Overview

The article "7 Key Insights on NOI Cap Rate for Real Estate Investors" emphasizes the critical role of Net Operating Income (NOI) and capitalization rates (cap rates) in the realm of real estate investing.

Understanding the NOI cap rate is essential for evaluating property profitability and market conditions.

This knowledge empowers investors to:

- Make informed decisions

- Assess potential returns

- Effectively navigate the complexities of the real estate market

By grasping these concepts, investors can enhance their strategies and achieve greater success in their investment endeavors.

Introduction

In the intricate world of real estate investment, understanding key financial metrics is paramount for success. Among these, Net Operating Income (NOI) and capitalization rates (cap rates) stand out as crucial indicators that can significantly influence investment decisions.

As market dynamics shift and economic indicators fluctuate, investors must remain vigilant and informed. This article delves into the nuances of NOI and cap rates, exploring their implications on property valuation, investment strategies, and market trends.

By examining the factors that affect these metrics, including:

- Interest rates

- Property location

investors can better navigate the complexities of the real estate landscape and seize opportunities for growth.

Zero Flux: Daily Insights on NOI and Cap Rates for Real Estate Investors

Zero Flux delivers daily insights tailored for real estate stakeholders, emphasizing critical metrics such as Net Operating Income (NOI) and the NOI cap rate. By aggregating data from over 100 sources, the newsletter guarantees that subscribers receive the most pertinent and actionable information. This commitment to data integrity empowers investors to adeptly navigate the complexities of the real estate market, enabling them to make informed decisions grounded in the latest trends and analyses.

Net Operating Income (NOI): The Foundation of Cap Rate Calculations

Net Operating Income (NOI) is a critical metric in real estate investment, and the noi cap rate is calculated by deducting all operating expenses from the total revenue generated by an asset. This figure is indispensable for assessing the capitalization percentage, as it directly reflects the asset's profitability.

For instance, consider an asset that generates $600,000 in NOI and is appraised at $14 million; the resulting capitalization percentage would approximate 4.3%.

Understanding the noi cap rate is essential for investors, as it facilitates the evaluation of potential returns on investment and allows for meaningful comparisons among various real estate assets.

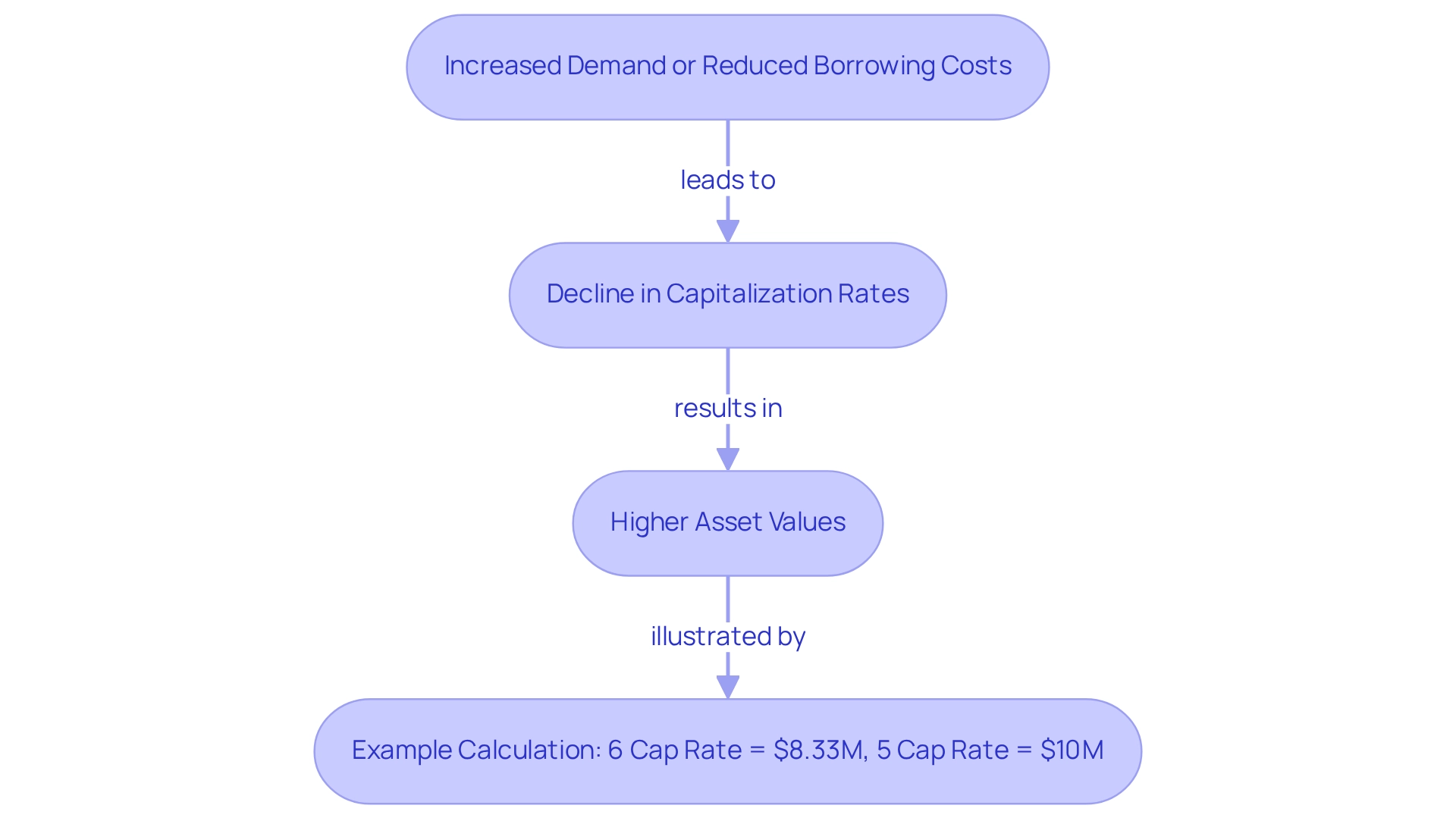

Cap Rate Compression: Understanding Its Impact on Property Values

Noi cap rate compression occurs when capitalization rates for assets decline, typically due to increased demand or reduced borrowing costs. This phenomenon can lead to elevated asset values, as investors are inclined to pay more for properties that improve the noi cap rate by generating consistent income.

For example, if the average capitalization rate in a market decreases from 6% to 5%, the value of a property yielding $500,000 in net operating income (NOI) would increase from approximately $8.33 million to $10 million.

Understanding this trend is crucial for investors looking to capitalize on the noi cap rate associated with market fluctuations.

Market Trends: Key Economic Indicators Affecting Cap Rates

Economic indicators, including interest levels, inflation, and employment statistics, significantly influence the noi cap rate, which is essential for real estate investors. Increasing interest levels typically elevate borrowing expenses, resulting in a higher noi cap rate and potentially decreased asset values. For instance, the stability of capitalization values for Chicago industrial properties remained constant at 0.00% from Q2 2023 to Q3 2024, signaling a period of relative steadiness amidst varying economic conditions.

Conversely, a strong job market can boost demand for rental properties, which may lower capitalization values as competition for these assets rises. As we approach 2025, it is crucial for stakeholders to closely observe these economic signals, as the most significant obstacles in commercial real estate debt are anticipated for that year. Moreover, the relationship between interest levels and inflation is vital; increased inflation can diminish purchasing power, impacting rental income and, consequently, the noi cap rate. Financial analysts emphasize that an individual's awareness and diligence regarding these factors can be the differentiator between expectations and outcomes. By remaining attuned to job statistics and other economic metrics, investors can make more strategic choices in a complex market environment.

Property Types: Variations in Cap Rates Across the Market

Capitalization rates vary significantly across different asset types, including multifamily, retail, and industrial properties. For instance, multifamily assets often exhibit lower capitalization values due to their stable income potential. In contrast, retail assets may demonstrate higher capitalization values, reflecting the volatility of market conditions. Investors must carefully consider these distinctions when assessing potential investments, as they can profoundly influence overall returns and risk profiles.

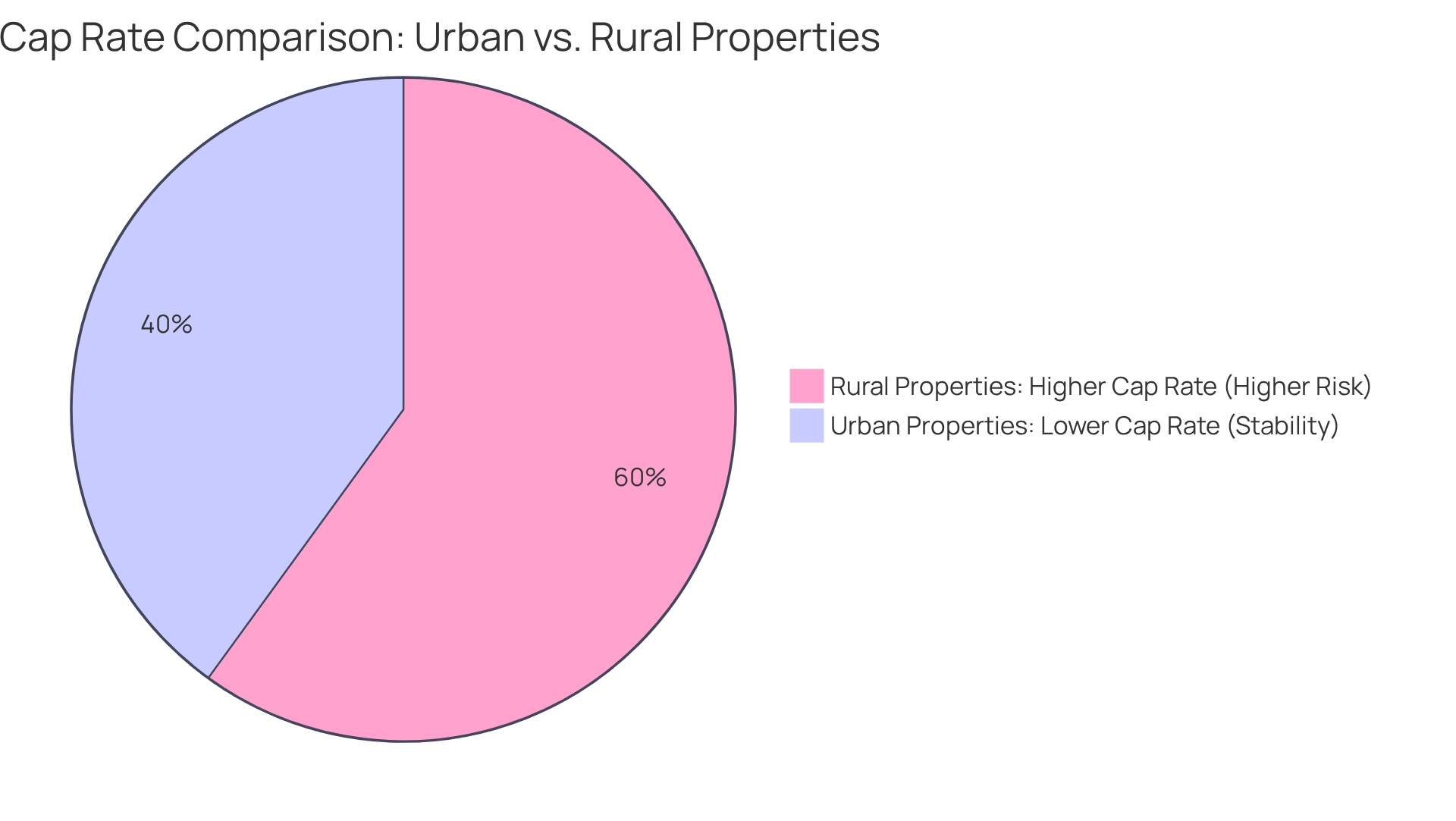

Location Matters: How Property Location Affects Cap Rates

The location of an asset is paramount when assessing its NOI cap rate, which is a critical metric for real estate investors. Properties situated in high-demand urban areas typically exhibit a lower NOI cap rate due to their perceived stability and potential for appreciation. Conversely, assets in less favorable or rural regions often demonstrate a higher NOI cap rate, signaling the increased risk associated with these investments.

This contrast underscores the importance of location in investment strategy; urban properties may yield more stable returns, while rural investments could offer opportunities for greater yields. Investors must conduct comprehensive evaluations of location to optimize their portfolios and align with their risk tolerance.

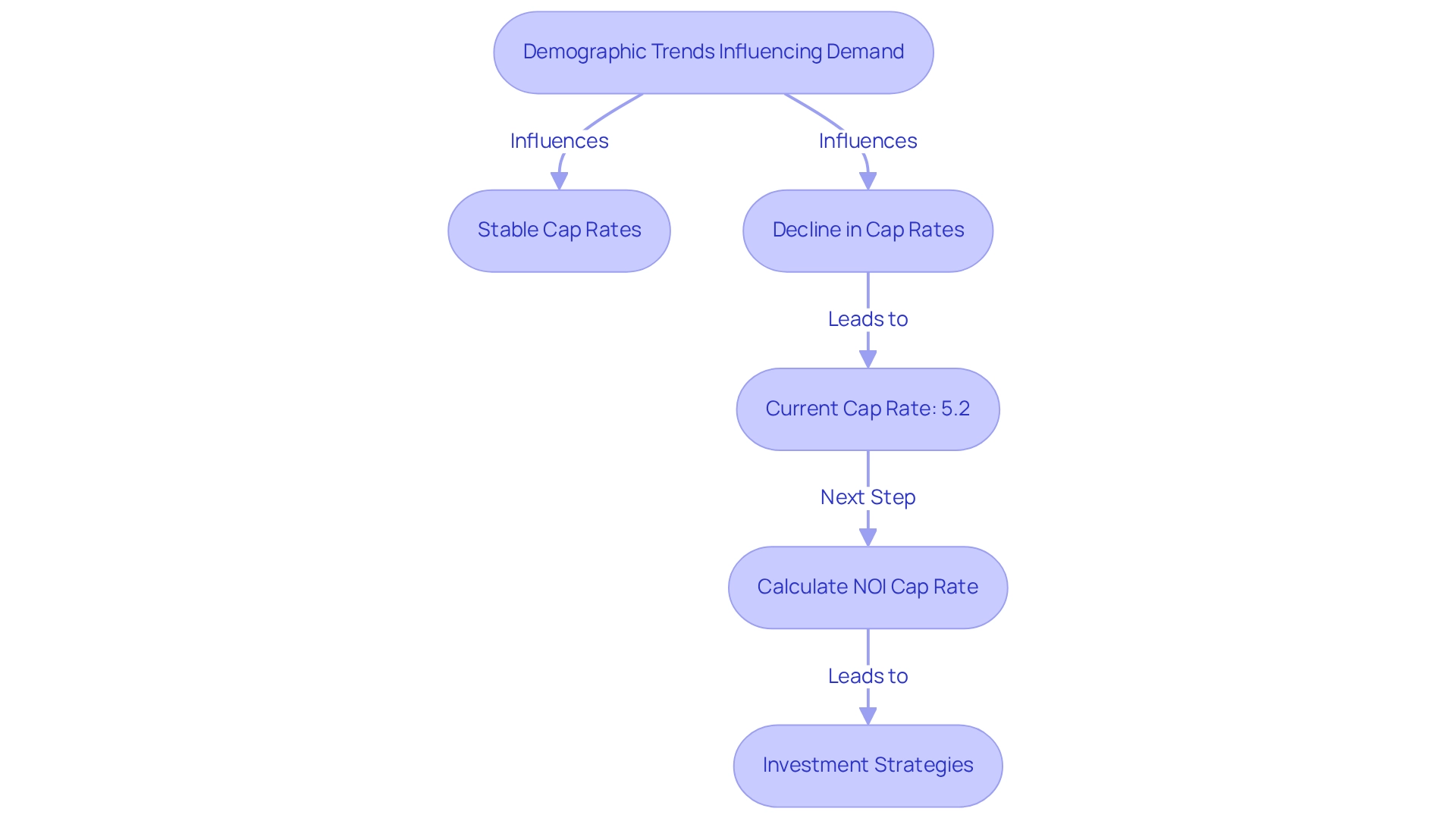

Prevailing Cap Rates: Insights for Multifamily Investments

In 2025, the average capitalization figures for multifamily properties stand at approximately 5.2%. This marks a slight decline from a trend where capitalization levels had remained stable since Q1 2022, until the noted drop in Q3 2024. Such a decrease signals robust demand for rental housing, significantly influenced by ongoing demographic shifts, particularly as younger generations increasingly favor urban living. As these trends continue, the demand for multifamily units is expected to rise, further impacting capitalization metrics. Investors should closely monitor these figures, as they offer essential insights into market stability and potential growth opportunities.

Understanding the dynamics of the noi cap rate—calculated as net operating income divided by asset price—is crucial for making informed acquisition decisions in this evolving landscape. According to Xander Snyder, a noi cap rate represents an estimation of the yield or return on investment from a property, calculated by dividing the net operating income (NOI) produced by the property by its purchase price. Moreover, employing the multifamily PCR Model can serve as a valuable resource for grasping market trends and informing investment strategies.

To maximize investment potential, real estate investors must consider not only the current cap values but also the demographic trends shaping the demand for multifamily units.

Going-In vs. Going-Out Cap Rates: Key Differences Explained

Going-in capitalization rates, also known as the NOI cap rate, signify the expected return on an investment asset, calculated by dividing the initial year's net operating income (NOI) by the acquisition cost. For instance, if an asset is acquired for $1 million with an anticipated NOI of $100,000, the initial cap percentage is 10%. Conversely, going-out capitalization rates, or exit capitalization rates, are utilized to evaluate a real estate asset's value at the time of sale, based on projected future NOI. If the same property is expected to sell for $1.2 million with an NOI of $120,000, the going-out capitalization would also be 10%. Understanding the distinction between these figures is crucial for evaluating the NOI cap rate and investment performance.

The typical going-in capitalization figures for real estate investments in 2025 are anticipated to vary according to local market conditions, with stable locations often exhibiting lower capitalization levels compared to transitional areas. Notably, in Washington's multifamily sector, cap values remained constant at 0.00% from Q2 2023 to Q3 2024, indicating market stability.

A practical illustration of these concepts can be observed in a case study where an individual acquires a fully occupied asset for $100 million, expecting a first-year NOI of $5 million, resulting in a going-in cap value of 5%. After seven years, the stakeholder predicts a terminal capitalization percentage of 4% and estimates the previous year's NOI at $5.5 million. This leads to an estimated resale value of $137.5 million, calculated by dividing the anticipated NOI by the terminal cap ratio. This example underscores how the NOI cap rate significantly influences property valuation over time. As highlighted by industry specialists, a buyer’s awareness and diligence can be the differentiator between expectations and outcomes. This emphasizes the importance of accurately calculating and comprehending both entering and exiting cap ratios.

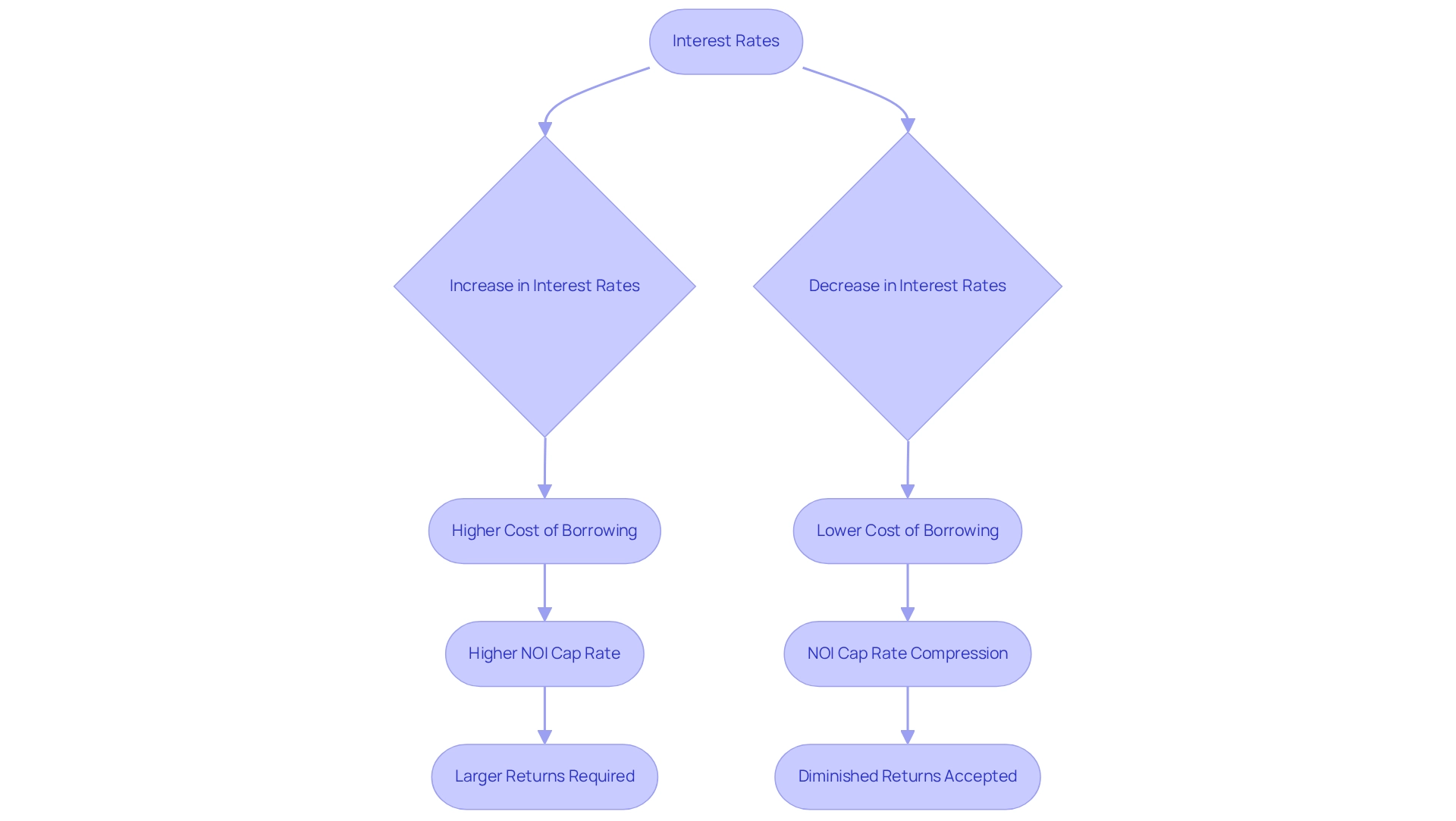

Interest Rates: Their Influence on Cap Rates and Investment Returns

Interest levels significantly influence capitalization values and overall investment yields. When interest rates increase, the cost of borrowing rises, resulting in a higher noi cap rate as stakeholders seek larger returns to mitigate the increased risk. Conversely, lower interest rates can result in noi cap rate compression, as buyers tend to accept diminished returns in a more favorable lending environment. For instance, should the Federal Reserve lower interest rates, capitalization rates may decline, enhancing real estate values and making investments in real estate more attractive. Understanding these dynamics is crucial for informed investment decisions.

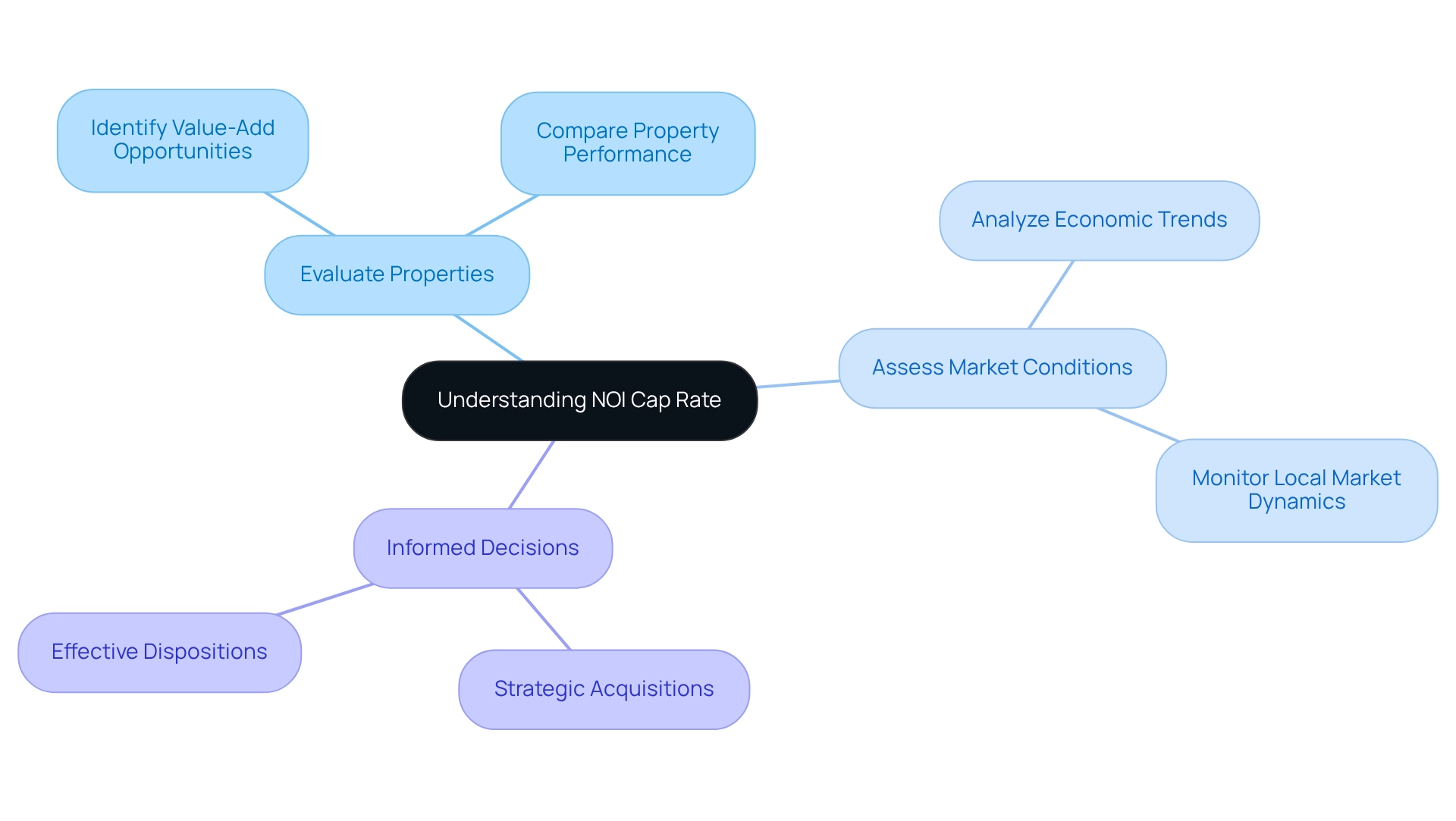

Strategic Advantage: The Importance of Understanding Cap Rates

Understanding the noi cap rate is essential for real estate stakeholders who aim to optimize profits and mitigate risks. By analyzing the noi cap rate, stakeholders can:

- Evaluate diverse properties

- Assess market conditions

- Make informed decisions regarding acquisitions and dispositions

A strategic approach to capital values allows investors to identify market opportunities, whether through value-add strategies or by capitalizing on favorable economic conditions. Ultimately, a comprehensive grasp of noi cap rate can offer a competitive advantage in the dynamic real estate landscape.

Conclusion

The intricacies of Net Operating Income (NOI) and capitalization rates (cap rates) are pivotal in real estate investment. A comprehensive understanding of NOI enables investors to assess property profitability effectively and make informed comparisons across various opportunities. Cap rates, shaped by market demand, interest rates, and location, are critical indicators for property valuation and investment strategy.

As market dynamics evolve, the relationship between cap rates and economic indicators gains importance. Interest rates, inflation, and employment trends significantly influence cap rates, shaping the overall landscape for real estate investments. Investors who remain vigilant and informed about these trends can position themselves to capitalize on emerging opportunities while mitigating potential risks.

Recognizing the variations in cap rates across different property types and locations underscores the necessity of tailored investment strategies. Properties in high-demand areas often present lower cap rates due to perceived stability, whereas those in less desirable locations might offer higher yields at greater risk. This nuanced understanding empowers investors to optimize their portfolios and align strategies with their individual risk tolerance.

In summary, a thorough grasp of NOI and cap rates is indispensable for real estate investors aiming to navigate the complexities of the market successfully. By leveraging this knowledge, investors can enhance their decision-making processes, ultimately leading to more robust investment outcomes in a constantly shifting economic environment. Staying informed and adaptable is key to thriving in the competitive landscape of real estate investment.