Overview

The office real estate outlook for 2025 forecasts a gradual recovery in workspace demand, propelled by the growing trends towards flexible work environments, sustainability, and technological advancements. As businesses increasingly adapt to hybrid work models and emphasize high-quality workspaces, it is crucial to recognize that economic recovery and demographic shifts will significantly influence market dynamics. This evolving landscape presents both opportunities and challenges for investors and developers alike.

Investors should be aware that the shift towards flexible workspaces is not merely a trend but a fundamental change in how businesses operate. The demand for sustainable and technologically advanced environments is expected to rise, driven by the need for efficiency and employee satisfaction. As such, understanding these trends will be vital for making informed investment decisions.

In conclusion, the office real estate market in 2025 will be shaped by various factors, including the ongoing adaptation to hybrid models and the emphasis on quality. Stakeholders must remain vigilant and proactive in navigating this landscape, leveraging insights to capitalize on emerging opportunities while addressing potential challenges.

Introduction

As the world transitions into a post-pandemic era, the office real estate market is experiencing a significant transformation, driven by evolving work dynamics and changing tenant preferences. The outlook for 2025 presents a complex interplay of factors—economic recovery, demographic shifts, technological advancements, and sustainability initiatives. Stakeholders in the commercial real estate sector must navigate these influences to make informed decisions regarding:

- Property investments

- Leasing strategies

- Workspace design

With the rise of flexible office spaces and an increasing demand for high-quality environments, the landscape is rich with opportunities and challenges that will shape the future of office real estate.

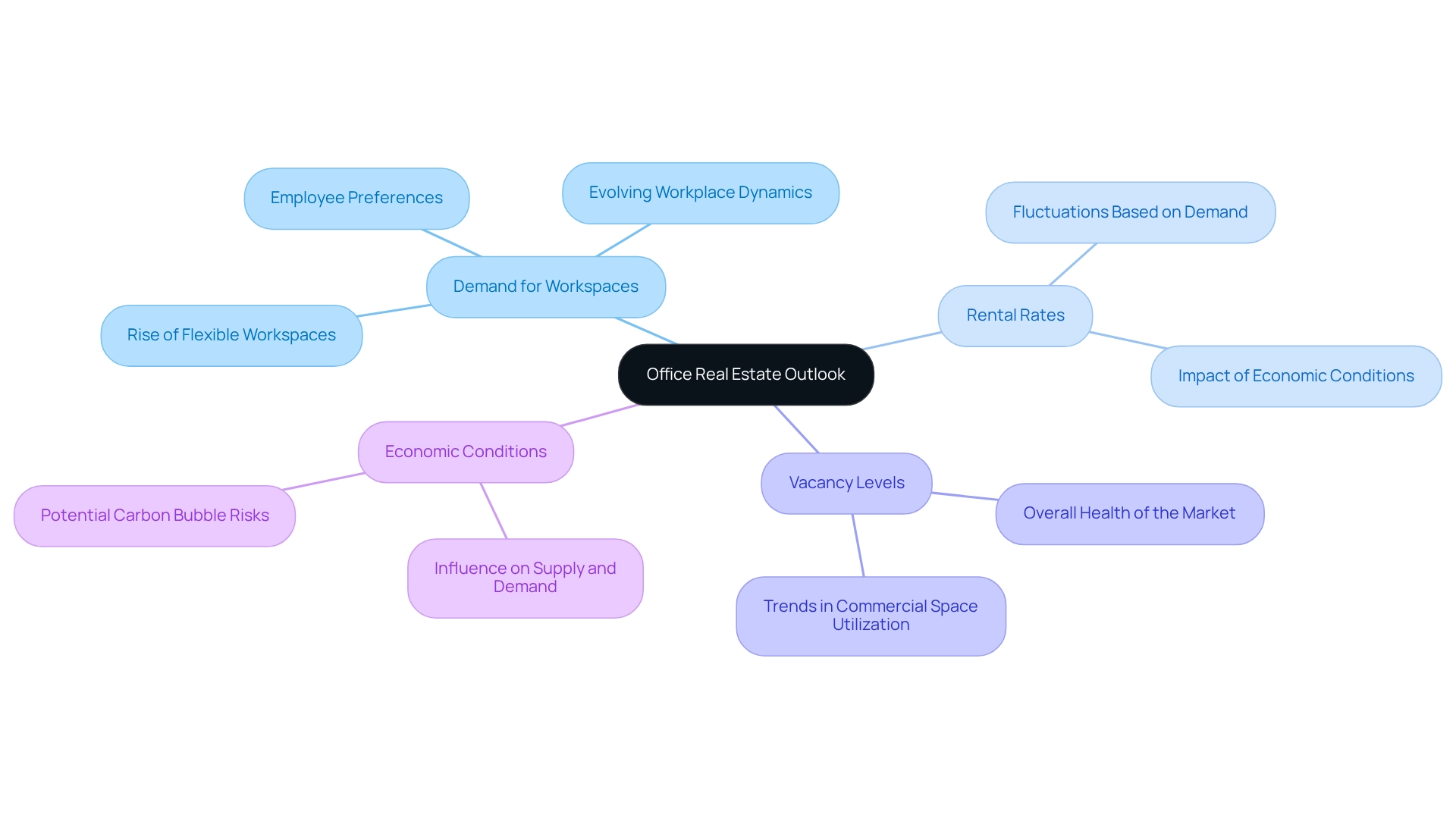

Define Office Real Estate Outlook

The office real estate outlook provides insights into anticipated trends, conditions, and dynamics that will shape the workspace market, particularly in 2025. Key elements include the demand for workspace, rental rates, vacancy levels, and the impact of economic conditions on the commercial sector. Understanding the office real estate outlook is essential for investors, developers, and enterprises as it informs their strategic decisions regarding property purchases, leasing, and investment opportunities within the commercial property landscape.

As we look ahead, the demand for flexible workspaces is expected to rise, influenced by evolving workplace dynamics and employee preferences. Rental rates may fluctuate based on these trends, while vacancy levels will reflect the overall health of the commercial market. Economic conditions will play a pivotal role, affecting both supply and demand across various sectors.

In conclusion, grasping the commercial property forecast equips stakeholders with the insights necessary to navigate the complexities of the market. By leveraging this information, investors and developers can make informed decisions that align with emerging trends, ultimately positioning themselves for success in the competitive commercial property arena.

Contextual Factors Influencing the 2025 Outlook

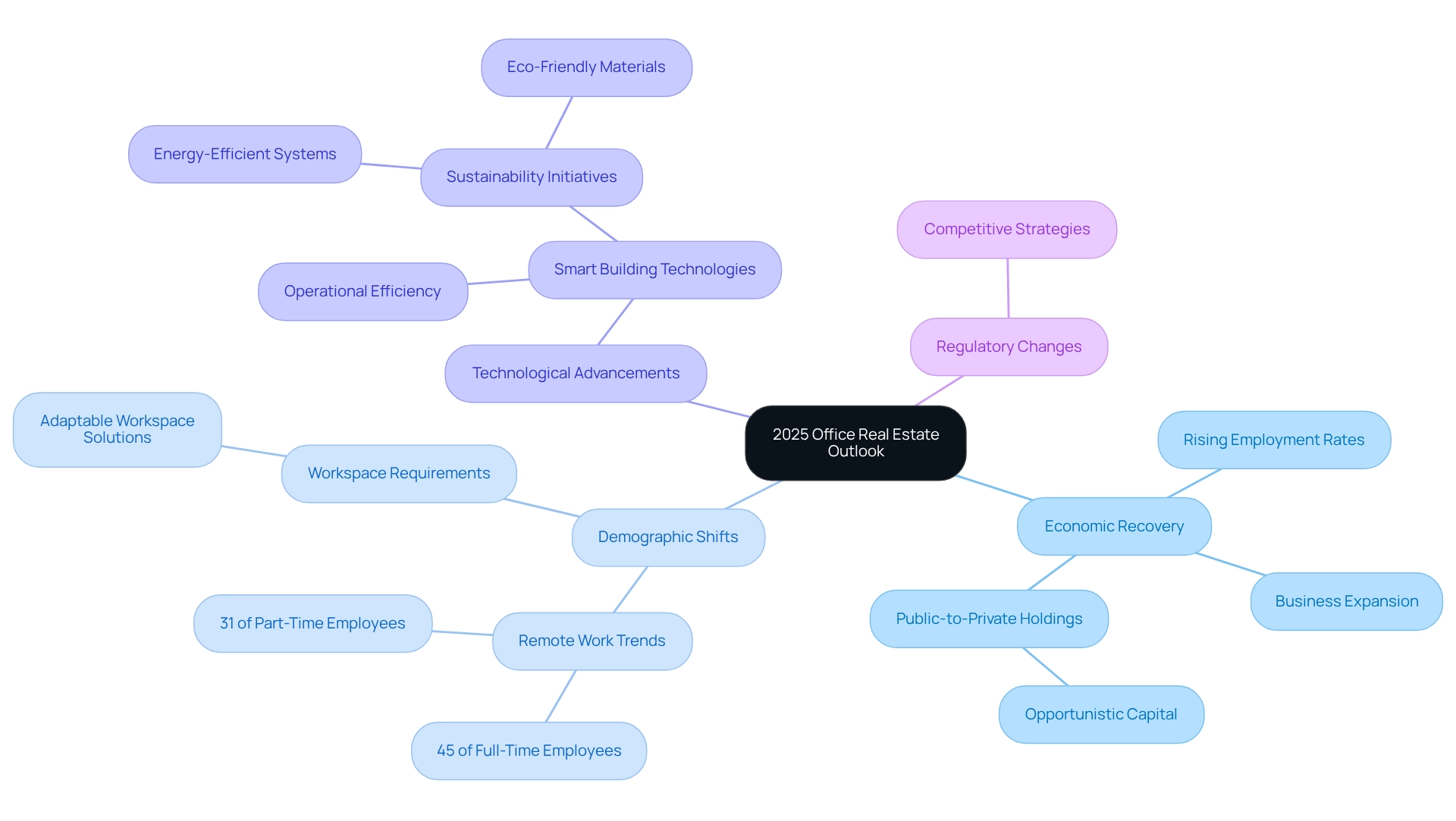

Multiple contextual elements are influencing the office real estate outlook for 2025. Economic recovery post-pandemic, marked by rising employment rates and business expansion, stands out as a significant driver. Public-to-private holdings are increasingly appealing to opportunistic capital amid market adjustments, potentially presenting new investment opportunities for real estate investors. Moreover, demographic shifts, particularly the rise of remote and hybrid work models, are reshaping workspace requirements. Studies reveal that:

- 45% of full-time employees with advanced degrees are more inclined to work remotely.

- 31% of part-time employees with advanced degrees are more inclined to work remotely.

This trend necessitates a reassessment of conventional workplace designs and the incorporation of adaptable workspace solutions to accommodate diverse working styles.

Technological advancements, including the integration of smart building technologies, are playing a pivotal role in transforming the workspace landscape. These innovations not only enhance operational efficiency but also align with sustainability initiatives, such as energy-efficient systems and eco-friendly materials. These factors are increasingly important to tenants. As landlords adapt their properties to meet these evolving expectations, overall market dynamics are shifting.

Furthermore, regulatory changes are compelling landlords to rethink their strategies, ensuring their offerings remain competitive in a rapidly changing environment. The interplay of these elements—economic recovery, demographic changes, technological integration, and regulatory adjustments—will significantly influence the office real estate outlook as we move towards 2025.

Key Trends Shaping the Office Market in 2025

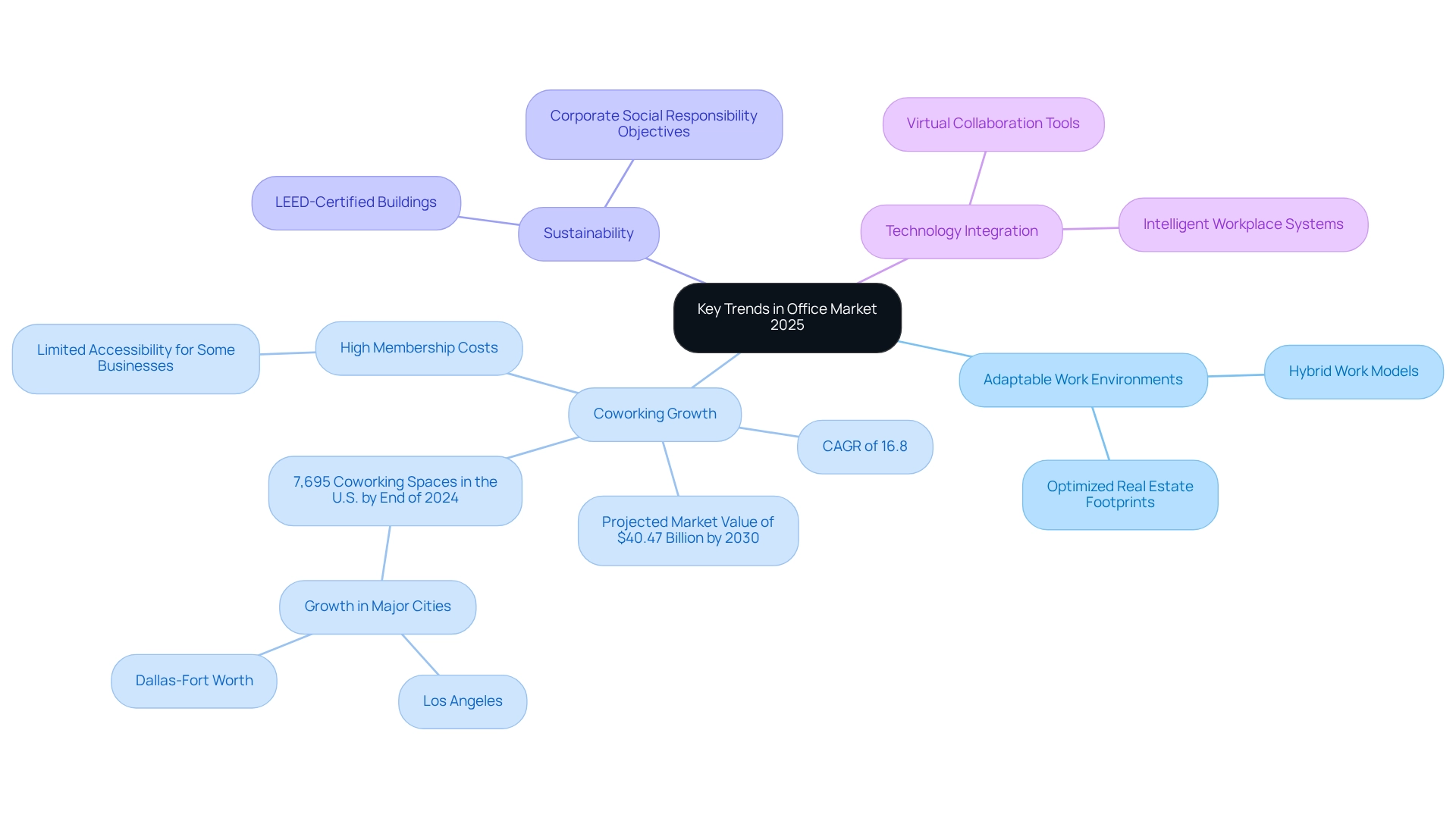

Significant trends are influencing the office real estate outlook for the workspace market in 2025. A prominent shift towards adaptable work environments is evident, as companies strive to optimize their real estate footprints in response to hybrid work models. This trend is underscored by the coworking sector, projected to grow at a compound annual growth rate (CAGR) of 16.8% from 2025 to 2029, with expectations to reach $40.47 billion by 2030, according to industry insights. As organizations seek to attract and retain talent, the demand for high-quality, amenity-rich workspaces is on the rise. However, it is crucial to recognize that high-end coworking environments often come with hefty memberships, which may restrict accessibility for some businesses, potentially hindering their ability to leverage these flexible work settings.

Moreover, sustainability is emerging as a priority, with numerous organizations pursuing LEED-certified buildings that align with their corporate social responsibility objectives. This shift not only enhances the appeal of workspaces but also contributes to a healthier work environment. Additionally, the integration of technology-driven solutions, such as virtual collaboration tools and intelligent workplace systems, is transforming the design and utilization of work environments, thereby enhancing productivity and employee satisfaction. By the end of 2024, the U.S. boasted 7,695 coworking spaces, with notable growth in major cities like Los Angeles and Dallas-Fort Worth, indicating a rising trend towards flexible work environments. As businesses navigate the complexities of the post-pandemic landscape, the office real estate outlook will be pivotal in shaping the future of commercial properties.

Predictions and Challenges for Office Real Estate in 2025

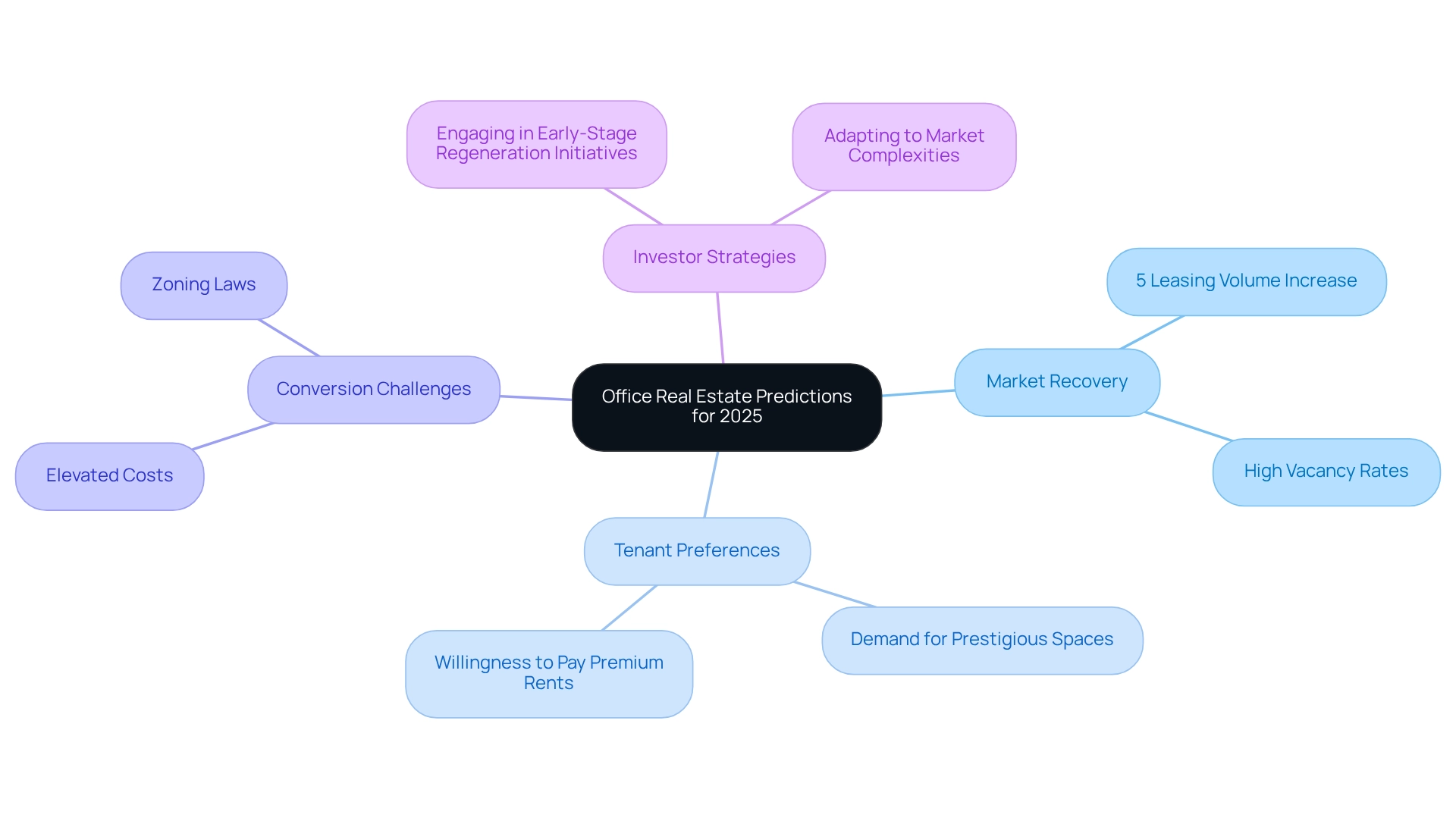

As we approach 2025, the commercial real estate market is poised for a complex landscape, brimming with both opportunities and challenges. Forecasts suggest a gradual recovery in workspace demand, with leasing volumes anticipated to rise by approximately 5% as businesses adapt to evolving work models. Notably, the active tenant pipeline in Manhattan exceeds its pre-pandemic average, illustrating a contrasting trend in this pivotal market. However, this recovery may be tempered by high vacancy rates in less desirable areas and the ongoing effects of remote work policies, which continue to reshape workplace dynamics.

Financial incentives and a reconfiguration of pricing structures will be crucial for the success of conversion projects, particularly as older commercial buildings struggle to compete with newer developments. The trend of converting outdated commercial structures into residential properties is gaining momentum, especially in urban areas facing housing shortages, as evidenced by the case study on outdated commercial buildings. Yet, challenges such as elevated conversion costs and zoning laws remain significant hurdles. Moreover, the demand for prestigious spaces is on the rise, with tenants increasingly willing to pay premium rents for high-quality work environments. This trend could potentially lead to a shortage of available inventory, as much of the existing stock becomes leased.

Investors must remain agile, adjusting their strategies to navigate these complexities while capitalizing on emerging opportunities in the evolving workspace. As Doug West notes, the emphasis on 'sophisticated sound management' will become a workplace priority, reflecting the broader shift towards collaborative workspaces and collective hubs. In summary, while the office real estate outlook indicates a gradual recovery for the market, stakeholders must be prepared to address the challenges posed by high vacancy rates, rising costs, and shifting tenant preferences to fully leverage the opportunities ahead. Savvy investors will need to engage in early-stage regeneration initiatives to effectively navigate this changing landscape.

Conclusion

The office real estate market is on the brink of a significant transformation, shaped by various factors that will influence its path through 2025. With economic recovery gaining momentum, the demand for office space is projected to gradually rebound, especially in prime locations where businesses are keen to adapt to hybrid work models. The emergence of flexible office environments and the increasing preference for high-quality, amenity-rich spaces highlight a crucial shift in tenant expectations, presenting both challenges and opportunities for stakeholders.

Technological advancements and sustainability initiatives are also central to this evolution. The integration of smart building technologies not only boosts operational efficiencies but also aligns with the rising demand for eco-friendly workspaces. As businesses prioritize corporate social responsibility, the pursuit of LEED-certified buildings will significantly impact market dynamics, making sustainability a vital consideration in future developments.

However, challenges persist. High vacancy rates in less desirable areas and the financial implications of converting older office spaces into appealing environments pose hurdles that necessitate innovative solutions. Investors and developers must remain agile, adopting new strategies to navigate this complex landscape while seizing emerging opportunities.

In summary, the outlook for office real estate in 2025 is marked by a blend of optimism and caution. Stakeholders must stay informed and adaptable, leveraging insights into market trends, tenant preferences, and technological advancements to thrive in this evolving environment. The ability to respond effectively to these changes will ultimately determine success in the future of office real estate.