Overview

This article identifies the most promising real estate markets for investment in 2025, spotlighting cities such as Fayetteville, Raleigh, and Phoenix. Each market undergoes a thorough analysis based on critical factors like economic growth, job opportunities, and housing demand. Investors are equipped with valuable insights into the potential for appreciation and the favorable conditions for property investment.

By examining these key markets, readers can better understand the dynamics at play. For instance, the economic growth trends in Fayetteville may suggest a robust future for property values. Similarly, the job opportunities in Raleigh are likely to attract new residents, further driving housing demand.

Ultimately, this analysis serves as a guide for investors looking to make informed decisions. With the right information, you can position yourself strategically in these emerging markets, capitalizing on their growth potential. Take action now to explore these opportunities and enhance your investment strategy.

Introduction

In the dynamic realm of real estate investment, certain cities are emerging as prime hotspots, each presenting unique opportunities for discerning investors. From the vibrant growth of Fayetteville, Arkansas, to the cultural richness of Nashville, Tennessee, the year 2025 is poised to be a pivotal moment for those eager to capitalize on market trends.

As economic factors drive demand and home prices fluctuate, grasping the intricacies of these markets becomes essential. This article explores key cities across the United States that are primed for remarkable growth, offering insights into their real estate potential and the strategies investors can employ to navigate these promising terrains.

Whether it's tapping into the tech-driven job market in Raleigh or exploring the diverse options in Atlanta, these locales present exciting prospects for both seasoned and novice investors alike.

Zero Flux: Daily Insights on Real Estate Market Trends

Zero Flux serves as an authoritative daily newsletter that delivers essential property industry trends and insights. By aggregating information from over 100 diverse sources, including premium content, Zero Flux equips subscribers with a comprehensive overview of the latest developments in the real estate sector.

Committed to providing accurate and unbiased information, the newsletter stands as a vital resource for industry professionals and enthusiasts who seek to stay informed about market dynamics.

Subscribers benefit from a concise format that allows for quick comprehension of the most pertinent information shaping the property landscape, making it indispensable for navigating the complexities of the industry.

Fayetteville, Arkansas: A Prime Fix-and-Flip Market

Fayetteville, Arkansas, stands out as a premier destination for fix-and-flip investments in 2025. This city boasts a unique combination of steady university-driven demand and strong economic growth, positioning it among the best real estate markets to invest in.

Properties in Fayetteville are moving quickly, often selling within just 11 days on the market—significantly faster than the national average. Furthermore, with a median home price increase of 3.8% over the past year, investors can anticipate substantial returns on their renovations.

As such, Fayetteville is undeniably one of the best real estate markets to invest in for those eager to capitalize on property flipping opportunities.

Raleigh, North Carolina: Emerging Investment Opportunities

Raleigh, North Carolina, is emerging as one of the best real estate markets to invest in by 2025. The city's thriving job market, particularly in the technology and education sectors, serves as a significant driver of population growth, attracting a steady influx of new residents. With home prices expected to rise by 4-6% each year, based on Zero Flux's latest insights, individuals have a prime opportunity to capitalize on the growing demand for housing. Raleigh's diverse neighborhoods present a range of opportunities, from single-family homes to multi-family units, catering to both novice and seasoned investors.

Expert insights indicate that the strong job environment is directly impacting housing demand. Analysts have observed a significant connection between employment growth and property investment potential. Phil Slezak, a real estate agent, emphasizes, "As AI-Certified Agents, we utilize advanced technology to deliver precise, data-informed insights on conditions and enhance your buying or selling approach." This perspective underscores the notion that as the city continues to grow, the need for housing is expected to remain elevated, making Raleigh a desirable choice for individuals seeking to benefit from the evolving economic landscape.

Successful financial strategies in Raleigh for 2025 involve focusing on emerging neighborhoods undergoing revitalization and growth. Investors are advised to conduct thorough market research and leverage data-driven insights to identify the best opportunities. For instance, a recent case study highlighted a substantial return in a revitalized area, showcasing the potential for profitable outcomes. While the allure of high-risk ventures is apparent, it is crucial for individuals to assess the risks in relation to potential gains. Overall, the combination of a robust employment landscape, increasing home values, and diverse financial opportunities makes Raleigh, North Carolina, one of the best real estate markets to invest in for the upcoming year.

Phoenix, Arizona: A Hotspot for Real Estate Investment

Phoenix, Arizona, is considered one of the best real estate markets to invest in for 2025, even amidst recent fluctuations in home prices. The city's economy is thriving, driven by substantial job growth in pivotal sectors like technology and healthcare, which continues to fuel housing demand. While home prices have seen a decrease of 2.6% over the past year, conditions are expected to stabilize and recover as inventory levels normalize.

Experts suggest that a 20% adjustment in the housing sector is plausible if inventory continues to rise; this presents a unique opportunity for buyers to enter the market at potentially lower prices. Daryl Fairweather, Chief Economist at Redfin, emphasizes, "Don’t buy more than you can afford. Make sure you can continue to afford your housing payments through a rough patch like a job loss or health emergency." This perspective is essential for investors navigating the current landscape.

The outlook for potential buyers is optimistic; as the market adjusts, conditions are anticipated to improve over the next 12 months, offering more favorable purchasing opportunities. The case study titled "Future Outlook for Phoenix Buyers" indicates that as the housing market corrects, buyers should exercise patience, with expectations that the market will become increasingly favorable, leading to more opportunities to purchase homes at reduced prices.

Investors are particularly attracted to Phoenix, as it is considered one of the best real estate markets to invest in due to its potential for long-term growth and strong rental returns, making it a strategic choice for those looking to navigate the complexities of the current property market.

Atlanta, Georgia: A Diverse and Growing Market

Atlanta, Georgia, is poised for significant expansion in 2025, establishing itself as a prime location for real estate stakeholders. The city's economy is notably diverse, with key sectors such as film, technology, and logistics driving job creation. In 2023, Atlanta's job growth rate reached 2.5%, significantly outpacing the national average by 47%. This statistic serves as a strong indicator of the city's economic vitality.

Investors can anticipate a steady increase in home prices, projected to rise between 3% and 6% annually. This trend reflects Atlanta's ongoing appeal as both a residential and commercial hub, promising solid returns. The city's lively neighborhoods, diverse cultural amenities, and increasing population further enhance its attractiveness for financial opportunities.

The RealWealth Investment Club exemplifies successful financial strategies in Atlanta, connecting investors with vetted resources such as lenders and turnkey providers. This network streamlines the funding process, enabling members to gain valuable insights and opportunities in the field, including turnkey rental pro formas for potential ventures. As Kathy Fettke, co-founder of RealWealth, emphasizes, the club's mission is to simplify real estate investing by providing essential connections and resources, especially in the best real estate markets to invest in, such as Atlanta, which offers numerous investment opportunities for 2025 across both residential and commercial properties. Real estate experts highlight the city's unique combination of growth potential and cultural richness, making it one of the best real estate markets to invest in for both seasoned investors and newcomers alike.

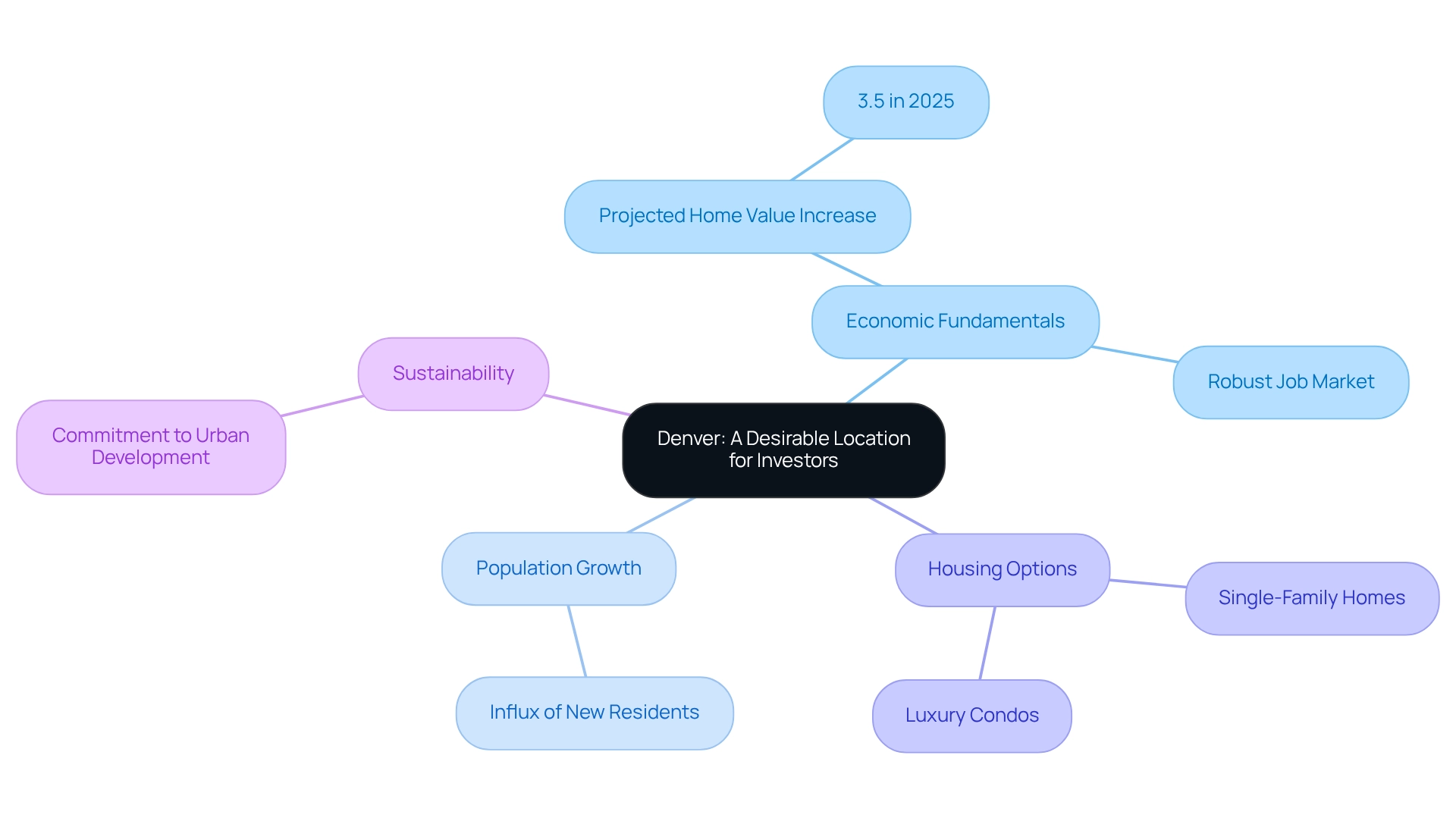

Denver, Colorado: A Desirable Location for Investors

In 2025, Denver, Colorado, remains one of the best real estate markets to invest in, thanks to its strong economic fundamentals and significant population growth. With the city's average home value projected to rise by 3.5% this year, fueled by a robust job market and an influx of new residents, it stands out as one of the best real estate markets to invest in.

Investors will find a diverse array of housing options in Denver, from single-family homes to luxury condos, catering to various buyer demographics. Furthermore, the city's commitment to sustainability and urban development enhances its appeal, positioning it among the best real estate markets to invest in, making it an attractive choice for those looking to capitalize on the market.

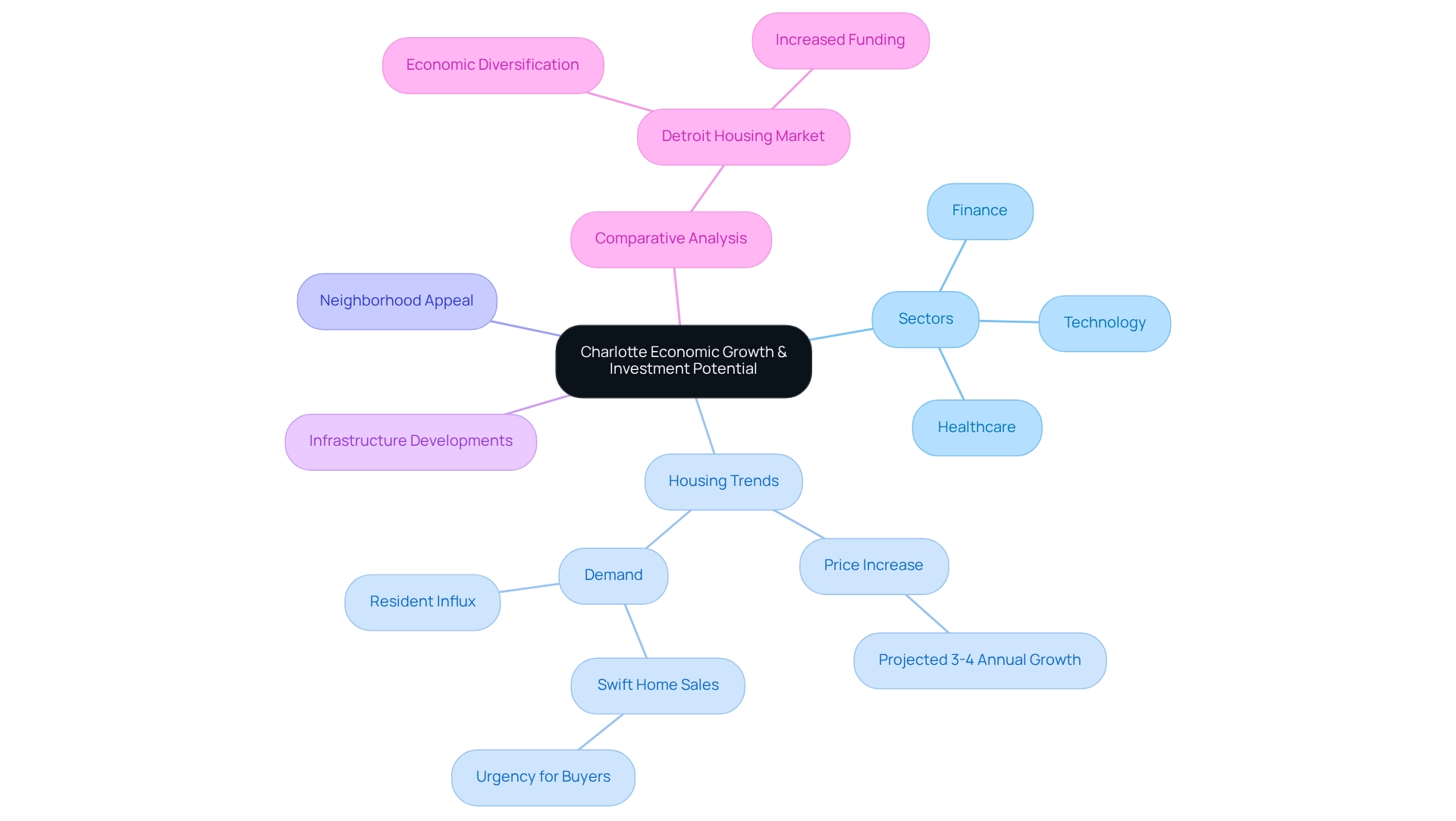

Charlotte, North Carolina: Economic Growth and Investment Potential

Charlotte, North Carolina, stands on the precipice of significant economic growth in 2025, establishing itself as one of the best real estate markets to invest in. The city's economy, marked by a robust blend of finance, technology, and healthcare sectors, is drawing an influx of new residents and businesses. Recent market analyses project home prices to rise by 3-4% annually, underscoring the escalating demand for housing in the area. This trend is further emphasized by the observation that many homes in Charlotte are selling swiftly; as Zero Flux notes, "Many homes in Charlotte are selling fast; if you're buying, plan to act quickly," highlighting the urgency for potential buyers to respond without delay.

The vibrant neighborhoods of Charlotte, combined with ongoing infrastructure developments, enhance its investment appeal. Experts highlight the city's economic resilience and the potential for lucrative real estate opportunities, indicating it is among the best real estate markets to invest in, particularly as demographic shifts increasingly favor urban living. Furthermore, housing demand trends indicate a robust sector, with statistics showing a steady influx of new residents seeking housing options.

Case studies, such as the recent analysis of the Detroit housing market, suggest that similar growth patterns can be anticipated in Charlotte. The elements contributing to Detroit's revival—economic diversification and increased funding—are mirrored in Charlotte, establishing it as a critical region for capital allocation in the coming years. As the city continues to evolve, investors are encouraged to explore the best real estate markets to invest in, including the diverse opportunities within Charlotte's property market.

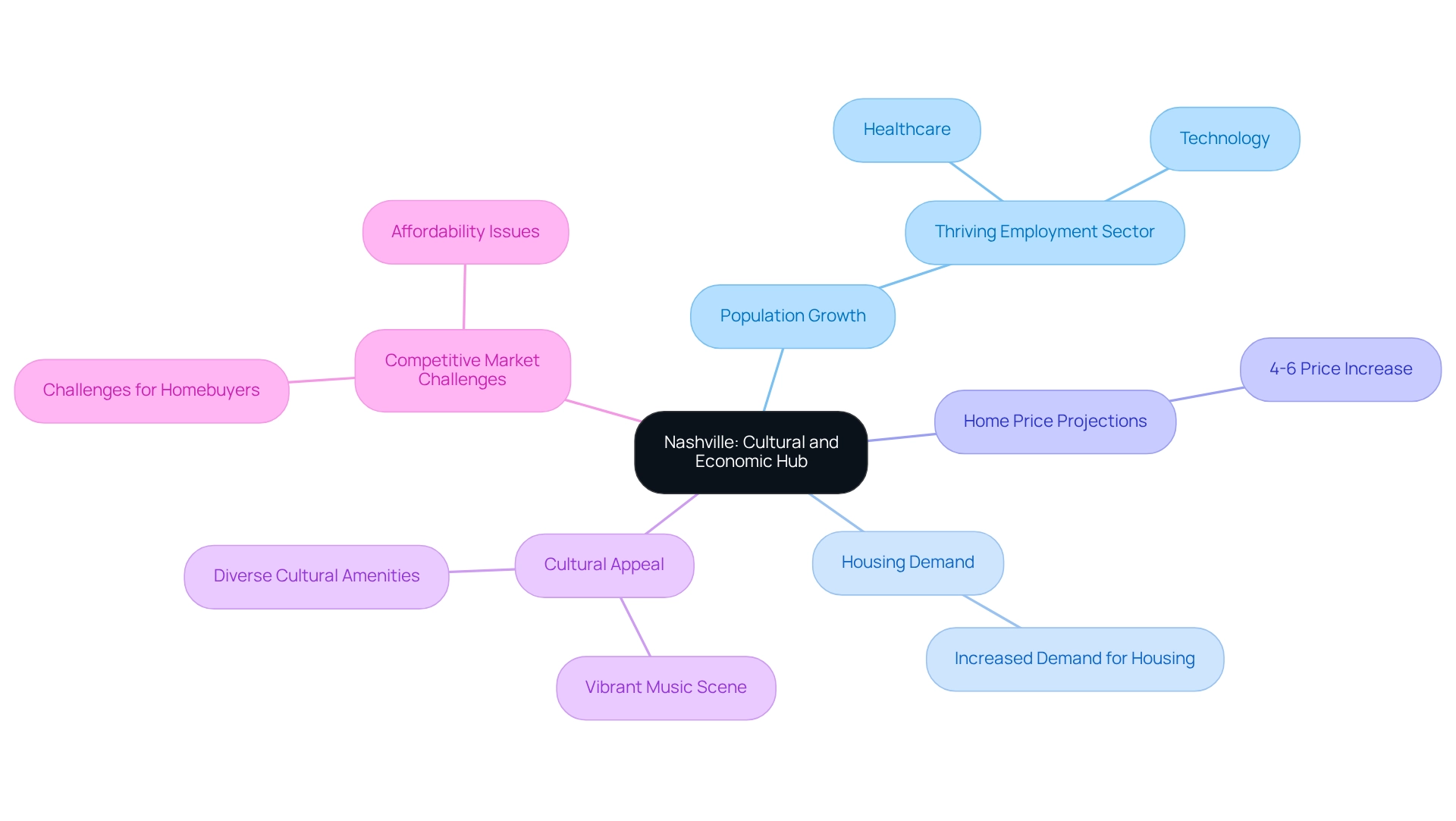

Nashville, Tennessee: A Cultural and Economic Hub

Nashville, Tennessee, emerges as a cultural and economic powerhouse, establishing itself as one of the best real estate markets to invest in by 2025. The city is experiencing significant population growth, primarily fueled by a thriving employment sector in healthcare and technology, which in turn drives the demand for housing. Projections indicate that home prices are set to rise by 4-6% this year, presenting individuals with substantial opportunities for appreciation. Moreover, Nashville's vibrant music scene and diverse cultural amenities not only enhance its appeal to potential residents but also attract tourists, further invigorating the local economy.

According to the case study titled 'Strategic Decision-Making in Real Estate,' grasping key factors such as industry analysis is vital for making informed investment decisions. This framework can guide investors in effectively navigating Nashville's dynamic landscape. Furthermore, professional insights from the Music City Group of Benchmark Realty underscore the importance of recognizing the competitive characteristics of the industry. As Edd Ehsan Hamzanlui notes, 'it is crucial to recognize the challenges posed by the competitive environment, especially for prospective homebuyers who might face difficulties in finding affordable housing in certain areas of the city. As the city continues to evolve, the combination of these elements fortifies Nashville's position as one of the best real estate markets to invest in, making it an ideal location for astute individuals seeking to capitalize on emerging trends.

Tampa, Florida: A Growing Market with Favorable Conditions

Tampa, Florida, is rapidly emerging as one of the best real estate markets to invest in for 2025, distinguished by favorable conditions for both purchasers and stakeholders. The city's average home value is anticipated to increase by 3.2% annually, propelled by a robust employment landscape and a growing population. Notably, the median sold price for 5+ bedroom homes remains steady at $916.8K, establishing a clear price point for potential investors. This upward trajectory is underscored by recent data, revealing that 51% of homes sold in March 2025 were listed for less than 30 days, indicative of a brisk real estate environment.

Investors are drawn to Tampa's diverse housing options and a thriving rental market, making it an attractive choice for both short-term and long-term opportunities. Continuous infrastructure upgrades, such as enhancements to the Selmon Expressway that will introduce advanced technologies to improve traffic flow, further bolster the city's appeal for investment. Additionally, economic development initiatives are paving the way for sustained growth, positioning Tampa as a significant player in the real estate landscape.

As the industry evolves, staying informed about regional trends and financial prospects is crucial. Experts emphasize the increasing demand for housing in Tampa, highlighting the necessity of strategic investment approaches tailored to the city's unique dynamics. Brian Porter notes that "Water Street Tampa is reshaping the city's waterfront with new residential, commercial, and public spaces," underscoring the transformative developments underway. Furthermore, the case study titled "Breakdown of Home Sale Times in Tampa" illustrates that numerous homes are selling swiftly, accentuating the fast-moving nature of the environment.

For individuals looking to navigate this dynamic landscape, subscribing to a reputable newsletter or following local economic reports can provide invaluable insights. With its combination of growth potential and favorable economic conditions, Tampa is positioned to be among the best real estate markets to invest in by 2025.

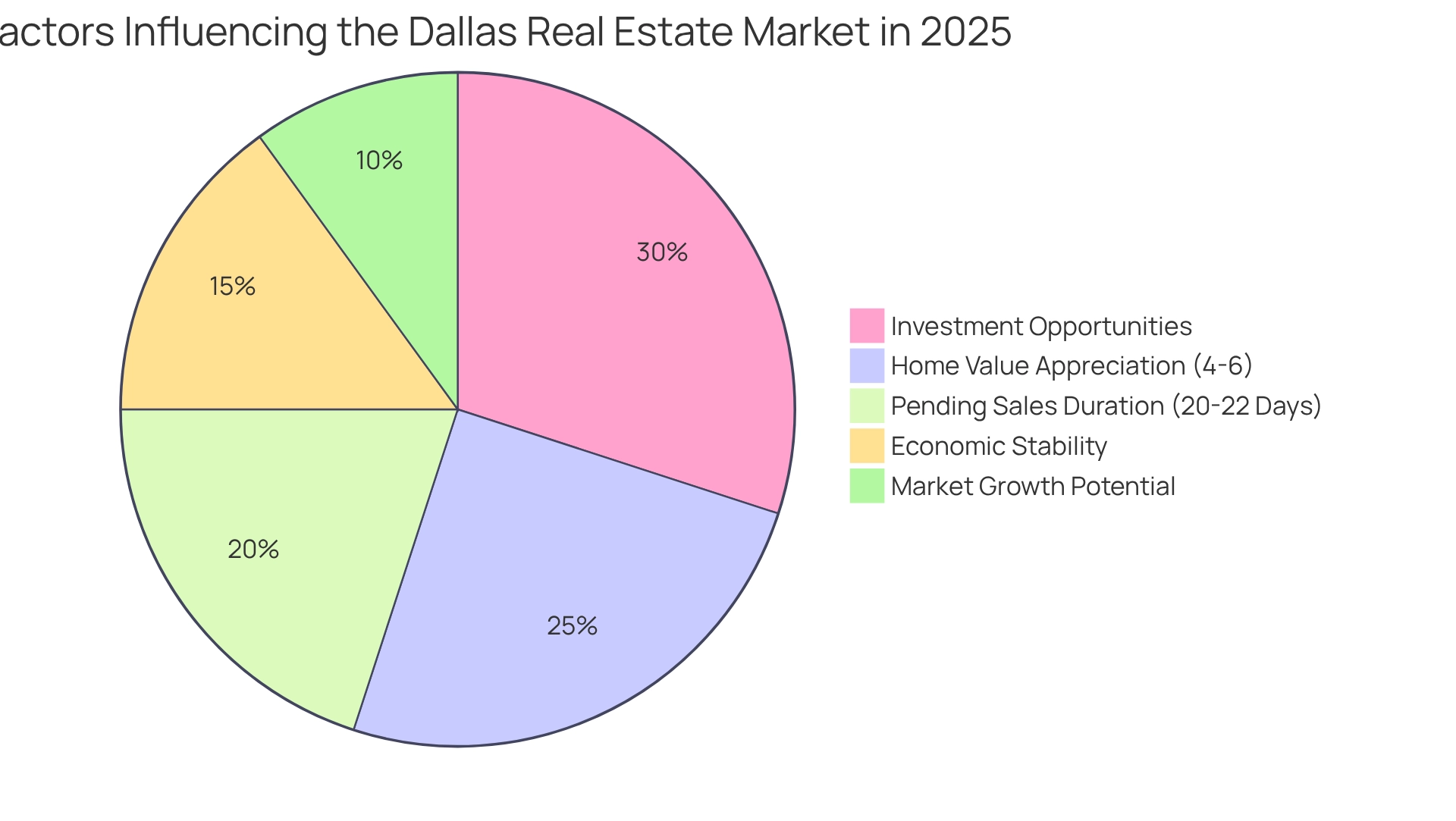

Dallas, Texas: A Strong Economy and Investment Destination

Dallas, Texas, emerges as a premier opportunity location in 2025, bolstered by a robust economy and a diverse job market. The city's average home value is anticipated to appreciate by 4-6% this year, driven by ongoing population growth and heightened demand for housing. Currently, properties in Dallas are pending sale in approximately 20 to 22 days, indicative of a competitive market landscape. Investors have the chance to leverage the city's thriving neighborhoods and burgeoning commercial developments, which offer a multitude of lucrative investment opportunities.

Economic factors significantly influence Dallas's real estate landscape. The city enjoys a strategic location and a business-friendly environment, attracting both companies and talent. This trend is further supported by a notable decrease in US foreclosure activity, which fell by 10% in 2024, signaling stability in the housing sector and enhancing buyer confidence in Dallas. Moreover, the rising demand for versatile homes—a trend that has gained traction since the pandemic—suggests potential for market growth and aligns with the evolving preferences of buyers.

Expert insights indicate that the Dallas housing market is well-positioned for sustained success. While forecasts predict a potential decline of -1.8% in median home prices by June 2025, it is essential for stakeholders to acknowledge that Dallas remains resilient due to its solid economic fundamentals. Successful financial outcomes in the area are epitomized by figures like Marco Santarelli, founder of Norada Real Estate Investments, who underscores the significance of education and guidance in navigating the financial landscape. His strategy is particularly relevant for individuals aiming to capitalize on the unique opportunities within the Dallas market. With its dynamic economic environment and favorable investment conditions, Dallas, Texas, is considered one of the best real estate markets to invest in for 2025.

Conclusion

The real estate landscape in 2025 offers a wealth of opportunities for investors in several key U.S. cities. Fayetteville, Arkansas, emerges as a prime market for fix-and-flip investments, driven by rapid property turnover and a robust economic foundation. In contrast, Raleigh, North Carolina, garners attention with its booming job market and diverse housing options, promising substantial returns for those who invest wisely.

Cities like Phoenix and Atlanta present unique advantages as well. Phoenix showcases potential for long-term appreciation despite recent price fluctuations, while Atlanta's diverse economy fuels consistent home price increases. Similarly, Denver and Charlotte are poised for significant growth, supported by strong job markets and rising housing demand. Nashville's cultural allure and economic vitality enhance its appeal, whereas Tampa's rapid market evolution is characterized by favorable conditions for both buyers and investors.

As market dynamics evolve, staying informed and leveraging data-driven insights is crucial for effective investment strategies. Each of these cities not only offers distinct advantages but also highlights the necessity of thorough market research and strategic planning. For both seasoned investors and newcomers, 2025 is set to be a year abundant with potential in the real estate sector. Embracing these emerging trends and understanding local market conditions will be essential for navigating the complexities of real estate investment successfully.