Overview

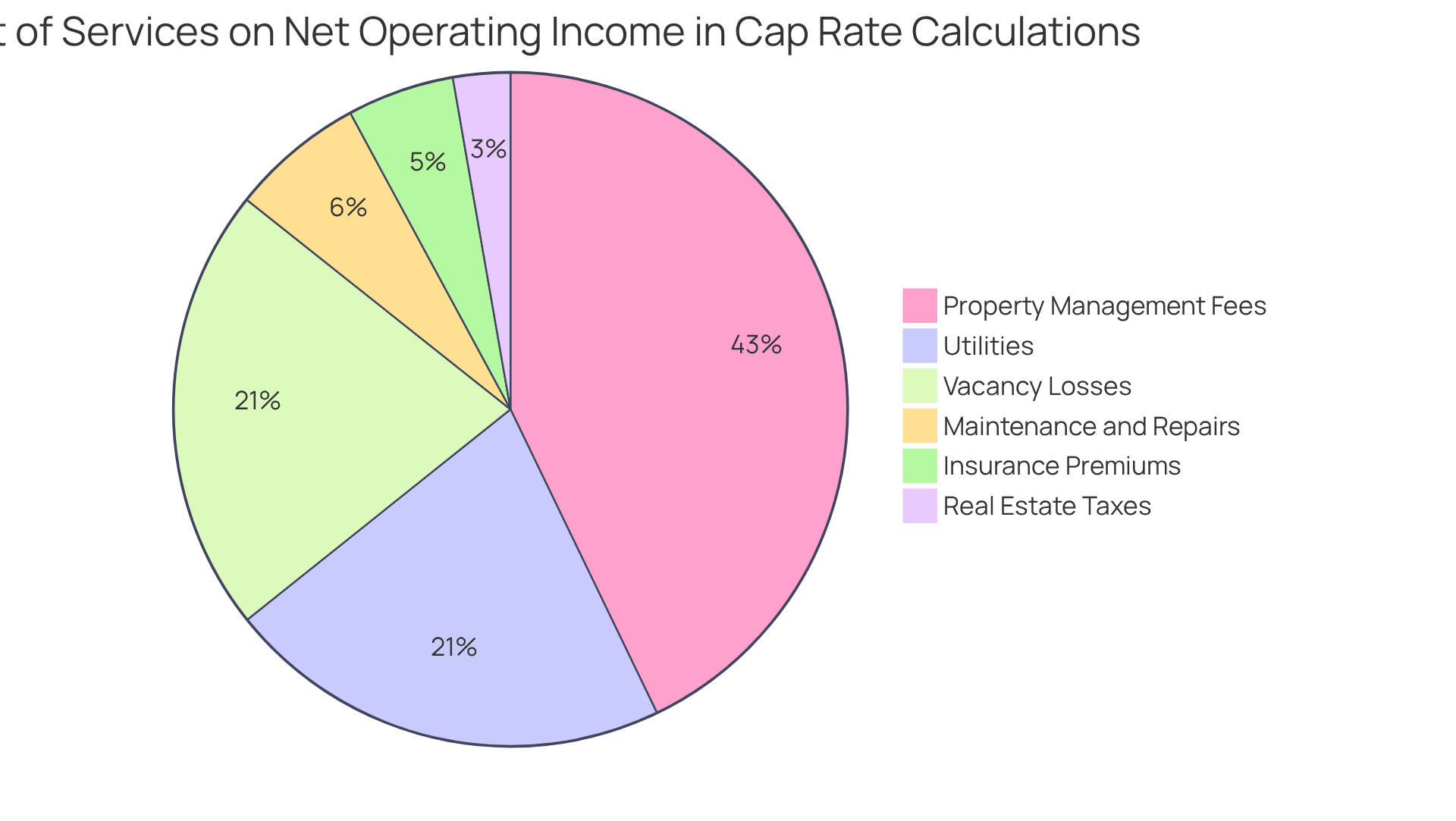

This article emphasizes the critical role of identifying services typically included in cap rate calculations, which is essential for accurately assessing a real estate investment's net operating income (NOI). Services such as:

- Property management fees

- Maintenance and repairs

- Real estate taxes

- Insurance premiums

- Utilities

- Vacancy losses

significantly impact the NOI and, consequently, the cap rate. Understanding these factors is vital for making informed investment decisions. By recognizing the influence of these services, investors can better navigate the complexities of real estate investments and enhance their strategies.

Introduction

Understanding the intricacies of real estate investment necessitates a firm grasp of the capitalization rate, commonly referred to as the cap rate. This essential metric not only provides insight into potential returns but also highlights the various services and costs that influence a property's net operating income (NOI). As investors delve into the complexities of cap rate calculations, they may ponder:

- Which specific services are typically included in these assessments?

- How do they impact overall investment viability?

By exploring these components, investors can make more informed decisions that align with their financial goals in an ever-evolving market.

Define Cap Rate: Understanding the Basics

The capitalization ratio, commonly referred to as the cap ratio, serves as a vital metric in real estate for assessing the potential return on an asset. This ratio is calculated by dividing the asset's net operating income (NOI) by its current market value or acquisition cost. Expressed as a percentage, the cap figure provides investors with a swift overview of the anticipated return from an asset, enabling straightforward comparisons across different investment opportunities. For example, if a real estate asset generates an NOI of $100,000 and is valued at $1,000,000, the capitalization percentage would be 10%. This metric is particularly advantageous for investors looking to evaluate the profitability of income-producing assets, such as commercial properties or rental homes.

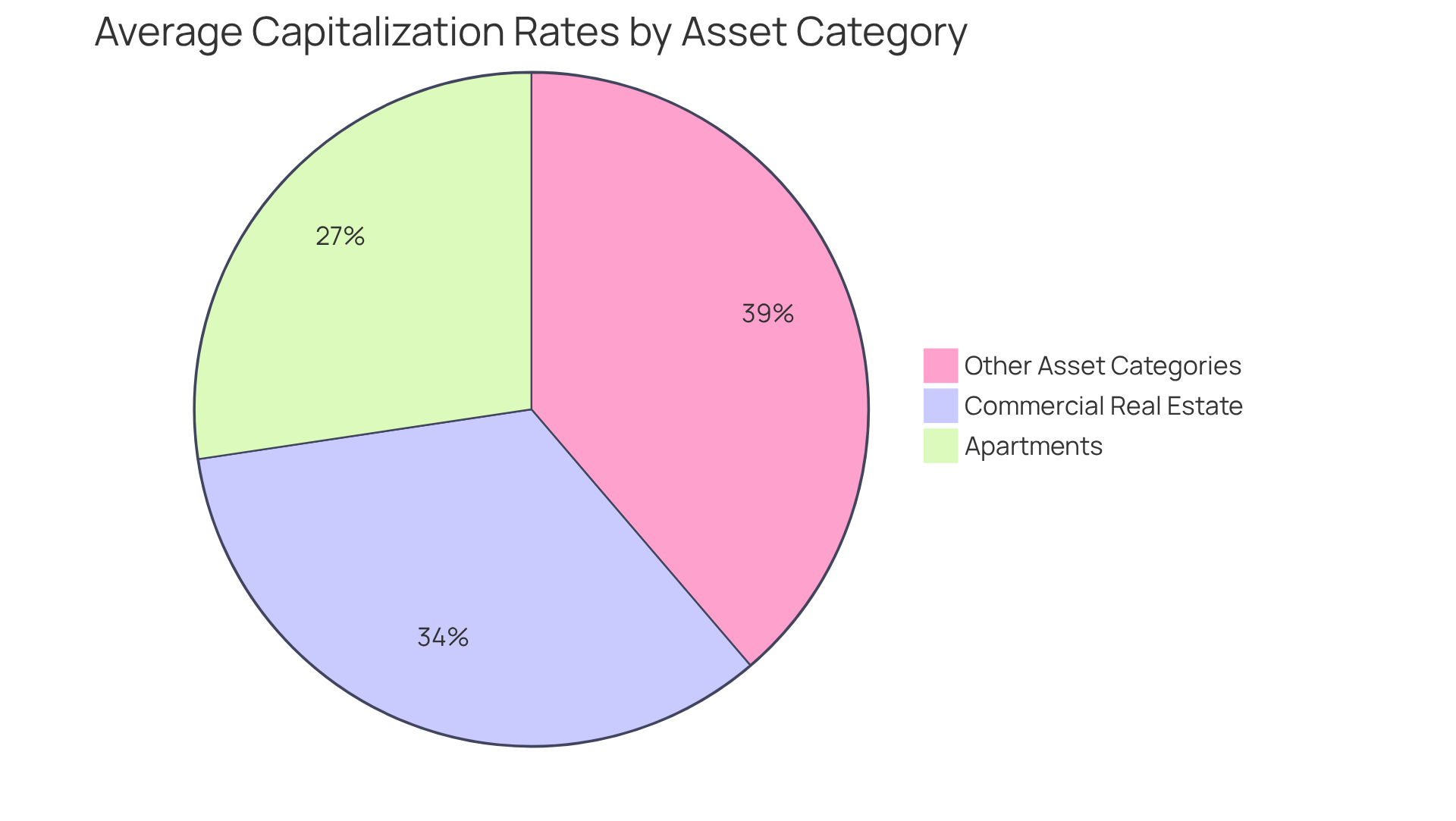

In 2025, average capitalization values across various asset categories reveal differing levels of risk and return. Notably, apartment deals have recorded capitalization averages of 5.65%, the lowest among major asset categories, indicating strong investor interest in this sector. Conversely, commercial real estate is experiencing higher capitalization percentages, which may signify increased risk due to market fluctuations, with asset values declining by 7% over the past year.

Understanding capitalization metrics is crucial for investors, as they not only reflect potential profitability but also aid in assessing the relative risk associated with different assets. A higher cap typically denotes a riskier investment, while a lower cap suggests a more stable opportunity with reduced risk. As John notes, the capitalization percentage for a property is generally expected to fall between 4% and 10%, depending on location and anticipated returns. As the real estate market evolves, particularly in light of recent trends and economic shifts, the capitalization figure remains an essential tool for making informed financial decisions. However, it is imperative to consider a broader range of metrics alongside the capitalization figure, as it should not be the sole indicator of an investment's viability.

Identify Services Included in Cap Rate Calculations

In cap rate calculations, it is important to identify which of the following services are typically included in the cap rate, as these services and costs significantly impact a real estate's net operating income (NOI). Understanding these components is essential for making informed investment decisions.

- Property Management Fees: These costs arise from hiring a management company to oversee the property, typically ranging from 8% to 12% of the monthly rent across various regions. This fee structure directly affects the NOI, as higher management costs diminish the income available to investors.

- Maintenance and Repairs: Regular upkeep is vital for preserving the asset's condition and can account for 1-2% of its value each year. Property management companies generally maintain a reserve of $250.00 per unit for minor repairs, which is crucial for accurate cap rate calculations.

- Real Estate Taxes: Local authorities impose taxes based on the asset's assessed value, which can vary significantly by area. For instance, in Tennessee, real estate taxes average approximately 0.64% of the assessed value, impacting overall profitability.

- Insurance Premiums: Costs for insuring the property against potential risks can range from $800 to $1,200 annually in Tennessee. The average cost of landlord insurance in the state is approximately $1,540 per year, providing a clearer financial context for investors.

- Utilities: Expenses for essential services such as water, electricity, and gas contribute to the overall operating costs and should be included in the NOI assessment.

- Vacancy Losses: This represents the estimated income lost due to unoccupied units, a critical factor in understanding potential revenue fluctuations. Incorporating data about typical vacancy levels can offer a more comprehensive perspective on their influence on NOI.

By meticulously considering these expenses, investors can achieve a more accurate NOI, which is vital for determining which of the following services are typically included in the cap rate and making informed investment choices. As the real estate management market is projected to expand considerably, grasping these dynamics will be increasingly important for investors in 2025 and beyond.

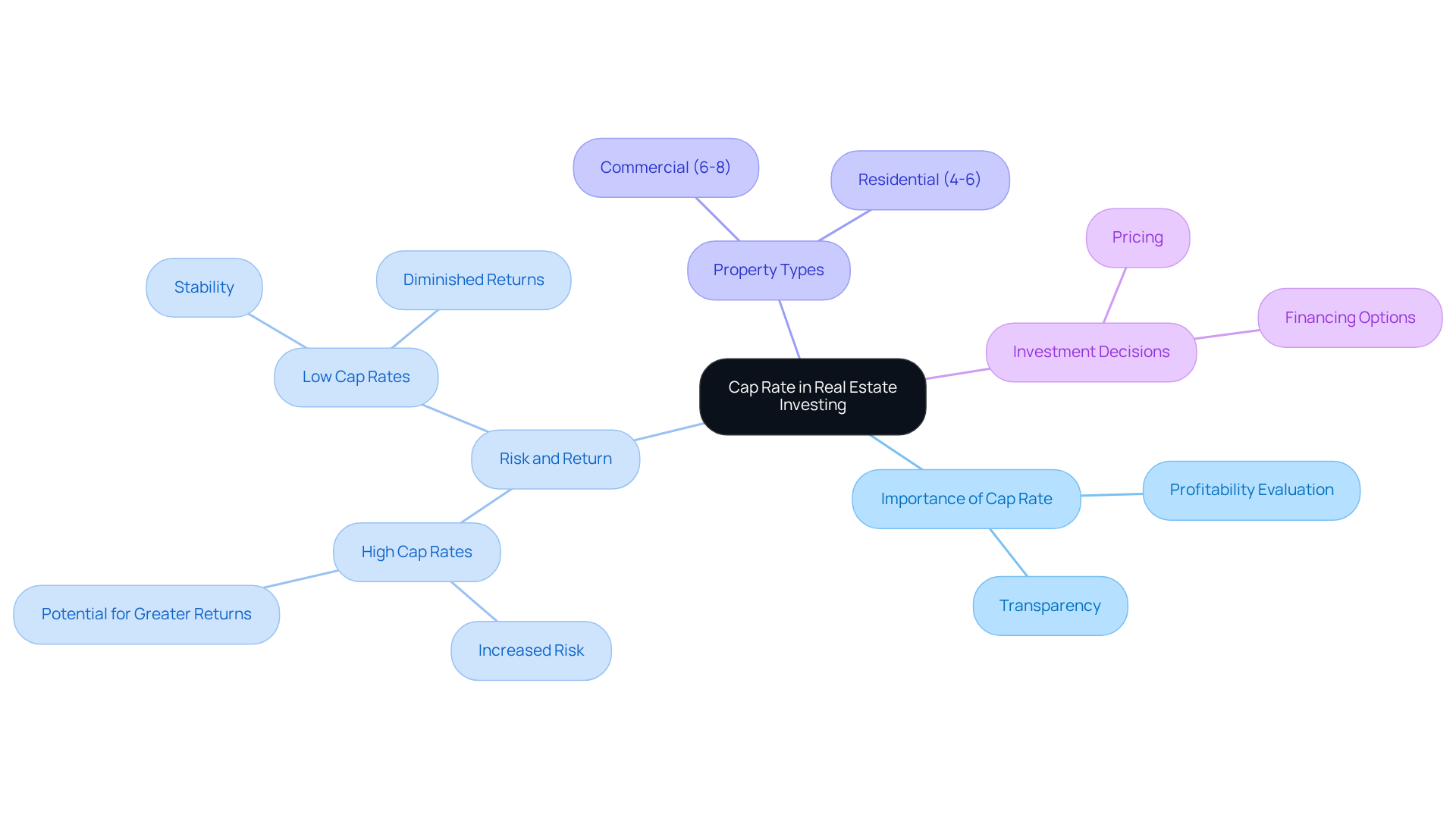

Explain the Importance of Cap Rate in Real Estate Investing

The cap percentage serves as a crucial metric for real estate investors, providing a transparent method for evaluating the profitability of diverse properties. By examining capitalization ratios among comparable assets, investors can pinpoint opportunities that may yield higher returns relative to their acquisition costs. Generally, a higher capitalization ratio signifies increased risk alongside the potential for greater returns, whereas a lower ratio indicates a more stable investment with diminished returns. For example, an asset generating $1 million in Net Operating Income (NOI) with a purchase cost of $10 million results in a cap of 10%. Conversely, an asset with a cap percentage of 8% is typically viewed as riskier than one with a cap percentage of 4%, prompting investors to carefully assess their risk tolerance in light of potential gains.

Looking ahead to 2025, average capitalization percentages for commercial real estate are projected to hover around 6-8%, while residential real estate may see figures between 4-6%. This differentiation underscores the varying risk profiles associated with different real estate types. Additionally, capitalization rates significantly influence decisions regarding real estate pricing, financing options, and overall investment strategy. However, it is imperative for investors to recognize that capitalization metrics do not account for critical factors such as tenant risk or lease structure, which raises the question of which of the following services are typically included in the cap rate to understand the security of rental income. Furthermore, capitalization ratios are not definitive indicators of property risk or quality, as numerous elements can impact them. Therefore, while cap measures provide a quick evaluation tool, they should be employed alongside other metrics for a comprehensive analysis of investment opportunities.

Discuss Limitations and Considerations of Cap Rates

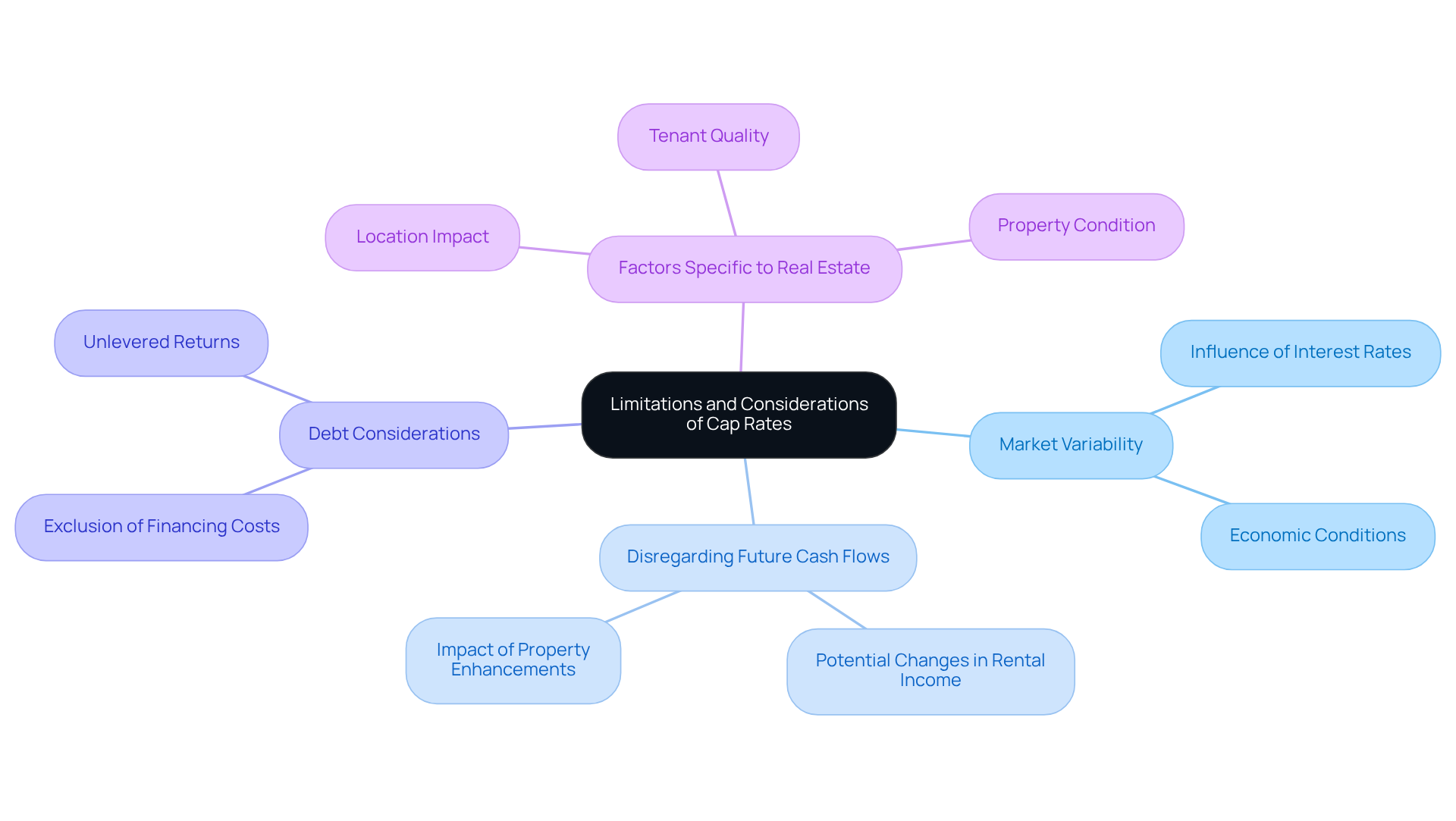

Capitalization values serve as a crucial metric for evaluating real estate investments, yet they come with inherent limitations that investors must navigate.

- Market Variability: Capitalization rates are influenced by fluctuations stemming from broader economic conditions. For instance, in 2025, rising interest rates may tighten capitalization rates, signaling increased borrowing costs and reduced demand for real estate. In contrast, low-interest environments can lead to compressed capitalization ratios, making it vital to understand these market dynamics for accurate cap ratio interpretation.

- Disregarding Future Cash Flows: Although capitalization rates provide insights based on current income and expenses, they overlook potential future changes in rental income, property values, or operating costs. Additionally, capitalization ratios do not account for possible future enhancements to an asset, which could significantly impact upcoming cash flows. Investors should evaluate how anticipated market trends and property improvements might influence their returns.

- Debt Considerations: Capitalization percentages exclude financing costs, which can dramatically alter an investor's actual return on investment. It is essential to recognize that capitalization figures represent unlevered returns, meaning they do not factor in debt financing. Properties with lower capitalization percentages may appear less attractive; however, favorable financing conditions can enhance their appeal, underscoring the importance of assessing leverage's effect on total returns.

- Factors Specific to Real Estate: Unique characteristics such as location, tenant quality, and property condition can significantly influence capitalization rates. For example, a property situated in a high-demand area may command a lower capitalization due to its desirability, while a comparable property in a less favorable location may demonstrate a higher capitalization, reflecting increased risk. Furthermore, lease structures and tenant quality can impact income stability, complicating cap assessments.

To effectively navigate these complexities, investors should regard cap rates as one of several analytical tools, supplementing them with additional metrics like cash-on-cash return and internal rate of return. This multifaceted strategy fosters a more thorough understanding of an investment's potential, facilitating informed decision-making in the ever-evolving real estate landscape.

Conclusion

Understanding the capitalization rate, or cap rate, is crucial for investors navigating the real estate landscape. This metric not only provides insight into potential returns but also serves as a compass for assessing the risk associated with various assets. By grasping the intricacies of cap rate calculations and the services that impact net operating income (NOI), investors can make informed decisions that align with their financial goals.

Key components such as property management fees, maintenance costs, real estate taxes, insurance premiums, utilities, and vacancy losses significantly shape the net operating income. Each of these elements affects the overall profitability of an investment, underscoring the importance of a thorough understanding of what is included in cap rate calculations. Recognizing the nuances of these services enables investors to achieve a more accurate assessment of their potential returns and risks.

Ultimately, while the cap rate serves as a foundational tool in real estate investing, it should not be the sole metric relied upon. Investors are encouraged to consider additional factors, such as market variability, future cash flows, and unique property characteristics, to gain a comprehensive view of an investment's potential. By embracing a multifaceted approach to investment analysis, one can navigate the complexities of the real estate market with greater confidence and clarity, ensuring that each decision is informed by a thorough understanding of both risks and rewards.