Overview

The article identifies ten up-and-coming real estate markets to watch in 2025, emphasizing areas with strong growth potential and favorable investment conditions. It highlights specific cities such as:

- Buffalo

- Richmond

- Kansas City

These markets, where economic growth, affordability, and housing demand indicate promising opportunities for property investors, are not just emerging; they are poised for significant expansion. This makes them worthy of consideration for savvy investors looking to capitalize on the next wave of real estate growth. By focusing on these key insights, investors can strategically position themselves in markets that are likely to yield substantial returns.

Introduction

In the ever-evolving landscape of real estate, staying informed about emerging markets is crucial for investors seeking profitable opportunities. The Zero Flux newsletter provides a comprehensive look into the latest trends and insights, meticulously gathering data from over 100 sources to present a clear picture of the dynamic housing market.

As cities like Buffalo, Richmond, and Kansas City rise to prominence, understanding the factors driving their growth becomes paramount. From affordability to economic revitalization, each market presents unique characteristics that can significantly impact investment strategies.

As 2025 approaches, this article delves into the key cities poised for real estate success, equipping investors with the knowledge they need to navigate these promising landscapes.

Zero Flux: Daily Insights on Emerging Real Estate Markets

Zero Flux delivers daily insights into the property sector, focusing on up and coming real estate markets and investment prospects. By meticulously curating data from over 100 diverse sources, including those behind paywalls, it equips subscribers with a comprehensive overview of the latest developments. This commitment to accurate reporting enables property professionals and investors to stay informed about industry dynamics, positioning Zero Flux as an indispensable tool for navigating the complexities of property investment in 2025.

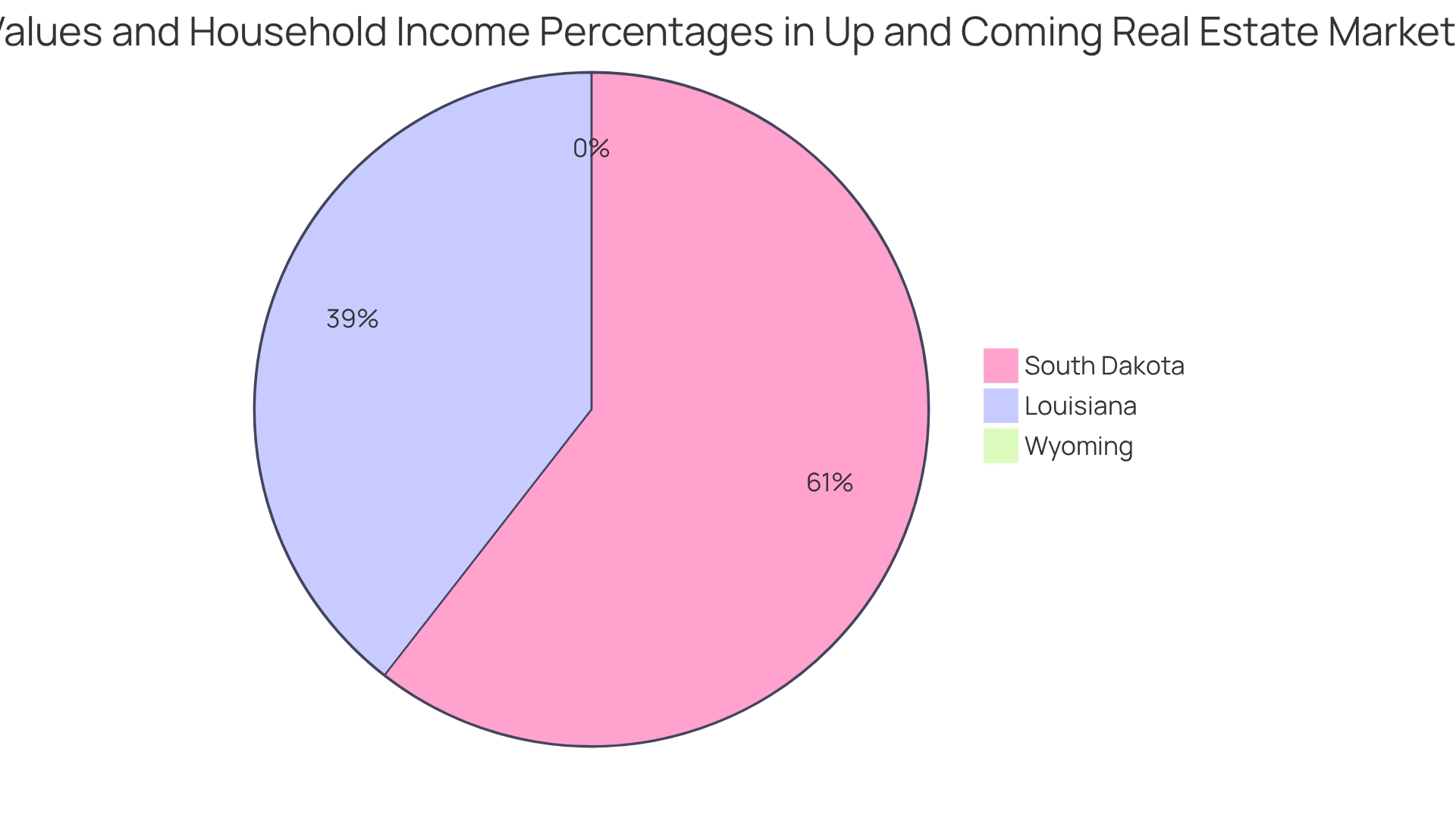

Consider Louisiana, where the average home value stands at $200,963—significantly below the national average—making it one of the most budget-friendly housing markets in the nation. This affordability is further highlighted by a median household income that constitutes 28% of home value, underscoring the investment potential in up and coming real estate markets. In a similar vein, South Dakota's typical home value of $308,172, which is 86% of the typical U.S. price, reflects a median household income percentage of 23%, indicating that it is considered one of the up and coming real estate markets. Additionally, Wyoming's median household income as a percentage of home value is 6%, further illustrating the affordability and investment opportunities within up and coming real estate markets.

As the property landscape evolves, Zero Flux remains at the forefront, providing subscribers with essential insights that facilitate informed decision-making. The newsletter's focus on emerging trends and data integrity solidifies its status as a leading authority in property information dissemination, crucial for anyone looking to capitalize on investment opportunities in 2025.

As noted in 'Emerging Trends in Real Estate,' the sector encompasses a diverse array of up and coming real estate markets, each offering unique portfolio diversification traits—from the skyscraper-laden streets of Manhattan to the history-rich charm of Charleston, South Carolina.

Buffalo, NY: A Rising Star in Real Estate Investment

Buffalo, NY, has emerged as a leading property sector for 2025, with Zillow identifying it as the most sought-after residential area in the U.S. The city features a robust economy, and home values are projected to appreciate by approximately 3% this year. This growth in up and coming real estate markets is driven by a limited property supply and heightened interest from both local and out-of-state buyers, making these markets an attractive option for property investors.

The implications of these trends are significant for potential investors. The combination of economic strength and demand creates a favorable environment for investing in up and coming real estate markets. As home values continue to rise, those looking to enter the market should consider Buffalo, which is one of the up and coming real estate markets, as a prime opportunity. With the right insights and strategies, investors can capitalize on up and coming real estate markets and secure valuable assets in a thriving location.

Richmond, VA: A Market with Strong Growth Indicators

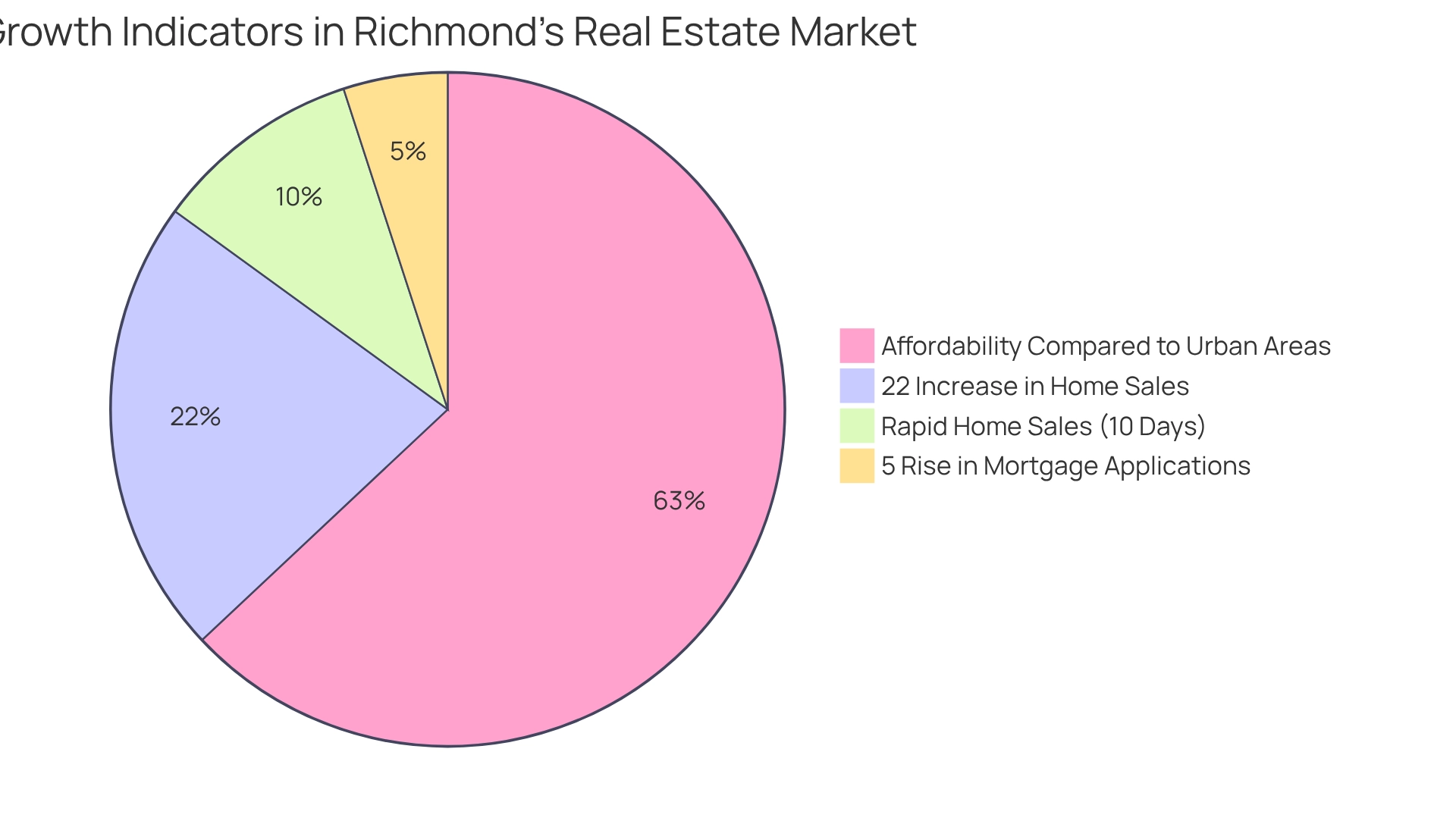

Richmond, VA, is becoming one of the up and coming real estate markets, with forecasts suggesting a notable 22% rise in current home sales compared to 2024. This growth is driven by the city's varied economy and a consistently rising population, collectively generating a strong need for residences. Richmond's affordability, particularly in comparison to nearby urban regions, further boosts its appeal as one of the up and coming real estate markets for property investment in 2025. Recent data indicates that homes in Richmond are selling rapidly, often within a mere 10 days, demonstrating the increased interest from purchasers.

In the broader context, the rate of mortgage applications for purchase loans has risen by 5% year-over-year through mid-March, indicating a positive trend in buyer activity that could significantly influence Richmond's market, which is among the up and coming real estate markets. Experts note that the city's strategic location and quality of life contribute significantly to its appeal, making it a desirable destination for both new residents and investors.

In a recent analysis, local real estate experts emphasized that Richmond's housing sector is not only resilient but also poised for sustained growth within up and coming real estate markets. As Jessica Sawyer, the 2025 President of the Omaha Area Board of Realtors, noted, while buyers are adjusting to higher mortgage rates, increasing home prices pose challenges for first-time purchases—a sentiment that aligns with the current trends in Richmond.

Moreover, Buffalo, NY, has led the hottest areas list for the second consecutive year, with home values projected to rise by 2.8% in 2025. This comparison highlights the competitive characteristics of the industry, as homes in Buffalo are selling in about 12 days. With these compelling indicators, Richmond, VA, is highlighted as one of the up and coming real estate markets to watch in 2025.

Kansas City, MO: Affordable Housing with Investment Potential

Kansas City, MO, emerges as a premier destination for affordable housing, showcasing a median home price of approximately $241,000—46% below the national average. With an anticipated 5.6% increase in home values by 2025, fueled by a robust employment sector and a surge of new residents, this favorable mix of affordability and appreciation potential positions Kansas City as one of the up and coming real estate markets for investors looking to maximize their returns.

The community's stability is underscored by a 3.6-year affordability timeframe for residences, indicating a healthy equilibrium between income levels and property expenses. This timeframe is crucial for investors, as it signifies a stable environment where properties remain accessible, thereby mitigating the risk of drastic price fluctuations.

Moreover, insights from real estate experts emphasize the importance of the livability score; a decline below 70 could signal challenges that may adversely affect property values. Monitoring this metric is essential for investors, as it reflects the overall desirability of the area.

Investors should also examine the dynamics of affordable housing in Kansas City, as illustrated by case studies on trust fund adoption throughout the state. These studies reveal significant indicators of investment success, including historical state property expenditures and the political landscape, which can influence economic conditions. As noted by Siphokazi Kwatubana, "Lack of monitoring and control of the budgets and absence of adherence to the stipulations in circular 33/2010 were the main challenges," highlighting the critical role of governance in ensuring the efficacy of residential initiatives.

In summary, Kansas City's affordable real estate landscape in 2025 represents an enticing opportunity for investors interested in up and coming real estate markets, combining low entry costs with promising growth forecasts.

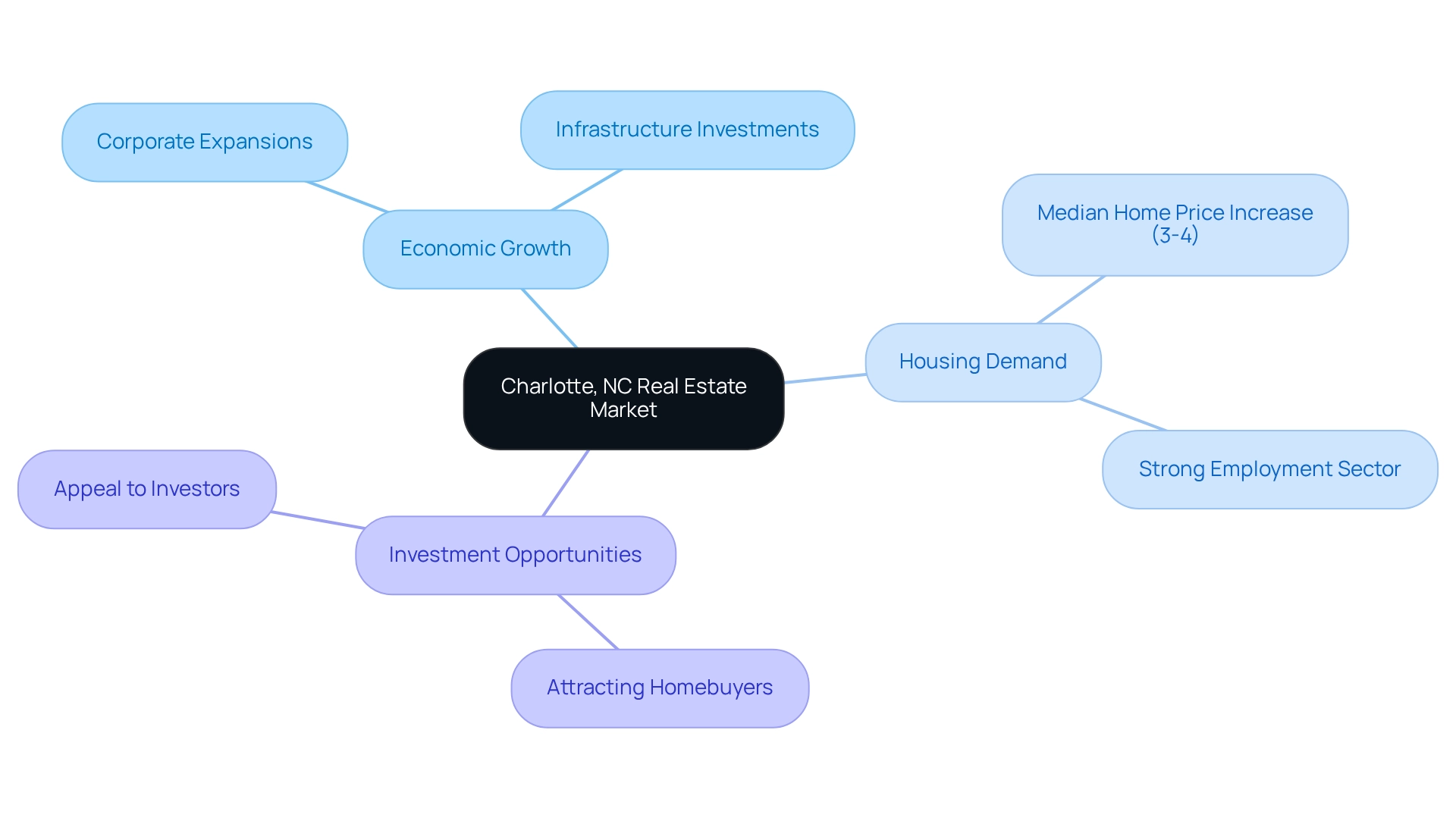

Charlotte, NC: Economic Growth Fuels Real Estate Demand

Charlotte, NC, is experiencing significant economic expansion, establishing itself as one of the up and coming real estate markets for property investment. The city's median home price is projected to rise by 3-4% in 2025, fueled by a strong employment sector and increasing housing demand.

With major corporate expansions and infrastructure investments underway, Charlotte is emerging as one of the up and coming real estate markets, poised for sustained growth and attracting both homebuyers and investors alike.

This upward trajectory not only highlights the city's appeal but also suggests that now is an opportune time for potential investors to consider entering this dynamic market.

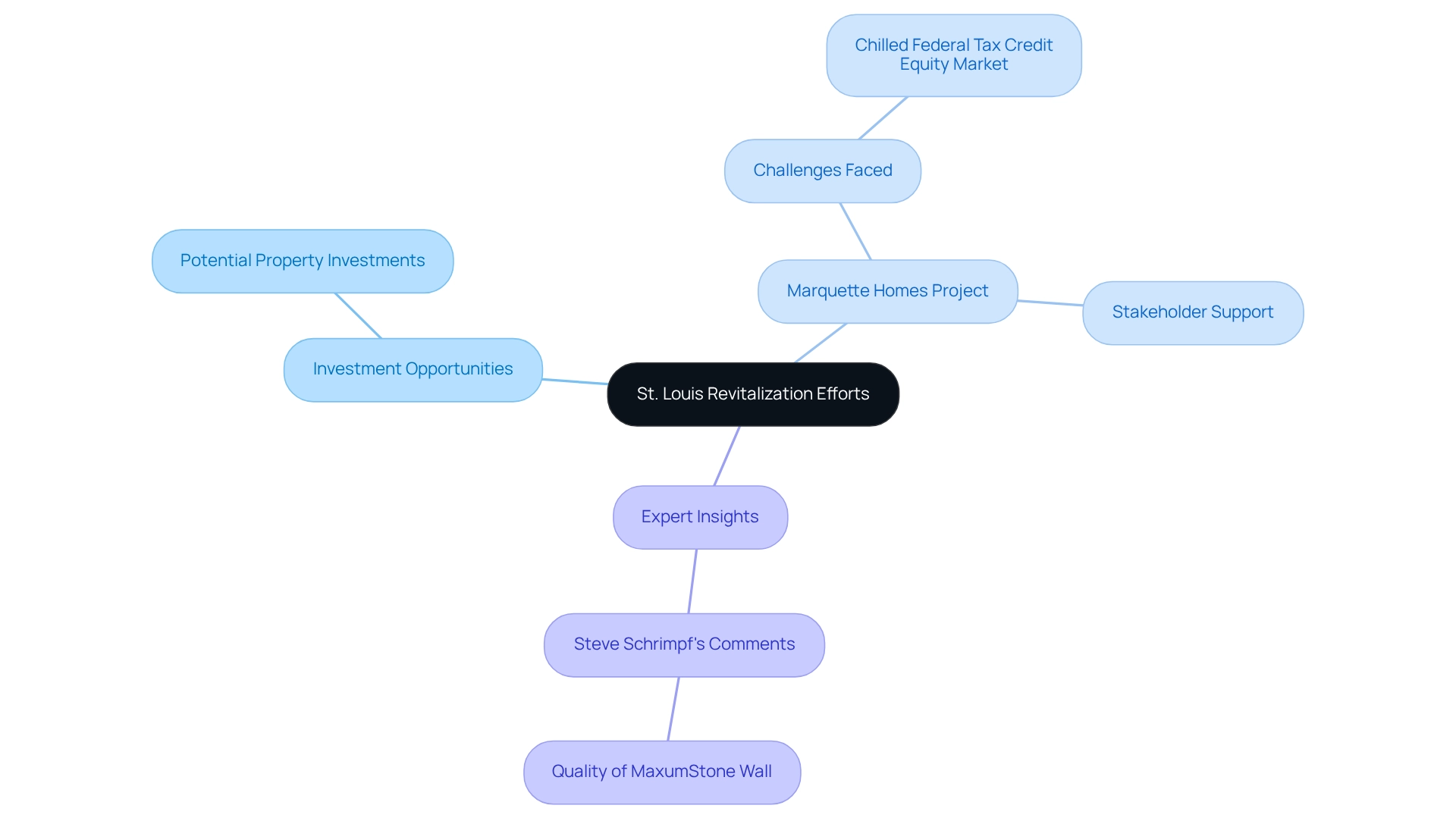

St. Louis, MO: Revitalization Efforts Create Investment Opportunities

St. Louis, MO, is experiencing a dynamic revitalization, particularly in its downtown area, which is drawing in new businesses and residents. The city has committed over $16 million for neighborhood transformation projects, showcasing a strong dedication to urban redevelopment. This investment is expected to create substantial opportunities for property investors looking to capitalize on up and coming real estate markets through urban renewal.

Key highlights of St. Louis's revitalization efforts include:

- Marquette Homes Project: This initiative exemplifies the challenges and resilience of development in the area. Despite facing obstacles from a 'chilled' federal tax credit equity sector, local stakeholders are actively supporting the project, ensuring its progression. This scenario reflects the broader economic landscape while underscoring the potential for investment in revitalized neighborhoods.

- Expert Insight: Steve Schrimpf, an installer and owner of Schrimpf Landscaping Inc., noted, "The MaxumStone wall looks fantastic, and it hasn’t moved a bit," illustrating the quality and durability of materials employed in revitalization projects.

As St. Louis continues to evolve, it presents a multitude of property investment prospects in up and coming real estate markets for those eager to engage in its revitalization initiatives.

Philadelphia, PA: Diverse Economy Supports Real Estate Growth

Philadelphia, PA, is witnessing a remarkable revival in its property sector, fueled by a diverse economy that sustains steady demand for residences. In 2025, home values are anticipated to increase by 3.4%, underscoring the city's allure for young professionals and families in search of vibrant neighborhoods. This influx of residents is not only revitalizing established areas but also creating unique investment opportunities throughout the city.

Insights from Trammell Crow Company reveal that generational shifts are profoundly influencing housing demand, emphasizing the necessity for potential investors to grasp these trends. Furthermore, the comprehensive April 2025 report on U.S. industrial sectors indicates that economic recovery fundamentals are improving, which bodes well for Philadelphia's property landscape.

As the industry evolves, Philadelphia stands out among the up and coming real estate markets for property investors eager to capitalize on its growth potential, supported by Zero Flux's commitment to data integrity and distinctive information sourcing.

Hartford, CT: Affordable Options with Growth Potential

Hartford, CT, is becoming one of the up and coming real estate markets, with home prices projected to increase by 4.2% in 2025. This growth is driven by a supply-demand imbalance, where limited inventory propels prices upward. The city is particularly appealing to first-time homebuyers and investors due to its affordable living options. Ongoing efforts to enhance property inventory and improve affordability position Hartford among the up and coming real estate markets, making it a unique investment opportunity.

In 2025, the real estate sector in Hartford is expected to witness considerable expansion, supported by continuous legislative efforts aimed at enhancing affordable living options. The Planning and Development Committee is actively discussing legislation that could further refine residential development regulations, which may facilitate industry growth. As highlighted in the Zero Flux newsletter, these trends are essential for investors seeking data-driven insights into emerging markets.

Hartford's commitment to affordable living is evident through various programs designed to support this initiative. As Julie Martin Banks noted, "Real estate transaction fees that support several programs – from affordable living to farmland preservation – haven’t increased since 2011, but state legislators and advocates assert it’s time to change that." This context underscores the importance of legislative support in addressing the rising demand for budget-friendly accommodations. Investors can uncover profitable opportunities in this sector, especially as the city focuses on enhancing the availability and affordability of residences, making it an attractive location for those looking to capitalize on up and coming real estate markets along with expanding economic trends.

Providence, RI: Cultural Appeal Drives Real Estate Interest

Providence, RI, is being recognized as one of the up and coming real estate markets, with projections indicating a home price increase of 4-5% in 2025. The city's lively cultural scene, characterized by its arts, music, and culinary options, significantly attracts new residents, thereby increasing demand for accommodations. In April 2025, an impressive 55.4% of homes sold in Providence County were sold above asking price, underscoring the competitive nature of the market.

The limited inventory further fuels this demand, particularly as urban living continues to gain appeal. A recent case study on residential supply in Providence County revealed a 5.0% decrease in the inventory of one-bedroom homes, while the availability of larger properties (two bedrooms and above) increased. This shift indicates changing buyer preferences, emphasizing the diverse needs of potential homeowners and investors alike, particularly in up and coming real estate markets.

Experts note that the cultural richness of Providence enhances its livability and positions it as a prime location for property investment in these up and coming real estate markets. Marco Santarelli, an investor and founder of Norada Real Estate Investments, highlights the importance of considering individual needs when evaluating affordability in Providence. He suggests that the city's cultural appeal plays a crucial role in attracting a diverse population. As the city continues to draw new inhabitants, the interplay between cultural allure and accommodation demand is expected to significantly influence economic dynamics in 2025.

Indianapolis, IN: Strong Job Market Enhances Real Estate Appeal

Indianapolis, IN, is recognized as one of the up and coming real estate markets for property investment, bolstered by a robust employment sector projected to see a 3.4% increase in home values by 2025. With its affordable living options and a steadily growing population, the city stands out as an appealing choice for both homebuyers and investors looking in up and coming real estate markets. With a diverse economy encompassing healthcare, technology, and manufacturing, Indianapolis is becoming recognized as one of the up and coming real estate markets, driven by significant development projects that enhance its investment potential.

The strong employment landscape not only attracts new residents but also sustains ongoing demand for housing, thereby fostering a favorable environment for property investments in up and coming real estate markets. Urbanization trends are driving interest in metropolitan areas, with Indianapolis well-positioned to capitalize on this shift, as highlighted in the case study titled "Summary of Regional Price Trends." Marco Santarelli, founder of Norada Real Estate Investments, underscores the importance of the job market in fostering real estate investments, stating, "My mission is to help 1 million people create wealth and passive income and put them on the path to financial freedom with real estate." As the city continues to evolve, it presents a compelling opportunity for investors aiming to leverage up and coming real estate markets in 2025 and beyond. Zero Flux curates data from over 100 diverse sources, ensuring the reliability of the insights shared.

Conclusion

The real estate landscape is evolving at a rapid pace, necessitating that investors remain vigilant to capitalize on emerging opportunities. Cities such as:

- Buffalo

- Richmond

- Kansas City

- Charlotte

are emerging as stars in the market, each presenting unique advantages that make them appealing for investment in 2025. Buffalo's affordability, coupled with strong economic indicators, positions it as a leader. In contrast, Richmond's remarkable growth in home sales underscores its dynamic market potential. Kansas City's affordable housing, combined with a robust job market, showcases its promising investment landscape, while Charlotte's ongoing economic growth continues to drive real estate demand.

Moreover, cities like:

- St. Louis

- Philadelphia

are experiencing revitalization and economic resurgence, creating fertile ground for real estate investment. Hartford presents affordable options with significant growth potential, and Providence's cultural allure fuels intense housing demand. Indianapolis distinguishes itself with a strong job market, further enhancing its appeal in the real estate sector.

As we approach 2025, it is crucial for investors to stay informed about these markets and their respective characteristics to maximize returns. The Zero Flux newsletter serves as an essential resource, offering valuable insights and data-driven analysis from over 100 sources, equipping investors with the knowledge needed to navigate these promising opportunities. Embracing the dynamics of these emerging markets can lead to successful investment strategies and long-term growth in an ever-evolving real estate landscape.