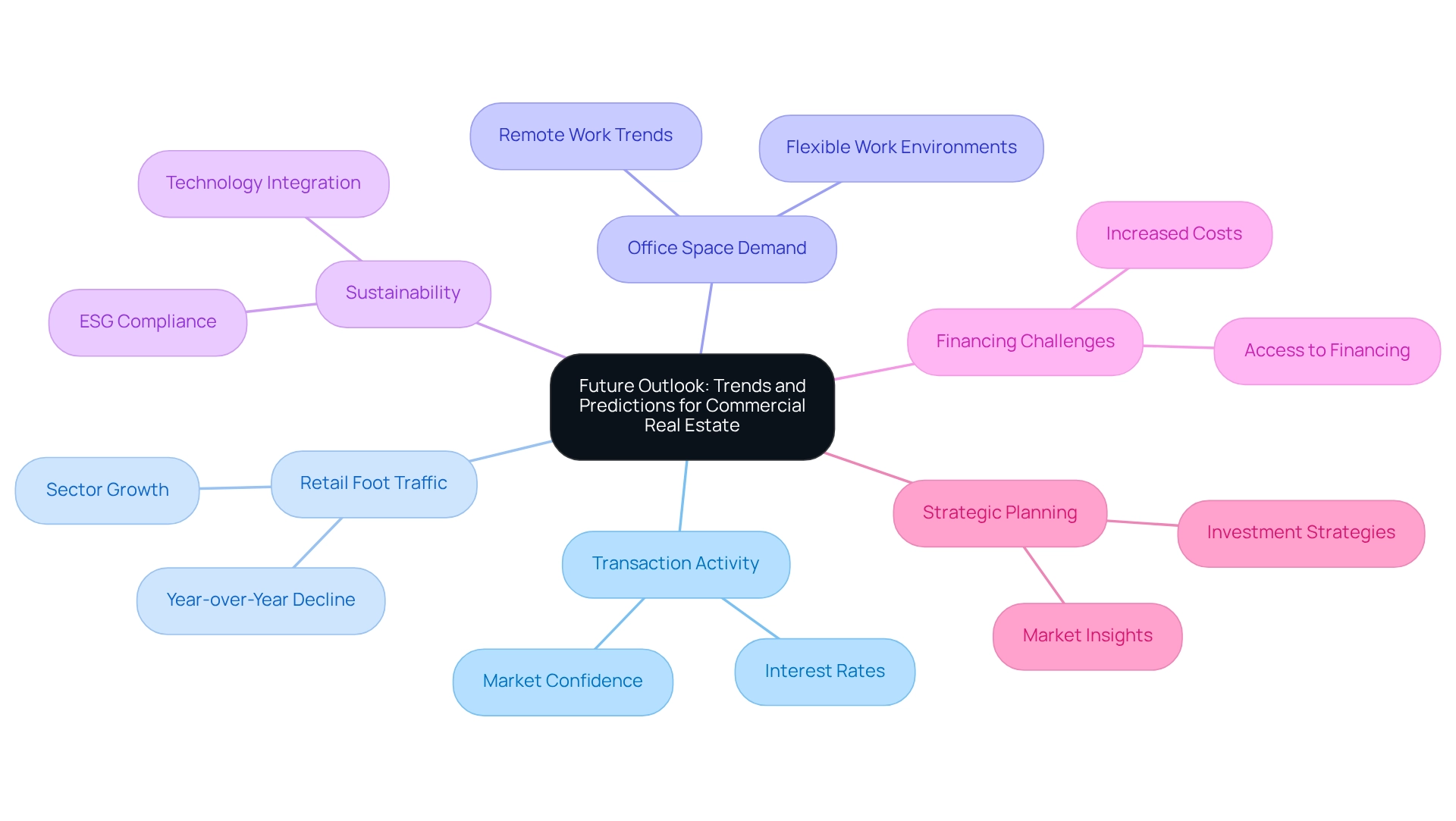

Future Outlook: Trends and Predictions for Commercial Real Estate

The commercial real estate crisis has set the stage for substantial transformation in the market in the coming years. As interest rates stabilize, there is a potential resurgence in confidence among financiers, which could lead to a notable uptick in transaction activity. However, it is important to note that retail foot traffic has declined by 12% year-over-year, despite the sector achieving 3.2% growth, indicating a complex environment for stakeholders.

The ongoing shift towards remote work continues to reshape the demand for office spaces, with a growing preference for flexible work environments that cater to diverse needs. This trend is not merely a temporary adjustment; it reflects a fundamental change in how businesses operate and utilize physical space. Moreover, sustainability and technology integration are set to become pivotal in future developments. Investors should be aware that nearly half of C-level executives surveyed by the Deloitte Center for Financial Services anticipate challenges in financing stemming from the commercial real estate crisis, with expectations that financing will be more expensive and difficult to obtain persisting into 2024.

This highlights the significance of strategic planning and flexibility in investment strategies. Looking forward to 2025, forecasts suggest that the commercial property sector will increasingly emphasize ESG compliance, although doubt persists about its effects on profitability. As the market evolves, staying informed about these trends will be essential for investors aiming to navigate the complexities of the commercial real estate crisis effectively. Case studies from industry leaders, such as Deloitte's experienced team, highlight the importance of leveraging insights and expertise to make informed decisions in this dynamic environment.

Conclusion

The commercial real estate market in 2025 presents a complex interplay of challenges and opportunities, significantly influenced by the enduring effects of the pandemic, rising interest rates, and evolving consumer behaviors. The office sector confronts elevated vacancy rates, a direct consequence of the shift towards remote work. In contrast, the industrial and retail sectors exhibit resilience, navigating through economic uncertainties. Investors must approach this cautious landscape with a strategic mindset, closely monitoring key indicators such as vacancy rates and rental prices to pinpoint viable opportunities.

Historical lessons from previous real estate crises underscore the necessity of thorough due diligence and robust risk management. Investors are advised to prioritize liquidity and diversify their portfolios, effectively mitigating risks linked to market fluctuations. Furthermore, the current environment highlights the imperative of adapting to technological advancements and sustainability goals, which are increasingly critical for success in the commercial real estate sector.

As the market evolves, identifying distressed assets and sectors poised for growth—such as logistics and healthcare—can furnish investors with a competitive edge. The integration of innovative solutions and proactive leadership strategies will be essential in positioning organizations for future success. Ultimately, staying informed about emerging trends and adopting a flexible approach will empower investors to adeptly navigate the complexities of the commercial real estate landscape, ensuring they are well-prepared for the opportunities that lie ahead.